If you want to increase your crypto earnings, then finding the best DeFi interest rates is the first thing you need to do. DeFi, or decentralized finance, offers unique opportunities to earn interest on crypto assets.

We’ve looked into and put together a list of the top DeFi earning platforms so you can find the most profitable options right now. We’ll also share details on how DeFi interest works, which DeFi coins you can earn interest on, and an easy guide on how to start earning interest today.

5 Platforms Offering the Best DeFi Interest Rates

Let’s take a look at which platforms have the best DeFi interest rates:

- DeFiSwap – Upcoming DeFi interest rates protocol that offers up to 75% APY.

- Aqru – Top platform for passive revenue with zero lockups.

- YouHodler – Earn interest on Bitcoin and Stablecoins.

- Crypto.com – Earn interest on DeFi across 40+ crypto assets.

- Nexo – Top platform for zero fees payments.

- Binance – Popular platform for hundreds of DeFi protocols.

Top DeFi Interest Platforms Reviewed

1. DeFi Swap – Upcoming DeFi Interest Rates Protocol

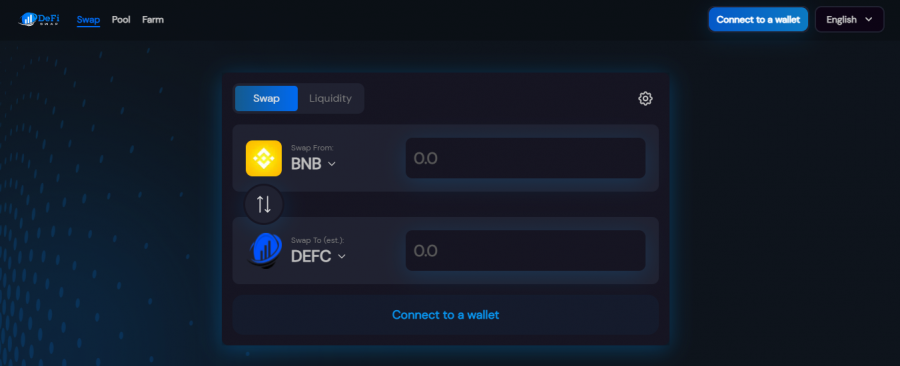

The best DeFi interest rate paying platform according to our research is DeFi Swap, a spinoff of the decentralised exchange (DEX) protocol DeFi Coin. DeFi Swap allows you to exchange your tokens with minimal obstacles.

The DeFi ecosystem has seen sustained growth in the past year, with the nascent sub-sector crossing over $200 billion in total value locked (TVL). The often criticised sub-sector comprises decentralised exchanges (DEXs), lending protocols, and yield farming platforms.

DeFi Swap allows users to swap, exchange, and provide liquidity on all ERC-20 tokens and stablecoins.

DeFi Coin operates as a DEX, liquidity hub, and passive income generating protocol. The protocol runs on three core fundamental pillars, including reflection, LP acquisition, and manual token burn strategy.

All transactions are levied 10%. 50% of this penalty is distributed to the long-term native token (DEFC) holders. This is done because the entire DeFi Coin and DeFi Swap ecosystem aim to discourage arbitrage trading and short-termism. The remaining 50% of the transaction fees provide liquidity to DEX protocols. As a result, DEFC holders can easily earn passively from all transactions carried out on the platform.

DeFi Swap recently made its foray into the DeFi space but has already posted impressive figures. At its core, the exchange platform allows users to swap, pool, and farm several digital assets. The platform’s annual percentage yield (APY) is even more mouth-watering and focused on the tier a user falls under.

DeFi Swap currently offers users four core plans with amazing APYs to back them up:

- Bronze – 30 Days – 30% APY

- Silver – 90 Days – 45% APY

- Gold – 180 Days – 60% APY

- Platinum – 365 Days – 75% APY

Holding for the long term means you can avoid fees and easily earn from owning some DEFC tokens.

Pros

Cons

Cryptoassets are a highly volatile unregulated investment product.

