There are hundreds of cryptocurrency exchanges available on a global scale. For people who are just getting started with the world of cryptocurrency trading, choosing the right Bitcoin exchange can be a bit tricky.

This can be especially difficult for those seeking bitcoin exchanges in Switzerland, as not every single exchange is available there.

To make the process of finding the best crypto Exchange in Switzerland a bit easier for everyone, today, we’ll review the best crypto exchanges in Switzerland available today. By the end of this review, users will be able to pick the best Swiss crypto exchange.

The Best Crypto Exchanges in Switzerland for 2025

When it comes to finding the best crypto exchange in Switzerland, these are the main options that users can look at, all of which are fully available across the country.

The 8 top crypto exchanges in Switzerland according to our reviews are:

- Crypto.com – Leading exchange with its native cryptocurrency token Cronos (CRO).

- Bitstamp – Cost-effective cryptocurrency exchange that features solid tools.

- YouHodler – Popular multi-chain exchange with cloud mining and yield farming.

- Coinbase – Well-established exchange with a large user base.

- Binance – A crypto exchange with the lowest fees for commissions.

- Bitcoin Suisse – First crypto payment processor in Switzerland with Bitcoin Lightning.

- Bity – Providers users in Switzerland with access to popular cryptocurrencies.

- SIX Digital Exchange – First fully regulated FMI digital asset exchange.

The Top Bitcoin Exchanges in Switzerland Reviewed

Through our research, we have found the 8 best crypto Exchange in Switzerland options that users can use in Switzerland. In the section below, users will find full reviews of each of these biggest crypto exchanges so users can make a well-educated decision as to which one suits their specific needs the most.

1. Crypto.com – Leading Exchange with its Native Cryptocurrency Token Cronos (CRO)

Crypto.com also has on offer what are known as interest-bearing accounts for a variety of different cryptocurrencies, and this can also be utilized through the usage of stablecoins.

Each user can lock their assets or set a flexible account with them, which can provide them with a high level of utility on the exchange.

Another notable feature surrounding the exchange is its well-optimized mobile application, which can be installed on devices running Android from the Google Play Store and those that run iOS from the App Store.

In terms of the payment methods that users can look forward to, users can use Mastercard, Visa, or e-wallets such as PayPal. Keep in mind that there is a fee of 2.99% unless users use cryptocurrencies, where the fee is just 0.40%. All of this makes it one of the best Switzerland crypto exchanges.

