The popularity of the best DeFi staking platforms lies in their ability to turn crypto holdings into assets. DeFi, or decentralized finance, has opened up ways for crypto enthusiasts to stake cryptocurrencies on various platforms, earning interest in return.

In this guide, we’ll cover six of these platforms, explaining how each of them works. and how you can use them to potentially start earning passive income.

The Best DeFi Staking Platforms List

- DeFi Swap – Decentralized Staking Platform Offering High APYs

- Aqru – Earn Up to 12% APY on Stablecoins

- YouHodler – Stake a Variety of Assets on One Platform

- Crypto.com – Stake 40+ Different Cryptocurrencies

- Nexo – 2% Bonus Interest When You Earn Interest in NEXO

- Binance – Ultra-high Interest Rates and Flexible Staking Periods

Top DeFi Staking Platforms Reviewed

Want to know more about the best DeFi staking platforms so you can decide which one is right for you? We’ll explain why each of these platforms stands out and why you should consider using them to stake your crypto.

1. DeFi Swap – Decentralized Staking Platform Offering High APYs

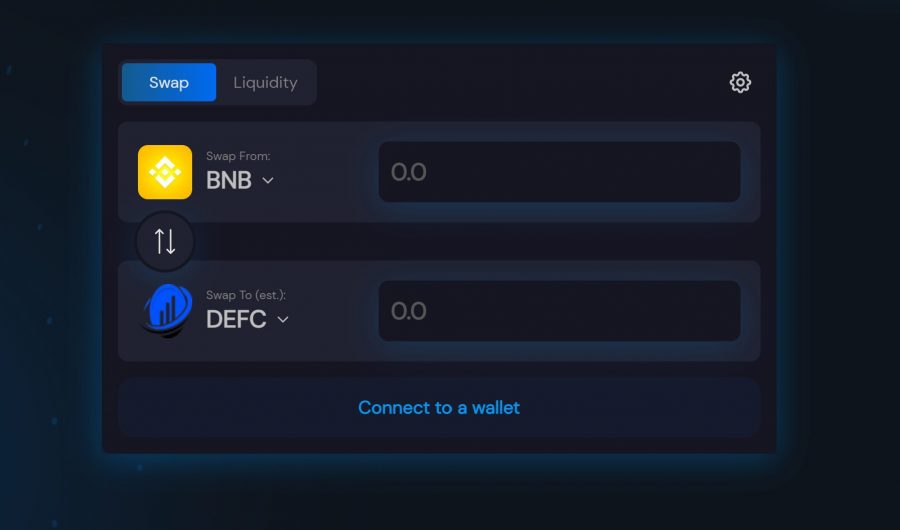

DeFi Swap is a new cryptocurrency exchange and one of the top staking platforms available today. The platform aims to be a complete solution for decentralized finance, which is reflected in its name, DeFi Swap. The exchange is fully decentralized and features DeFi Coin (DEFC) as its main token.

On DeFi Swap, token holders can stake DeFi Coin and earn interest up to 75% APY making it one of the best DeFi interest rates on the market. You don’t have to jump through any hoops and there are no limits on how little or how much you can stake. You can buy DeFi Coin through DeFi Swap by exchanging from any of hundreds of popular cryptocurrencies.

There are currently 4 lock-in periods available at DeFi Swap: 30 days will earn you 30% APY, 90 days earns 45% APY, 180 days earns 60% APY, and 360 days earns 75% APY. Those lock-in periods are long compared to other staking platforms, but you’ll also be hard-pressed to find such high interest rates. It’s also worth keeping in mind that DeFi Coin has appreciation potential – after DeFi Swap launched, the coin’s value jumped by 500%.

There’s also another reason to keep your DeFi Coin locked and earning interest: DeFi Swap charges a 10% transaction fee every time someone sells DEFC. That fee is designed to encourage a mindset of long-term investing in DeFi Coin. All fees paid from sales are distributed as rewards to current token holders.

Pros

- Interest rates up to 75% APY

- Choose from 4 lock-in periods

- DeFi Coin jumped 500% after exchange launch

- Fee on sales encourages long-term holding

Cons

- Only accepts DeFi Coin for staking

- No mobile app available

2. Aqru – Earn Up to 12% APY on Stablecoins

Aqru is another one of the best DeFi staking platforms in 2025 and it makes starting to earn interest incredibly simple. With this platform, you don’t even have to own crypto to jump into staking. Aqru accepts deposits by credit card, debit card, and bank transfer in addition to crypto transfers. If you deposit fiat, Aqru will automatically exchange your funds for the cryptocurrency you want to stake.

