Explore the most reliable investment options with our guide on the best Bitcoin ETFs. The Bitcoin ETF is an exchange-traded fund that allows investors to buy shares in a Bitcoin ETF without owning BTC. This also allows traders to monitor changes in the price of Bitcoin.

Before the approval of crypto ETFs, it was impossible to invest in cryptocurrencies without owning them. However, that changed after January 10, 2024, when the SEC approved the launch of several spot BTC ETFs.

Bitcoin ETFs List

- Bitcoin ETF Token (BTCETF)

- ProShares Bitcoin Strategy ETF

- Valkyrie Bitcoin Strategy ETF

- VanEck Bitcoin Strategy ETF

- Grayscale Bitcoin Trust

- Fidelity Advantage Bitcoin ETF

- Global X Blockchain & Bitcoin Strategy ETF

- Simplify US Equity Plus GBTC ETF

- Purpose Bitcoin ETF

- Bitwise Crypto Industry Innovators ETF

Best Bitcoin ETFs Reviewed

Here’s why we think these are the best Bitcoin ETFs that you can invest in this year.

1. Bitcoin ETF Token (BTCETF)

Bitcoin ETF token (BTCETF) is a project created to celebrate the Bitcoin ETF approval in the US. BTCETF is, in a way, its alternative that can bring many benefits to investors.

This crypto ETF project started its presale on November 5, 2023, and in the first two days, it managed to raise over $35,000. The roadmap of this ERC-20 token includes five key stages. In each stage, 5% of the token will be burned, which will reduce its availability and stimulate the growth of its value.

That said, the total supply of the Bitcoin ETF token is capped at 2,100,000,000 tokens — 40% of the tokens are intended for presale, while 25% will go towards staking rewards. Token’s initial price stands at $0.0005, and it will gradually increase as the project progresses through its presale phases.

The goal of this project is to reward its long-term holders by decreasing the supply of the tokens. To achieve this, a total of 25% of the token will be burned, 5% in each presale stage. This will further increase its value on the crypto market. On top of that, the last 10% of tokens will be reserved for liquidity.

Taking all the mentioned factors into account, we believe that the price of the Bitcoin ETF token could reach a potential high of $0.75 by the end of 2024.

More information can be found within the Bitcoin ETF Token Whitepaper. This presale also offers regular alerts and updates concerning BTC ETF approval.

This info is periodically released on the Bitcoin ETF Token Twitter and Telegram accounts.

2. ProShares Bitcoin Strategy ETF (BITO)

Next on our Bitcoin ETFs list is ProShares, a provider that launched the first BTC-linked EFT in the US on October 18, 2021. ProShares Bitcoin Strategy ETF (BITO) is known in the crypto world as a project that managed to raise over $1 billion in assets by its second trading day.

The goal of this exchange-traded fund is to enable users to invest in Bitcoin futures. It’s also one of the largest crypto index funds when it comes to assets under management. On that note, ProShares currently has $55 million in assets under management. The company collects 0.95% in fees, which translates to $95 per $10,000 investment.

As a futures ETF, BITO doesn’t hold Bitcoin but its futures contracts. In this way, users can gain exposure to BTC prices without owning it. At the time of writing, the price of the BITO token is $19.22, while its maximum value could reach $28.11 by the end of 2024.

BITO is one of the best crypto funds for BTC futures. By investing in it, you’ll be able to both diversify your portfolio and gain exposure to BTC returns. You’ll also be able to buy and sell BITO like a stock.

3. Valkyrie Bitcoin Strategy ETF (BTF)

The Valkyrie Bitcoin Strategy ETF (BTF) is the best cryptocurrency ETF for traders who are into investing in Bitcoin and Ethereum futures contracts. Like its main competitor, BITO, this project also launched in October 2021. Its goal is to invest 100%, or nearly all of its net assets in Bitcoin and ether futures contracts.

However, compared to BITO, its expense ratio is much higher — 1.2%. The Valkyrie Bitcoin Strategy ETF also has fewer assets under management, at $35 million. Besides providing dual exposure to both BTC and ETH futures, BTF charges 95 bps in annual fees. Its current price stands at $12.72, while by 2025 its price could reach $15.30.

Its average 30-day trading volume amounts to 122,900 trades, while its average bid stands at $0.04 or 0.291%. In addition to BTF, Valkyrie has another ETF Bitcoin fund — the Valkyrie Bitcoin Miners ETF (WGMI). This fund invests in public companies engaged in Bitcoin mining.

In 2023, the Valkyrie Bitcoin Miners ETF was one of the best-performing ETFs with a 261% annual return. On the other hand, in the same year, BTF managed to outperform the market by gaining a return of +62.2%.