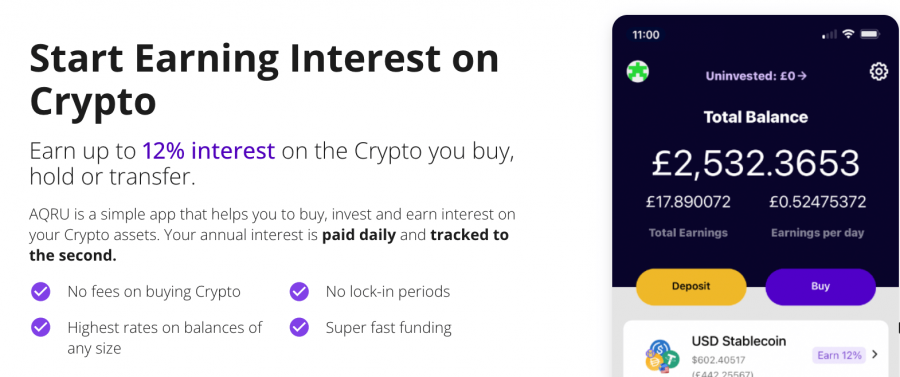

2. Aqru – Top Platform For Passive Revenue with Zero Lockups

Aqru is a recent entrant into the crypto space. The platform offers users an opportunity to earn a sizable amount of interest on their digital assets with zero lock-up periods. During the lock-up period, users can access their funds anytime they need them without delays due to the daily payout scheme Aqru operates.

You can earn from five top-performing digital assets in Aqru’s supported crypto library. These digital assets include USDT, USDC, and DAI which stands at 12%.

Also, pure-play cryptocurrencies are not left out. You can earn as much as 7% APY on Bitcoin and Ethereum deposits respectively. Aqru does not charge for crypto deposits or fiat withdrawals, but crypto funds withdrawn from users’ wallets attract a $20 fee.

The platform has partnered with the popular digital wallet service provider, Fireblocks, to safeguard digital assets under its custody. There is also a $30 million insurance cover for security breaches on the platform.

Aqru is regulated in the UK and Bulgaria as a virtual asset service provider (VASP).

Pros

Cons

Cryptoassets are a highly volatile unregulated investment product.

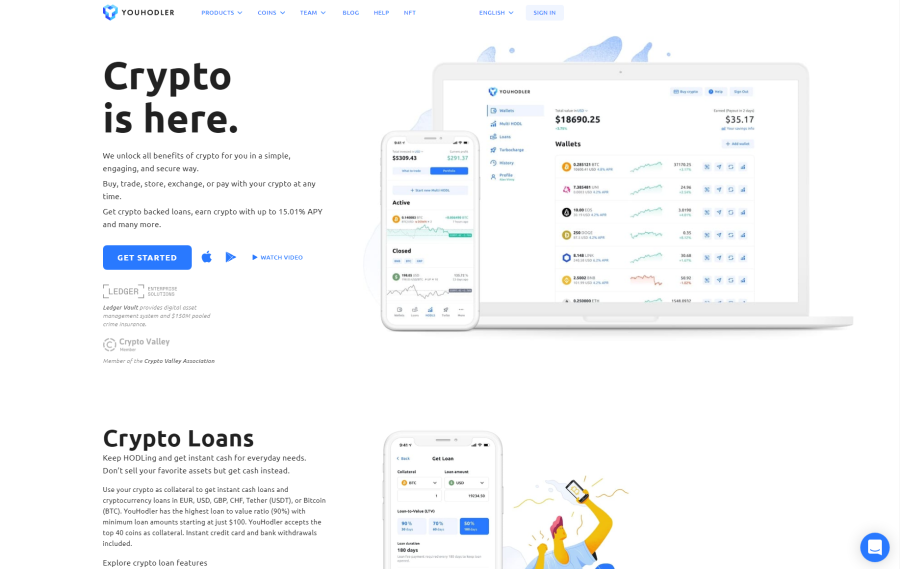

3. YouHodler – Earn Interest on Bitcoin and Stablecoins

Founded in 2017, YouHodler quickly shot to the forefront of the sector. This rise to fame was fueled by innovation, excellent rates, and a customer-focused approach. With more than 150,000 users already earning interest with YouHodler, things are looking rather promising for YouHodler.

It’s available in most countries but there are a few exceptions. YouHodler is not available in Afghanistan, Bangladesh, China, Cuba, Germany, Iran, Iraq, North Korea, Pakistan, Sudan, Syria, the USA, and US Islands.

