Lately, there has been a significant surge in DeFi platforms, and identifying the best DeFi apps can be quite a task.

In this guide, we review the top 8 choices and the criteria used for evaluation.

Let’s dive in.

The Best DeFi Apps for 2025 List

We found that the providers listed below offer the overall best DeFi apps for 2025.

- DeFi Swap – Overall Best DeFi App for 2025

- Aqru – Popular DeFi App with No Fees on Buying Crypto

- Crypto.com DeFi Wallet – Various DeFi Lending Accounts to Choose From

- Binance – Trade DeFi Coins and Earn Interest

- Coinbase – Access the Decentralized Web via iOS and Android

- Nexo – Leading DeFi Lending Marketplace

- YouHodler – Top DeFi App for Diversified Portfolio

- Trust Wallet – Decentralized App to Access BSc Network

Each of the above DeFi apps differs in terms of its services offered, fees, minimum deposits, and more.

As such, it’s a good idea to read through our best DApps reviews before choosing a provider.

A Closer Look at the Top DeFi Apps

In order to select the best DeFi app for your requirements, you will first need to assess what services you seek. For instance, are you looking to earn interest on your idle digital currencies or or a secure storage solution?

You will also need to research the DeFi app provider in terms of safety, fees, supported tokens, and more.

To simplify your decision, we conducted a comprehensive review of the leading DeFi apps.

1. DeFi Swap – Overall Best DeFi App for 2025

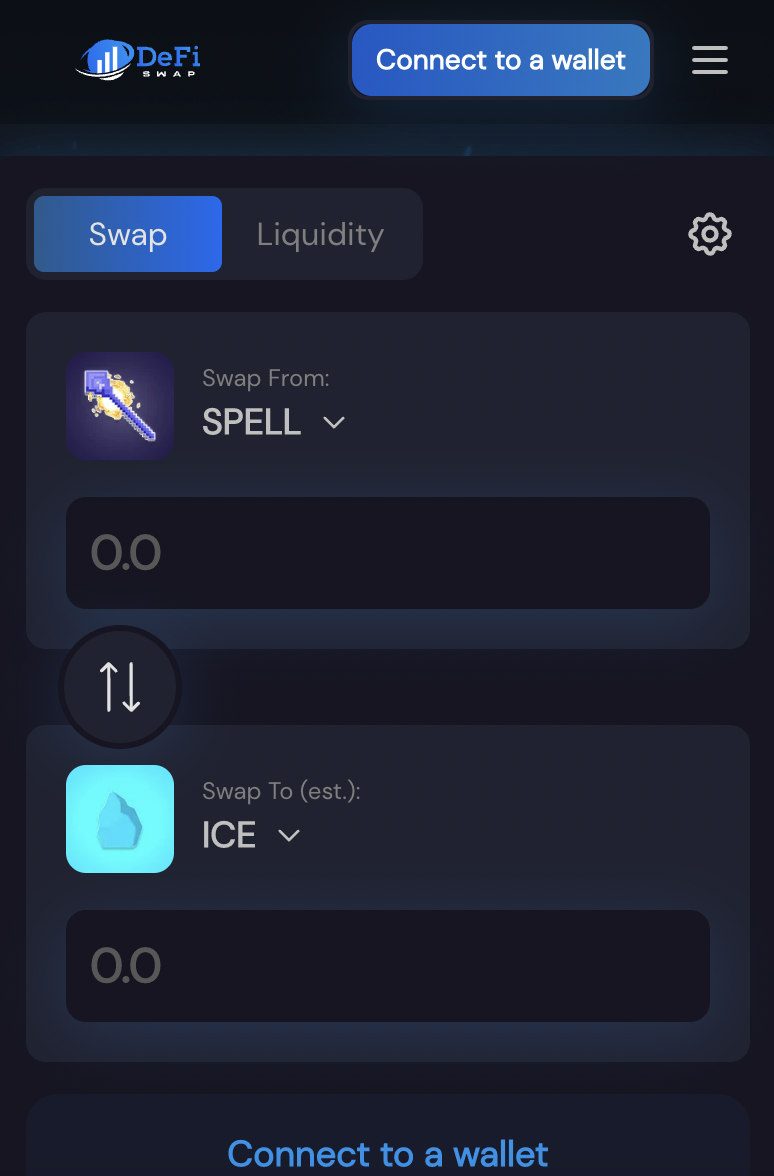

DeFi Swap ranks as one of the best DeFi apps to explore in 2025 because it gives users access to some of the top DEX coins. DeFi Swap is a recently launched decentralized exchange that provides many services, including a complete DEX that supports a large range of BSc tokens.

This means that you can use DeFi Swap to buy and sell digital currencies without needing to use a centralized platform. And as such, it allows for anonymous trading without the need for an account registration. Instead, you simply need to connect your crypto wallet to the DeFi Swap platform and you are good to go.

