If you are looking for the best crypto tools, our team of experts at Business2Community made an in-depth analysis to assist investors in outperforming the crypto market.

We give you a brief overview of the best crypto analysis tools for your trading endeavors.

The 10 Best Crypto Analysis Tools

- Dash 2 Trade – A Cutting-Edge Crypto Analysis Tool

- CryptoSignals.org – Specialist Crypto Signals for Semi-Automated Trading

- TradingView – High-Level Crypto Charting Tools

- 3Commas – Create an Automated Trading Bot

- Copy Trading – Fully-Automated Tool to Copy Successful Crypto Traders

- Leveraged Crypto Derivatives – Buy and Sell Cryptocurrencies With Leverage

- CoinMarketCap – Best Crypto Research Site for Beginners

- Coin Market Manager – Advanced Portfolio Tracker and Analytics

- Fibonacci Retracement – Evaluate Support and Resistance Levels When Trading Crypto

- Relative Strength Index – Easiest Technical Indicator for Newbies

A Closer Look at the Top Crypto Tools

Many traders will concurrently utilize several of the best crypto analysis tools listed above. Therefore, we discuss how each tool works in the following sections of this guide.

1. Dash 2 Trade – A Cutting-Edge Crypto Analysis Tool

A new crypto analysis tool to consider is Dash 2 Trade, an analytics terminal in its early-to-mid stages of development.

The end product will offer an all-in-one crypto analytics dashboard enabling users to take their trading endeavors to the next level. For example, Dash 2 Trade provides the best crypto signals that are formulated by an in-house team of analysts in addition to emerging technologies like artificial intelligence.

The Dash 2 Trade terminal will distribute a signal when a trading opportunity is discovered. This informs users of the best crypto asset to trade and whether a long or short order should be entered. The suggested take-profit and stop-loss order prices are also provided, which ensures that Dash 2 Trade users invest risk-averse.

Dash 2 Trade is also one of the best cryptocurrency analysis tools when it comes to cutting-edge data. The underlying algorithm scans and analyzes many metrics around the clock, including social media platforms like Reddit, Telegram, and Twitter. After all, some of the best cryptocurrencies to buy during the crash are those trending on social media.

Dash 2 Trade scans leading blockchain networks, such as Bitcoin, Ethereum, and BNB, to highlight potential whale movements – to and from an exchange or crypto wallet.

Dash 2 Trade users will have seamless access to other metrics, including new exchange listing announcements, upcoming ICOs alongside ratings, and professional-grade data concerning pricing, volume, market depth, and more.

Dash 2 Trade is also one of the best crypto analysis tools for automated trading. This is because users have the capacity to create their trading strategy before trialing it out in the backtesting facility, mirroring live market conditions.

Most importantly, the Dash 2 Trade analytics terminal is backed and powered by the D2T token. The D2T presale has now concluded, and its alpha product has been released.

Users must choose a monthly subscription plan to access every crypto analysis tool discussed above. Fees are paid in D2T, so this ERC-20 token has real-world utility.

2. CryptoSignals.org – Specialist Crypto Signals for Semi-Automated Trading

Next up on our list of the best crypto trading tools is CryptoSignals.org. As the name suggests, this popular platform specializes exclusively in trading signals. This means that members will receive trading suggestions on which coin to buy or sell, in addition to the suggested entry, take-profit, and stop-loss orders.

This means that CryptoSignals.org is the best cryptocurrency analysis tool for semi-automated trading. Upon receiving a signal, traders can head to their preferred crypto exchange and place the suggested orders.

An example of a CryptoSignals.org trading signal is as followings:

- Coin – Ethereum

- Order – Buy

- Entry Price – $1,490

- Take-Profit – $1,673

- Stop-Loss – $1,329

In terms of pricing, CryptoSignals.org offers four premium packages in addition to its free plan. The free plan comes with three crypto signals per week. The premium plans, however, extend the service to 2-3 signals per day. As such, premium members will never miss a trading opportunity.

Monthly plans start at £42, albeit paying for three months costs just £78. Bi-annual and annual plans cost £114 and £210, respectively. All CryptoSignals.org trading signals are sent via the Telegram group, now home to thousands of members.

3. TradingView – High-Level Crypto Charting Tools

TradingView is a top crypto analysis tool, especially for those relying on technical analysis. Some of the most popular crypto exchanges – including Binance, have integrated TradingView into their pricing chart dashboard. That way, it provides real-time pricing data and offers a comprehensive suite of features, including indicators, heat maps, drawing tools, and screeners.

