Crypto’s popularity has spread across Europe and has found a home in Italy. Many Italian investors have used crypto to diversify their portfolios, and more are joining the market every day. Making a good crypto investment means buying through an exchange that offers great features and low costs.

We searched for the best crypto exchange in Italy to help investors get the most out of their investments.

The Best Crypto Exchanges in Italy for 2025

Searching for the best crypto exchange in Italy resulted in us finding several top picks:

- Crypto.com – Popular Exchange with Convenient App

- Bitstamp – Crypto Exchange Offering Low Fees

- Coinbase – Most Known Exchange Globally

- Binance – Offers Numerous Coins and High Staking Returns

- Kraken – Exchange Offering 24/7 Global Support

- BitPanda – Popular Exchange Offering Crypto Indices

- Coinsmart – One-Stop Crypto Exchange

The Top Bitcoin Exchanges in Italy Reviewed

While searching for the best Italian crypto exchange, we compared features, fees, regulations, support and several other aspects and came up with a shortlist. The Italian crypto exchange that impressed us the most was Crypto.com.

1. Crypto.com – Popular Exchange with Convenient App

One of the top crypto exchanges in Italy is Crypto.com. It offers traders more than 250 cryptocurrencies and has amassed a global following of more than 50 million users. One of the reasons for such a large user base is that Crypto.com offers a convenient platform for beginners and advanced traders. Its app offers the same features available on a desktop, but it’s conveniently designed for a mobile screen.

One of the top crypto exchanges in Italy is Crypto.com. It offers traders more than 250 cryptocurrencies and has amassed a global following of more than 50 million users. One of the reasons for such a large user base is that Crypto.com offers a convenient platform for beginners and advanced traders. Its app offers the same features available on a desktop, but it’s conveniently designed for a mobile screen.

Traders can fund their accounts via bank wires, ACH, debit/credit cards and crypto wallets. Using a card to trade crypto via the app is available for free for the first month. Then, a 2.99% fee is applicable. The platform requires a minimum deposit of 100 USDC. Depositing cryptos is free, but withdrawals vary depending on the coin. Fees applicable to monthly trading of up to $25,000 is 0.4%. The fees decrease with higher trading volume.

One of the great features Crypto.com offers is staking. That enables investors to lock in their coins with this platform to earn interest. Some of the coins enable investors to earn up to 14.5% per annum. Crypto.com offers 10% returns for stablecoins. Another staking option is CRO, the platform’s native coin. Staking CRO enables investors to earn a 4% annual percentage yield (APY).

| Number of Cryptos | Pricing Structure | Bitcoin Fee | Minimum Deposit |

| 250+ | Tier-based | 0.4% | 100 USDC |

Pros

- Low fees

- Offers staking

- User-friendly app

- Zero card deposits for first month

Cons

- Low APY for CRO staking

Cryptoassets are a highly volatile unregulated investment product. Your capital is at risk.

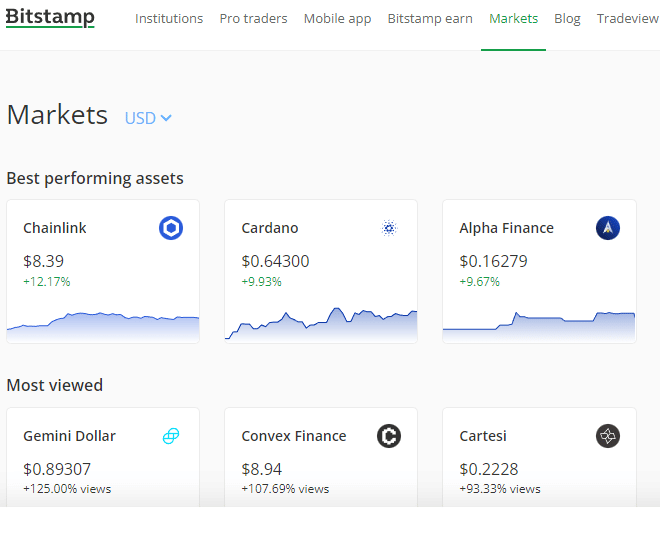

2. Bitstamp – Crypto Exchange Offering Low Fees

To get started, investors can buy crypto via a card purchase, which incurs a 5% fee. Free deposits are available via SEPA and ACH. An international wire incurs a 0.05% fee, with a minimum of €7.5. Wire withdrawal fees are 0.1%, and a SEPA withdrawal is €3. Traders with a 30-day volume of $10,000 or less will pay 0.5% trading fees. The fees fall to 0.25% once traders exceed that limit.

