Decentralized finance (DeFi) has turned the eyes of many investors towards crypto staking, liquidity providing, and other yield farming opportunities.

If you’re looking for a popular decentralized exchange (DEX) that supports the most blockchains and is the fastest to implement new chains, the SushiSwap Exchange might be what you need. Let’s run through what sets Sushiswap apart from the hundreds of DEXs out there.

What Is SushiSwap Exchange?

The SushiSwap Exchange was created from the open-source code of Uniswap, the most popular decentralized exchange today. For this reason, SushiSwap is a “hard fork” of Uniswap. SushiSwap added a few community-driven features into its predecessor’s application that have brought plenty of investors into the network.

Some DEXs only work on one chain like Uniswap which only works on Ethereum and PancakeSwap which runs on the Binance Smart Chain. SushiSwap runs on these chains and many more. Its goal is to be the earliest platform to adopt decentralized finance services on up-and-coming blockchains.

Just like how Bitcoin was created by the entity known as Satoshi Nakamoto, the SushiSwap Exchange was created by an anonymous group called “Chef Nomi”. Later on, ownership of the SushiSwap contract was transferred from Chef Nomi to Sam Bankman-Fried.

SushiSwap Exchange Pros & Cons

Let’s take a look at some of the key benefits and limitations of the SushiSwap Exchange below.

Pros:

- One of the fastest to launch on new blockchains

- Runs on 14 blockchains

- SushiSwap exchange volume is 7th among all DEXs

- Lending and borrowing features available

- Crypto staking available

- Swapping and interoperability among different blockchains

- Connect with multiple wallets like Metamask, WalletConnect, and more

- SushiSwap Exchange fees are uniform at 0.3% for all pairs

Cons:

- Limited utility for its network token, SUSHI

- Does not offer concentrated liquidity

Which Cryptocurrencies Can You Trade in SushiSwap Exchange?

With 14 blockchains under its belt, the SushiSwap Exchange offers many crypto pairs that can be traded. Some popular coins on the platform are:

- Bitcoin – Best Crypto with Largest Market Cap in 2022

- Ethereum – Ethereum

- Polygon – Third Largest Proof-of-Stake Crypto in 2022

- USD Coin – One of the Largest Stablecoins in 2022

- Tether – Most Popular Stablecoin in 2022

- Dai – Ethereum-based Token Among the Top Five Stablecoins

- ILV – One of the Most Popular Metaverse Coins in 2022

- OHM – Popular DeFi and Algorithmic Stablecoin

Bitcoin

Bitcoin was designed to be electronic cash or a store of value since its launch in 2009. Even if you haven’t entered the crypto sphere in any way, you’ve probably still heard of Bitcoin in one way or another. After weathering drastic rising and falling in prices, Bitcoin remains to be the most valuable cryptocurrency to date.

With a market cap of around $860 billion at the time of writing, Bitcoin peaked at its price back in November 2021 when it reached close to $68 thousand. Owing to its deflationary and decentralized nature, Bitcoin is considered to be the gold standard among digital assets. Because of this, the popular cryptocurrency is often touted as “crypto gold”.

