One of the countries in Europe where Bitcoin’s popularity has grown is Greece. Buying cryptocurrency in Greece requires investors to find the best cryptocurrency exchanges, which is time-consuming and an incorrect decision could be costly.

We analyzed the market and found the best crypto exchanges in Greece. So we delved deeper into each of their offerings and reviewed their fees, regulations, security and features. Let’s take a closer look at what the top crypto exchanges in Greece have to offer. And we’ll include everything an investor needs to know about buying Bitcoin.

The Best Crypto Exchanges in Greece for 2025

After analyzing the market, we found eight of the best crypto exchanges in Greece.

- Crypto.com – Popular Exchange Offering User-Friendly Platform

- Bitstamp – Crypto Exchange with Low Fees

- Coinbase – Globally Popular Exchange

- Binance – High-Volume Bitcoin Exchange

- BitPanda – Bitcoin Exchange Offering Indices

- GreekCoin – Exchange Tailored for Greek Investors

- Coinsmart – One-Stop Crypto Exchange

The Top Bitcoin Exchanges in Greece Reviewed

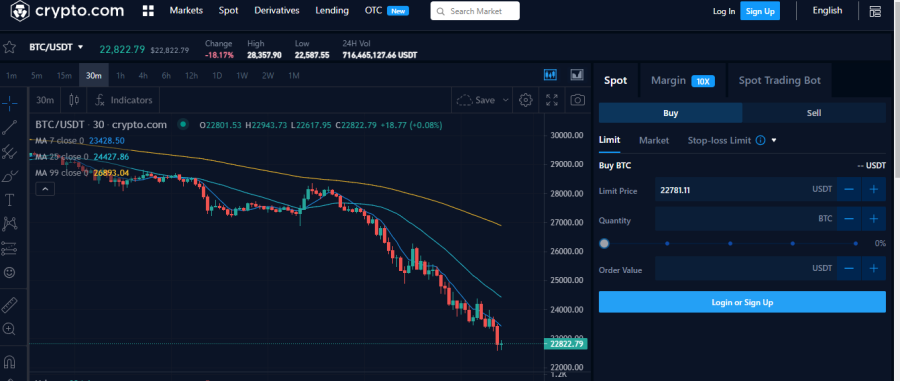

1. Crypto.com – Popular Exchange Offering User-Friendly Platform

Another platform we found to be one of the best crypto exchanges in Greece is Crypto.com. This exchange is home to 50 million global users who trade more than 250 cryptocurrencies offered. Its large client base is because it offers a platform suitable for beginner and advanced traders. Mobile traders will find Crypto.com’s app extremely useful. It’s designed to be convenient for mobile screens, and it’s available on iOS and Android.

Another platform we found to be one of the best crypto exchanges in Greece is Crypto.com. This exchange is home to 50 million global users who trade more than 250 cryptocurrencies offered. Its large client base is because it offers a platform suitable for beginner and advanced traders. Mobile traders will find Crypto.com’s app extremely useful. It’s designed to be convenient for mobile screens, and it’s available on iOS and Android.

Getting started on this exchange entails a minimum deposit of 100 USDC. Investors can transfer funds via debit/credit cards, bank wires and ACH. Investors can also deposit cryptos, which is free. But withdrawing them is charged, and the fee is determined based on each coin. Buying cryptos with a card is acceptable but charged at 2.99%. Crypto.com charges 0.4% for trading up to $25,000 monthly. Trading fees decrease beyond that volume.

Investors who think trading is risky can opt for earning interest on this platform by locking in their coins. Crypto.com offers staking coins, enabling investors to earn up to 14.5% per annum on certain coins for keeping them locked on the exchange. Another coin available for staking is CRO, Crypto.com’s native token. But it yields only a 4% annual return.

| Number of Cryptos | 250+ |

| Pricing Structure | Tier based |

| Bitcoin Fee | 0.4% |

| Minimum Deposit | 100 USDC |

Pros Cons

Cryptoassets are a highly volatile unregulated investment product. Your capital is at risk.

