Explore the best decentralized exchanges of 2025, where users can seamlessly engage in buying and selling cryptocurrencies without intermediaries. These decentralized exchanges (DEXs) provide advantages such as low fees, swift transaction speeds, anonymity, and more.

This comprehensive guide explains why traders and investors should consider using a DEX for their upcoming crypto transactions.

What Is the Best DEX Crypto Exchange?

We’ve tested out dozens of top DEXs to bring you the best options for 2025:

- Best Wallet — Best DeFi exchange with no registration needed

- Exodus — Decentralized exchange crypto supporting more than 300 digital assets

- Alpha X — One of the top decentralized exchanges with excellent security measures

- OKX — Decentralized trading platform that offers ultra-fast transactions

- Binance — Most popular decentralized exchange with many advanced trading features

- Changelly — Decentralized platform for cryptocurrency with the most competitive crypto swap rates

- KuCoin — 20+ payment methods for BTC, ETH, USDT, and USDC

- Uniswap — Popular decentralized exchange for DeFi

- PancakeSwap — Top exchange for discovering new cryptocurrencies

Top 9 Decentralized Crypto Exchanges in 2025

Out of dozens of tested platforms, we picked the five best exchanges. We’ll examine what each DEX offers crypto traders and investors.

1. Best Wallet — Best DeFi Exchange With No Registration Needed

Best DEX is Best Wallet’s exchange, allowing you to buy and sell instantly, with no registration needed. If you want to trade, all you have to do is connect your wallet. Best Wallet’s exchange provides all the required tools for navigating around crypto trading, like advanced charting via Trading View and real-time market updates.

It automatically matches users to the lowest-rate trading pair for your desired swap, meaning you can always get the best price on trades, saving money on transactions.

The exchange offers token analytics, offering traders in-depth, real-time data to perform the right trades. Best Wallet’s exchange has announced three new features: Token Sentiment, Token Info, and Token Security.

Moreover, its soon-to-launch BEST token airdrop may become one of the best crypto airdrops. During the forthcoming months, it will reward brand advocates and power users. BEST token holders will get exclusive benefits on the exchange, such as lower-cost trades.

Using Best Wallet, a non-custodial wallet, is an excellent way to manage digital assets. Its app allows users to securely store, buy, send, and receive many cryptocurrencies.

Currently, the exchange supports BNB Smart Chain, Ethereum, and Polygon networks but plans to support all active major blockchains in the future.

2. Exodus — Decentralized Exchange Crypto Supporting More Than 300 Digital Assets

Exodus is a Web3 crypto wallet whose decentralized exchange aggregators allow holders to swap tokens on-chain. It supports over 50 networks and more than 300 digital assets. Using a scannable QR code or an address, users can quickly send and receive any of the supported assets.

The platform’s built-in swap requires no verification and allows users to buy and sell one crypto for another in seconds.

The wallet is private and safe, encrypting transaction data and private keys on your device and ensuring they are accessible only to you. Moreover, there’s 24/7 customer support available. The platform gives users more options and convenience, as it supports crypto exchanges for both CEXs and DEXs.

Exodus can also connect to BNB Smart Chain, Ethereum, Solana, Polygon, Avalanche C-Chain, and Fantom. The platform also provides a Knowledge Base section with articles and FAQs to help users learn more about various aspects of cryptocurrency.

3. Alpha X — One of the Top Decentralized Exchanges With Excellent Security Measures

Alpha X was initially introduced as a centralized exchange (CEX) in 2023 but has since evolved into a fully-fledged DEX. The core members and founding team have gathered professionals from elite teams from top internet companies like Google and leading financial institutions like Standard Chartered Bank and JPMorgan.

One of the platform’s best features is its security measures. Its risk management mission is to safeguard your assets. In fact, Alpha X’s 2FA security certification ensures double-layered protection for your assets and accounts.

Its crypto derivative offerings allow users access to up to 125 leverage on perpetual pairs. Traders can open short or long positions for popular trading pairs like ETH-USDT, BTC-USDT, and SOL-USDT. The platform also offers advanced trading tools to enhance its futures trading interface.