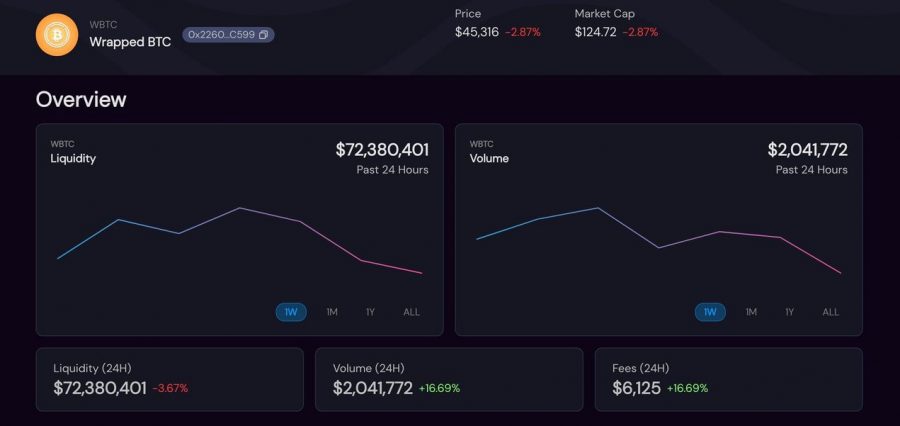

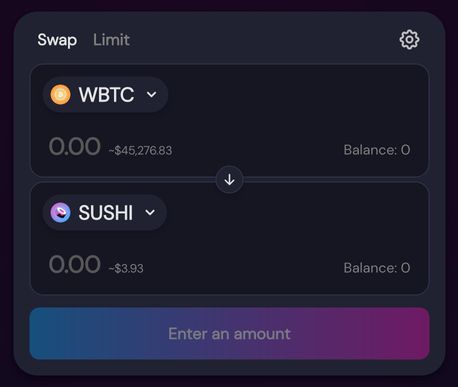

On the SushiSwap Exchange, Bitcoin is represented as WBTC or wrapped bitcoin. Wrapped bitcoin is an Ethereum token or ERC-20 token that represents an actual Bitcoin but on the Ethereum blockchain. The most popular pairs for Bitcoin on the SushiSwap Exchange are WBTC-ETH, WBTC-DIGG, and WBTC-BADGER.

If you’re looking for a centralized exchange to invest in Bitcoin, eToro is a great place to start. You can create an account in minutes and even use their crypto wallet to hold certain cryptocurrencies.

Cryptoassets are a highly volatile unregulated investment product. Your capital is at risk.

Ethereum

Ethereum is the second most popular cryptocurrency and is also called “digital silver”. Thanks to its ability to facilitate programmed contracts and applications, Ethereum has paved the path for decentralized finance itself.

In terms of utility, Ethereum shines as a cryptocurrency with tons of potential. Since Ethereum smart contracts are decentralized and self-executing, code and applications are run without the need for a centralized authority. Solidity is the object-oriented programming language that Ethereum uses.

Aside from Bitcoin, Ethereum is currently considered to be the only truly decentralized blockchain. Furthermore, the best builders and developers use the Ethereum platform to create their applications. Code in smart contracts is also open-source, meaning the actual lines of code are available to the public to see exactly how the contract works.

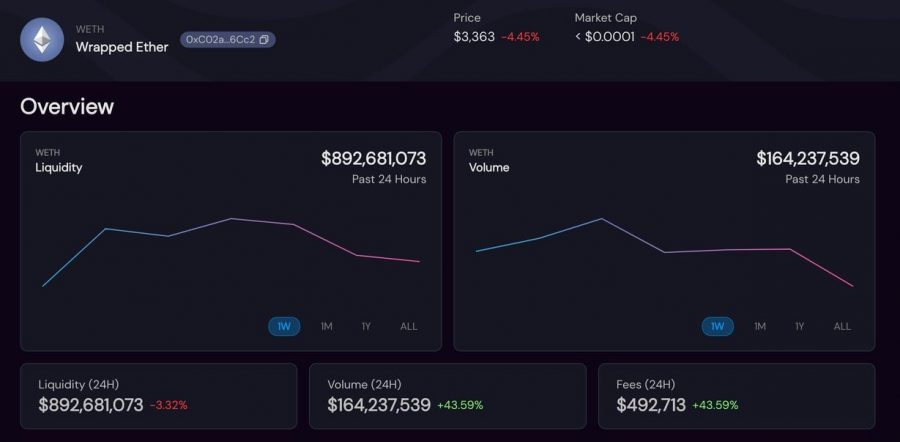

Ether exists on the SushiSwap platform as Wrapped Ether (WETH) which is an ERC-20 token of Ether. This allows for WETH to be traded with other ERC-20 tokens much like how WBTC is used to swap with other coins. If you want to buy Ethereum on SushiSwap, the top pairs of WETH include: ILV-ETH, USDC-ETH, and TOKE-ETH.

