Crypto trading has grown tremendously around the world, and it’s definitely made its mark in Qatar. Becoming a crypto investor requires one to conduct safe transactions through a reliable exchange. Although many options are available to investors, finding the best crypto exchange in Qatar is time-consuming and risky if investors make the wrong choice.

We made the search for investors easy by reviewing the best crypto exchanges in Qatar and comparing them to see how they fare against each other. Our guide analyzes the coins, fees, regulations, security and conveniences of each exchange.

The Best Crypto Exchanges Qatar 2025 List

Finding the best crypto exchange in Qatar requires an in-depth analysis of the exchange’s offerings such as fees, coin options and security. We looked at all of those features and took it a step further by providing a step-by-step process of how to open an account and trade with top crypto exchanges in Qatar.

- Crypto.com – Spot and futures trading of 250+ coins

- Coinbase – Most popular global crypto exchange

- Binance – Offers more than 600 coins

- BitOasis – Leading platform in the Middle East

- Rain – Low trading fees

- CoinMena – Offers competitive fees

The Top Bitcoin Exchanges in Qatar Reviewed

We’ve included all the information investors need to know about the best Bitcoin exchange in Qatar. After scouring the market, we found seven exchanges that make crypto investing easy.

1. Crypto.com – Low Fees for Trading More Than 250 Coins

Investors trading on Crypto.com can deposit funds via bank transfers and debit/credit cards. Using a debit card doesn’t contain a fee, but Crypto.com charges 2.99% for credit card deposits. The trading fees are appealing because the platform offers a tier system. Up to $25,000 30-day trading, investors pay 0.4%. Then, fees reduce as trading frequency increases.

Crypto.com enables investors to stake coins—locking-in coins for a certain period to earn interest. The platform provides a 14.5% annual return for certain coins. It also offers a native coin, CRO, at 4% per annum. Short-term investors can take advantage of the platform’s flexible, 1-month and 3-month stake terms. Investors wishing to stake stablecoins can earn up to 10% per annum.

One of the easiest ways to buy Bitcoin on this exchange is by using the app. Crypto.com app is available on iOS and Android and offers the same features as the website but in a user-friendly format. A minimum deposit of $20 is required to trade on this platform.

Crypto.com exchange is always looking for ways to adhere to the highest standard of compliance, so it achieved Service Organization Control (SOC) 2 audit conducted by Deloitte. The platform demonstrated it had implemented policies and procedures in accordance with the AICPA Trust Service Criteria.

| Number of Cryptos | 250+ |

| Deposit Fee | 2.99% for cards |

| Fee to Buy Bitcoin | 0.4% |

| Minimum Deposit | $20 |

Pros

Cons

Cryptoassets are a highly volatile unregulated investment product. Your capital is at risk.

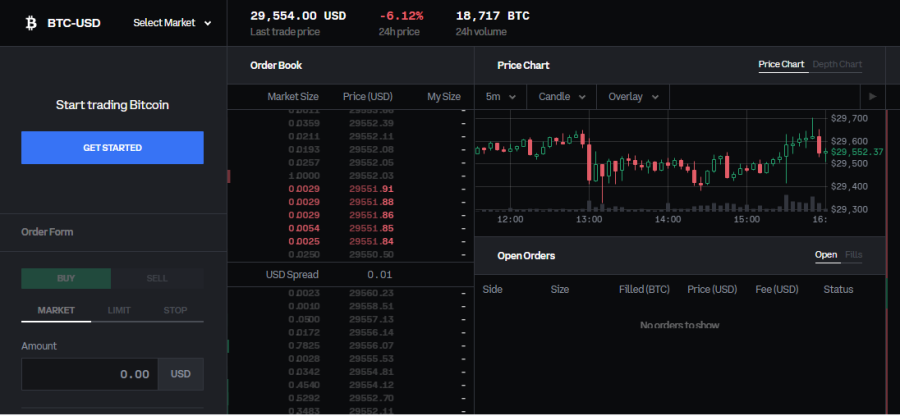

2. Coinbase – Most Popular Global Crypto Exchange

A minimum investment of $2 is required to buy crypto. For Coinbase to verify an investor’s bank account, a minimum deposit of $50 is needed. Although Coinbase’s popularity has spread globally, its fees are higher than some of the exchanges we found. Trading fees depend on whether traders are makers or takers. A maker with a trading volume of $0-$10,000 will pay 0.40% fees. A taker would pay 0.60% fees in that trading bracket. As a trader’s monthly volume increases, his/her fees are reduced.