This platform currently offers staking on 5 cryptocurrencies: Bitcoin, Ethereum, USD Coin, Tether, and DAI. You’ll earn 12% APY on the 3 stablecoins and 7% APY on Bitcoin or Ethereum.

Importantly, Aqru’s crypto interest account doesn’t have any lock-in periods, so you’re always free to change up your portfolio among these 5 cryptocurrencies or withdraw your funds at any time. In addition, Aqru pays out interest daily, speeding up the rate of compounding on your stake.

Aqru doesn’t charge any withdrawal fees when you take out fiat, although there is a small fee for crypto withdrawals. Withdrawals take around 24 hours. Right now, when you sign up for Aqru, the platform will give you 10 USDT as a bonus for trying out the platform. Aqru also offers a 75 USDT referral bonus.

Check out our Aqru review for more details.

Pros

- Earn 12% APY on USDT, USDC, and DAI

- Accepts fiat deposits

- No lock-in periods

- No withdrawal fees for fiat

Cons

- Limited selection of coins to stake

3. YouHodler – Stake a Variety of Assets on One Platform

YouHodler is a Swiss platform founded in 2017 with the intention of making DeFi staking simple and accessible. With over 150,000 users around the world already earning interest with YouHodler, it’s a great time to get involved.

As you’d expect from a platform centred around long-term crypto investments, security on YouHodler is first-rate. With in-built Ledger Vault technology, investors can choose from a range of custodial options to add more protection to their accounts. Additionally, YouHodler also owns crime prevention insurance, protecting up to $150 million worth of assets.

On top of YouHodler’s loan offerings, investors can also earn interest on their crypto holdings up to a rate of 15%. It’s possible to earn interest on over 50 different assets but the rates vary so it’s worth double-checking before locking up any funds.

Interest is compounding and paid weekly, which makes YouHodler an incredibly convenient place to store any assets. Investors can withdraw their crypto at any time or keep it stored for as long as they want, adding extra customizability to the platform.

All said and done, YouHodler is a small but powerful platform. It’s quickly growing to become one of the best DeFi platforms on the market and certainly has a ton of potential.

Pros

Cons

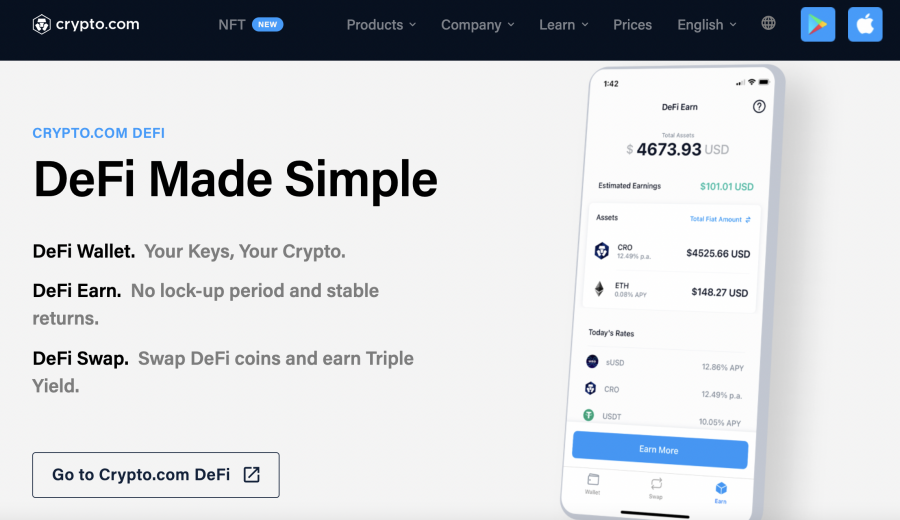

4. Crypto.com – Stake 40 Different Cryptocurrencies

Crypto.com is one of the largest DeFi crypto staking platforms available right now. It offers a comprehensive crypto exchange and lets you stake more than 40 different cryptocurrencies in your crypto savings account, making it a great option for any crypto investors who want to build a portfolio of interest-earning coins. Some of the coins accepted for staking include Bitcoin, Ethereum, USD Coin, Avalanche, Tezos, Solana, Pax Gold, DAI, Algorand, and Terra.

Crypto.com DeFi wallet staking rates vary based on a few different factors. First, each coin has a different staking rate. The maximum rate currently available is 14.5% APY, for staking Polygon. On top of that, your rate will depend on your lock-in period. Crypto.com offers flexible staking periods as well as 1-month and 3-month lock-in periods.

Finally, your Crypto.com DeFi wallet staking rates will depend on how much CRO you have staked. CRO is the native token of the Crypto.com blockchain. To get the best rates, you must stake at least 40,000 CRO – the equivalent of around $9,000. Mid-tier rates are available for users who stake at least 4,000 CRO (approximately $900).