Moreover, DeFi Swap offers several tools that allow you to earn interest on your idle tokens making it one of the best DeFi staking platforms in 2025. First, there is the liquidity provision tool. This allows you to lend your crypto assets to the DeFi Swap exchange via a secure and transparent smart contract. In return, you’ll receive a portion of the collected trading fees.

The more volume that people trade, the more fees that will be collected, and thus – this translates into higher earnings for you. There is no lock-up requirement when providing liquidity on the DeFi Swap platform.

The next passive investment tool this top-rated platform offers is crypto yield farming. This allows you to stake your chosen digital token and in turn, you will generate an attractive APY. For example, if you were to stake DeFi Coin – which is their native token backing the DeFi Swap ecosystem, you can earn up to 75% per year in interest.

Your DeFi interest rate will, however, depend on how long you wish to lock away your tokens.

Management at DeFi Swap notes that the app is compatible with both iOS and Android devices.

Pros

Cons

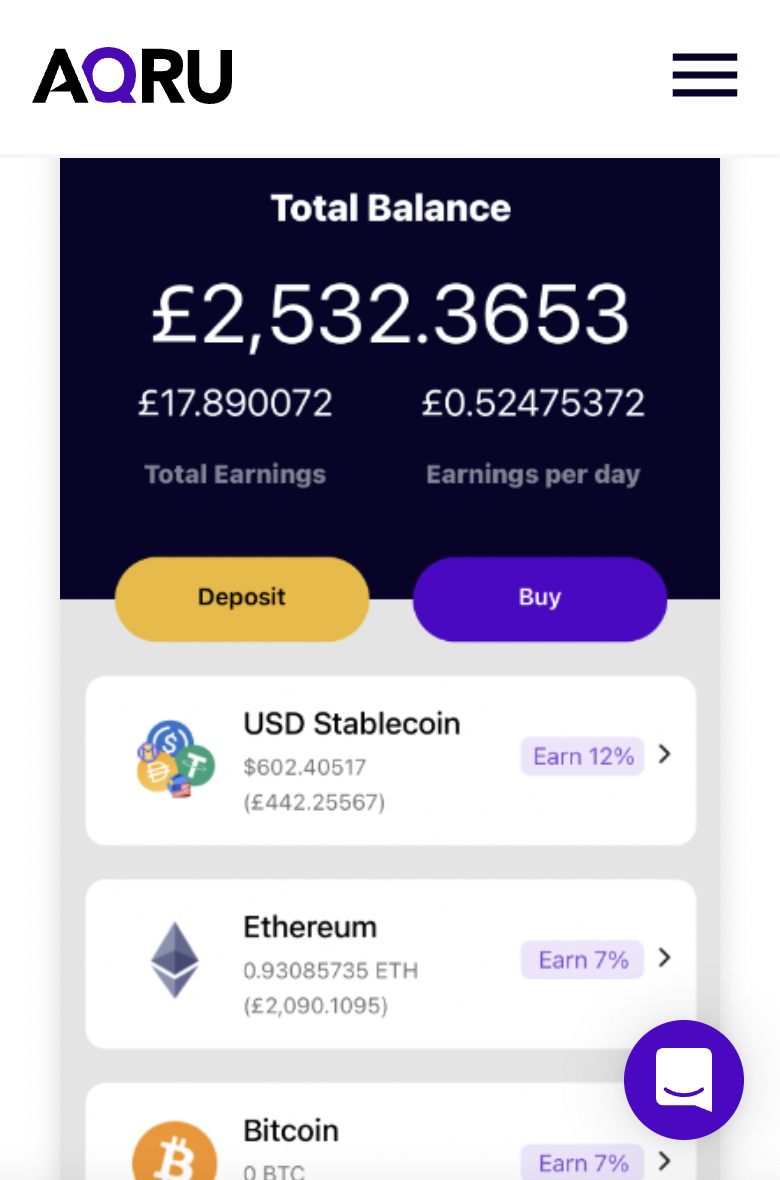

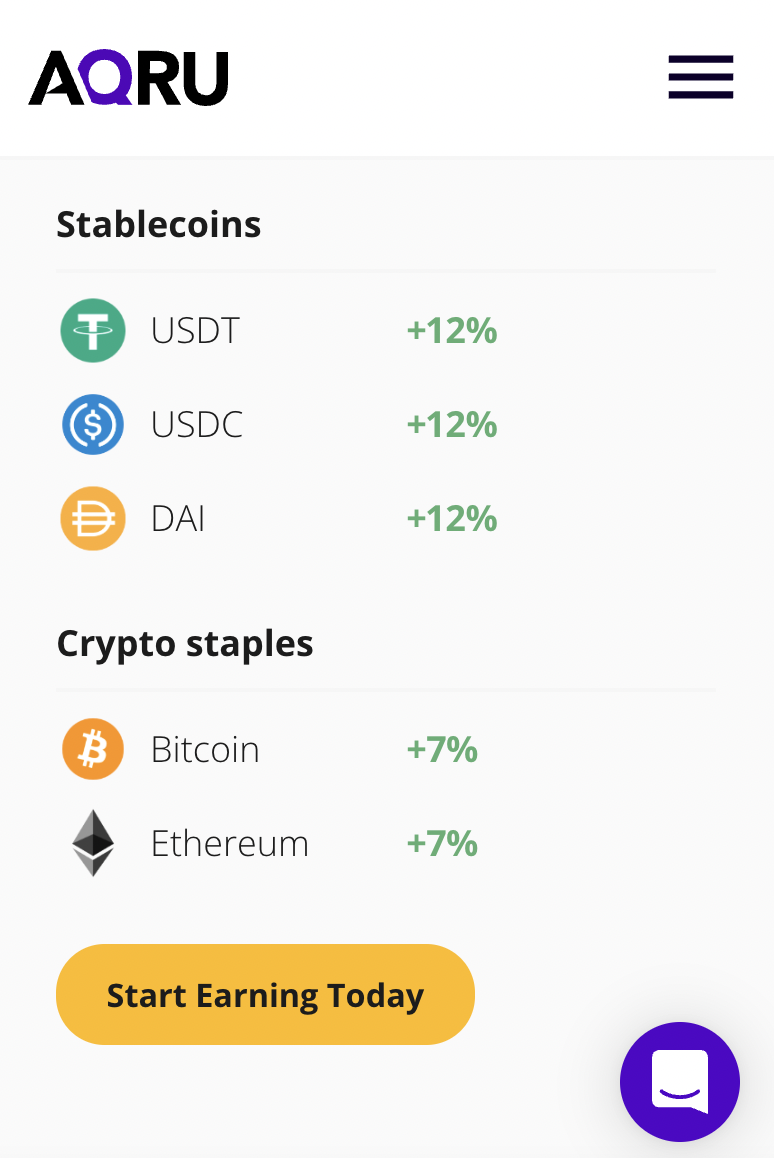

2. Aqru – Popular DeFi App with No Fees on Fiat Withdrawals

If you’re looking for the best DeFi yield app in terms of earning interest on major crypto assets like Bitcoin, then look no further than Aqru. In a nutshell, Aqru allows you to earn interest when you deposit Bitcoin and Ethereum into its crypto savings account.

Best of all, unlike many other crypto interest accounts in this industry, there are no caps in place. This means that you can deposit as much Bitcoin and Ethereum into your Aqru account and still maximize your interest per year. Moreover, you will not need to lock your tokens away for a minimum period of time at Aqru.