Bitstamp is one of the few Italian Bitcoin exchanges that offer staking. At the moment, Bitstamp offers staking only for Ethereum and Algorand. Investors can earn up to 4.39% APY for Ethereum and 5% APY for Algorand.

It’s nice to see that Bitstamp is serious about having the interest of its clients’ money. That’s the reason it’s regulated by the Luxembourg Financial Regulator, the Commission de Surveillance du Secteur Financier.

| Number of Cryptos | Pricing Structure | Bitcoin Fee | Minimum Deposit |

| 73 | Tier-based | 0.5% | €7.5 |

Pros

- Low minimum deposit

- Reasonable fees

- 24/7 Support

- Free deposit via SEPA

Cons

- High card fees

Cryptoassets are a highly volatile unregulated investment product. Your capital is at risk.

3. Coinbase – Most Known Exchange Globally

Apart from offering crypto trading, Coinbase enables investors to stake crypto and buy non-fungible tokens (NFTs). The platform offers a 0% for a limited time to create and collect NFTs. Investors can stake Bitcoin and other coins to earn up to 5.75% APY.

Italian investors can buy crypto with credit/debit cards and fund their accounts via bank wires, SEPA and Ideal. Cashing out is available through Paypal and Instant Card Cashouts. Apple Pay is available for buying cryptos. An ACH deposit is free, but a SEPA transfer incurs only a €0.15 charge. A USD wire costs $10.

Investors need a minimum deposit of $25 to buy Bitcoin. Coinbase charges the taker 0.6% for trading, and the maker is charged 0.4% up to $10,000. Fees decrease above that 30-day volume. A withdrawal fee through SEPA is only €0.15. Coinbase doesn’t charge traders for having a Coinbase Pro account.

| Number of Cryptos | Pricing Structure | Bitcoin Fee | Minimum Deposit |

| 100+ | Taker/maker based | 0.6% taker, 0.4% maker | $25 |

Pros

- 0% fees for NFTs for limited time

- Offers Coinbase Pro for experts

- Low SEPA deposit fees

- Affordable trading fees

Cons

- Low APY for staking

Cryptoassets are a highly volatile unregulated investment product. Your capital is at risk.