Tether

One of the most common forms of yield farming cryptocurrencies is through stablecoins. Because the price of cryptocurrencies like bitcoin and ether usually fluctuate due to volatility, stablecoins were created in order to have cryptocurrencies with a stable value.

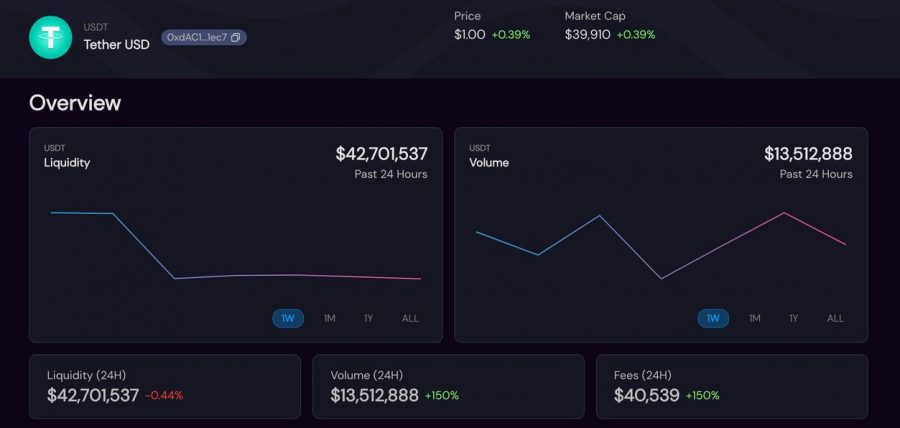

Tether (USDT) is a popular stablecoin that is pegged to the US dollar. The current market cap of the cryptocurrency is $82 billion at the time of writing. Together with other stablecoins, USDT is very popular when it comes to crypto lending. Returns from stablecoin yield farming are more consistent in terms of value.

The most popular crypto pairs on SushiSwap for USDT are ETH-USDT, LON-USDT, and APE-USDT.

Polygon

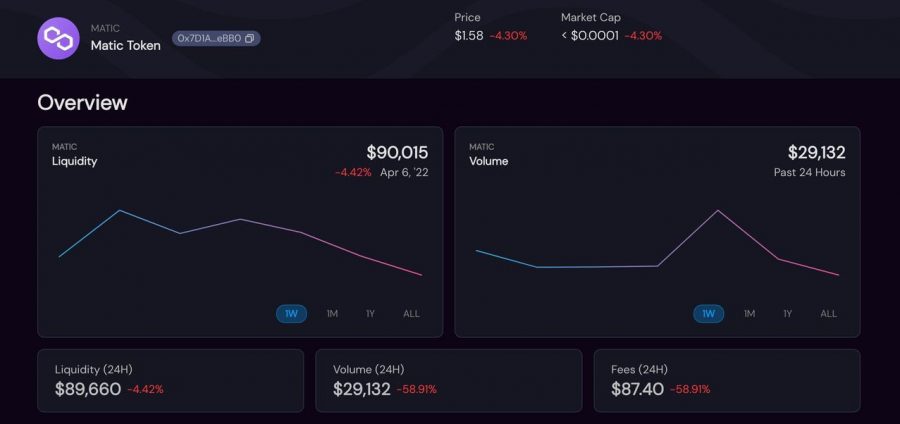

Polygon (MATIC) is the third-largest proof-of-stake token with a market cap of $11.9 billion. As a layer-two scaling solution for Ethereum, Polygon’s design is more efficient while being just as secure as its parent network. Aside from this, it aims to give developers user-friendly tools to better aid project proposals and the creation of their own projects. With decent annual percentage rates in DEXs, the token is one of the best crypto to invest in passively.