Additinally, withdrawals are honored whenever you wish to cash your tokens out. However, although fiat currency withdrawals are free here, you will be charged $20 when transferring crypto out of Aqru.

Aqru is one of the few providers in this space that allows you to deposit funds in dollars, euros, and pounds, and allows you to buy cryptocurrency and then automatically swap the tokens over to a savings account of your choosing.

When it comes to the Aqru DeFi app, this is available to download for free on both iOS and Android devices.

Pros

Cons

Cryptoassets are a highly volatile unregulated investment product.

3. Crypto.com DeFi Wallet – Various DeFi Lending Accounts to Choose From

Crypto.com also offers one of the best DeFi apps in the market. This decentralized mobile app triples up as a wallet, DeFi exchange, and crypto staking tool.

Starting with its storage offering, Crypto.com offers a non-custodial wallet. This means that not even Crypto.com can access your DeFi coins. And therefore, you do need to ensure that you do not lose your backup passphrase. Available on both iOS and Android, the Crypto.com DeFi wallet app also allows you to swap tokens in a decentralized manner.

The app offers a wide selection of crypto tokens, so you will have plenty of options when it comes to finding DeFi investment opportunities. If you’re also looking to generate some passive income, the Crypto.com app also offers staking.

Crypto.com does not require you to lock your tokens away when staking digital tokens, which offers great flexibility. You will also find that Crypto.com offers superb APYs on many of its supported tokens. In terms of security, the Crypto.com DeFi wallet app will store your private keys directly on your smartphone device.

