Looking for the best long-term crypto investments to secure your financial future can be daunting. In the ever-evolving landscape of digital assets, the unpredictable crypto market makes it crucial to consider where to invest carefully.

In the fast-paced world of digital assets, finding stability and potential for significant returns is key, and we’ll navigate through some of the top choices to help you make informed decisions.

A quick overview of the best long-term crypto investments for 2025 can be found below.Best Cryptos for Long-Term Investment for 2025

Reviews of the Top Long-Term Crypto Investments

Our evaluation of the best long-term crypto considered the crypto’s establishment, number of token holders, market capitalization, potential upside, roadmap objectives, undervaluation potential, and real-world utility, all crucial for long-term profitability.

1. Pepe Unchained

If you’re looking for the best long-term crypto investments in the meme coin world, Pepe Unchained should be your number one choice. This Pepe the Frog clone aims to improve its predecessor through the power of Layer 2 technology. This means that it will offer the lowest transaction fees, higher volume capacity, and huge staking rewards.

Its native token, $PEPU, will be 100x faster than ETH and its holders will be able to earn staking rewards, which, at the time of writing, have an APY of 17,227%. This profit-making opportunity makes $PEPU an excellent long-term investment. Its lucrative staking protocol has allowed it to raise over $20 million so far.

Pepe Unchained is currently in the presale stage, during which investors will be able to buy $PEPU tokens at a price of $0.0115. However, once it gets listed on notable crypto exchanges, its price could go up by 220%, reaching a potential high of $0.0256. Its total supply is eight billion, of which 20% will be distributed towards the presale.

| Hard cap | N/A |

| Total tokens | 8 billion |

| Tokens available in presale | 1,600,000,000 |

| Blockchain | Ethereum |

| Token type | ERC-20 |

| Minimum purchase | 1 $PEPE |

| Purchase with | ETH, BNB, USDT, card |

2. Catslap

Catslap allows players to compete in a hilarious and addictive slapping game to earn the highest scores and increase their country’s ranking on the Slapometer. It aims to achieve what $CAT, $Popcat, $MOG, and $MEW achieved in 6 months within several weeks.

With many top influencers discussing the project and revealing the latest news about its development, Catslap has already gained a lot of popularity.

With a 10% community rewards allocation in the $SLAP tokenomics, it’s rumored that the project’s slapping game could be gamified, with a possible $SLAP airdrop based on the users’ Slapometer score.

Staking will launch in the second of the Catslap roadmap, allowing users to stake tokens at a fixed 40% reward rate.

Its Best Wallet partnership adds credibility. New tokens often carry risks, including hidden contract features or sudden liquidity removal. However, the $SLAP token has been audited by Coinsult and Solidproof, undergoing Best Wallet’s auditing and screening.

| Hard cap | 41.9 million (market cap) |

| Total tokens | 9 billion |

| Tokens available in presale | / |

| Blockchain | Ethereum |

| Token type | ERC-20 |

| Minimum purchase | N/A |

| Purchase with | ETH, USDT, card |

3. Crypto All-Stars

Crypto All-Stars is a groundbreaking staking platform offering the first-of-its-kind MemeValut protocol. This mechanism gathers 11 popular meme coins in one place, allowing users to stake them on a single platform. The current meme coin list includes Shiba Inu, Pepe, Turbo, Brett, and more, but it will expand and include even more meme coins in the future.

Still, to maximize the potential staking rewards, users must also own and stake $STARS tokens. In fact, by doing so, they will get 3x of the staking rewards, which come with a current APY of 5,391%. The token rewards are distributed at a rate of 280,144 $STARS per Ethereum block.

The project’s successful ongoing presale, impressive staking APY, and unique MemeVault mechanism made this token one of the cryptos with the most potential.

The total token supply is allocated to the presale staking, MemeVault ecosystem, presale, marketing, and CEX/DEX. Crypto All-Stars focuses on individual gains and building a united and powerful community of meme coin enthusiasts.

| Hard cap | N/A |

| Total tokens | 42.07 billion |

| Tokens available in presale | 8,413,939,394 |

| Blockchain | Ethereum |

| Token type | ERC-20 |

| Minimum purchase | 7 $STARS |

| Purchase with | ETH, USDT, BNB, Card |

4. Flockerz

Flockerz is another good crypto for long-term investment. Its distinctive feature lies in its strong emphasis on community involvement, setting it apart from other crypto projects. More specifically, Flockerz allows users to vote on all important decisions, including token burns, expansion plans, key project development, and marketing strategies. All of this is possible through the Vote-to-Earn mechanism, enabling users to also earn rewards while voting.