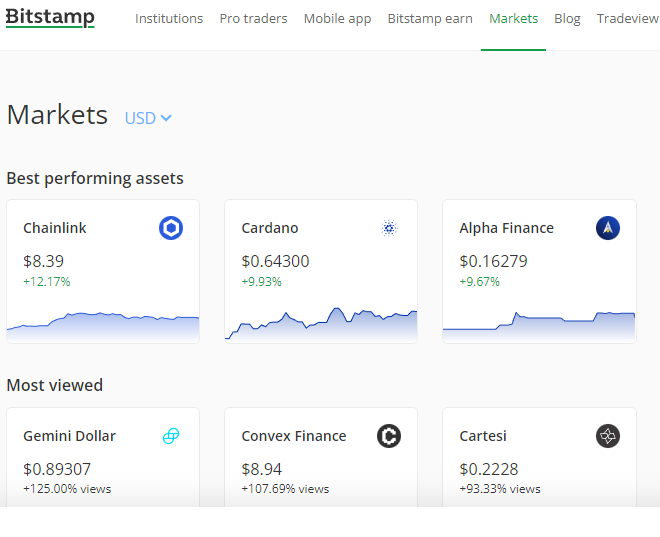

2. Bitstamp – Crypto Exchange with Low Fees

Investors wanting to open an account on Bitstamp can simply do that and transfer funds for free via SEPA and ACH. International wire funding is also possible, but it incurs a 0.05% fee and requires a minimum of €7.5. Withdrawing money via wire incurs a 0.1% fee and SEPA withdrawals are charged €3. Trading fees are 0.5% for a monthly volume up to $10,000. Then the fees fall to 0.25% if that limit is exceeded.

One of the aspects of the best Greece crypto exchanges that’s important is regulation. So we were happy to see that Bitstamp takes it seriously since it’s regulated by the Luxembourg Financial Regulator, the Commission de Surveillance du Secteur Financier.

This platform also offers staking. But investors can choose between only two coins: Ethereum and Algorand. Investors staking Ethereum can earn a 4.39% annual return, and Algorand enables investors to earn 5% annually.

| Number of Cryptos | 73 |

| Pricing Structure | Tier based |

| Bitcoin Fee | 0.5% |

| Minimum Deposit | €7.5 |

Pros Cons

Cryptoassets are a highly volatile unregulated investment product. Your capital is at risk.