The most popular MATIC pairs on SushiSwap are ETH-USDT, LON-USDT, and APE-USDT. If you want to buy MATIC tokens on a centralized exchange, you can easily buy Polygon on eToro.

Cryptoassets are a highly volatile unregulated investment product. Your capital is at risk.

Sushiswap Exchange Fees & Commissions

Here we have listed key SushiSwap Exchange fees and commissions below:

| Fee Type | Charge |

| xSushi Fee Reward | 0.25% |

| Withdrawal Fee | Free |

| Deposit Fee | Free |

| Ethereum Gas Fees | 18-33 gweis |

| Liquidity Providing Fee | 0.25% |

| Swap Fee | 0.30% |

| xSushi Staking Reward Fee in SushiBar | 0.05% |

Sushiswap Exchange User Experience

The SushiSwap Exchange has a great landing page that introduces the platform with all its key features. From the introductory page, the Sushiswap Exchange volume in total can be viewed alongside the network coin’s price and total pairs.

Heading into the SushiSwap app itself, the decentralized exchange is simple and usable. Users are met with a black overlay with a navbar that redirects to the different swapping, stack yields, lending, and other products offered.

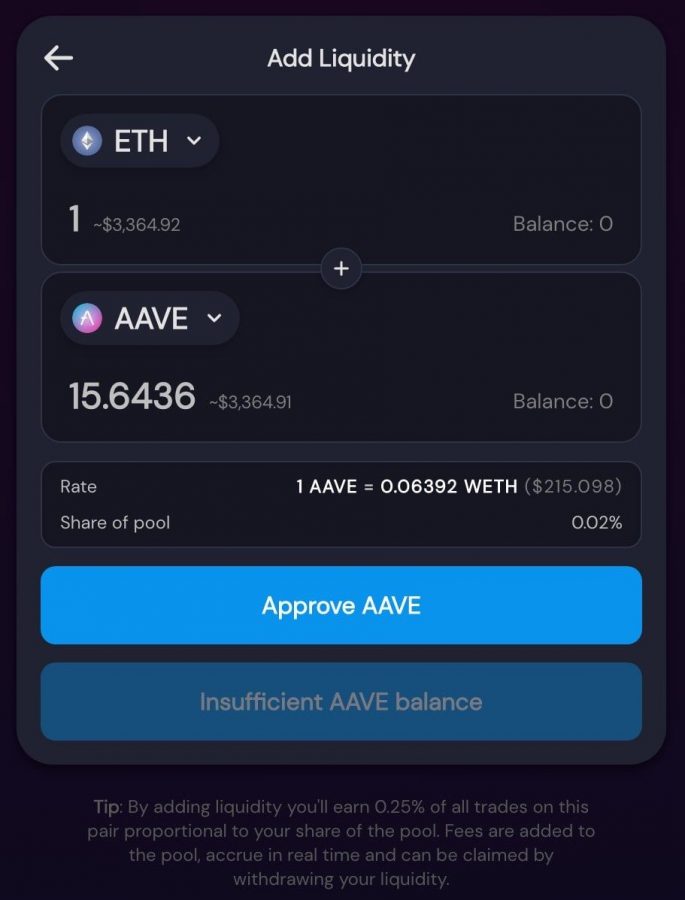

In our review, we connected a MetaMask wallet to the platform which was fast and easy to integrate. Providing liquidity to a pool for a crypto pair is also very simple on SushiSwap. Once on the page, users just have to select two tokens on the form and approve the transfer of cryptocurrencies.