Flockerz has a three-step roadmap, with its last step announcing that $FLOCK will be ready for public trading. The total token supply is 12 billion, of which 2.4 billion, or 20%, are reserved for the presale. The project has raised over $950k so far. Staking is another available feature, with rewards with an APY of 6,166%.

The current price of $FLOCK is $0.0058161, but it is set to increase with each of the 50 presale stages, meaning this may be the best time to buy this coin.

| Hard cap | N/A |

| Total tokens | 12 billion |

| Tokens available in presale | 2.4 billion |

| Blockchain | Ethereum |

| Token type | ERC-20 |

| Minimum purchase | 1 $FLOCK |

| Purchase with | ETH, USDT, BNB, Card |

5. Best Wallet Token

Best Wallet token is the best long term cryptocurrency investment for Best Wallet users.$BEST is an ERC-20 token that powers Best Wallet’s ecosystem. This token enables users to pay lower transaction fees and gain higher staking rewards. It also acts as a governance token. Moreover, its holders will get early access to new projects.

Its presale will be open only to Best Wallet users during the first two weeks. They’ll be able to buy $BEST tokens directly via the Best Wallet app, i.e., from the Upcoming Tokens page. Its total supply is capped at 10 billion, of which 4.5% will go towards the presale. Early buyers will also be able to earn $BEST tokens by participating in airdrops.

The Best Wallet token has the potential to become the highest market cap wallet token. During its first presale stage, this token raised over $162,000. Download Best Wallet now to buy $BEST tokens at a starting price of $0.0225.

| Hard cap | $10m |

| Total tokens | 10 billion |

| Tokens available in presale | 450,000,000 |

| Blockchain | Ethereum |

| Token type | ERC-20 |

| Minimum purchase | N/A |

| Purchase with | ETH, BNB, USDT, card |

6. Sponge V2

Sponge V2 is a community meme token created to replace Sponge V1, whose value increased by 100x once it went live. Its developers believe that their V2 project will experience the same success as its predecessor.

We also believe that V2 can be a good long-term crypto investment, thanks to its stake-to-bridge model. This model allows investors to generate V2 tokens by staking their V1 tokens. The staking process will last four years, while SPONGE V2 reward rates will vary from 182% on Ethereum to 657% on Polygon.

After the staking pool is exhausted, V1 tokens will be replaced by V2 tokens. V2 has a fixed total supply of 150 billion, of which 43.09% will be allocated towards staking rewards.

Sponge V2 has a roadmap consisting of three stages during which $SPONGEV2 bonuses can be collected. The aim is to reach a $100 million market cap and 13,000 unique holders. V2 token currently costs $0.000017; however, once it launches and after their P2E game comes out, we expect its price to jump to $0.004 per token.

| Hard Cap | N/A |

| Total Tokens | 150 billion |

| Tokens available in presale | No presale |

| Blockchain | Ethereum |

| Token type | ERC-20 |

| Minimum Purchase | None |

| Payment method | ETH, USDT, MATIC |

7. FreeDum Fighters

FreeDum Fighters is the best long-term cryptocurrency investment for political buffs and crypto gamers. This satirical meme coin is inspired by the ongoing US presidential race. With that in mind, investors can side with two mechanized candidates – the maga machine Magatron and the hunter of injustice Kamacop 9000. They’ll also be able to participate in weekly debates by creating humorous arguments on FreeDum Fighters’ social media channels. The team that scores the most points will win a secret airdrop.

In addition, investors can earn rewards by voting, i.e., locking their coins in two reward pools. The pool with more votes will have a lower APY. The starting price of the $DUM token is $0.00005.

This project raised over $100k in just one hour. Its marketing campaigns will align with real-life political milestones, which will further increase its visibility and long-term potential.

Hard cap

$3,375,000

Total tokens

270 billion

Tokens available in presale

108,000,000,000

Blockchain

Ethereum, Base, BSC EVM Chains (ETH), And SOL

Token type

ERC-20 (Base Chain)

Minimum purchase

$5

Purchase with

ETH, Base, BNB, SOL, USDT, USDC

What Is a Long-Term Crypto Investment?

Investment horizons are a little shorter in cryptocurrency as compared to traditional finance. In crypto, a short-term investment is less than 6 months. A mid-term investment is about 6 months to 3 years. Anything longer can be considered long-term (3 years and more). This makes sense because you can make returns in crypto faster than other asset classes so that investment durations can be shortened.

The best cryptos for long-term investment can offer price stability with more readily available information. A project that has been around for five years with active users is much more credible than a completely new project.

What Are The Benefits Of Long-Term Crypto Investment?