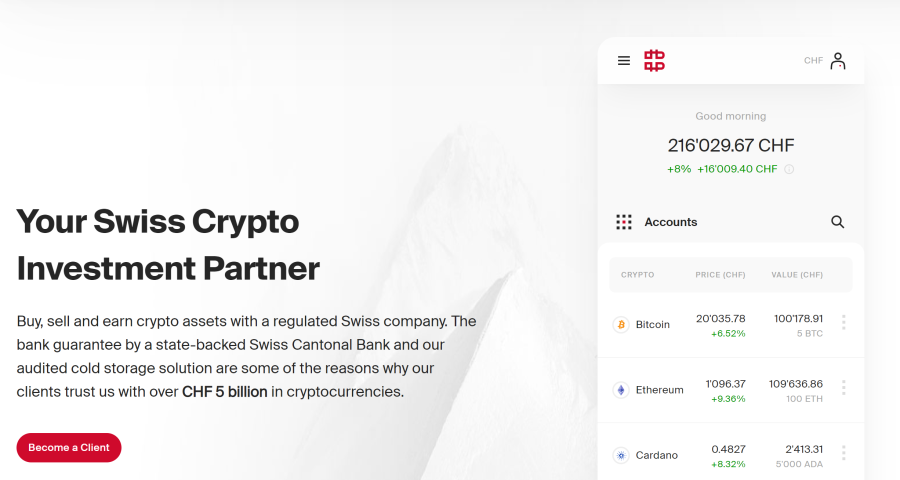

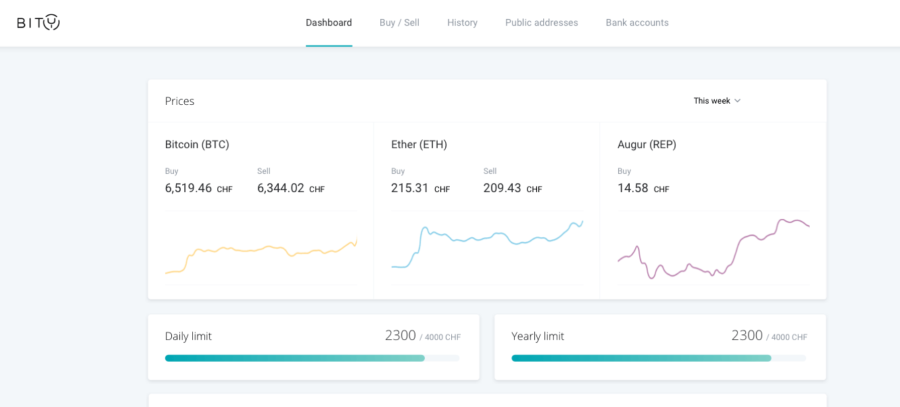

Pros Cons Cryptoassets are a highly volatile unregulated investment product. Furthermore, users are also given the opportunity to buy cryptocurrencies through the usage of a debit card or a debit card, but keep in mind that this has one of the highest fees associated with it at 5% per transaction. In any case, this is an ideal opportunity for those getting into buying cryptocurrencies for the very first time. The minimum trade amount is $10 and 0.0002 BTC for Bitcoin-denominated pairs. Alongside the solid web-based application, there is also a mobile application that can be downloaded without any additional cost from the App Store on iOS or from the Google Play Store on Android, which opens up the exchange for people on the go. If users are looking for one of the best Switzerland crypto exchanges, this might be a solid option. Pros Cons Cryptoassets are a highly volatile unregulated investment product. Get loans in fiat, such as CHF, EUR, USD or GBP or get stablecoins and crypto. Another feature that you can’t find with every exchange is the Bitcoin cloud miner. This lets you earn up to 0.2 BTC (around 9,000 CHF) per month. The way it works is you complete tasks to earn sparks and then you use sparks to mine BTC. Youhodler’s main feature is MultiHODL. This is a trading solution with no exchange or margin fees where you can open a position with a collateral from just $10 and use up to 70x leverage. This means you can trade $7,000 worth of assets with a $100 collateral. Pros Cons Users can open up an account for Coinbase within the span of just a few minutes and invest in any cryptocurrency that is available on the exchange by connecting one of the many available payment methods, such as a credit card, debit card, or e-wallet option. Furthermore, users need to be aware that credit or debit card transactions are the priciest at 3.99%. However, users can also use alternative methods that cost less. When it comes to its use case, it has a simple and well-designed mobile application, and each customer is required to verify their identity and enable two-factor authentication (2FA) for the highest level of security by default. If users want to buy over 100 cryptocurrencies on a safe exchange that has a large user base and a well-established reputation, then Coinbase might be one of their most solid options in Switzerland. Pros Cons Cryptoassets are a highly volatile unregulated investment product. This exchange has made a reputation for itself due to the fact that users can trade crypto-to-crypto pairs, such as BTC/ETH, for example, at just 0.10%. What this means is that if users would, for example, have a stake that would cost $100, all users would need to pay in fees is just $0.10. There are also hundreds of cryptocurrencies available for users to pick from and trade. Additionally, if users are interested in buying cryptocurrencies with FIAT money, remember that there are additional fees. For example, if users want to make a purchase with Visa or Mastercard, users would pay a fee of 4.5%. However, there is a solid mobile application, and there are a lot of useful trading features alongside the Binance launchpad and launchpool, which make it a solid offering for those that want to go beyond just simply trading cryptocurrencies. This is a go-to exchange for anyone looking for a cheap, well-established option, and it even has its own native cryptocurrency token known as BNB (BNB). Pros Cons Cryptoassets are a highly volatile unregulated investment product. According to the official website, ‘the clients trust this exchange with over CHF 5 billion in cryptocurrencies. The service also aggregates the best available market prices from across the most popular cryptocurrency exchanges on a global scale, and crypto-assets can also be traded against various FIAT currencies, which also makes this a solid option for beginners who are just getting into the crypto sphere for the very first time.’ Pros Cons Furthermore, this is an exchange that is controlled by Swiss regulatory authorities and, as such, complies with all of the international AML regulations. KPMG is responsible for the process of auditing its operations. The company features a vast range of products as well as services, and users are given the opportunity to use FIAT money to get crypto and crypto to get FIAT money. Bity even features a cryptocurrency ATM and other facilities when it comes to paying bills through online means and features API services as well as OTC desks which are a popular offering. Pros Cons They also offer a cryptocurrency bond that comprises two exchangeable parts. There is what is known as the digital part. This part got listed and traded on SDX Trading Ltd, and centrally held by the SIX Digital Exchange Ltd. The traditional part is then