Pros

Cons

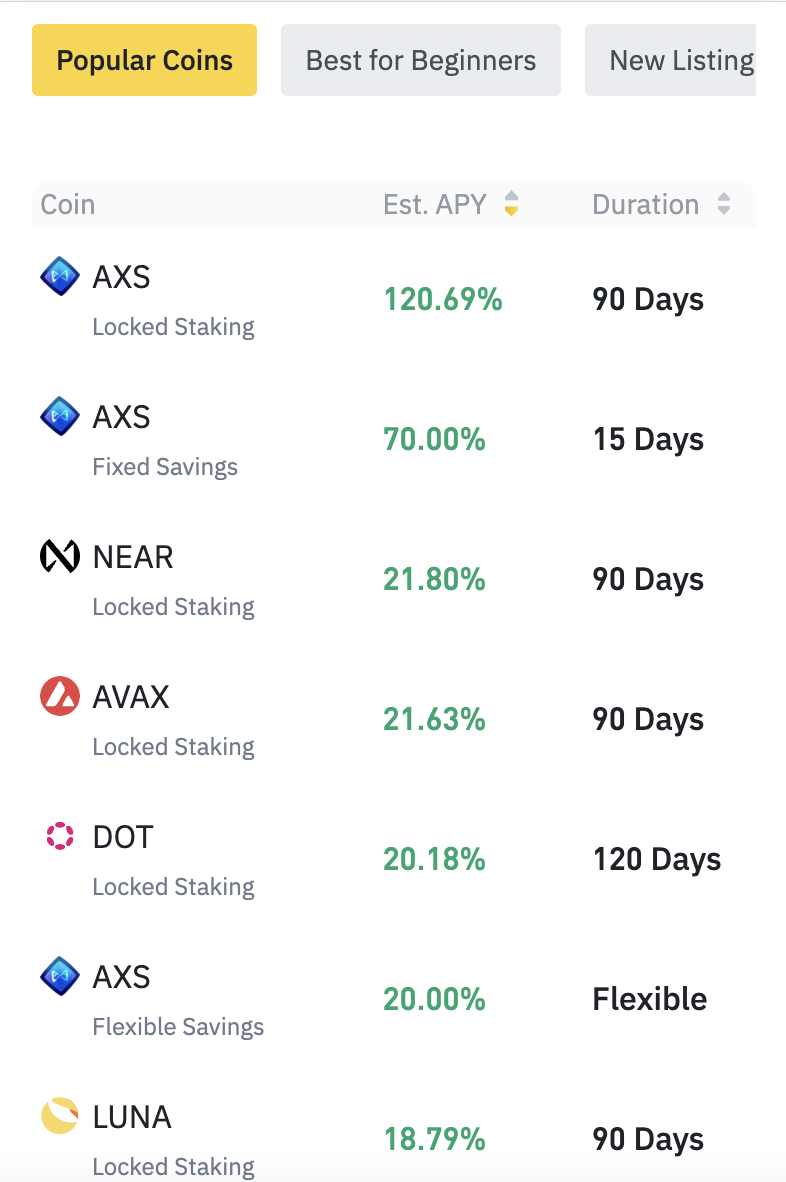

4. Binance – Trade DeFi Coins and Earn Interest

Binance , the world’s largest crypto exchange for trading volume, is looking to become the go-to hub for all things DeFi. First and foremost, once you have created an account with this provider, you can then download its mobile app for iOS and Android.

Then, you can start earning interest on your idle digital currencies straightaway. All you need to do is choose a suitable plan and you are good to go. Binance offers DeFI interest accounts on dozens of tokens, and APYs varying based on your chosen lock-up duration. Nonetheless, some tokens attract an APY of well over 100%.

In addition to savings accounts, you can also generate interest through staking. Moreover, if you are looking to build a diverse portfolio of DeFi tokens, Binance has you covered. After all, its global exchange – which excludes the US, offers over 600 different crypto assets. US traders, however, have access to just over 100+ tokens.

Pros

Cons

Cryptoassets are a highly volatile unregulated investment product.