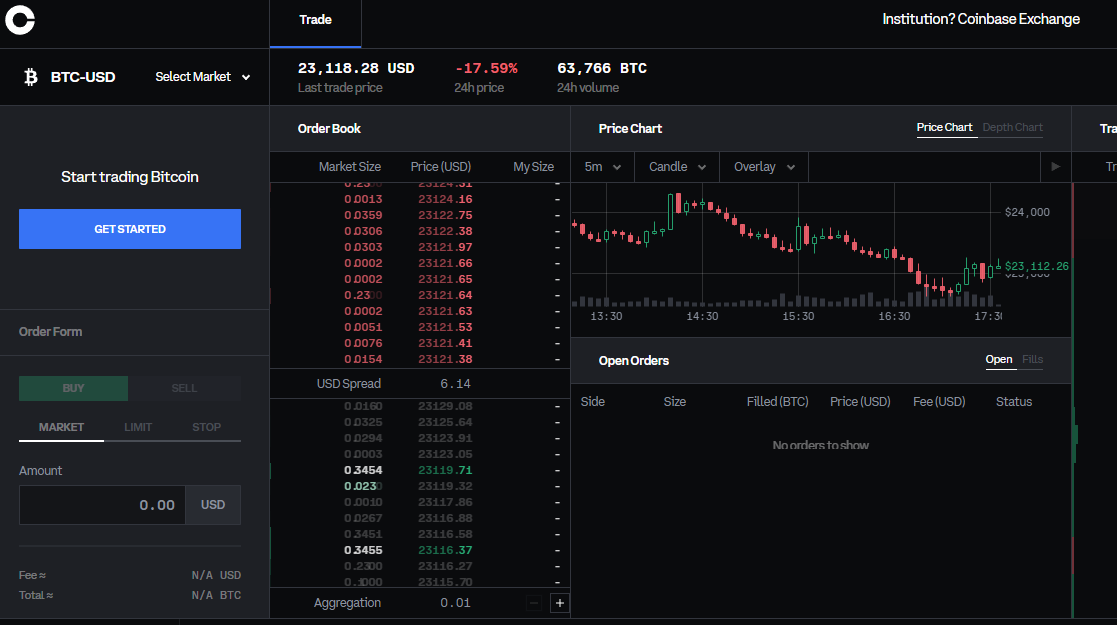

3. Coinbase – Globally Popular Exchange

Two great features offered on Coinbase are staking coins and non-fungible tokens (NFTs). Investors wanting to buy NFTs on Coinbase won’t incur any transaction fees for a limited period. Staking coins on this platform can earn investors up to 5.75%.

Funding a Coinbase account comes with a $25 minimum deposit. The available deposit options include bank wires, SEPA and Ideal. Depositing via ACH is free, but a SEPA transfer is charged at €0.15. Doing a USD wire transfer costs $10. Withdrawing funds is possible via PayPal and Instant Card Cashouts. Investors withdrawing via SEPA will incur a €0.15 fee.

Buying cryptos is available with Apple Pay and debit/credit cards on Coinbase. Trading fees are split between takers and makers. Takers are charged 0.6%, and makers pay transaction fees of 0.4%. Once the monthly trading volume exceeds $10,000, the fees decrease.

| Number of Cryptos | 100 |

| Pricing Structure | Taker/maker based |

| Bitcoin Fee | 0.6% taker, 0.4% maker |

| Minimum Deposit | $25 |

Pros

Cons

Cryptoassets are a highly volatile unregulated investment product. Your capital is at risk.

4. Binance – High-Volume Bitcoin Exchange

Trading with Binance is convenient because the platform enables euro funding via SEPA, P2P Express, Etana and AdvCash. SEPA deposits incur a €1 fee, but the other methods are free. Investors wishing to fund their accounts with cards can do so, but it comes with a 1.8% fee. The thing that makes Binance one of the best Bitcoin exchanges in Greece is the fees. This platform charges only 0.1% for trading, making it one of the cheapest exchanges.

Investing with a regulated exchange is important, and Binance has taken steps to be regulated. It’s recognized by the French government as a regulated digital asset service provider. But that’s in France, so Binance really needs to look into being regulated in Greece.

| Number of Cryptos | 600+ |

| Pricing Structure | Fixed |

| Bitcoin Fee | 0.1% |

| Minimum Deposit | €3 |

Pros Cons

Cryptoassets are a highly volatile unregulated investment product. Your capital is at risk.

5. BitPanda – Bitcoin Exchange Offering Indices

It’s easy to open an account with BitPanda, and investors can fund accounts via SEPA, debit/credit cards, Neteller, Skrill and Sofort. The minimum investors can fund their accounts is €25.

After funding accounts, investors can trade more than 60 cryptocurrencies. The one thing that separates this exchange from so many of the best Bitcoin exchanges in Greece is that it offers crypto indices. Instead of buying individual coins, investors can trade a crypto index. BitPanda offers three indices: BitPanda Crypto Index 5, 10 and 25.

Another aspect that makes BitPanda one of the best cryptocurrency exchanges is that it’s regulated. We were glad to see that BitPanda is regulated by MiFID II and PSD2, a payment institution. This platform is also compliant with AML5. That means it offers secure storage offline. Combining all of these aspects of BitPanda, it’s easy to see why it’s one of the best Greek crypto exchanges.

| Number of Cryptos | 60+ |

| Pricing Structure | Taker/maker based |

| Bitcoin Fee | 0.15% taker, 0.10% maker |

| Minimum Deposit | €25 |

Pros:

- Low fees on BitPanda Pro

- Various funding options

- Crypto Index fund options

- Regulated

Cons:

- Standard platform offers high fees

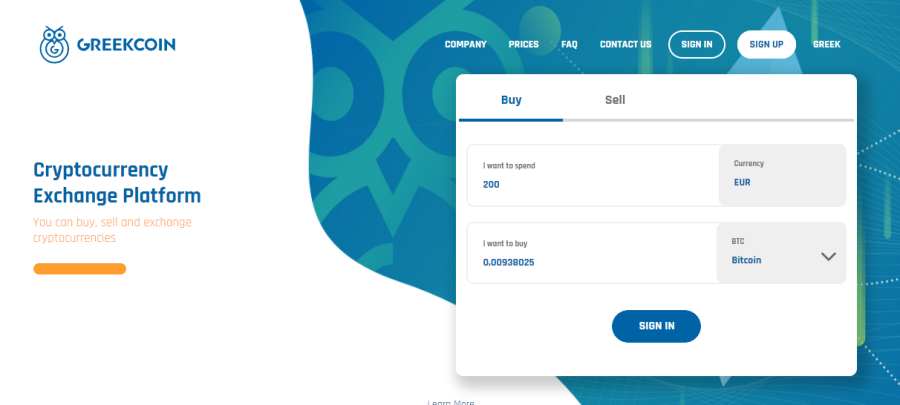

6. GreekCoin – Exchange Tailored for Greek Investors

This platform is specifically for Greek investors as it offers support in Greek and payments in euros. Investors can opt for funding their accounts only with a bank wire, but GreekCoin will add more methods in the future. The deposit fees vary according to the coin deposited. As an example, Bitcoin deposits are charged 0.0003 BTC. Trading any coin costs 2.45%, and withdrawals also incur a fee, depending on the coin. A Bitcoin withdrawal is 0.0005 BTC, making this platform expensive to trade.

The great thing about GreekCoin is that it’s licensed and regulated. GreekCoin has received a license from the European Union, the Republic of Estonia and the Estonian Financial Intelligence Unit.

| Number of Cryptos | 13 |

| Pricing Structure | Varies per coin |

| Bitcoin Fee | 2.45% |

| Minimum Deposit | Not stated |

Pros:

- Perfect for beginners

- Free tutorials

- Offers 13 cryptocurrencies

- EU regulated

Cons:

- High trading fees

7. Coinsmart – One-Stop Crypto Exchange

Greek investors who have any queries can contact support 24/7. The live chat feature is great, and a consultant is always on standby to answer questions. Mobile traders can use the Coinsmart app on iOS and Android. It’s simple to use and contains all the features found on a desktop.

Depositing funds on Coinsmart is available via SEPA, bank wire, bank draft and cards. The only deposit method to incur charges is cards—6% fees. The minimum amount investors need to deposit via SEPA is €50 and card deposits have a minimum of €100.

The trading fees are split between single and double. A single trade incurs a 0.20% fee, and a double trade is 0.30%. Trading pairs that don’t incur Bitcoin is considered a double trade. An example would be ETH/XRP.

We like that Coinsmart is regulated by the Ontario Securities Commission, Canadian Securities Administrators and the Investment Industry Regulatory Organization of Canada.

| Number of Cryptos | 15+ |

| Pricing Structure | Single/double trade |

| Bitcoin Fee | 0.20% single, 0.30% double trade |

| Minimum Deposit | €50 |

Pros Cons

The Best Greece Crypto Exchanges Compared

We wanted to compare the best crypto exchanges in Greece to see how they fare against each other.

| Crypto Exchanges | Number of Cryptos | Pricing Structure | Bitcoin Buying Fee | Minimum Deposit | Payment Methods |

| Crypto.com | 250+ | Tier based | 0.4% | 100 USDC | Cards, bank wires and ACH |

| Bitstamp | 73 | Tier based | 0.5% | €7.5 | SEPA, ACH and bank wire |

| Coinbase | 100+ | Taker/maker based | 0.6% taker, 0.4% maker | $25 | Cards, bank wires, SEPA and Ideal |

| Binance | 600+ | Fixed | 0.1% | €3 | SEPA, P2P Express, Advcash Account Balance, Etana Account Balance |

| BitPanda | 60+ | Taker/maker based | 0.15% taker, 0.10% maker | €25 | Cards, SEPA, Skrill, Neteller, Sofort |

| GreekCoin | 13 | Fixed | 2.45% | Not stated | Bank wire |

| CoinSmart | 15+ | Single/double trade | 0.20% single, 0.30% double | €50 | Cards, SEPA, bank wire and bank drafts |

How to Choose the Best Greece Cryptocurrency Exchange

When choosing the best Bitcoin exchange in Greece, it’s vital that investors examine a few factors. Doing their due diligence will ensure they invest by minimizing their risk.