There are thousands of markets supported across crypto, stocks, index funds, and more – not least because TradingView scalps data from leading exchanges and brokers.

TradingView also fully enables traders to customize their charting screen with features like multi-timeframe analysis, candlestick recognition, and volume profiles. It supports over 100,000 community-built indicators and fully integrates Pine Script. Traders can stay informed 24/7 with alerts on mobile and desktop devices, covering 12 conditions.

For instance, if the trader wishes to receive an alert when the RSI on BTC/USD falls below 40, this can be set up at the click of a few buttons. In terms of pricing, TradingView offers most of its charts, drawing tools, and technical indicators for free. Advanced traders, however, might consider the pro, pro+, and premium plans at $14.95, $29.95, and $59.95, respectively.

4. 3Commas – Create an Automated Trading Bot

3Commas is one of the best crypto trading tools for those who wish to engage in a fully automated investment journey. It enables users to create a customized trading bot based on pre-defined conditions. For instance, a trader might want to buy XRP if it drops more than 4% in 24 hours. This operates on a what-if basis, meaning the bot will enter or exit a position based on pre-defined conditions.

The bot executes a buy position when the ‘if’ condition in this example is triggered (XRP declining by 4%). 3Commas provides flexibility for multiple conditions and a range of automated strategies.

Nonetheless, 3Commas is ideal for trading cryptocurrency around the clock fully automatedly. Those without the required skills to build their own strategy can also consider using one of 3Commas’ pre-built bots. This includes a DCA (Dollar-Cost Averaging) bot that will buy selected cryptocurrencies when they drop below a certain threshold.

3Commas offers a free plan f to try the platform out, but it has limitations, such as allowing only one bot (DCA, options, or GRID) and lacking support for paper trading. The pro plan, priced at $49.50 per month with an annual payment, offers unlimited bots, pre-defined conditions, and a live backtesting facility.

5. Copy Trading – Fully Automated Tool to Copy Successful Crypto Traders

One of the best crypto tools for those who wish to actively trade digital assets without performing their own research is copy trading. This concept enables investors to copy successful crypto traders.

Choose a brokerage that offers a fully automated copy trading service and supports dozens of low-cost cryptocurrencies in addition to stocks, ETFs, forex, and more.

To help the decision-making process, a good platform will display abundant data – such as the trader’s average position time, preferred assets and cryptos, risk profile, maximum drawdown, and most importantly – monthly gains and losses since joining the platform you choose. It’s then just a case of meeting any minimum investment and electing to copy the chosen trader.

6. Leveraged Crypto Derivatives – Buy and Sell Cryptocurrencies With Leverage

One of the key issues that beginners face when trading cryptocurrencies full-time is access to suitable capital levels. This is especially true for those wishing to engage with cryptocurrency day trading – which generally targets frequent but small margins. This is where leveraged crypto assets come into play.

In a nutshell, a range of trading platforms in this space enable users to trade cryptocurrencies with more money than they have in their accounts. Otherwise referred to as margin trading, traders can amplify the size of their trading stakes.

For example, the trader has $100 in their account and they have access to leverage of 1:100.

This means that the $100 stake can be turned into a trading position of $10,000. However, it is important to remember that utilizing high leverage increases the chance of liquidation. This means the trader will have their position closed by the exchange or broker if it declines by a certain amount.

Non-US traders can easily access leverage CFDs (contracts-for-differences). This financial derivative is offered by regulated CFD brokers, and the instrument simply tracks the real-time value of the chosen crypto pair. Alternatively, platforms like Bitmex also offer leveraged markets, but the provider operates in an unregulated space.

7. CoinMarketCap – Best Crypto Research Site for Beginners

Those in the market for the best crypto analysis tool for beginners might consider CoinMarketCap, and it is often considered the gold standard for cryptocurrency data. Although there are some more advanced and accurate alternatives, CoinMarketCap is a suitable crypto tool for keeping tabs on market prices.

CoinMarketCap lists more than 21,600 cryptocurrencies as of writing, and serves as a comprehensive platform for traders to stay informed about market prices and trends by aggregating data from various exchanges. Additionally, it provides a social feed for traders to engage in communication with each other.