Coinbase has more than 98 million users, and it requires everyone to add a 2-Factor Authentication. The New York State Department of Financial Services regulates and licenses the platform. Coinbase ensures that 98% of client digital assets are stored in a cold wallet.

Investors wanting to stake cryptocurrencies on Coinbase can do so and expect an annual return of up to 5.75%. Only $1 is needed to start staking.

Professional traders seeking lower fees and advanced trading tools will find Coinbase Pro to be more suitable than the standard platform.

| Number of Cryptos | 100+ |

| Deposit Fee | 2.49% |

| Fee to Trade Crypto | 0.5% |

| Minimum Deposit | $2, but $50 to verify a user’s bank account |

Pros

Cons

Cryptoassets are a highly volatile unregulated investment product. Your capital is at risk.

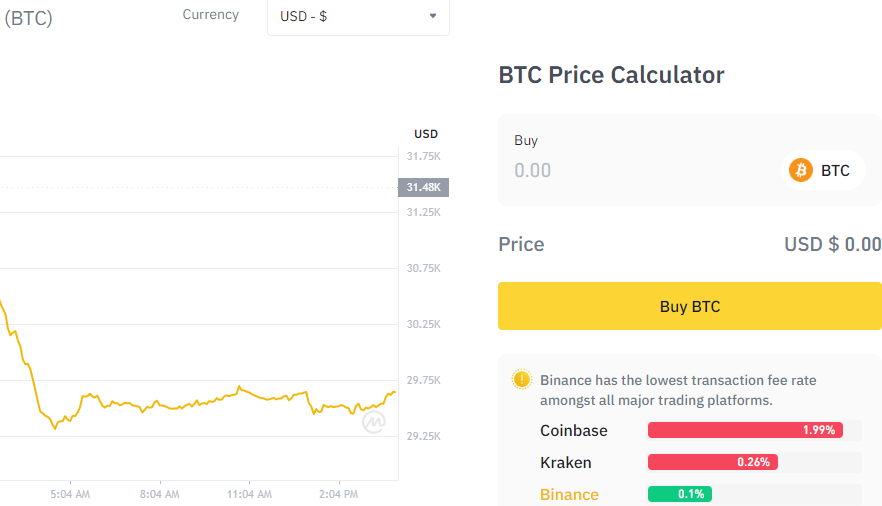

3. Binance – Offers More than 600 Coins

The exchange offers more than 120 staking coins. The best part is the annual percentage yield (APY) offered. Some of the coins offered on Binance for staking offer more than 120% APY for locking in coins for 90 days. Binance also offers flexible, 15-day, 30-day, 60-day, 90-day and 120-day staking periods.

Qatar traders wanting to buy cryptocurrencies will need to pay a 0.1% spot trading fee and 0.5% for instant buy/sell. Beginner traders will find the platform easy to use. It enables chart customization, numerous technical indicators and advanced trading orders. Investors paying for trading fees with BNB are entitled to a 25% discount.

Unlike some exchanges, Binance doesn’t charge clients for depositing funds. The usual fee for trading with a card is 3%, but using a Visa card entitles investors to a 1% fee.

To safeguard client assets, Binance requires 2-Factor Authentication and offers a web and mobile wallet. Another option for storage is the Trust Wallet app, a non-custodial wallet backed by Binance and available on iOS and Android. The exchange has also established the Secure Asset Fund for Users (SAFU) as an emergency insurance fund to protect investor interests.

| Number of Cryptos | 600+ |

| Debit Card Fee | Free bank transfer deposit |

| Fee to Buy Bitcoin | 0.1% |

| Minimum Deposit | Varies based on the payment method |

Pros

Cons

Cryptoassets are a highly volatile unregulated investment product. Your capital is at risk.