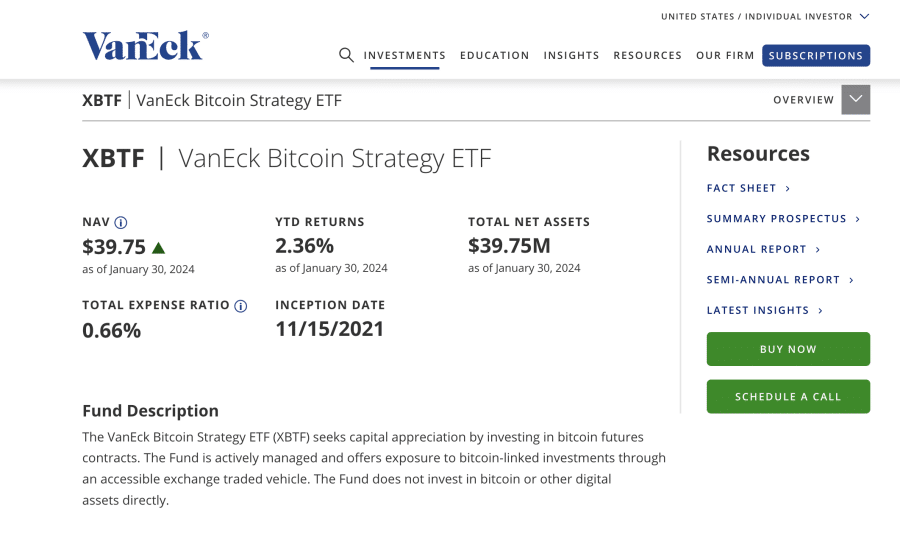

4. VanEck Bitcoin Strategy ETF (XBTF)

VanEck Bitcoin Strategy ETF (XBTF) is a fund that was first launched on November 19, 2020. In the beginning, this fund offered investments in cash-settled Bitcoin futures contracts. XBTF was unique compared to other crypto index funds as it was structured as a C-corp. This means that investors had to pay lower taxes.

However, as of January 11, 2024, this option is closed as VanEck has received permission to provide a Bitcoin spot ETF option. That said, as a Bitcoin futures ETF, VanEck managed to generate more than $53 million worth of Bitcoin futures contracts by the time it closed.

The company’s spot Bitcoin ETF option is called the VanEck Bitcoin Trust (HODL). This fund managed to outdo XBTF in total net assets by generating over $80 million. HODL also has a much lower expense ratio than XBTF, 0.25% vs. 0.76%, or $25 per $10,000 investment.

At the same time, its initial capital amounts to $72.5 million. This is a very large amount of seed capital compared to other spot Bitcoin ETF products.

You can buy XBTF for a price of $36.74, while the price of 1 HODL, at the moment of writing, stands at $45.06. VanEck is the best ETF to buy if you want to avoid the problems associated with futures contracts, such as high fees and negative roll yield.

5. Grayscale Bitcoin Trust ETF (GBTC)

Grayscale Bitcoin Trust ETF (GBTC) is one of the biggest commodity-based ETFs that launched on September 25, 2013. Its main goal is to allow investors to gain exposure to BTC in the form of a security. This means investors won’t have to buy, own, or store BTC directly.

As of January 2024, its Bitcoin ETF ticker, GBTC, has one of the largest assets under management — $20,385,825,902.75. However, it also has a large total expense ratio compared to other crypto ETFs — 1.50%.

Moreover, GBTC has a total of 512,644,8764 BTCs in its trust, while its daily trading volume is 14,150,305. Traders can invest in both publicly traded products and private placement products.

Grayscale Bitcoin Trust functions in the following way. It collects money from wealthy investors, which it then uses to purchase bitcoins. Then Grayscale lists its fund on public exchanges allowing anyone to buy and sell GBTC shares.

The market price of the GBTC token currently stands at $35.44. However, by the end of 2025, its value could reach $50.49, which makes it a good long-term investment. Besides BTC, you can also invest in other cryptocurrencies, like Ethereum, Bitcoin Cash, and Litecoin.

6. Fidelity Advantage Bitcoin ETF

If you want to invest in a Bitcoin ETF stock, we suggest giving Fidelity Advantage Bitcoin ETF a go. Fidelity has been offering its users to invest in cryptocurrencies for a long time. In October 2018, Fidelity launched an LLC called Fidelity Digital Assets. This LLC enables traders to buy and sell BTC and ETH commission-free.

After that, on November 30, 2021, they launched the Fidelity Advantage Bitcoin ETF, which enables traders to invest in BTC without owning it.

The Fidelity Advantage Bitcoin ETF uses its users’ money to buy BTC for them. These funds are then stored in cold storage off-chain. Fidelity Investments also announced that, as of January 12, 2024, they will lower their management expense ratio for the Fidelity Advantage Bitcoin ETF from 0.95% to 0.39%. This fee reduction will also apply to the Fidelity Advantage Bitcoin ETF fund.