Additionally, CoinMarketCap can be useful in assessing exchange data regarding volume and market depth. Further tools available on CoinMarketCap include alerts, events and ICO calendars, free popular crypto airdrops, blockchain explorers, and a learning center. CoinMarketCap also offers educational videos and articles.

See our list of crypto price tracker sites for some CoinMarketCap alternatives.

8. Coin Market Manager – Advanced Portfolio Tracker and Analytics

Coin Market Manager is one of the best crypto analysis websites for keeping track of investment portfolios in real time. The platform offers a one-stop shop to track portfolio valuations across multiple exchanges, either online or via the app, useful for those who trade cryptocurrencies across multiple platforms.

Not only that, but Coin Market Manager offers advanced insights into the portfolio and historical trading positions, enabling users to assess which strategies and investments are working and which ones are not.

Coin Market Manager offers three plans: a free one with basic features, including portfolio overviews, one account slot per exchange, and a manual trade journal. Users looking for more advanced features can explore the professional and enterprise plans, priced at $69.99 and $89.99 per month, with a 14-day free trial for first-time customers.

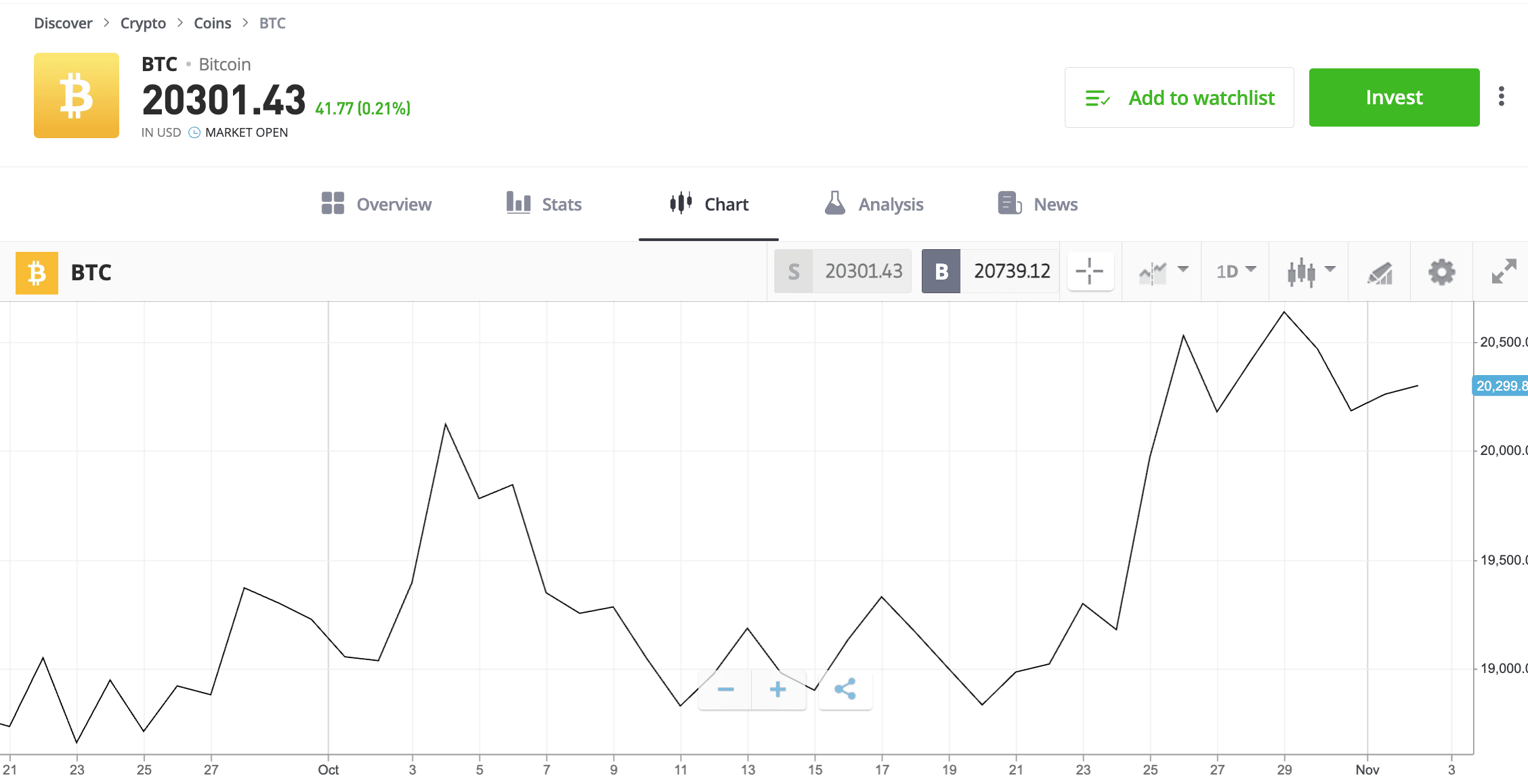

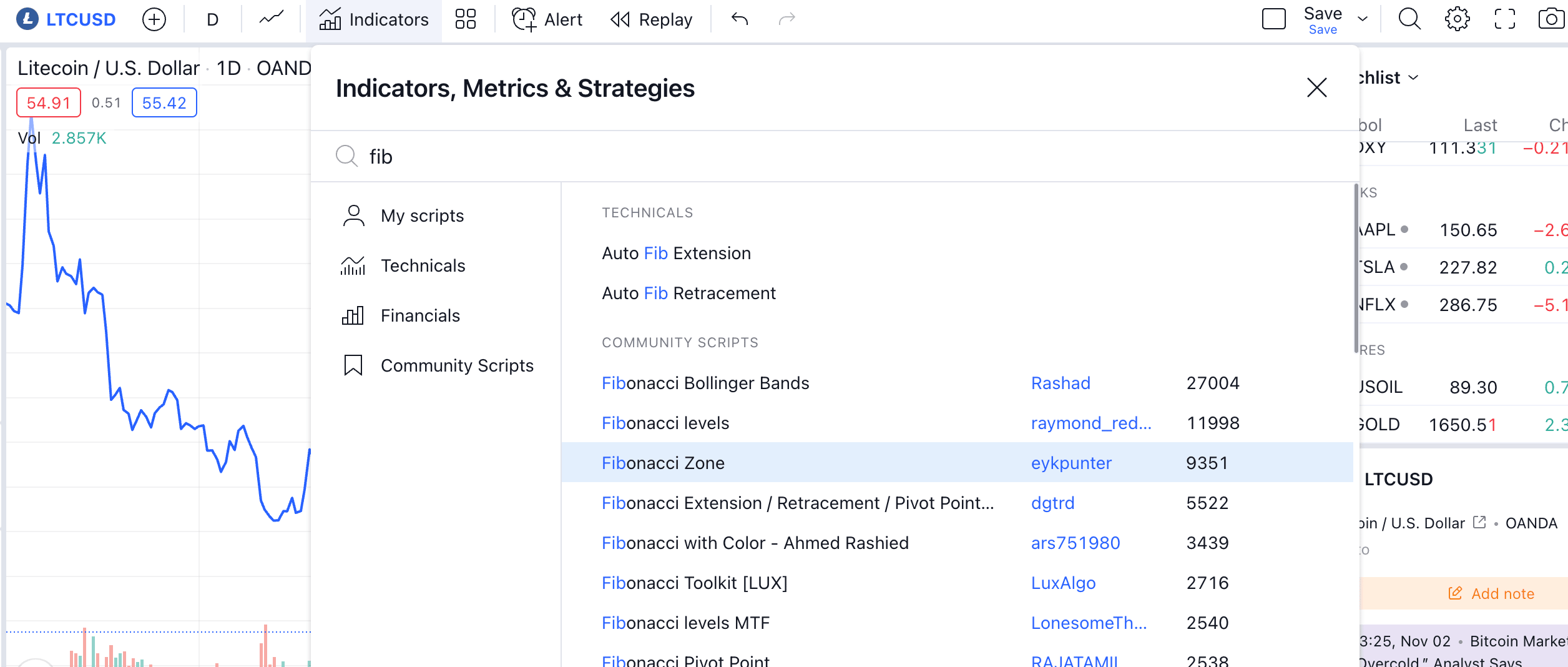

9. Fibonacci Retracement – Evaluate Core Pricing Points for Long and Short Positions

For those experienced in forex trading, the Fibonacci retracement indicator should be a familiar topic. One of the best crypto trading tools to have a firm grasp of to maximize profits is the Fibonacci Retracement. It is a hugely useful technical indicator that enables traders to find and trade support and resistance levels. The former highlights a pricing level that historically finds mass support from the markets.

For example, one of the most important support levels of Bitcoin is the $20,000 region. This is why Bitcoin has traded in and around this crucial support zone for nearly four months. On the other hand, resistance levels highlight a pricing point where a crypto asset typically struggles to pass. In turn, the crypto price will often reverse around the resistance zone.