Alpha X can connect to Ethereum and Arbitrum, its Layer-2 network, to reduce fees.

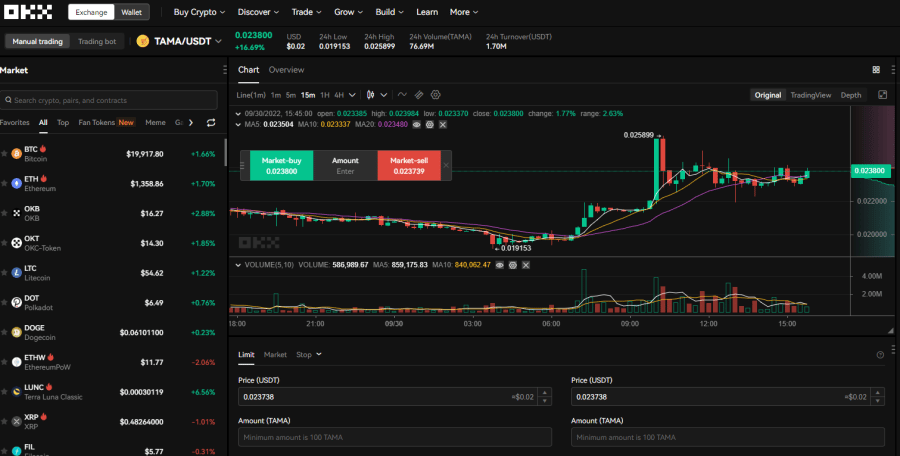

4. OKX — Decentralized Trading Platform That Offers Ultra-Fast Transactions

OKX is an innovative crypto exchange with top-notch financial offerings. It supports over 70 blockchains and is available in over 180 regions. However, it is restricted in the US. OKX is known for its fast transactions, low fees, and powerful APIs.

It allows users to trade with many tokens and trading pairs and create, sell, and buy NFTs. Moreover, users can connect their Web3 wallet and manage their DeFi portfolios, allowing them to organize all their decentralized assets in a single place. Users can discover the platform’s decentralized applications, including gaming dApps.

They can also connect to the popular TradingView Platform and trade directly with their supercharged charts. OKX also has cross-chain functionality, so users can swap tokens using two network standards. Earning DeFi yields is also available through OKX, as the platform uses a bridge aggregator and connects with other exchanges’ liquidity pools.

5. Binance — Most Popular Decentralized Exchange With Many Advanced Trading Features

Binance is the most popular DEX exchange. It supports an extensive range of cryptocurrencies that can be traded on futures, spot, and margin markets. Users can earn interest on their cryptocurrencies with Binance Earn and buy and sell cryptos with Binance P2P.

With Binance, users can earn passive income through many methods, such as staking, earning accounts for over 180 coins, and using the BNB vault. Experienced traders can benefit from the Binance decentralized exchange since it offers many advanced trading features like charting tools, several order types, and automated trading options.

Moreover, its NFT marketplace allows users to loan, trade, and stake NFTs, whereas the Binance Launchpad enables users to buy and earn new tokens. That platform offers its users an extensive education center, providing them with a wealth of information. Binance is compatible with Windows, Linux, and MacOS, and the app is available on both Android and iOS. The mobile app has Pro and Lite modes.

6. Changelly — Decentralized Platform for Cryptocurrency With the Most Competitive Crypto Swap Rates

Changelly is an exchange with a built-in DEX aggregator, supporting seven networks and more than 500 cryptocurrencies. It offers fast transactions, with an average transaction speed between 5 and 40 minutes.

DeFi Swap, Changelly’s decentralized trading system, connects to many exchanges to offer the lowest possible fees and competitive crypto swap rates. Anyone can connect their wallet to start swapping tokens on DeFi Swap. However, to use the centralized exchange features, users have to create an account on the platform.

Moreover, users can connect one of seven supported wallets. The top networks that Changelly can access for its DeFi exchange are Binance Smart Chain, Ethereum, Polygon, and Avalanche. Changelly offers 24/7 live support, providing personalized assistance. Moreover, there are many helpful guides that can help users learn more about the crypto space. The app is available for Android and iOS.