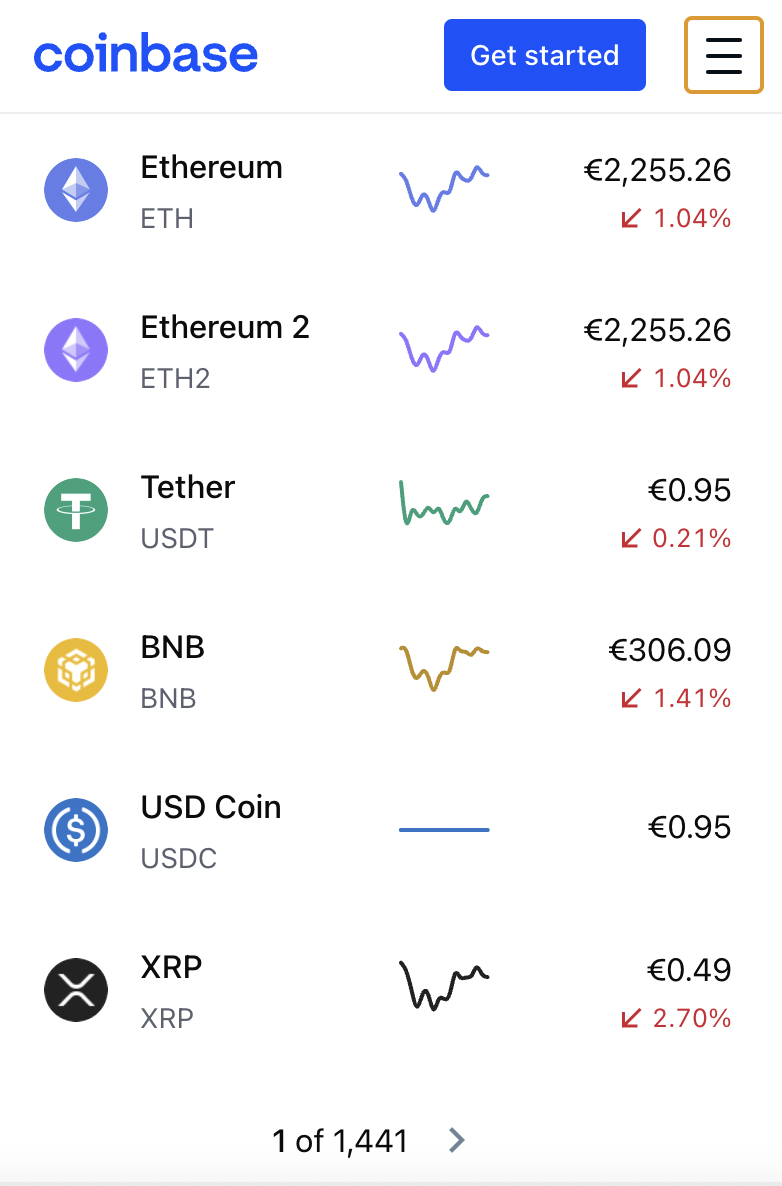

5. Coinbase – Access the Decentralized Web via iOS and Android

The Coinbase is perhaps the best DeFi app for beginners. Just like the main Coinbase website, the app is very user-friendly and requires very little, if any, prior experience.

This DeFi app offers a decentralized wallet that gives you full control over your private keys and backup passphrase. This also means that it is your responsibility to keep your private keys away from the wrong hands. In addition to offering great wallet services, this DeFi app also gives you access to an NFT marketplace.

This covers a wide variety of ERC-721 compatible tokens. If you wish to buy and sell DeFi tokens, the Coinbase app supports hundreds of markets. You simply need to choose which tokens you want to swap and the exchange will happen instantly.

Pros

Cons

[/su_list]

Cryptoassets are a highly volatile unregulated investment product.

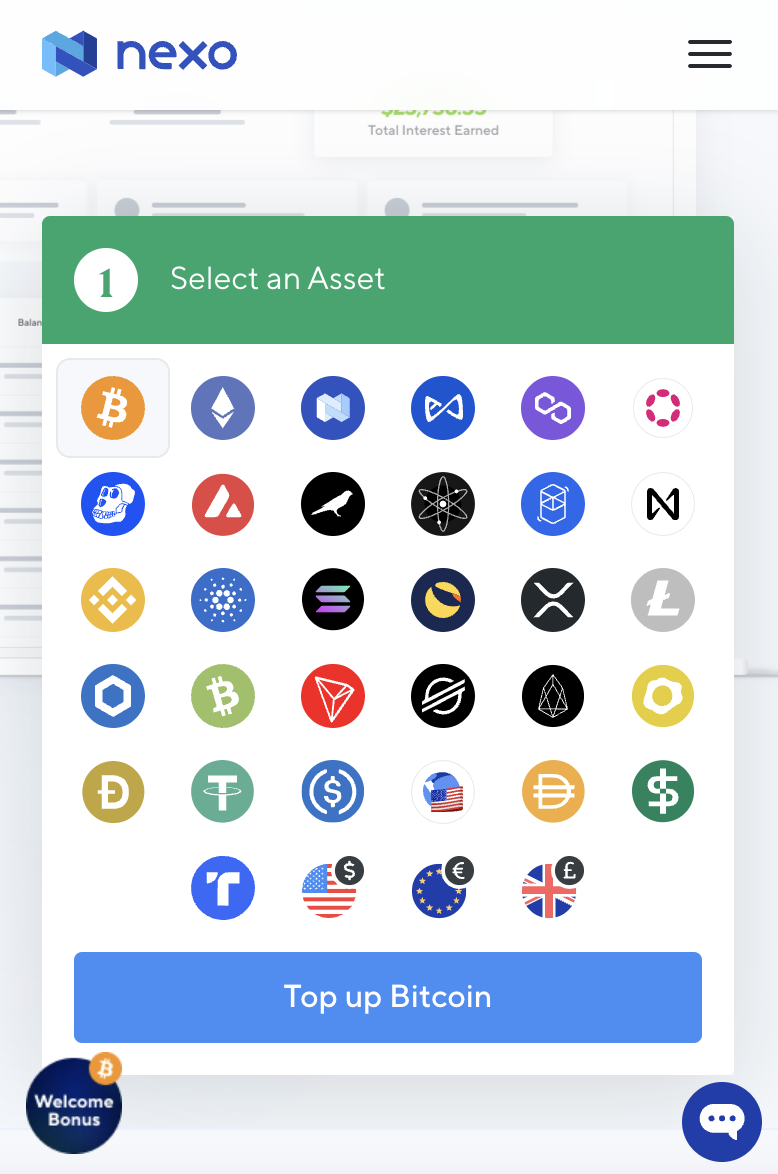

6. Nexo – Leading DeFi Lending Marketplace

The next provider to consider from our list of the best DeFi apps is Nexo. This platform is a popular DeFi lending marketplace that supports both borrowers and investors via a single hub. If you want to borrow against your digital assets, you can get up to 50% loan-to-value (LTV). Moreover, as no credit checks are carried out, your loan will be approved instantly. Lending rates are competitive and you can create your own repayment plan.