This means that both support and resistance levels crucially enable traders to enter risk-adjusted positions based on identified trends. When deploying the Fibonacci Retracement, traders can enter a stop-loss order above or below the resistance or support level, respectively, just in case the indicator is proven wrong.

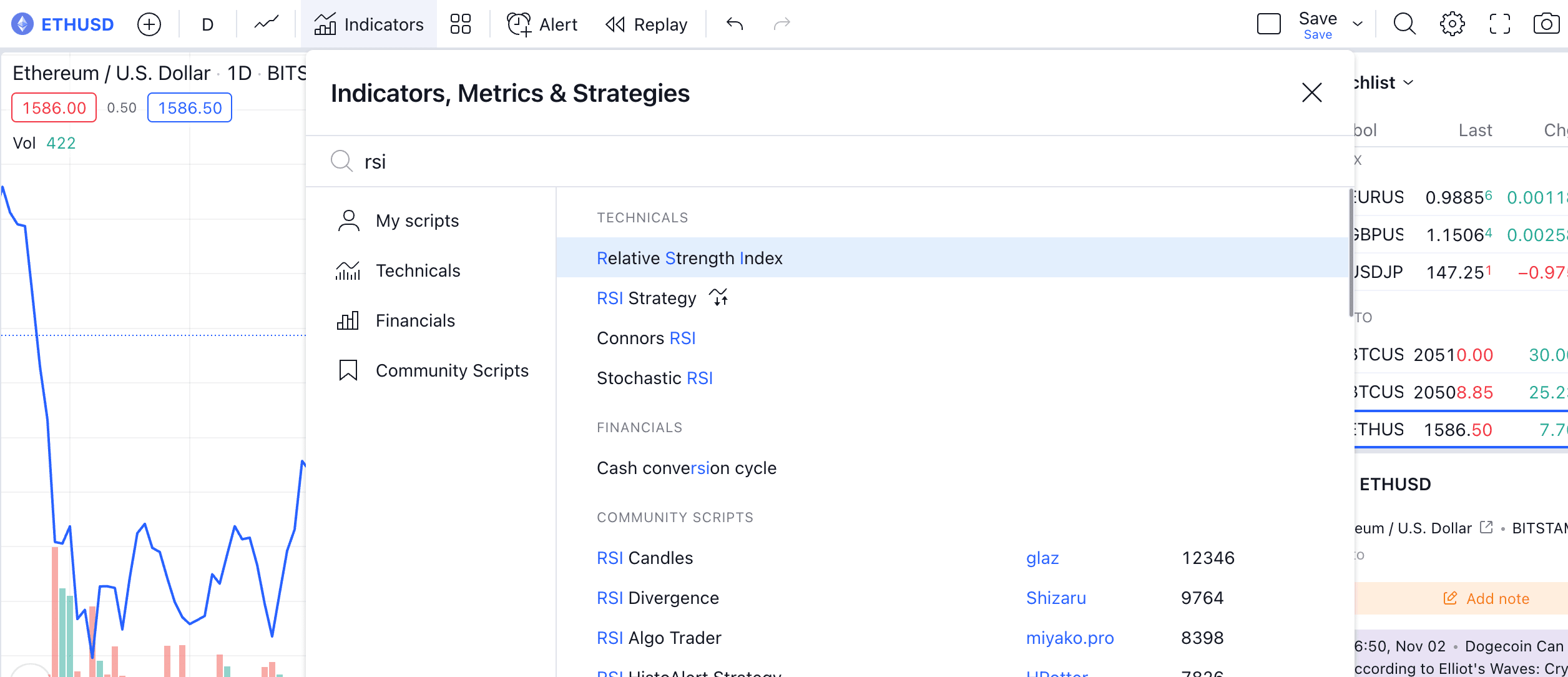

10. Relative Strength Index – Easiest Technical Indicator for Newbies

The Relative Strength Index (RSI) is perhaps the best crypto analysis tool for complete beginners who wish to learn technical analysis for the first time. The RSI is deployed to evaluate whether a cryptocurrency is overbought or oversold. If the cryptocurrency is overbought, this means that it could be due a market correction.

For instance, although Bitcoin might be enjoying an extended bull run, a temporary decline may occur when investors decide to cash in their profits. In that case, the RSI can signal that Bitcoin is oversold, allowing traders to enter a short position accordingly.