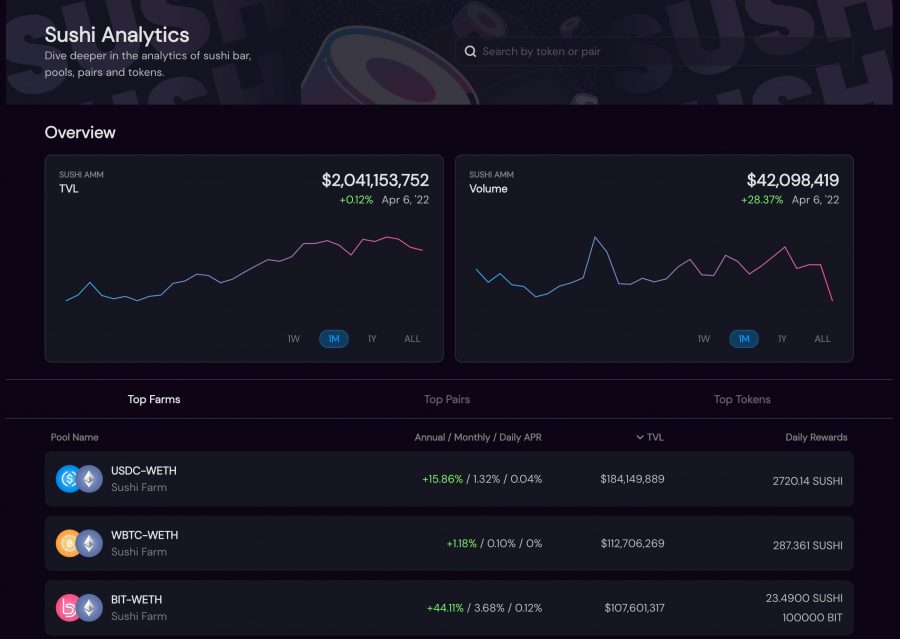

As far as analytics go, the SushiSwap analytics dashboard lets you dive deeper into the sushi bar, pairs, pools, and tokens. A line chart of the SUSHI automated market maker (AMM) is shown alongside the SushiSwap Exchange volume in the past 24 hours.

Below the dashboard, the top farms, best cryptos to invest in, and top tokens can be displayed as a list. Annual, monthly, and daily annual percentage rate (APR) is shown per farm together with the total value locked. This information is important for investors looking at popularity and volume as metrics.

For SushiSwap newcomers, instructions and information on all features can be found on the SushiSwap documentation site. It is recommended that users browse through the documents for the features that they want to get into such as Sushiswap’s yield farming, bento box, and more.

SushiSwap Exchange Features

Aside from SushiSwap Exchange’s flagship feature, yield farming, the decentralized exchange also offers crypto lending and a token vault. Kashi lending is SushiSwap’s customized lending and margin trading platform that aims to isolate the risk of its margin positions through individual lending markets.

BentoBox is SushiSwap’s yield generating token vault, a popular way for DEXs to offer interest for their users’ cryptocurrency. The improvement of BentoBox to this model is being able to track a user’s deposits and idle funds so that they can be used to earn passively in low-risk farming systems.

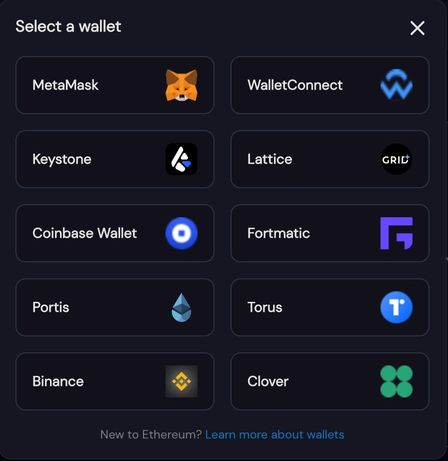

Access to the SushiSwap Exchange requires connecting your crypto wallet to the platform. Below are the crypto wallets that can be connected on SushiSwap:

- MetaMask

- WalletConnect

- Keystone

- Lattice

- Coinbase Wallet

- Fortmatic

- Portis

- Torus

- Binance

- Clover

SushiSwap Exchange Account Types

Unlike centralized exchanges that offer different account types like pro and demo accounts, SushiSwap offers the same features for all users given their wallets have the right blockchains integrated.