7. KuCoin — Among the Top Cryptocurrency Decentralized Exchanges, Supporting Over 1,300 Trading Pairs

KuCoin is a crypto exchange that allows you to sell, buy, and trade Bitcoin, Ethereum, and over 700 altcoins. It is available in more than 200 countries and regions, supports over 1,300 trading pairs, and has launched more than 200 projects.

The platform enables futures trading, spot trading with a comprehensive set of powerful tools, and margin trading, allowing you to borrow, trade, and repay. With KuCoin Earn, users can use the help of a professional asset manager to invest and earn a steady income. The GemSPACE is an exclusive KuCoin feature, enabling users to discover new coins with limitless potential.

Users don’t have to constantly monitor markets, as the platform offers a trading bot to help them earn passive income round-the-clock. Moreover, they can amplify their investment returns by selling and buying leveraged tokens.

The platform prioritizes security using a PoR method, industry-leading encryption systems, and the highest security standards.

8. Uniswap — Best Decentralized Exchange for DeFi

Uniswap is one of the best crypto DEX of 2024 running on the Ethereum blockchain. Since launching in 2018, this DEX has processed more than $1.2 trillion in transaction volume — to this day it remains at the top of decentralized exchanges by volume. Today, it has more than 300 integrations and more than 4,400 community delegates helping to secure the network.

There are hundreds of ERC-20 tokens available to buy and sell on Uniswap. That’s in part because this DEX makes it incredibly simple for new tokens to list. Holders of a unique token just need to add the coin to the exchange by funding an equivalent amount of Ethereum to create a new liquidity pool. This means that Uniswap is home to many new crypto tokens that can’t be found elsewhere.

Uniswap has some of the lowest transaction fees of any major decentralized exchange. On top of that, users can earn interest on their crypto holdings by staking tokens to a liquidity pool. This makes trading easier in that token and offers opportunities for crypto yield farming.

Notably, Uniswap also offers a governance token, UNI. UNI holders have a vote on open proposals on Uniswap, which helps to reward the people who support this exchange and keep Uniswap competitive.

9. PancakeSwap — Top DEX for Discovering New Cryptocurrencies

PancakeSwap is one of the best decentralized exchanges for finding new cryptocurrencies before they get big. Thanks to the platform’s simple listing process and low transaction fees, it’s often the exchange of choice for new crypto projects making their ICO. Projects listed first on PancakeSwap include Battle Infinity, Lucky Block, and more.

PancakeSwap was originally built on the Binance Smart Chain, making it quite distinct from competitors like Uniswap and SushiSwap. Recently, it launched a new integration with the Ethereum blockchain. Now that PancakeSwap operates on both blockchains, users have access to thousands of tokens and more liquidity.

Swapping from one token to another on PancakeSwap is incredibly simple and takes only seconds. The platform also has a special swap for stablecoins that offers near-zero fees and reduced slippage.

Another reason PancakeSwap is on our list of decentralized exchanges is that it’s attractive as a DeFi crypto interest platform. This DEX offers numerous liquidity pools where investors can stake their tokens and yield farming offers that earn up to 778% APY interest. PancakeSwap’s crypto token, CAKE, can be staked alongside stablecoins like BUSD and USDT to earn up to 50% APY.

How Do Decentralized Exchanges Work?

Decentralized exchanges don’t have a middleman to facilitate trades. Instead, they rely on automated processes to ensure that a buyer receives their tokens and a seller receives their payment.

The seller’s tokens are put into an escrow account when a transaction is initiated. This is a secure account in which the tokens are controlled by the smart contract or algorithm governing the DEX. When the buyer’s payment reaches the seller, tokens in the escrow account are automatically transferred to the buyer. If payment is not made, tokens in the escrow account can be returned to the seller.

There are two types of DEXs: swaps and orderbook exchanges.

Swaps, like Uniswap and PancakeSwap, are designed to enable traders to swap one token for another. They rely on liquidity pools that contain pairs of tokens, such as ETH/USDT.