What makes Fidelity unique is that, unlike other exchange-traded funds, they use in-house custodians. The price of the Fidelity Advantage Bitcoin ETF currently stands at $18.79. Fidelity’s net assets are worth $211.9 million, while they have 3752.2142 BTCs available in their fund. Fidelity’s Bitcoin ETF symbol on the Toronto Stock Exchange is FBTC, while its dollar version is marked as FBTC.U.

7. Global X Blockchain & Bitcoin Strategy ETF (BITS)

The Global X Blockchain & Bitcoin Strategy ETF (BITS) was launched on November 15, 2021. What makes it the best Bitcoin ETF is its way of working. On that note, BITS divides its holdings into two parts. That is, 50% of its shares go to Bitcoin futures contracts, while the other 50% is allocated to blockchain companies.

To achieve this, Global X invests in its sister company — Global X Blockchain ETF (BKCH). BKCH owns various types of blockchain stocks, from some well-known crypto exchanges to companies that deal with mining and creating new blockchain apps. BKCH’s top three holdings include Coinbase, Marathon Digital, and Voyager Digital.

This dividing strategy allows investors to gain exposure to both Bitcoin futures prices and company yields. This design also reduces roll costs, since only 50% goes to futures.

That said, the Global X Blockchain & Bitcoin Strategy ETF has a total expense ratio of 0.65%. The number of assets under its management stands at $25.38 million, while its Bitcoin ETF price stands at $46.20. However, by the end of 2024, its average market price could reach $77.18.

Investing in Global X Blockchain & Bitcoin Strategy ETF will benefit traders who want to invest directly or indirectly in crypto and blockchain companies.

8. Simplify US Equity Plus GBTC ETF (SPBC)

The Simplify US Equity PLUS GBTC ETF (SPBC) was launched on May 24, 2021. Its goal is to increase the capital of its users by investing in US equities and Bitcoin futures. On that note, the fund invests 100% in US equities through ETF contracts and direct purchase of securities.

It also allocates 10% to Bitcoin futures through Grayscale Bitcoin Trust (GBTC). The Grayscale Bitcoin Trust is a private fund that tracks the price of BTC and invests in crypto-related securities. This means that SPBC will not hold your BTCs, nor will it directly invest in them — this task will belong to its subsidiary.

In addition to that, this fund enables investors to actively manage the allocation of Bitcoin, while the ETF wrapper enables liquidity and transparency.

The Simplify US Equity PLUS GBTC ETF (SPBC) has a 0.72% gross expense ratio. Traders will have to pay 0.50% management fees, while its fund has $9,596,906.24 in total assets. Since its inception, SPBC’s market price grew by 22.79%. That said, its current market price stands at $29.53, while its price could reach $35.31 by the end of 2024, which makes it a great long-term investment.

9. Purpose Bitcoin ETF (BTCC)

Purpose Bitcoin ETF (BTCC) launched on 18 February 2021. The purpose of this exchange-traded fund is to allow investors to invest directly in physical BTC and not in derivatives. This reduces the risk of self-custody.

The Purpose Bitcoin ETF is also backed up by physically settled Bitcoin holdings. This means that your BTC assets will be taken care of by custodians, such as Coinbase Custody Trust Company and Gemini Trust Company.

BTCC has 32818.516864 BTC in its fund and $2 billion in assets under management. Its management expense ratio is capped at 1.50%, while its management fee stands at 1%.

Simplify US Equity Plus GBTC ETF can be bought in three ways — as BTCC, BTCC.B, and BTCC.U. You can buy BTCC with Canadian dollars, which are protected from US dollar fluctuations. The same applies to buying BTCC.B, although in this case, CAD is not hedged against fluctuation.

Conversely, BTCC.U can only be bought with US dollars. BTCC can also be traded via tax-free savings accounts and registered retirement savings plan accounts.

BTCC is an ideal investment option for both professional and beginner crypto traders. Why? Because it can be purchased by creating an online brokerage account or by using a robo-advisor. Moreover, its current market price is pretty low — $7.62.

10. Bitwise Crypto Industry Innovators ETF (BITQ)

Bitwise Crypto Industry Innovators ETF (BITQ) launched on May 11, 2021. This ETF allows traders to invest in companies that deal with cryptocurrencies. Bitwise identifies companies that generate most of their revenue from crypto activities.

To do this, BITQ divides the companies it analyzes into two tiers. Tier-1 companies or Crypto Innovators include companies that generate over 75% of their revenue from crypto activities. Moreover, over 75% of their net assets are related to direct BTC holdings. Tier-2 companies are companies that have a minimum market cap of $10 billion and that hold at least $100 million of BTC or other crypto assets.

On that note, BITQ’s top holdings include Marathon Digital Holdings, MicroStrategy, and Coinbase Global, Inc.