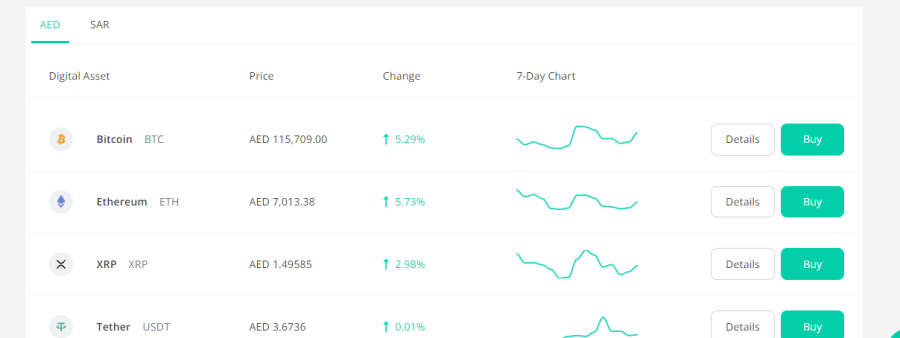

4. BitOasis – Leading Platform in the Middle East

The platform is designed specifically for beginners. Trading cryptos on this platform consists of a few basic steps such as choosing a cryptocurrency and confirming the order. Pro traders wanting to optimize their strategies and access to advanced tools will find those on the BitOasis Pro platform.

Investors wanting to buy cryptocurrencies with AED will incur fees based on trading volume. A 30-day trading volume means that the taker will pay 0.48%, and the maker is charged 0.24%. More trading volume results in lower trading fees. Digit asset pair trading is also possible. The taker will pay 0.15% and the maker pays 0.10%.

BitOasis received provisional approval from Virtual Asset Regulatory Authority (VARA), a Dubai crypto regulator.

| Number of Cryptos | 40+ |

| Deposit Fee | 3.99% |

| Fee to Buy Bitcoin | 0.48% |

| Minimum Deposit | 300 AED |

Pros

Cons

5. Rain – Low Trading-Fee Platform

The exchange offers 24/7 support in Arabic and designed its platform specifically for beginners. Investors in Qatar can easily deposit money into their accounts because Rain is integrated with many Middle Eastern banks.

Rain charges 0% trading fees for fiat and card buys. It also implemented a 0% swap fee. A variable spread applies when investors open trades.

Besides being regulated by the Centra Bank of Bahrain, Rain has ensured its compliance with Shariah. Traders can use Rain’s mobile app, available on iOS and Android, to access a user-friendly crypto platform.

| Number of Cryptos | 50 |

| Deposit Fee | 0% |

| Fee to Buy Bitcoin | 0% commission (variable spread) |

| Minimum Deposit | Varies |

Pros

Cons

6. CoinMena – Offers Competitive Fees

A minimum withdrawal is 500 AED, which incurs a fee of 110.63 AED. That’s a significant cost, but CoinMena has tried to be competitive by offering a 0.75% trading fee. CoinMena rewards high-volume traders with lower fees.

One of the main benefits of using CoinMena is that it offers over-the-counter (OTC) trading. OTC is perfect for investors wanting to purchase a large number of assets. CoinMet OTC is available to KYC-verified individuals. A minimum OTC transaction is $100,000. Because of the enormity of the transaction, OTCs have very small transaction fees.

CoinMena is licensed by the Central Bank of Bahrain.

| Number of Cryptos | 13+ |

| Deposit Fee | 3.5% with card |

| Fee to Buy Bitcoin | 0.75% |

| Minimum Deposit | 36.5 AED |

Pros

Cons

The Best Qatar Crypto Exchanges Compared

| Exchange | Number of coins | Deposit Fee | Fee for Buying Bitcoin | Supported Payments |

| Crypto.com | 250+ | 2.99% card | 0.4% | Bank wire, debit/credit card |

| Coinbase | 100+ | 2.49% | 0.5% | Bank wire, debit/credit card |

| Binance | 600+ | Free bank wire | 0.1% | Debit/credit card, bank wire |

| BitOasis | 40+ | 4.5% | 0.47% | Debit/credit card, bank wire |

| Rain | 50+ | 0% | 0% (variable spread) | Bank wire, debit/credit card |

| CoinMena | 13+ | 3.5% card | 0.75% | debit/credit card, bank wire |

How to Choose the Best Qatar Cryptocurrency Exchange

Investors need to consider several factors when choosing a cryptocurrency exchange. Covering that basis will optimize safety and reduce investment risk.

Regulation

To ensure funds are safe, investors should invest with regulated cryptocurrency exchanges. Regulating exchanges is important so that they are held to an ethical and legal standard. By doing so, investors receive a certain level of protection. The last thing investors want is for exchanges to do with their money as they please. Regulations provide that safety.