If a trader wants to swap ETH for USDT or vice versa, the tokens for the trade simply come from this liquidity pool following the escrow process above. Users can stake tokens to a liquidity pool to provide liquidity, typically in exchange for interest on their staked tokens.

Orderbook exchanges like OKX, Binance, and Huobi enable traders to list tokens they want to buy or sell along with the prices and payment methods they’re willing to accept. In this case, traders are buying or selling directly from one another.

It’s up to traders to search the order book for trades that they’re interested in. The coins and payment methods available for trading can vary significantly over time.

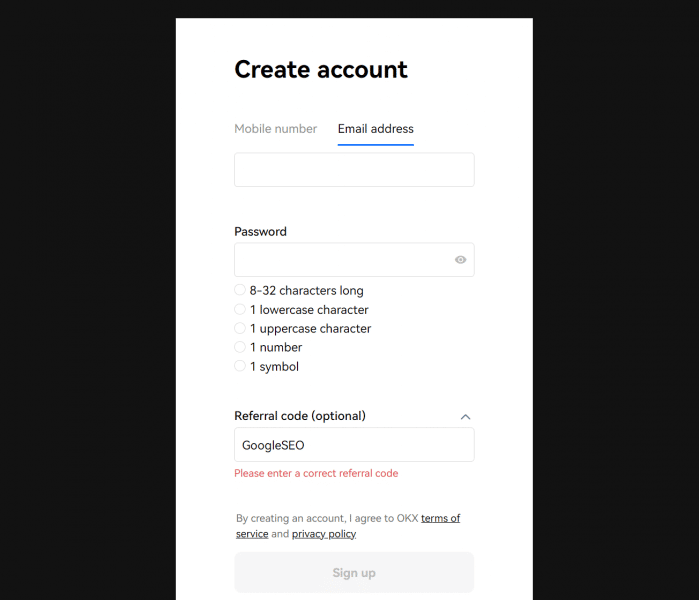

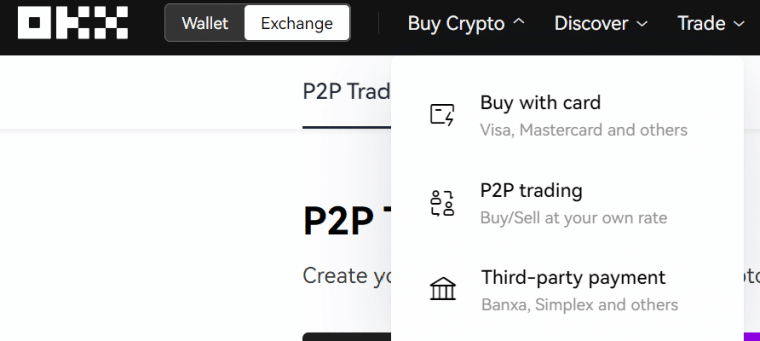

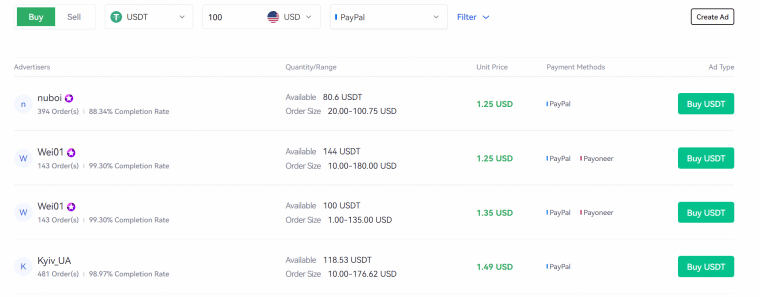

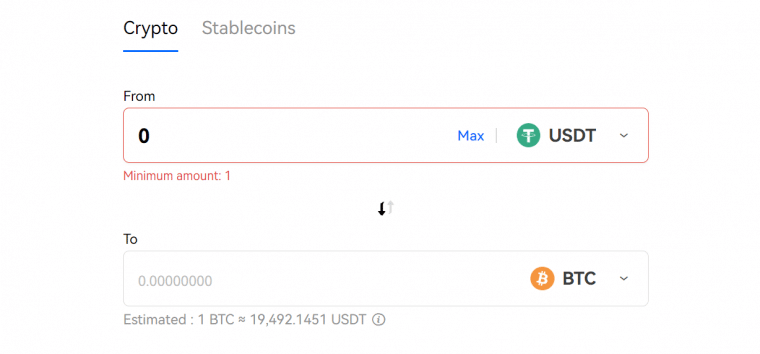

Ready to buy crypto on a decentralized exchange? We’ll walk readers through the process of buying Tamadoge, one of the best crypto tokens in 2025, from OKX, our top-rated DEX. To get started, head to the OKX website and click Sign Up. Enter an email address or phone number and a password, then click Sign Up. From the OKX dashboard, select Buy Crypto from the navigation menu and then select P2P Exchange. In the P2P exchange window, select Buy and choose a token to purchase. OKX offers decentralized trading on BTC, ETH, USDT, USDC, TUSD, and DAI. Enter a currency and payment method, then choose one of the available offers. Click Buy and make the payment to purchase the chosen tokens. Now the purchased crypto tokens can be converted to Tamadoge. From the OKX navigation menu, select Trade and then Convert. Select the token purchased from the DEX and select TAMA as the token to convert to. Then click Convert to get TAMA.How to Use a Decentralized Crypto Exchange

Step 1: Sign Up

Step 2: Visit P2P Exchange

Step 3: Buy Crypto

Step 4: Convert to TAMA

Why Choose a Decentralized Exchange

Best DEX in 2024 have several benefits over centralized exchanges.

Coin Selection

One of the biggest advantages of using a decentralized crypto exchange is that the coin selection is often enormous. DEXs make it easy for new coins to list, so traders and investors can access emerging cryptocurrencies very early on. Many cryptocurrencies spike in price after launching on a DEX, so this could be a big advantage for traders in search of the next big token.

Privacy