BITQ is unique because it tracks crypto stocks instead of BTC futures. This means that traders will be able to invest in the future growth of the crypto industry, not just the BTC price. Bitwise has 29 holdings and a net asset of $104,007,118. Its expense ratio is 0.85% while its current market price stands at $8.37.

However, according to market analysis, by the end of 2024, its average price could reach $13.89.

Should You Invest in Bitcoin ETFs?

So now that you’ve got so far, you’re probably asking whether it’s profitable to invest in our best crypto BTF list. The answer is yes. Here’s why.

Diversification and Simplicity

Investing in BTC ETFs will allow you to invest in Bitcoin without owning it. In this way, you will not only expand your portfolio, but you’ll also gain exposure to BTC price movements. Moreover, buying ETFs is much simpler than buying Bitcoin directly. Why? Because you won’t need to use a crypto wallet or a crypto exchange. Instead, you’ll be able to buy BTC ETFs using your brokerage account.

This simple approach is especially beneficial to beginner crypto investors and traditional traders.

A Chance to Profit From the Increase in the Price of BTC

All new ETFs are backed by BTC instead of derivatives contracts, meaning they offer a 1:1 match with its price performance. Since new ETFs hold only BTC, if its price rises, the same will happen with ETFs. This allows investors to profit from the increase in the price of BTC without buying it.

Buying EFTs is also a good way to take advantage of Bitcoin’s long-term price potential.

Low Fees

BTC ETFs will reduce the total cost of ownership as they come with low expense fees. On that note, expense fees usually range between 0.25% and 1.50%.

Security

Since you won’t own BTC directly, you won’t have to store your private keys, which reduces the chance of hacking. On that note, ETF managers will keep your assets in cold wallets off-chain. Moreover, by buying ETFs, you will own shares of the fund — derivatives based on BTC price movements.

How to Invest in Bitcoin ETF

You can invest in three different types of BTC ETFs—spot ETF, futures ETF, and leveraged Bitcoin ETF—by opening a brokerage account. ETFs are bought in the same way as stocks. However, unlike stocks, BTC EFTs usually don’t require a minimum investment and can be bought as single shares.

After opening a brokerage account, go to the interface and look for the ticker symbol of the ETF you want to buy. Then enter the amount you’d like to buy and tap the Buy button.

To find the ideal ETF, take into consideration its share price and expense ratio. Namely, BTC ETFs come with an annual expense ratio. As mentioned above, these ratios usually vary between 0.25% and 1.50%. And finally, since cryptocurrencies are highly volatile, make sure to invest only as much as you can afford to lose.

Where to Buy the Best Crypto ETFs

You can buy BTC ETFs through online brokers, like Webull, Fidelity, and ProShares, or traditional exchanges, like the Nasdaq. Some brokers will allow you to invest directly in BTC, while others will allow you to invest in BTC futures. If you want to do the former, you’ll have to open an account on a crypto exchange.

On the other hand, investors outside the US will have to use:

- International brokerage platforms with access to US markets

- International exchanges

- Local markets that offer BTC ETFs

Some countries will list Bitcoin ETFs on their local exchanges. For example, the Toronto Stock Exchange lists several BTC ETFs, such as the Purpose Bitcoin ETF.

Difference Between Bitcoin Spot ETF and Bitcoin Futures ETF

To find out what the main differences are between these two terms, let’s first define what a spot ETF is and what is a futures ETF.

Futures ETF is a fund that owns BTC futures contracts. These contracts refer to buying or selling BTC at a certain price on a specific date that is determined in advance. Brokers offering BTC futures ETFs usually charge annual fees.

On the other hand, BTC spot ETFs refer to direct investments in Bitcoin. Investors who buy spot BTC ETFs will be able to profit from market movements. Spot ETFs became available on exchanges after the SEC approved them on January 10, 2024. On that note, 11 spot BTC ETFs have been approved so far.

That said, the main difference between futures and spot ETFs is in their underlying assets. BTC futures EFTs hold BTC futures contracts, while spot BTC ETFs hold actual BTCs. Other futures vs. spot EFT differences include:

- Price tracking: futures market price vs. direct BTC price

- Market exposure: indirect vs. direct BTC exposure

- Risk level: futures market risks vs. BTC volatility

- Storage: no need for physical storage vs. physical storage

- Settlement: cash settlement vs. physical BTC

Conclusion

Now that you’ve seen our list of the best Bitcoin ETFs to invest in this year, as well as how and where to buy them, choose the ones that best suit your investment style. The main advantage of investing in BTC ETFs is their availability, simplicity, and low expense. You can also invest in three types of ETFs – futures, spot, and leveraged ETFs.

Keep in mind that cryptocurrencies are highly volatile, so never invest more than you can afford to lose.