If you’re new to DeFi and using decentralized exchanges, it might be best to start with a small amount first to get a grasp of using the platforms. It takes time to swap coins due to different gas fees. In terms of the SushiSwap Exchange fees, it’s a little more user-friendly as all swap fees are 0.3% regardless of crypto pair.

Are you new to trading crypto? Create an account with eToro and use their demo trading feature to build your understanding of crypto trading.

Cryptoassets are a highly volatile unregulated investment product. Your capital is at risk.

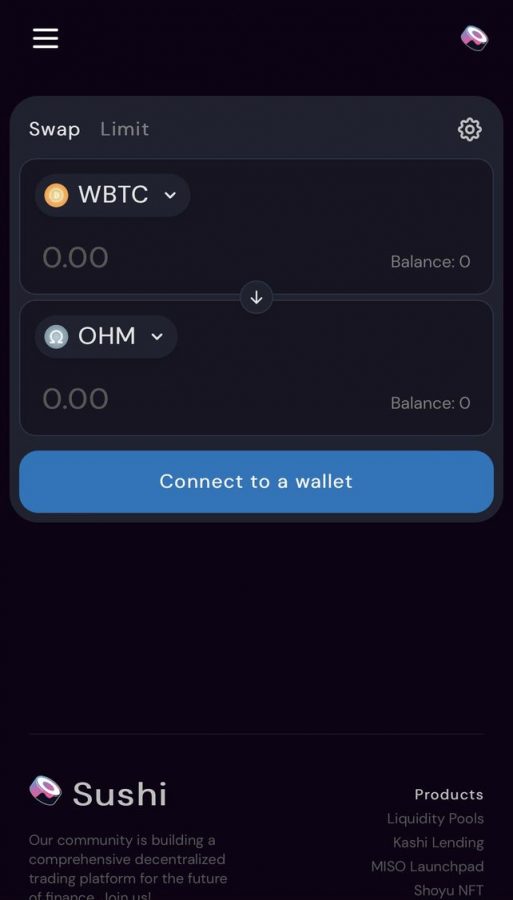

SushiSwap Exchange Mobile App Review

If you have a crypto wallet on your mobile device like MetaMask, you can easily access the SushiSwap exchange on your phone. Once you head to the SushiSwap site via web browser, you can connect to your wallet and SushiSwap will run on your wallet app.

Because liquidity pools and other yield farming products run 24/7, it’s important to be able to access your coins and tokens on the go. In our testing of the SushiSwap Exchange on the MetaMask app, we found the interface to be responsive for mobile. All features that can be accessed through the web platform are available on mobile.

SushiSwap Exchange Deposit and Withdrawal Methods

All deposit and withdrawal functions on SushiSwap happen through the connected crypto wallet. This means that you’ll need a wallet with cryptocurrency to start using the platform. Luckily, many crypto wallets let you top up on different cryptocurrencies if you’re looking to convert your dollars and invest in cryptocurrency.