Decentralized exchanges typically do not require identity verification or other Know-Your-Customer (KYC) measures. This means that traders can buy and sell crypto on an exchange in near-total anonymity.

Low Fees

Trading fees on decentralized crypto exchanges are often lower than those on centralized exchanges. That’s because there’s less work and risk involved for the exchange itself since the exchange never holds tokens as a middleman.

DeFi Access

Many of the best decentralized exchanges are also platforms that offer crypto staking. Traders who use a DEX can stake their tokens to a liquidity pool to support the exchange’s operations and earn interest on their crypto.

Decentralized Exchanges vs Centralized Exchanges

Decentralized exchanges are fundamentally distinct from centralized exchanges, which serve as middlemen to match buy and sell orders for specific tokens.

Compared to decentralized exchanges, centralized exchanges typically charge higher fees and have smaller selections of cryptocurrencies. However, they also offer some benefits, such as greater customer support and simpler user interfaces. Many centralized exchanges also have custodial wallets for customers to store their crypto on the exchange, which some users may find easier than storing their tokens in a non-custodial wallet.

To some extent, centralized and decentralized exchanges serve different purposes in the crypto ecosystem. Centralized exchanges provide an easy on-ramp into crypto and offer experiences more similar to traditional finance. Decentralized exchanges serve as the backbone for DeFi and make it possible for more advanced crypto investors to swap tokens and earn yield.

It’s important to note that many centralized exchanges have decentralized exchange platforms within them. The P2P trading platforms at OKX, Binance, and Huobi are all decentralized exchanges within these larger centralized exchange platforms.

When we evaluate crypto exchanges to recommend to our readers, our team takes into account numerous critical factors. The following are the most important ones:Our Methodology for Ranking and Reviewing Crypto Exchanges

Conclusion

The best decentralized exchanges enable traders to buy or sell crypto without using a middleman. They offer reduced trading fees, privacy, a greater coin selection, and access to yield-generating DeFi staking.

Our top pick in 2025 is OKX, which offers P2P trading with zero fees for several popular cryptocurrencies. Check out OKX today to buy crypto!