The benefits of long-term crypto investment include reduced volatility. As seen in the recent PEPE incident, short-term investments in meme coins can lead to significant gains, followed by crashes. Long-term projects, on the other hand, exhibit resilience and price stability, bouncing back from dips.

Long-term investment also offers increased price returns. As previously mentioned, buying and holding a coin like BTC in 2013 would have seen nearly 20,000% returns. From 2015 to 2023, Ethereum would have seen a 125,000% increase. And these are without any additional rewards. With Bitcoin, users would also receive additional coins like Bitcoin Cash and Bitcoin Gold due to hard forks.

With long-term crypto investments, you can often benefit from DeFi rewards such as staking. These are primarily tokenized rewards for your investment, similar to how bank accounts used to give you an interest rate for deposits. You lock up your funds (such as SOL or ETH), meaning you can’t use them. In return, you are given rewards in the same token/currency. These rewards can be reinvested with compounding returns, a significant financial benefit.

Short-Term vs. Long-Term Crypto Trading

Short-term traders look at short-term price movements. They try to gauge technical indicators to see where an asset is heading. This can be done on a daily, weekly, or monthly basis. Long-term traders are more concerned with project fundamentals, which signify that a coin has a good future regardless of the current price point. Project fundamentals that long-term investors look for might include:

- The number of active developers

- Total transaction volume

- Network upgrades

- Active wallet addresses

- The project roadmap

A short list of technical indicators used by crypto traders would include:

- Social sentiment analysis

- Fear and greed index

- RSI indicators

- Whale positioning

The main difference is that short-term traders are looking to make a quick profit based on the trading market’s current performance. The long-term investor is not concerned with the trading market because a high-quality project will ultimately survive, even in the face of adversity.

Trading and investing in crypto has advantages and disadvantages. One significant drawback is that traders do not benefit from staking, and they must pay a fee to trade.

In contrast, long-term investors have more flexibility and less stress managing multiple positions. They also benefit from time working in their favor. While staying updated on project developments, long-term investors experience less time pressure than daily traders.

How to Decide Whether to HODL a Crypto

HODLing is a play on the concept of ‘holding’ onto a crypto investment in the long term. In doing so, the idea is to ride out short-term volatility. As the ancient adage goes, “time in the market beats timing the market.”

The HODL term essentially describes what every seasoned investor does – hold their assets for long periods, remaining stoic in the face of price fluctuations. But because crypto is so volatile, it means holding onto it when times are extremely tough and volatile.

If In Doubt — HODL There are additional technical considerations when choosing to sell or hold your assets. Remember that you will pay a fee to buy and sell crypto assets. And you also pay fees to transfer/swap assets. This fee can be extremely high if the network is congested. At one time, Ethereum fees were over $100, depending on the transfer size and other considerations. The default position should always be to HODL rather than sell. Because the overall market tends to go up with time, and you pay a fee when you buy and a fee when you sell. The best portfolios are passively managed and the longer you can hold, the more profitable you will likely be. At least if you are well-diversified.

If you’re wondering whether or not you should HODL your long-term crypto investments, consider the key points discussed below.

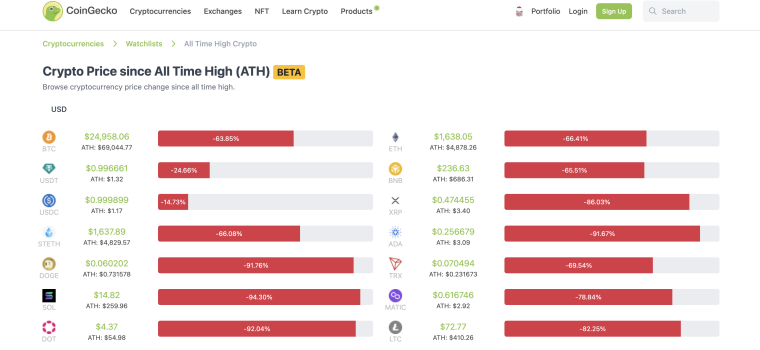

#1 — Prior All-Time High

A great way to find the best long-term crypto investments for HODLing is to research prior all-time highs (ATH). In doing so, you can extract some really useful information about the strength of your investment.

- For example, Bitcoin, Solana, the Sandbox, and plenty of other top-rated crypto projects last hit an all-time high in late 2021.

- Although the broader markets might be stuck in a bearish cycle, it likely won’t take too long for these projects to regain their prior peaks.

- Some coins offer increased potential compared to their ATH than others. Purchasing coins with a low value relative to their ATH could offer increased price potential.

So, while the crypto industry largely moves in the same direction, there are still discrepancies regarding the ATH that need to be addressed.