Staking with Crypto.com is fairly straightforward, making it a good choice for first-time DeFi users. The platform also offers its own crypto wallet for you to use.

Pros

- Stake 40+ cryptocurrencies

- Integrated exchange and crypto wallet

- Earn up to 14.5% APY

- Flexible staking or lock-in periods up to 3 months

Cons

- Must stake CRO for best rates

- Low interest rates for stablecoins

5. Nexo – 2% Bonus Interest When You Earn Interest in NEXO

Nexo is a top crypto staking and crypto lending platform that offers excellent perks based on its native NEXO crypto token. To understand how interest rates at Nexo work, you have to understand the platform’s loyalty system. There are 4 tiers, and you progress based on how much NEXO you hold in your portfolio. To reach the top Platinum tier, at least 10% of your account balance must be in NEXO.

Platinum-level account holders get interest rates up to 10% APY on stablecoins and 7% on most other cryptocurrencies. In addition, if you opt to take your interest payments in NEXO rather than the coin you staked, you’ll receive 2% bonus interest.

Nexo doesn’t require you to lock in your coins when staking to get these rates and all interest is paid out daily. So, Nexo offers the potential for flexible compounding interest and the ability to move in and out of coins quickly as market conditions change.

Nexo accepts staking on a wide range of cryptocurrencies, including Bitcoin, Ethereum, Litecoin, Ripple, EOS, Solana, BNB, Avalanche, Terra, and more. You can also borrow against the value of your staked cryptocurrencies, making this platform ideal for investors who want to earn money while taking on opportunities to earn even more.

Pros

- Rates up to 10% APY for stablecoins

- Earn 2% bonus interest if you get paid in NEXO

- Wide range of cryptocurrencies to stake

- Interest is paid out daily

Cons

- Must hold NEXO to get the best rates

- Loyalty system can be difficult to navigate

6. Binance – Ultra-high Interest Rates and Flexible Staking Periods

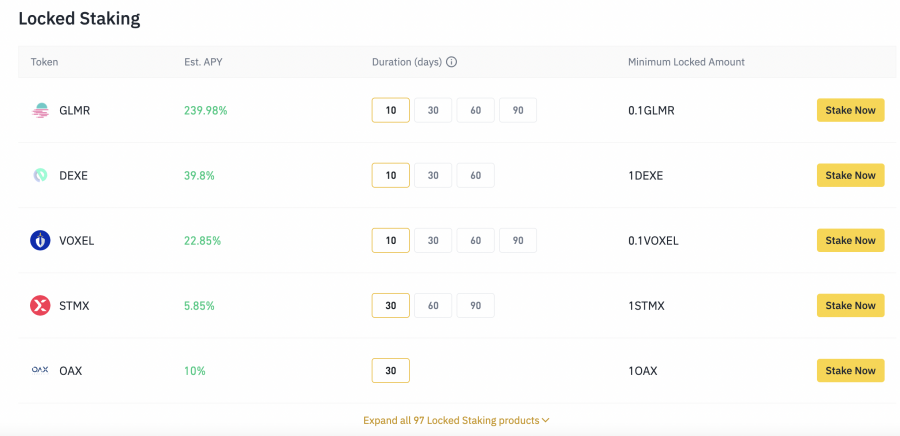

Binance is the crypto staking platform of choice if you’re after ultra-high interest rates in the triple digits. Right now, you can earn interest on Axie Infinity (AXS) up to 120% APY with a lock-in period of 90 days. Other coins available for staking offer rates well over 50% APY if you’re willing to stake your coins for 90 or 120 days.

In addition to locked staking, Binance also offers flexible DeFi staking periods. The range of coins and staking options is quite impressive and gives investors the flexibility needed to build a portfolio of different returns. In all, there are more than 120 different cryptocurrencies available for staking on Binance.

Binance also stands out for offering some of the highest staking rates for Bitcoin. A flexible stake will only earn you 1.2% APY, but locking in your Bitcoin for 60 days will earn you 8.19% APY. So, Binance can be a good option to buy Bitcoin and hold it while earning interest.

All interest earned from staking with Binance is paid out daily. There are staking minimums, which vary by coin. If you use Binance as your crypto exchange, you can filter the list of available staking options to match the coins you hold in your wallet.

Pros

- Rates up to 120% APY for volatile coins

- Locked and flexible staking options

- Rates up to 8.19% APY for Bitcoin

- Interest paid out daily

Cons

- Long lock-in periods for highly volatile coins

- List of coins to stake is constantly changing

How Does DeFi Staking Work?