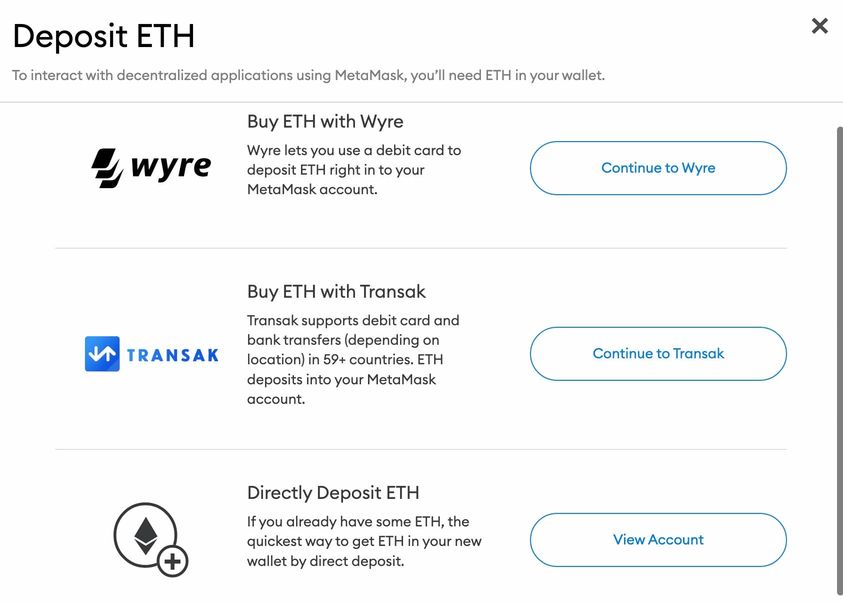

For example, you can buy ETH and add it to your MetaMask wallet via Wyre or Transak. If you have a Binance account, you can even transfer the coins and tokens from your account to your other wallets which you can then connect on the SushiSwap exchange.

SushiSwap Exchange Contact and Customer Service

Contacting customer service on centralized exchanges is relatively fast and easy as the platforms usually have dedicated teams that service user queries. On a decentralized exchange like SushiSwap, these departments don’t exist. Instead, support is offered via the application’s documentation page.

Part of SushiSwap’s allure in the community is the SUSHI AMM which automatically executes exchanges, liquidity providing, and other features. Although there is a team behind the development and updates of the SushiSwap Exchange, instructions for users and other developers remain limited to their documentation.

If a great contact and customer service are important to you when trading cryptocurrencies, consider investing in crypto with eToro. They have an excellent customer service with live chat agents and higher-tiered users even get their own account managers.

Cryptoassets are a highly volatile unregulated investment product. Your capital is at risk.

Is Sushiswap Exchange Safe?

Despite crypto volatility and the prevalence of rug pulls in crypto projects, SushiSwap is considered to be a great place to buy cryptocurrency safely. Since the platform’s features run via smart contracts, transactions are secured on the blockchains of the cryptocurrencies being traded.

The network token of SushiSwap is SUSHI which is an ERC-20 token that also functions as a governance token for the project. Holders of the SUSHI token can vote on governance proposals for the platform.

How it works is that one SUSHI in a SUSHI-ETH pool equates to two SUSHIPOWAH. SUSHI-ETH pair: 1 SUSHI in the pool = 2 SUSHIPOWAH. It takes 5 million SUSHIPOWAH to reach a quorum on a governance proposal.

Additionally, there is no know-your-customer (KYC) process when starting with SushiSwap. Transactions are anonymous much as they go through the blockchain and the only requirement for using the platform is a crypto wallet.

How To Start With SushiSwap Exchange

Let’s go through the key steps on how to open a SushiSwap Exchange account today.

Step 1: Open A Trading Account

First, head over to the SushiSwap website and click on the Connect to a Wallet button at the top right-hand corner. This should lead you to a modal with multiple wallets that you can connect to the platform. If you don’t have a crypto wallet yet, you can create one online first.

Once connected, your wallet address should be shown at the top right of the page.

Step 2: Deposit Funds

Once you’ve connected your crypto wallet to the SushiSwap Exchange, you can proceed to deposit your coins and tokens. If you’re looking to provide liquidity, you can hover over Liquidity and click on the Pool option. If you want to deposit your coin on the app to swap for another coin, you can head to the Trade option and click on Swap.

Step 3: Trade DeFi Cryptos With SushiSwap Exchange

There are two options for trading DeFi coins on the SushiSwap exchange. You can swap tokens wherein you’ll need to select the token that you will send and the token you’ll receive from the swap.

The second option is making a limit order which uses funds from the BentoBox of the SushiSwap platform. Here, you also need to input the two tokens, their amounts, but also the SUSHI rate, and the expiration date of the order.

Is SushiSwap the Best Crypto Exchange?