#2 — Passive Income

Passive or additional income is a major factor when deciding to hold on to your crypto long-term. It’s income that is guaranteed, provided the ecosystem survives. Projects like Solana and Algorand each offer 7% staking rewards. These are known as “proof-of-stake” (POS) ecosystems.

A 5% to 10% reward for the amount staked is generous and should be a prime consideration for new investors. The rewards encourage more people to the ecosystem, and the more people on a network/ecosystem, the more resilient it will be, reducing the risk of collapse. There are other benefits, such as yield farming, but this is for advanced crypto users.

Be Careful With Enticing Staking Rewards Projects that offer rewards above 15% should be considered with skepticism. Such rewards are typically not sustainable. OlympusDAO offered 7,000% rewards in its earlier days before being revealed as a Ponzi scheme. After all, where exactly is the money coming from? A project can grow 5%—10% in a year but is not likely to generate 7,000% organically.

#3 — Market Competition

With over 22,000 cryptocurrencies listed on CoinMarketCap, competition is now extremely fierce in the blockchain arena.

This is why it is important to choose projects that offer something unique. If a project doesn’t offer something unique, it must provide a more efficient and powerful output than its main competitors.

Ethereum’s high fees and inability to handle more than 16 transactions per second make it inefficient. Solana can handle over 65,000 transactions per second at near-zero fees. Polkadot is another promising long-term coin, with over 577 projects building on its network.

It’s worth remembering that a project can have good fundamentals but might not attain price appreciation due to market saturation. An example is the Web3 payments industry, which tends to have many projects claiming to make payments easier. It’s more difficult to stand out in such markets.

#4 — Utility & Real World Uptake

Adoption levels and actual use cases are extremely important when deciding whether to HODL a coin. Consider the project roadmap, the number of current users, and what area it addresses.

Some areas, such as gaming, are more lucrative than others. This is because gamers spend much time (and money) on a given ecosystem, potentially thousands of hours. Fans can also be passionate about games, a huge advantage to any ecosystem.

It’s important to avoid short-term investors who are only interested in making a quick profit. Relying just on financial figures can be misleading. Instead, you should assess whether there is genuine interest in the project, which can be demonstrated by its promotion on social media platforms like Twitter and Facebook.

Additionally, you should examine the project’s tokenomics and roadmap. The roadmap outlines the project’s plan for the next 1-5 years. The tokenomics describes how tokens are distributed and the cost per token at each stage.

To hold onto your cryptocurrency, you will also want to take these factors into account:

- DeFi Rewards — There is little reason to sell if a coin offers staking rewards between 5% and 15%.

- Longevity & Sustainability — A garbage coin is better sold than holding out. The longer a Web3 project has been operational, the more traffic, apps, developers, and users it will have, making it less likely to go bust. Parallels can be drawn with the equity market.

- Multichain Providers — Multichain providers (Solana, Polygon) have more potential in many ways because they are networks that other Web3 projects build upon. This increases their longevity because you are far less likely to go bust if you have hundreds of projects within your network.

- Privacy, Security, and Decentralization — There is an ongoing desire from the public to keep their transactions private and secure. When a blockchain is reputed not to fulfill these aims, it can result in poor PR and a negative price impact.

#5 — Regulatory Concerns

Another point to remember is regulation, which can impact a project regardless of its success. Privacy-based coins have been banned in certain countries and cannot be purchased on centralized exchanges. The SEC recently targeted Coinbase and Binance, which prompted Crypto.com to shut down regional operations. Robinhood, meanwhile, is delisting Cardano, Polygon, and Solana based on their classification by the SEC as securities.

The SEC Could Finally Be Restructured — Good For HODLers?

At the time of this writing, the Republicans have introduced a Bill to fire Garry Gensler, the SEC chairperson, due to an “abuse of power” about cryptocurrency investigations. The SEC Stabilization Act was introduced to clarify Web3 businesses and exchanges. Such a bill is long-awaited within the Web3 industry, where regulators have been inconsistent.

We treat all of our investment suggestions with extreme caution and responsibility. Our team examines 12 distinct performance indicators when evaluating any digital asset we present to our readers. Here are the most important ones:Our Methodology for Ranking and Reviewing Crypto Assets

Conclusion

This article explored the best long-term crypto investments for 2024, identifying projects with solid fundamentals, resilience, and growth potential.

With the potential for less volatility and a focus on well-established projects, investors can navigate the dynamic crypto landscape and position themselves for sustained growth over time. It’s essential to stay informed, conduct thorough research, and choose projects that align with individual investment goals and risk tolerance.

FAQs

Can you invest in crypto long-term?

Which cryptocurrency is best for long-term investment?

Which crypto has the most potential?