If you want to earn interest on your crypto assets, Nexo offers up to 17% on stablecoins. You can also earn up to 36% on DeFi tokens like Axie Infinity. Finally, Nexo also offers a pre-paid credit card that allows you to spend your crypto tokens in the real world.

Pros

Cons

Cryptoassets are a highly volatile unregulated investment product.

7. YouHodler – Top DeFi App for Diversified Portfolio

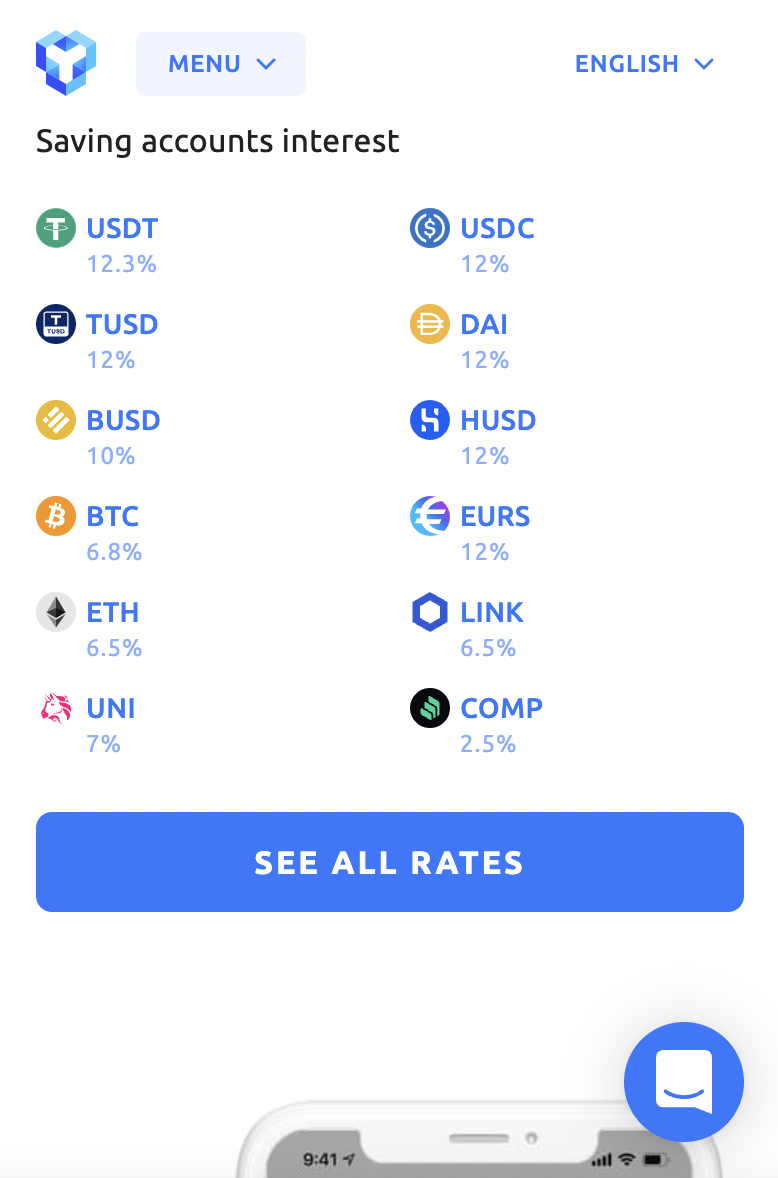

YouHodler is another leading DeFi app that allows you to earn interest on your crypto tokens, and supports dozens of digital currencies of various yields and risk levels. For example, Bitcoin attracts an interest rate of up to 6.8% annually, while Litecoin offers an APY of up to 7%.

You then have stablecoins like HUSD and TUSD – both of which yield 12% per year. You only need a minimum deposit of $100 on this popular DeFi app, allowing you to diversify across various DeFi tokens without risking large volumes.

Another thing to note about YouHodler is that you can keep your tokens in one of its crypto interests for as long as you wish. You can generate a long-term yield without the need to log in after each term expires.