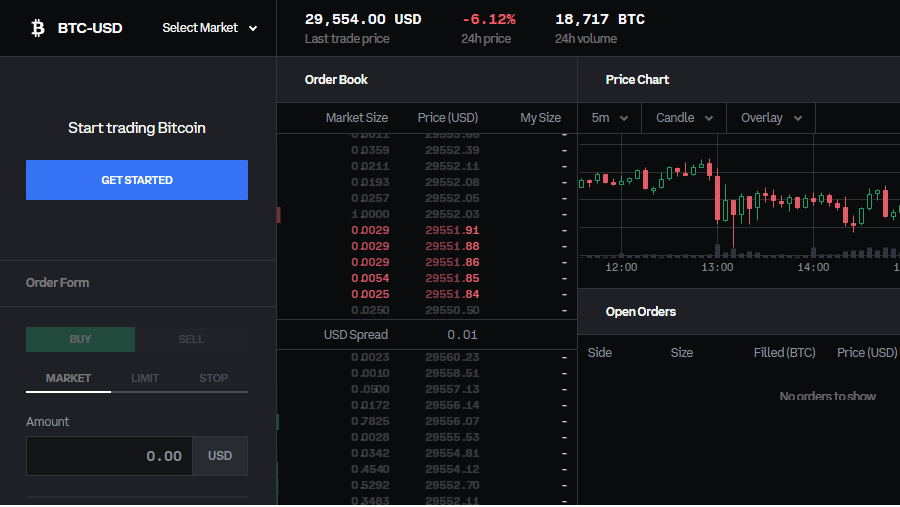

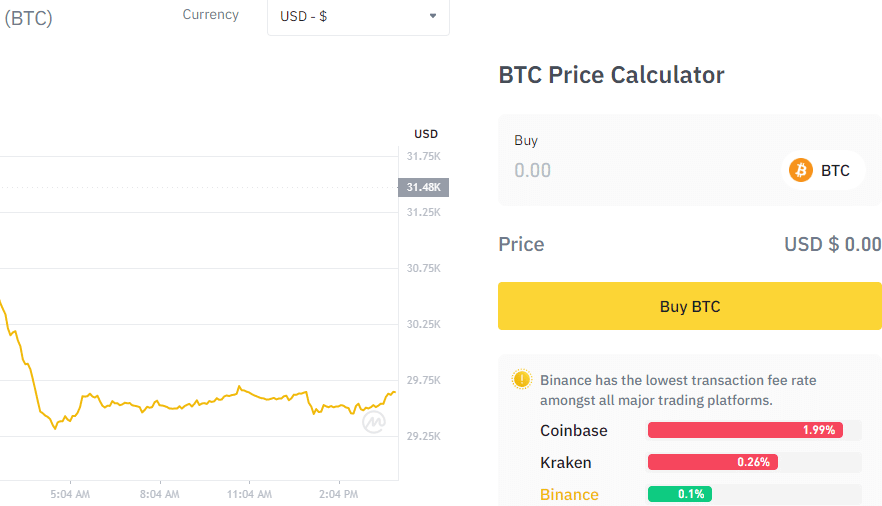

4. Binance – Offers Numerous Coins and High Staking Returns

Funding an account with euros is available via SEPA, P2P Express, Advcash Account Balance and Etana Account Balance. All the methods are for free except SEPA, which incurs a €1 fee. Investors can also fund their accounts via credit cards, which comes with a 1.8% fee. Binance offers one of the lowest trading fees of all the best Italian crypto exchanges—only 0.10%.

Besides offering more than 600 cryptos, Binance also enables investors to earn high interest for staking. Binance offers 112 locked staking coins and 13 DeFi staking coins. The great thing about staking with Binance is that some coins offer more than 100% APY for a 90-day lock-in period. The platform offers lower duration days, but the APY is then also lower.

One of the aspects that Binance has worked on in the last few years is enacting a regulatory framework. The platform is a regulated digital asset service provider in France, and it’s still working on expanding its regulatory reach to other European countries.

| Number of Cryptos | Pricing Structure | Bitcoin Fee | Minimum Deposit |

| 600+ | Fixed | 0.1% | €3 |

Pros

- Large coin offering

- High APY for staking

- Low trading fees

- Low minimum deposit

Cons

- Lacks regulations

Cryptoassets are a highly volatile unregulated investment product. Your capital is at risk.

5. Kraken – Exchange Offering 24/7 Support

Funding an account is available via SEPA, Etana Custody and wire transfer. A minimum deposit of €3 is for SEPA deposits, which are free. Traders can use the instant buy option to purchase cryptos with a card. A transaction fee of 2.75% is applicable. Otherwise, Kraken Pro trading chargers takers 0.26% and makers 0.16% up to $50,000 trading volume.

Besides offering free crypto guides, videos and podcasts as tutorials, Kraken also enables investors to sign up for its up-and-coming NFT marketplace.

| Number of Cryptos | Pricing Structure | Bitcoin Fee | Minimum Deposit |

| 65 | Taker/maker based | 0.26% taker, 0.16% maker | €3 |

Pros

- 24/7 support

- Numerous cryptos available

- Low trading fees

- NFT marketplace coming

Cons

- High card fees

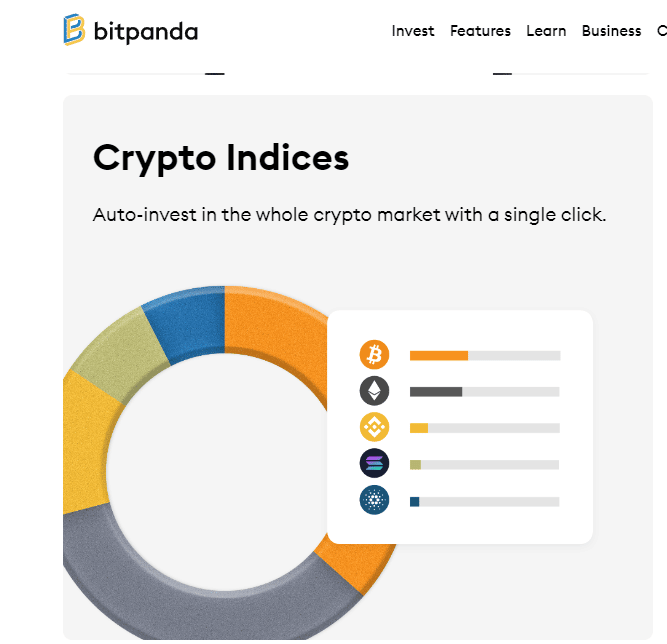

6. BitPanda – Popular Exchange Offering Crypto Indices

The great thing about BitPanda is that it offers several features for investors. Besides enabling investors to earn interest via staking, this platform also allows diversification by trading crypto indices. BitPanda currently offers 3 indices: BitPanda Crypto Index 5, 10 and 25. Other products available are the BitPanda app and card.