DeFi staking involves locking your tokens to a blockchain for a certain amount of time. When you lock your tokens to a blockchain, they can be used by blockchain users—called validators—to verify new transactions on that blockchain.

Once new transactions are validated, the blockchain releases new coins. Some of these new coins go to the validators as a reward for their work, and some go to stakers as interest payments for lending their coins to enable the whole process.

So, DeFi staking is a way to earn interest on the cryptocurrency you already own. It puts your crypto to work for you, generating steady income without requiring you to sell your tokens. It’s often referred to as DeFi yield farming.

DeFi staking typically requires you to stake your coins for a minimum of one day to start earning interest. If you choose a platform or staking option that enables flexible staking, you can withdraw your coins anytime after that and keep any interest you earn. This is a good option for volatile coins since you may want to withdraw them from staking and swap them for another cryptocurrency to realize your gains or limit losses during a big price movement.

If you choose a lock-in period, you must keep your coins staked for the entire period in order to collect your interest. You can typically earn higher interest rates in exchange for staking your coins for a longer period. However, keep in mind that you are at greater risk if the price of your coins drops while they are staked.

Interest from staking can be paid out daily, weekly, or monthly. Typically, daily interest payments are most favorable to crypto investors because the interest you earn can be staked. So, the amount you have staked – and your potential returns – compound on a daily basis.

Which Platforms Have the Best DeFi Staking Rates?

The best DeFi earning platforms offer not only a wide selection of coins to stake, but they also offer some of the best staking coins with high interest rates. Our top pick, DeFi Swap, currently offers rates starting at 30% APY and as high as 75% APY when you stake DeFi Coin. On Binance, you can get rates up to 120% for coins like Axie Infinity.

Staking rates vary based on a number of different factors. First, the coin you’re staking matters. Coins that are in high demand for validation typically offer higher interest rates. You can also find different interest rates for the same coins at different platforms.

Staking rates also vary based on whether you choose a flexible staking period or a preset lock-in period. The longer your lock-in period, the higher the interest rates you’re likely to get.

Finally, some platforms offer higher interest rates for popular cryptocurrencies in exchange for staking or holding their native tokens. For example, Crypto.com reserves its top-tier rates for users who stake CRO. Nexo offers a 2% interest rate boost if at least 10% of your account balance is held in NEXO.

Keep in mind that there is risk in staking DeFi coins, especially if you choose a lock-in period and a volatile coin. If the value of the coins you have staked falls during your staking period, it could negate the money you earned through interest. On the other hand, there is also a chance that your coins will appreciate, potentially earning you more money.

What DeFi Coins Can You Stake?

The DeFi coins available to stake vary from platform to platform.

Generally, most DeFi staking platforms allow you to stake widely used coins like Bitcoin and Ethereum. You can also stake stablecoins like USD Coin and Tether. Platforms like Binance offer more than 120 coins for staking, while Crypto.com offers more than 40 coins.

On the other hand, some platforms, such as DeFi Swap, focus on specific coins. For example, at DeFi Swap, the only coin available for staking is DeFi Coin. While you won’t have as much freedom to build a portfolio with platforms like this, you can get higher rates. DeFi Swap currently offers interest up to 75% APY for DeFi Coin.

Keep in mind that staking interest rates vary by coin. Some coins will pay only a few percent interest, while others will pay double or even triple-digit rates. In addition, the availability of flexible staking periods or lock-in terms will vary from coin to coin at most DeFi staking platforms.

Is DeFi Staking Taxed?

Profits earned from staking DeFi tokens are taxed. The IRS hasn’t issued clear guidance on how to report staking income, but most accounting experts recommend treating it as you would any other type of interest income. So, staking gains are reported as ordinary income rather than capital gains.

Is Defi Staking Safe?

As with most things in cryptocurrency, DeFi staking carries risk. When you stake DeFi coins, you are giving up ownership of those coins. If your DeFi staking platform is hacked or your coins are otherwise lost, you may not have recourse to get them back. Some platforms have insurance policies to protect users against these types of losses, but there is no guarantee.

The other thing to keep in mind when staking DeFi coins is that the price of the coin itself can change during your staking period. If the value of the coins you have staked falls, your losses could exceed your gains from staking interest.

Conclusion

Just like with any other investment, investing in the best DeFi platforms carries a certain risk. The primary risk being the inherent volatility of cryptocurrency, which means that there’s a potential for both high rewards and significant losses. Therefore, although it is often a risk worth taking, doing in-depth research is vital.

If you’re interested in staking today, check out Sponge V2. It is an upgraded version of the $SPONGE token with more utility and even higher rewards. It offers a high minimum staking APy of 40% for early stakers.