Pros

Cons

8. Trust Wallet – Decentralized App to Access BSc Network

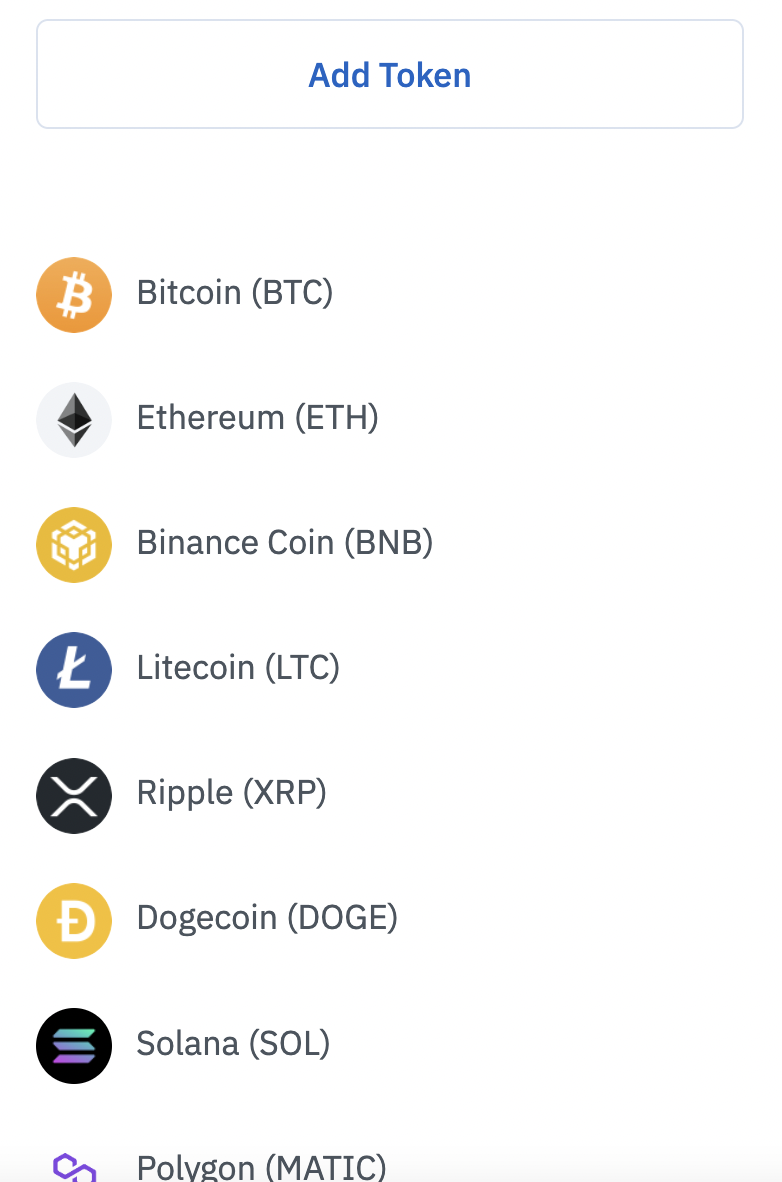

The final option on our list is Trust Wallet. This well-known DeFi app offers more than just wallet services. In addition to supporting more than 56 different blockchains, Trust Wallet gives you direct access to the Binance Smart Chain.

This means that you can easily buy leading BSc tokens like DeFi Coin at the click of a button. You can achieve this by linking Trust Wallet to WalletConnect via the DeFi Swap website. Or, you can connect to Pancakeswap via the ‘DApps’ button. Either way, if there is a BSc token that you are interested in, you are sure to find it on Trust Wallet.

Pros

Cons

What Are DeFi Apps?

DeFi apps give you access to decentralized finance services directly on your smartphone, enabling you to manage your DeFi needs from anywhere.

In terms of the services offered, this will vary from one DeFi app to the next. This might, for example, include the ability to earn interest in your digital currency investments. DeFi Swap, for example, offers a staking tool for various tokens on the Binance Smart Chain, and you can also generate a yield by lending your tokens on its decentralized exchange.

In doing so, you will earn a share of any transaction fees collected.

Additionally, the top DeFi apps in the market also offer exchange services. This means that you can swap one digital token for another without needing to use a centralized platform.

What Can You Do on DeFi Apps??

As noted above, the best Defi apps will offer a variety of decentralized finance services.

We explore each service in more detail in the sections below:

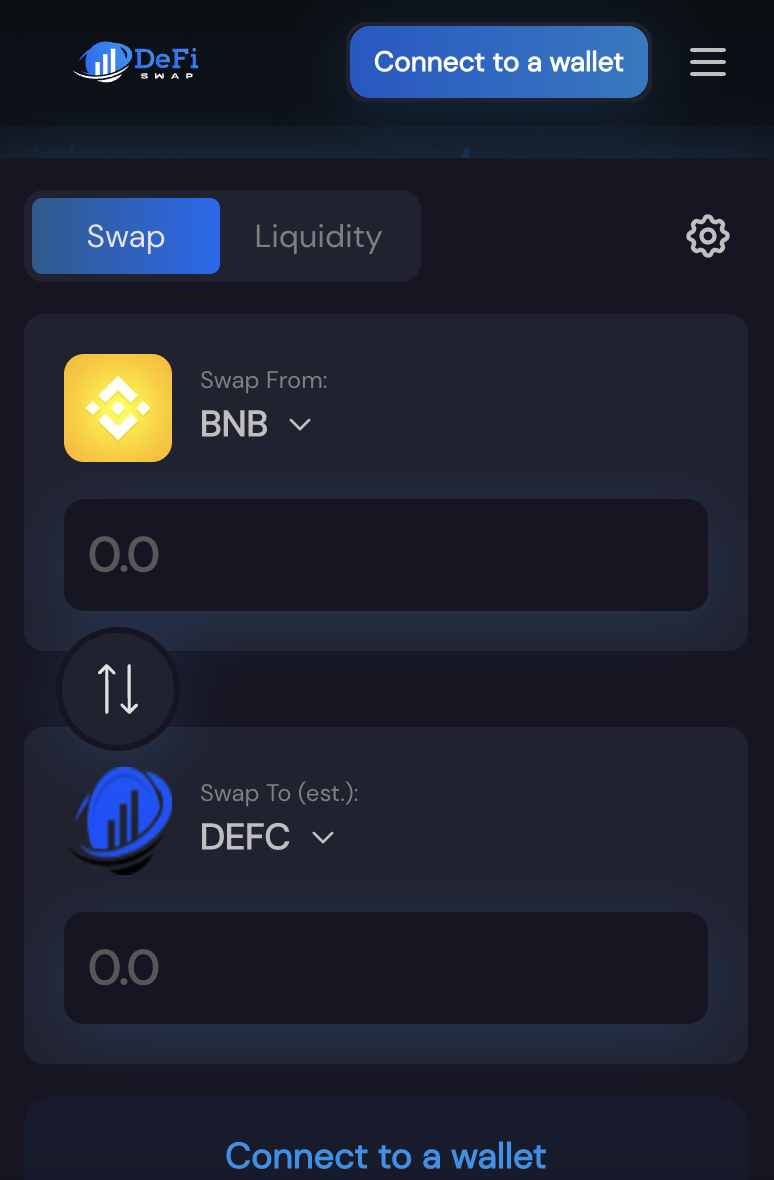

Instant and Decentralized Swaps

Many of the top DeFi apps that we came across offer a swapping tool. Put simply, this means that you can swap one token for another. For instance, let’s suppose that you hold BNB tokens in your wallet and you want to swap them for DeFi Coin.

Usually, you’d have to send BNB to a third-party exchange, exchange BNB for DeFi Coin, and then send the DeFi Coins back to your wallet. This can be both a slow and cumbersome process.

In comparison, DeFi apps allow you to swap tokens instantly without leaving your wallet interface. Moreover, when using a low-cost DEX like DeFi Swap, you will find that fees are ultra-competitive.

Wallet Storage

Next up, you should look for DeFi apps that also double as a wallet. This will allow you to store your digital token investments securely. Unlike traditional wallets, DeFi apps offer a non-custodial service.

As we briefly touched on earlier, this means that you will be the only person that has access to your private keys.

Interest Accounts

The best DeFi apps in the market will also offer interest accounts. Aqru, for example, offers Bitcoin and Ethereum interest accounts.

Staking

Staking also allows you to earn interest on your idle crypto tokens. As a prime example, DeFi Swap offers a huge APY of up to 75% when you stake its native DeFi Coin.

In most cases, you will need to lock your tokens away for a certain period of time when staking. And, the longer the term, the higher the interest rate.

Liquidity Pools

You can also make money via liquidity pools when using a top-rated DeFi app. This will see you loan tokens to a decentralized exchange like DeFi Swap, which is used to provide liquidity to traders.

You will then be paid a commission on any trading fees collected. There are usually no lock-up requirements when utilizing liquidity pools.

How to Choose the Best Defi App for You?

If you are still not sure which is the best DeFi app for you, consider the following points in your search for the right provider.

DeFi Services

You will first need to determine what it is you are looking to achieve from a DeFi app. If you want to earn a regular income from your crypto tokens, select a DeFi app with staking, yield farming, or liquidity pools.

Alternatively, if you need decentralized borrowing options, look for apps that offer instant loans without credit checks. As the internet becomes more decentralized, we can expect new web3 DeFi apps to provide additional features and services.

Reputation

More and more DeFi apps are entering the market, which is great for consumer choice. However, many DeFi apps in this space have little to no track record. As such, you might be taking a big risk by depositing tokens into the app.

With this in mind, you should research the DeFi app provider extensively before proceeding.

Supported Coins

In addition to checking whether or not your chosen DeFi app offers your preferred services, you also need to consider what coins are supported.

For example, while the provider might offer interest accounts, you need to ensure that this covers coins that you currently own.

Fees

DeFi apps, regardless of what their marketing materials tell you, are in the business of making money. Therefore, you should spend some time exploring what fees are applicable for the DeFi services that interest you.

User Experience

The decentralized finance space can be a complex battleground for newbies. As such, if you are somewhat new to DeFi, make sure that the app is easy to use. It should be simple to connect your wallet and browse through the services offered.

The DeFi app should also be fully optimized for your mobile operating system.

Conclusion

The world of decentralized finance is evolving rapidly, and these best DeFi apps have something to offer. Whether you’re looking to earn a passive income, borrow funds without intermediaries, or simply explore the expanding possibilities of web3, DeFi apps offer a world of opportunities.

To get started with the best DeFi platform for 2025 right now – consider DeFi Swap.

Remember to choose the one that aligns with your financial goals and risk tolerance, and always stay informed in this dynamic and innovative space.

Cryptoassets are a highly volatile unregulated investment product.