listed and traded on SIX Swiss Exchange Ltd. and centrally held by SIX SIS Ltd. The company has made a reputation for itself due to the fact that it introduced this innovative approach. While it does not feature as many cryptocurrencies as other exchanges and is a bit more complicated to use, traders in Switzerland might feel a lot more comfortable using it as it is fully regulated. If users were looking for the best bitcoin exchange in Switzerland, hopefully now users have a heightened perspective. Pros Cons Ever wondered which crypto exchange in Switzerland had the most competitive fees in 2025? Now that readers know a bit more about some of the best Switzerland crypto exchanges, the next step to take is to figure out which supplier or provider is right for their specific needs. Regulation can play a major role when it comes to the safety of a cryptocurrency exchange. Regulators are responsible for ensuring that a crypto exchange protects users’ funds and operates in a way that’s fair. As such, it is crucial that users go over the regulatory status of a cryptocurrency exchange before users end up making an account or depositing funds into it. Another aspect to consider is the number of cryptocurrencies that are on offer at an exchange. There are over 19,000 cryptocurrencies listed as of 2022, but most crypto exchanges don’t carry all of them. Ideally, users want to find an exchange that will provide as much variety as possible. For users who have specific cryptocurrencies in mind to trade, it’s important to find an exchange that offers these coins. The best bitcoin exchanges in Switzerland typically offer bonuses in the form of sign-up offers. These will typically provide a specific bonus like cash, cryptocurrency, or reduced trading fees. Another aspect of a cryptocurrency exchange that should be high up on users’ radar is the tools and features available through the exchange. While as a beginner, users will likely not utilize all of the features from the very start. Over time, as users get more comfortable with trading, they will need specific charting tools, candlesticks, and other features that will enable users to make market predictions. The best cryptocurrency exchanges have many trading tools and features available. Swiss users will typically want to find a cryptocurrency exchange that offers a variety of different payment options, from credit cards to debit cards, direct bank wire transfers, e-wallets, and even cryptocurrency wallets. The more options it has, the more chances users have of making a deposit and actually starting to use the exchange in question. Watch out for high fees for specific payment methods, such as credit card payments. Most modern cryptocurrency exchanges rarely run into any issues. However, there might come a point in time when users experience a bug or simply run into an issue and need assistance. So, it’s a good idea to find an exchange that features a solid support team. Look for support by phone and live chat in addition to email. Whenever possible, 24/7 customer support is best since the crypto market never sleeps. In Switzerland, cryptocurrencies, as well as virtual currencies, are legal. However, they are classified as assets or as property. Exchanges are also legal in Switzerland. The Switzerland cryptocurrency regulation is progressive. In fact, users choose cryptocurrency exchanges based in Switzerland that are regulated by regulatory bodies present and active in Switzerland. When it comes to taxation in Switzerland, for private investors, there are rules for securities trading, which qualify capital gains as tax-free if the following conditions are met. If the holding period is at least six months if the trading turnover is smaller than 5x the holding at the beginning of the tax period, and capital gains are smaller than 50% of the total income in the respective tax period. No debt financing and derivatives are solely used for hedging. Furthermore, every taxpayer gets a federal income tax allowance of 14,500 CHF that is tax-free. There are many tax-free transactions in Switzerland, including buying crypto with FIAT currency like CHF, trading and spending crypto as a private investor, HODLing crypto, excluding the wealth tax on total assets, and transferring crypto between their own wallets. These rules might change over time, so it is always a good idea to double-check all of the data prior to investing in crypto in Switzerland. It’s important for new crypto traders to pick the best cryptocurrency exchange for their specific goals, ambitions, and preferred coins. Based on our reviews of the 8 best crypto platforms in Switzerland, we think Crypto.com is the best cryptocurrency exchange in Switzerland for most users. At Crypto.com, users will find access to many cryptocurrencies, all of which are easily accessible through a fully regulated exchange.

Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

Trading Platform

Number of Coins

Credit Card Fee (Instant Buy)

Deposit Methods

Minimum Deposit

Crypto.com

250+

2.99%

Credit card, debit card, e-wallet, direct bank deposit

$500 from bank transfers or $25

2. Bitstamp – Cost-Effective Cryptocurrency Exchange that Features Solid Tools

Trading Platform

Number of Coins

Credit Card Fee (Instant Buy)

Deposit Methods

Minimum Deposit

Bitstamp

50+

5%

Credit card, debit card, e-wallet, direct bank deposit

No minimum deposit stated

3. Youhodler – Popular Crypto Exchange With Yield Farming Features

Trading Platform

Number of Coins

Credit Card Fee (Instant Buy)

Deposit Methods

Minimum Deposit

Youhodler

50+

1%

Credit card, debit card, e-wallet, direct bank deposit, Apple Pay

Depends on deposit method

4. Coinbase – Well-established Exchange With a Large User Base

Trading Platform

Number of Coins

Credit Card Fee (Instant Buy)

Deposit Methods

Minimum Deposit

Coinbase

150+

3.99%

Credit card, debit card, e-wallet, direct bank deposit

No minimum deposit stated

5. Binance – A Crypto Exchange with The Lowest Fees for Commissions

If users are on the lookout for a cryptocurrency exchange that has some of the lowest fees, then users are looking for Binance.

Trading Platform

Number of Coins

Credit Card Fee (Instant Buy)

Deposit Methods

Minimum Deposit

Binance

500+

4.5%

Credit card, debit card, e-wallet, direct bank deposit

No minimum deposit threshold

6. Bitcoin Suisse – First crypto payment processor in Switzerland to integrate Bitcoin Lightning technology

Trading Platform

Number of Coins

Credit Card Fee (Instant Buy)

Deposit Methods

Minimum Deposit

Bitcoin Suisse

40+

1.25%

bank transfers in CHF, EUR, and USD.

Minimum initial deposit requirement of CHF 100.000 for private clients

7. Bity – Providers Users in Switzerland with Access to Popular Cryptocurrencies

Trading Platform

Number of Coins

Credit Card Fee (Instant Buy)

Deposit Methods

Minimum Deposit

Bity

3

3.5 – 8%

Credit/Debit Card Payment, Third-Party Payment, or P2P Trading

10 EUR

8. SIX Digital Exchange – First Fully Regulated FMI Digital Asset Exchange

Trading Platform

Number of Coins

Credit Card Fee (Instant Buy)

Deposit Methods

Minimum Deposit

SIX Digital Exchange

Shares and Bonds Only

No information

No information

No information

The Best Switzerland Crypto Exchanges Compared

Trading Platform

Number of Coins

Credit Card Fee (Instant Buy)

Deposit Methods

Minimum Deposit

Crypto.com

250+

2.99%

Credit card, debit card, e-wallet, direct bank deposit

$500 from bank transfers or $25

Bitstamp

50+

5%

Credit card, debit card, e-wallet, direct bank deposit

No minimum deposit stated

Youhodler

50+

1%

Credit card, debit card, e-wallet, direct bank deposit, Apple Pay

Depends on deposit method

Coinbase

150+

3.99%

Credit card, debit card, e-wallet, direct bank deposit

No minimum deposit stated

Binance

500+

4.5%

Credit card, debit card, e-wallet, direct bank deposit

No minimum deposit threshold

Bitcoin Suisse

40+

1.25%

bank transfers in CHF, EUR, and USD.

Minimum initial deposit requirement of CHF 100.000 for private clients

Bity

3

3.5 – 8%

Credit/Debit Card Payment, Third-Party Payment, or P2P Trading

10 EUR

SIX Digital Exchange

Shares and Bonds Only

No information

No information

No information

How to Choose the Best Switzerland Cryptocurrency Exchange for You

Regulation

Tradable Cryptos

Sign Up Offers

Tools & Features

Payment Methods

Customer service

Are Crypto Exchanges Legal in Switzerland?

Crypto Tax in Switzerland

Conclusion

FAQs

Can I Buy Crypto in Switzerland?

Is Crypto Regulated in Switzerland?

How Can I Buy Crypto in Switzerland?

What Crypto Exchanges Work in Switzerland?

Are Crypto Exchanges Regulated in Switzerland?

What Is the Best Crypto Exchange in Switzerland?

Can Binance Be Used in Switzerland?

Is Coinbase Available in Switzerland?