Investors wanting to trade on BitPanda will incur a taker’s fee of 0.15% and a maker’s fee of 0.10% on BitPanda Pro. Funding an account requires a minimum of €25. Euro deposits are available through SEPA, Skrill, cards, Neteller and Sofort.

| Number of Cryptos | Pricing Structure | Bitcoin Fee | Minimum Deposit |

| 60+ | Taker/maker based | 0.15% taker, 0.10% maker | €25 |

Pros

Cons

7. Coinsmart – One-Stop Crypto Exchange

Getting started with Coinsmart is easy because the platform offers various deposit options such as SEPA, bank wire, bank drafts and cards. The first three deposit methods are free, but credit cards incur up to 6% fees. A minimum deposit for SEPA is €50, a bank wire of €10,000, a bank draft of €500 and €100 for credit cards.

Coinsmart offers two trading fees: single trade and double trade. A double trade is when investors trade between two cryptocurrencies that are not Bitcoin e.g. ADA/XRP. A single trade costs 0.20% and a double trade is 0.30%.

This platform offers 24/7 support and is regulated by the Ontario Securities Commission, Canadian Securities Administrators and the Investment Industry Regulatory Organization of Canada.

| Number of Cryptos | Pricing Structure | Bitcoin Fee | Minimum Deposit |

| 15+ | Single/double trade | 0.20% single, 0.30% double trade | €50 |

The easiest way to determine the best crypto exchange in Italy is by comparing the exchanges in a table to see how they fare against each other. Investors need to analyze several features when determining the best crypto exchange in Italy. We’ve listed the most important ones. Much like the exchanges in other markets, cryptocurrency exchanges need to be regulated. Investors need to feel that a financial board is regulating exchanges and is looking out for their best interests. The cryptocurrency market consists of several thousand coins. It’s unrealistic to expect an exchange to list all of them, but having a broad selection enables investors to buy the desired coin easily. The best Italian crypto exchanges also offer a wide range of digital asset pairings, enabling investors to save on trading fees. Some of the best Italian crypto exchanges offer rewards or a deposit balance to entice customers to join. Although sign-up offers are a nice gesture, investors shouldn’t expect that to be the norm. One of the most important factors investors need to consider is the fees. High fees mean a larger loss position and decreased profits. Exchanges generate most of their revenue from fees, but they shouldn’t be so excessive that it hampers an investor’s returns. Beginner traders prefer a simple platform, but expert traders require advanced tools to optimize their trading strategies. That’s the reason a platform such as Coinbase offers a standard platform and Coinbase Pro. The more payment options an exchange offers, the easier it is for investors to begin trading. The most common methods an exchange should offer are cards, bank wire and Paypal. Investors execute trades instantaneously, so they might need a prompt response from support when they get stuck. Some exchanges such as Kraken and CoinSmart offer 24/7 global support. Yes, crypto exchanges are legal in Italy. Under Italian law, cryptocurrencies and foreign currencies are treated similarly. The use, storage and exchange of cryptocurrencies are not prohibited on the best Italian crypto exchanges. Italian courts disagree that cryptocurrencies should be treated as not being a legal tender. The other disagreement the courts have are over regulations. Despite court disagreements, the Italian Supreme Court views cryptocurrencies as financial instruments. Although cryptocurrencies are decentralized, the Italian government has stepped in and provided guidance about how to tax cryptocurrencies. The government has established a few key regulations: We scoured the market and found the best crypto exchanges in Italy. The exchange needed to offer several payment options, low fees and be regulated by several bodies. Crypto.com offers all of those features and more. That’s the reason it’s the best Bitcoin exchange in Italy. The platform enables investors to diversify their crypto holdings via its easy-to-use interface.

Pros

Cons

The Best Italy Crypto Exchanges Compared

Number of Cryptos

Pricing Structure

Bitcoin Buying Fee

Minimum Deposit

Payment Methods

Crypto.com

250+

Tier based

0.4%

100 USDC

Cards, bank wires and ACH

BitStamp

73

Tier based

0.5%

€7.5

SEPA, ACH and bank wire

Coinbase

100+

Taker/maker based

0.6% taker, 0.4% maker

$25

Cards, bank wires, SEPA and Ideal

Binance

600+

Fixed

0.1%

€3

SEPA, P2P Express, Advcash Account Balance, Etana Account Balance

Kraken

65

Taker/maker based

0.26% taker, 0.16% maker

€3

SEPA, Etany and wire transfer

BitPanda

60+

Taker/maker based

0.15% taker, 0.10% maker

€25

Cards, SEPA, Skrill, Neteller, Sofort

CoinSmart

15+

Single/double trade

0.20% single, 0.30% double

€50

Cards, SEPA, bank wire and bank drafts

How to Choose the Best Italy Cryptocurrency Exchange

Regulation

Tradable Cryptos

Sign-up offers

Fees

Tools & Features

Payment Methods

Customer service

Are Crypto Exchanges Legal in Italy?

Crypto Tax in Italy

Conclusion

Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.