The SushiSwap Exchange has everything you’ll need to get started with trading crypto in a decentralized exchange. As a one-stop-shop for a vast range of cryptocurrencies, you can be deeply creative with your crypto trading and yield farming strategies. However, decentralized exchanges like SushiSwap will be limited in terms of slower transaction speeds, gas fees, and a more restricted user interface.

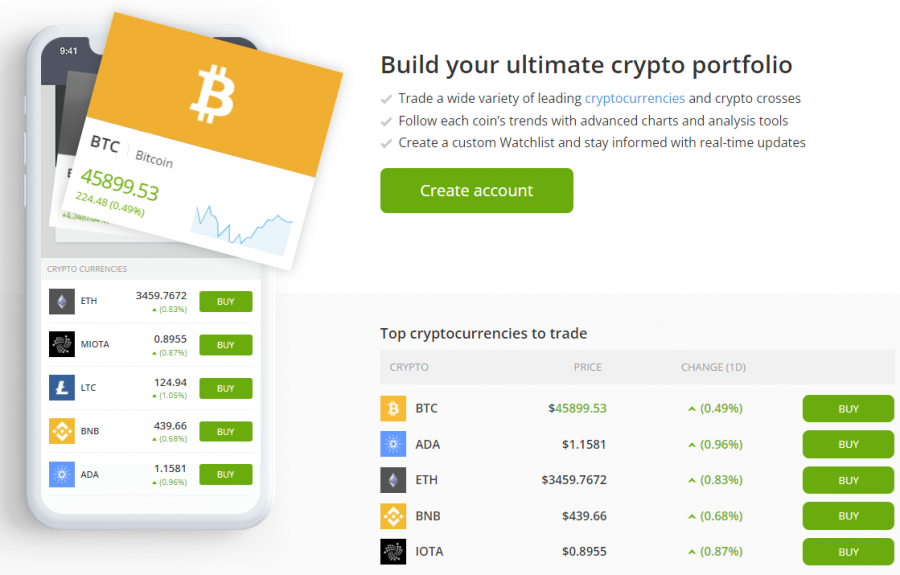

On the other hand, centralized exchanges are quicker and offer much more in their interface. We consider eToro as the best among centralized exchanges for cryptocurrency since it’s great for beginners. The platform even lets you trade stocks, indices, forex, and more.

As we touched briefly upon earlier, eToro is especially useful for beginners thanks to its demo trading feature. Decentralized platforms will require you to put up at least some capital in order to experience trading, but eToro gives you access to virtual funds so you can practice trading on their interface.

Their flagship feature, copy trading, even lets you follow the top traders’ positions so you have the chance to earn just as much as a professional. Copy traders have vast and varying portfolios with investments from indices, global stocks, cryptocurrencies, and even commodities. You can even view their past performance and risk scores to help you choose the best ones for you.

If you’re looking for faster transactions and a support team that you can contact regarding your account, then looking into a centralized platform for your crypto trades will be best. In this case, we would recommend eToro, an all-in-one regulated trading platform that has over 59 different cryptocurrencies available to trade.

To create an account and start trading crypto-assets and more, click on the link below and open an account with eToro today!

Conclusion

Although SushiSwap’s popularity has calmed down since the initial DeFi wave, the platform remains a solid site for crypto interoperability. It remains the application with one of the most chains.

Most of the popular cryptos being traded in the SushiSwap Exchange are Ethereum-based, but niche chains and coins are quickly implemented on the platform. Running on 14 blockchains and being 7th in terms of total volume among all DEXs makes SushiSwap an attractive option for many crypto investors.

However, we think eToro is a much better crypto exchange than SushiSwap due to it’s fantastically designed platform with innovative copy trading tools, as well as its competitive crypto trading fees.

FAQs

What is SushiSwap Exchange?

What is DeFi?

What crypto assets can I trade in SushiSwap Exchange?

Can I store cryptos in SushiSwap Exchange?

Can I open an account with SushiSwap Exchange in the US?