YouHodler’s transparent, cheap crypto loans are one of the main draws to the platform. Investors can deposit crypto, select a payback term, and instantly receive a fiat loan using crypto as collateral.

In addition to its loans, YouHodler also allows investors to earn interest on any crypto assets at a rate of up to 15%. Stablecoions yield the best interest rate at up to 15.01% (including compounding) but assets like Bitcoin aren’t far behind with a 6.8% APR. Additionally, investors are not locked into any lengthy holds and can withdraw their assets at any time..

YouHodler is a solid choice for investors trying to find the best DeFi interest rates. It offers excellent rates and tons of flexibility which is always welcome in a sector dominated by lengthy, fixed lockup periods.

Pros

Cons

Cryptoassets are a highly volatile unregulated investment product.

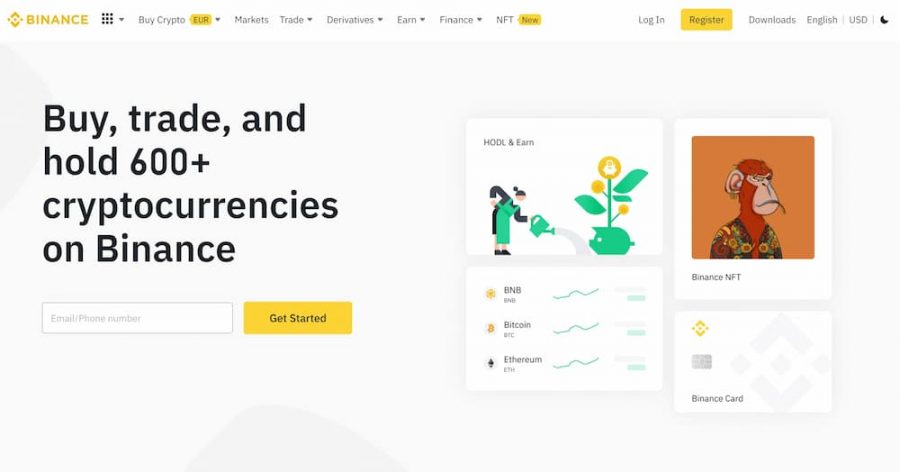

4. Binance – Popular Platform for Hundreds of DeFi Protocols

Binance is currently the world’s largest Bitcoin exchange. Launched in 2017, Binance processes billions of dollars worth of digital asset transactions daily.

The platform’s remarkable success is tied to its low or near-zero fees and the array of innovative financial products targeted at retail crypto investors. Binance offers access to 600+ digital assets for trading, with more than 50% of these blockchain-based assets available for passive income generation.

With Binance Earn, investors can earn as high as 100% on their crypto asset holdings. However, the earning potential on any digital asset is highly variable and may change depending on the number of subscribers per time.

For instance, Binance Earn offers users 120% APY to stake their tokens for a week with other options for a fixed option coming in at a handsome value of 70% APY for a two-week period.

Fee-wise, Binance Earn does not charge any deposit or withdrawal fees, and users can select between a flexible or more fixed earning regime.

Binance offers two-factor authentication (2FA), address whitelisting, and other industry-standard safety mechanisms. Several global financial watchdogs also regulate the platform.

Pros

Cons

Cryptoassets are a highly volatile unregulated investment product.

5. Crypto.com – Earn Interest on DeFi Across 40 Crypto Assets

Launched in 2016, Crypto.com started as a crypto trading platform. The Bitcoin exchange has since expanded its service offering for its 10 million customers to cover the DeFi space.

Crypto.com DeFi services are split into two factions. The first faction is its DeFi Wallet which allows users to store a large chunk of their ERC-20 tokens conveniently. Second is its Crypto.com Earn platform which boasts of many crypto assets.

Understanding the growing need among investors to generate passive income, Crypto.com allows users to interact with 40 yield-bearing digital assets.

The digital assets are split into stablecoins and pure-play cryptocurrencies. Maximum payout on the Crypto.com DeFi interest wallet rate stands at 14.5% APY. Meanwhile, stablecoins interest is pegged at 10% APY.

Crypto.com comes with a set of lock-up periods, including flexible holding terms of one or three-month lock-up periods. The amount a user earns depends on the amount of the exchange’s native token, Cronos (CRO), they hold in their wallet.