Exchanges that violate regulations and laws are penalized, usually monetarily. That disincentive makes exchanges apprehensive about breaking the rules that regulators stipulated to protect investor interests.

The more regulated an exchange is, the better.

Tradable Cryptos

Crypto exchanges should offer a large selection of coins. Some exchanges offer only Bitcoin and Ethereum. Not only does that limit investors who want to invest in the major altcoins, but it could mean that an exchange has limited liquidity. Most investors desire a highly liquid exchange so that their positions are filled immediately.

Some investors prefer to trade digital currency pairs. It sometimes saves them trading fees. If an exchange has a limited cryptocurrency selection, that impedes investors from saving on fees.

Sign-up Offers

One of the ways exchanges lure in customers is by offering them a sign-up offer. That usually entails funding a customer’s account with a certain amount of money to start trading or a discount on fees for a selected period.

BitOasis is an example of an exchange offering a sign-up. New users get 150 AED after they sign up. It’s a nice gesture, making users feel welcomed. But investors shouldn’t expect a sign-up offer from most exchanges.

Fees

Investors should be cognizant of high trading and deposit fees. Ideally, an exchange shouldn’t charge money to fund a user’s account. If it does, the exchange should provide low fees or not charge for trading.

High fees decrease profits and make losses even worse. It means the investor has less money to trade and the potential to make. It’s very important that investors know all the fees involved in trading, including withdrawals. Otherwise, they could see their profits shrink and then wonder why.

Tools & Features

Beginner traders prefer a simple platform. It needs to have basic tools to complete a trade. But pro traders want advanced tools so that they can use various strategies to optimize their positions.

The best Qatar crypto exchanges offer two platforms: a user-friendly one for beginners and an advanced one for experienced traders. Exchanges such as Coinbase and BitOasis offer both platforms.

Payment methods

The most basic transfer method an exchange should offer is bank wire. The best Bitcoin exchanges will make it convenient for clients to fund their accounts by offering several methods. The number of payment options an exchange offers could also affect withdrawals.

Customer service

Most exchange users, especially new ones, need help regarding the platform every once in a while. Since trading is in real-time, traders want to execute trades immediately. But that might not be possible if they’re stuck and can’t receive help.

That’s one of the reasons it’s vital that exchanges offer prompt support. Ideally, an exchange should have a live chat available 24/7 for traders to interact with someone in real-time. Otherwise, support should promptly answer emails.

How to Use a Qatari Crypto Exchange

Setting up an account with an exchange is simple, but we’ve made the process even easier by demonstrating it in our step-by-step guide.

Step 1: Open an Account

After you have chosen the platform you want to trade through, navigate to its website or app. From there, you should easily find the option to create an account.

You’re going to be asked for some basic personal information like your name, address, and date of birth. You’ll also need to create a username and password and maybe set up two-factor authentication, as well.

Step 2: Upload ID

When you choose a regulated platform, you can be sure it will ask you for your KYC documentation. This means you will need to upload da form of ID, like your passport or drivers license. Along with that, you will need to confirm your address through providing a bank statement or utility bill.

Step 3: Deposit Funds

Different platforms will have a minimum deposit amount to start trading. You will need to add this, or more, to your account to get started buying crypto. Platforms offer a range of payment options, so choose which one will work for you, follow the on-screen steps, and you will have money deposited to your account.

Step 4: Select a Cryptocurrency

Find the search button on your nw crpyto exchange and search for the coin you want. You’ll be able to find it through its name or the ticker symbol.

A good crypto exchange will also have an option to browse the range of coins it offers if you’re not sure which one you want to buy.

Step 5: Buy Crypto

Choose the coin you want to buy, and there will be a simple process to buy the coin. This should then be added to your portfolio immediately and the funds deducted from your cash balance.

Are Crypto Exchanges Legal in Qatar?

Several bitcoin exchanges in Qatar are licensed and regulated. Rain and CoinMena are regulated by the Central Bank of Bahrain. BitOasis received provisional approval from Virtual Asset Regulatory Authority (VARA), a Dubai crypto regulator.

Conclusion

Finding the best Bitcoin exchange in Qatar requires investors to look at several factors. An exchange should offer a large number of cryptocurrencies, offer low fees, be regulated and provide safety and security to clients. The exchange should also offer key features such as a platform convenient for beginners but also advanced enough for professional traders.