On the other hand, if a cryptocurrency is oversold, this means that a declining digital asset could be due a short-term price increase. In this scenario, the RSI will highlight that the cryptocurrency is oversold, and thus – the trader can enter a long position.

The RSI is suitable for beginners, considering that the technical indicator provides a score of 0-100.

Theoretically, if the RSI reading is above 70, this typically highlights overbought conditions. If the RSI is below 30, this highlights oversold conditions. The RSI should, however, be used in conjunction with the other technical indicators to confirm the respective reading.

Why Use Crypto Analysis Tools?

While some investors have the capacity to generate consistent gains in the crypto markets, most fail to achieve this goal. One of the key reasons for this is that unsuccessful traders do not have the required cryptocurrency tools and analytics to make smart and most importantly – risk-adjusted trading decisions.

Successful trading involves predicting the future direction of cryptocurrencies, whether it’s Bitcoin’s rise or XRP’s decline. This task is impossible without access to high-level data and tools, such as pricing charts that evaluate historical trends.

However, relying solely on pricing charts is not enough. Experienced traders use technical indicators like RSI, Fibonacci Retracement, and drawing tools. Trading signals can be a solution for those unfamiliar with chart analysis and indicators. These signals suggest suitable positions based on the signal provider’s research and analysis, allowing for semi-automated trading.

Moreover, beginners might also appreciate utilizing crypto research sites and tools that provide fundamental data. This refers to real-world news developments that can directly impact cryptocurrency prices. Ultimately, both beginners and experienced traders alike must ensure they utilize a range of crypto tools to ensure maximum gains are made.

Types of Crypto Trading Tools & Their Benefits

When entering the crypto trading markets for the first time, it is wise to have a firm grasp of the different types of tools and analytics available.

With this in mind, we will now discuss the best crypto tools to explore.

1. Crypto Bots

The first tool to consider is crypto trading bots. This automated way of trading enables investors to enter buy and sell orders in an autonomous manner. There are many different varieties of crypto bots – some more reliable than others.

- For example, many crypto auto trading platforms in this space provide pre-built software that can trade 24/7 on behalf of the user.

- While this might sound appealing, the bot is not guaranteed to make money.

- Moreover, users should ask themselves why the provider would share their highly profitable bot with the public.

Instead, the safer option is to use a trusted platform like Dash 2 Trade, which enables traders to build their own bots.

This means that the trader will set their own parameters surrounding metrics like pricing, trends, volume, and volatility, and the bot will enter positions when the pre-defined conditions are triggered.

Best of all, Dash 2 Trade provides a risk-free backtesting facility to assess how the bot performs in real market conditions.

2. Charting

Successful crypto traders will rely on accurate, up-to-date pricing charts. This enables traders to decide where the respective cryptocurrency could be headed in the short-to-medium term.

The data extracted from the pricing chart must be used with technical indicators – of which there are dozens. Each technical indicator will look to highlight a specific trend.

For example, we noted earlier that the RSI is one of the best crypto trading tools for evaluating whether a coin is potentially overbought or oversold.

3. Analytics

Crypto analytics provide crucial data points outside of a conventional pricing chart.

For example, the Dash 2 Trade analytics terminal provides users with social media metrics, which can help spot trending coins on Reddit and Telegram. Dash 2 Trade also offers on-chain metrics, which can help identify potential whale movements.

4. Signals

Trading signals are perhaps the best tool for beginners looking to maximize crypto profits. The main premise of signals is that they inform users of the specific trading orders to place.

For example, a Dash 2 Trade signal might suggest buying BNB at $290, with a stop-loss order of $270. The take-profit order price might suggest $410.

Nonetheless, it is just a case of the Dash 2 Trade user placing the suggested orders with their preferred crypto exchange.

Conclusion

Hopefully, our guide will help you navigate the crypto trading world more effectively by providing insights into the best crypto tools, such as signals, social media analysis, on-chain metrics, automated bots, backtesting facilities, and professional-grade pricing data.

With these tools, you can enhance your decision-making and stay ahead in the dynamic crypto markets.

Dash 2 Trade - New Gate.io Listing

- Also Listed on Bitmart, Changelly, LBank, Uniswap

- Collaborative Trading Platform Token

- Featured in Bitcoinist, Cointelegraph

- Solid Proof Audited, CoinSniper KYC Verified

- Trading Community of 70,000+ Members