Another benefit Crypto.com offers is security for crypto assets. The platform stores more than 90% of all cryptocurrencies in offline storage. Also, users’ funds are protected using multi-factor authentication (MFA). In addition, Crypto.com is licensed by the Malta Financial Sector Authority (MFSA).

Pros

Cons

Cryptoassets are a highly volatile unregulated investment product.

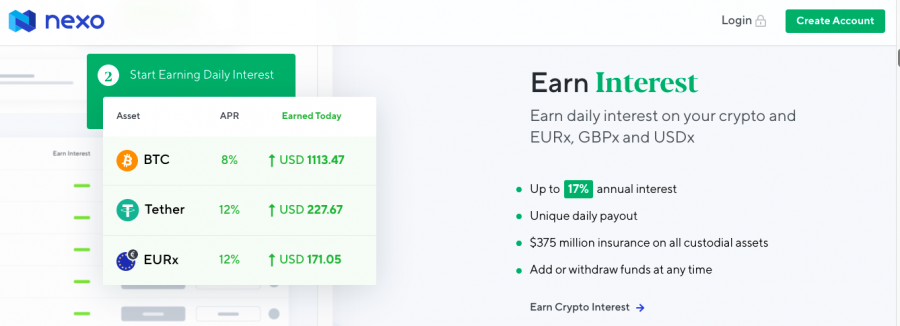

6. Nexo – Top Platform for Zero Fees

Nexo is a US-based crypto trading platform that has improved its crypto earning offers to accommodate the growing interest in DeFi-based services. The Bitcoin exchange is now one of the best DeFi interest rates platforms, given its focus on providing retail investors with a zero-fee trading structure.

While other DeFi-focused platforms may charge you a fee for accessing their earning program, Nexo does not have hidden fees or commissions. The platform doesn’t charge investors for deposits, withdrawals, or even holding digital funds for the long term.

As regards supported cryptocurrencies, the platform allows users to access over 35 digital assets. However, the amount you generate in passive income varies and it could range from a low 3% to as high as 17% APY. Stablecoin holdings attract the highest interest at 12% APY, and users can decide to earn in the network’s token, NEXO. This offering further boosts their earning potential by 4%. BTC and ETH deposits are pegged at a high of 8%, while other notable crypto assets command 10% and upwards in APY.

Nexo rewards users daily and offers both flexible and fixed earning schedules. Additionally, all Nexo earning accounts benefit from the $375 million insurance policy on the grounds of theft, loss of private keys, or hacks.

Unlike some of its competitors, Nexo is regulated by the US Financial Crimes Enforcement Network (FinCEN) as a money service business and Canada’s Financial Transactions and Reports Analysis Centre (FINTRAC).

Pros

Cons

Cryptoassets are a highly volatile unregulated investment product.

Best DeFi Interest Rates Compared

To compare the best DeFi interest rates, we have prepared an overview of the supported cryptos as well as the APY you stand to earn on each.

Platform

Amount of Crypto

Earning %

DeFi Coin

All ERC-20 coins and stablecoins

Aqru

5

Maximum APY of 12%

YouHodler

50+

Maximum APY of 15%

Crypto.com

40+

Maximum APY of 14.5%

Nexo

35+

Maximum APY of 17%

Binance

100+

Variable

How Does DeFi Interest Work?

DeFi interest yielding accounts work in two ways.

- The first way is similar to the traditional banking system in which digital assets are borrowed by crypto companies. These crypto-facing companies repay the loans with interest. The statutory APY is paid into the investor’s crypto account.

- Another way a DeFi interest account works is through staking. However, this works mainly for proof-of-stake (PoS) protocols. This PoS method requires users to lock up their crypto assets for a particular period. This lock-up is required to secure the network and verify transactions. In return, staked coins are rewarded with newly minted coins. But staking is a complex process and requires a lot of technical know-how for a retail user to execute. However, many crypto exchanges now offer staking-as-a-service (SaaS), which allows users to pool their coins to validate transactions in the underlying blockchain network. SaaS comes with a stated APY rate, which is paid to the user at the stipulated time frame minus the platform’s fees.

What Defi Coins Can You Earn Interest On?

The most likely coins for generating passive revenue are PoS-centered coins. While a number of platforms now offer yield-bearing accounts for proof-of-work (PoW) coins like Bitcoin, several investors prefer PoS assets due to the added flexibility of crypto earnings from borrowings and direct staking support.

These are a few of the best DeFi coins to earn interest:

1. DeFi Coin (DEFC)

Moreover, DeFi Coin employs a manual burning strategy that allows the team behind the project to reduce the amount of its utility token in circulation. This manual burning strategy is quite useful concerning its automatic counterpart which comes with a preset ratio. As a result of the strategy, the team can reduce a larger amount of DEFC tokens in circulation and better boost the digital asset’s value in the open market.

Price-wise, the digital asset has posted some of its best prices in the last couple of days. The ERC-20 token surged a whopping 240% following the launch of its long-awaited DeFi Swap DEX platform. Despite the crypto market facing the bearish doldrums, DEFC has remained a shining light in an otherwise austere climate. The digital asset is currently trading at $0.47, up 0.4% in the last 24 hours. This is a positive trend compared to the broader crypto market’s severe bearish outlook.

Cryptoassets are a highly volatile unregulated investment product.

2. Ethereum (ETH)

Ethereum is the foremost smart contract network and commands more than 50% of the entire DeFi ecosystem. Some of the best decentralised applications (dApps) are resident on Ethereum, as the layer-1 network offers unique security features as well as a feature-rich DeFi ecosystem.

However, the network has come under intense criticism for its reliance on the PoW consensus mechanism which comes with higher energy demands and slower throughput. Given this, the team is slowly transitioning to a PoS mechanism which addresses these deficiencies. To that effect, users can easily stake their coins on a number of crypto exchanges and earn interest for securing the network’s migration to a PoS model.

At press time, ETH is biting the dust alongside principal crypto Bitcoin. The foremost altcoin is currently trading at $2,530.66.

3. Cardano (ADA)

Cardano is a prominent rival to the Ethereum network. The platform offers a more robust and scalable alternative to DeFi users and investors through its Ouroboros PoS system. The platform costs a fraction in fees and requires little energy in verifying transactions.

The platform is currently fledgling out its ecosystem and now supports a number of promising dApps in its protocol. As a result, the PoS protocol can be locked up to earn interest in its native token, ADA. At press time, the digital asset is trading at $0.67, down 2.8% in the last 24 hours.

How to Earn Interest on DeFi

If you are keen on earning interest in this nascent industry, we recommend using the best DeFi interest rates platform, DeFi Swap. To get started, follow these steps:

Step 1: Connect Your Crypto Wallet

Visit the DeFi Swap website and start by connecting your cryptocurrency wallet. The platform is compatible with crypto wallets such as MetaMask. Users can click the ‘Connect Wallet’ option on the platform and follow the on-screen instructions to continue.

Step 2: Go to the DeFiSwap

Go to the official DeFiSwap website using the affiliate link.

Step 3: Buy and Hold DeFi Coins

Once you are on DeFi Swap, click on the “Buy with DeFi Swap” token to buy DEFC tokens. You can hold them in your DefiSwap account to continue earning interest.

Is Defi Interest Taxed?

Decentralised finance (DeFi) falls under the crypto umbrella, and the US Internal Revenue Service (IRS) views cryptocurrencies as ‘property’. This view means you will need to pay taxes based on your capital gains or income bracket.

However, DeFi interests are not directly taxed until there is a direct exchange for fiat currencies. So, you can easily earn more crypto assets, so you can pay less in taxes when you eventually decide to exchange for fiat.

Are Defi Interest Platforms Safe?

The crypto space is still relatively new, and there are several loopholes bad actors are exploiting to steal investors’ funds. However, this volatile industry is gradually ramping up its security measures, and many DeFi interest platforms are becoming more security conscious. Several undergo independent audit procedures by security firms.

Also, many DeFi platforms are supervised by global financial watchdogs. This supervision ensures that they uphold the highest security protocols in securing users’ funds. Insurance policies and user-specific security like MFA and 2FA, address whitelisting, and verification ensures that only the singular user has access to their funds at any one time.

Conclusion

In conclusion, our article has thoroughly reviewed the best DeFi interest rate platforms, delving into the working of DeFi interest, how to earn it, tax implications, and the safety of these platforms. We tried to simplify the process for you, providing the knowledge necessary so that you can maximize your earning easily and efficiently.

Cryptoassets are a highly volatile unregulated investment product.