Regulation

Choosing the best Greek crypto exchange means investing in one that is regulated. It’s important that crypto exchanges are regulated by financial bodies that expect them to act ethically. A financial regulator such as CySEC ensures that exchanges cannot do whatever they please with investor funds without being penalized.

Financial regulations dissuade exchanges from acting unethically because the consequences are harsh. Regulated exchanges are considered safer than unregulated ones because they abide by a specific code of conduct.

Tradeable Cryptos

Investors interested in purchasing coins other than Bitcoin prefer exchanges with a large altcoin selection. The more coins an exchange offers, the likelier altcoin investors are to find their preference and invest. Also, exchanges should offer various crypto pairs. Many traders prefer to trade crypto pairs since some offer low fees.

Sign-up Offers

To lure in new investors, some exchanges offer sign-up bonuses. The rewards offered can be lower fees for a limited time or a funded account to start trading. Those types of offers usually tend to entice investors to sign up and are common among exchanges trying to compete with the best crypto exchanges in Greece.

Beginner investors should note that sign-up offers aren’t available on all exchanges. It’s a nice gift, but it’s uncommon.

Fees

Besides regulations, investors need to know all the fees exchanges charge. Some charge for deposits and most have withdrawal charges. Investors can be charged for inactivity. Some exchanges even charge a convenience fee. Investors need to know all the fees involved in dealing with an exchange so they don’t get a surprise when withdrawing funds.

Exchanges offering high trading fees should be avoided. High fees are detrimental when investors incur losses, and they can significantly reduce profits.

Tools & Features

To be considered one of the best Greek crypto exchanges, a platform must cater to beginner and advanced traders. It’s essential that beginners can use the platform without needing assistance. However, a platform should never lack features that advanced traders need to optimize their strategies.

That’s the reason exchanges such as Coinbase and BitPanda offer a standard platform and a pro version. BitPanda Pro offers lower fees for high-volume traders.

Payment Methods

Exchanges that offer numerous payment methods allow investors to fund their accounts conveniently. The more payment options an exchange offers, the easier they make investing for users. The most common options an exchange should offer are bank wires, debit/credit cards and ACH.

Customer Service

While trading, some investors get stuck and need help immediately. Although most exchanges don’t offer a phone service, some provide 24/7 support via chat or email. Being one of the best Greek crypto exchanges means replying promptly to queries so that investors can continue trading asap.

How to Use a Greek Crypto Exchange

To make investing with a Greek crypto platform simple, we provided a step-by-step guide – note that the steps may be a little different depending on your choice of platform.

Step 1: Register with Exchange

Visit your chosen crypto exchange’s website or mobile app. Look for the button that will allow you to create an account. Complete the details you’re asked for by the platform.

Step 2: Verify Account

A regulated exchange will need to verify each user. A good platform will require investors to verify emails and phone numbers. Investors will also need to upload a government-issued ID or passport, as well as a utility bill.

Step 3: Deposit Funds

To start trading, investors need to deposit funds via the numerous payment options offered by the exchange you have chosen. Investors can fund accounts by inputting the amount to deposit, and completing the steps presented on the site.

Step 4: Search for Crypto

Once you have money on your exchange, you can locate the search bar and input either the coin name, e.g. Bitcoin, or code, e.g. BTC. You should see a range of historical data presented to you.

Step 5: Buy Crypto

Follow the exchange’s steps to make the purchase of the coin you want to buy.

Are Crypto Exchanges Legal in Greece?

Trading and holding Bitcoin and other cryptocurrencies in Greece is legal. The Greek government hasn’t enacted any specific regulations regarding the general crypto market. Some of the exchanges in our review possess licenses from European authorities to trade.

A regulatory framework doesn’t exist yet, but they seem to be on the way. Until then, Greek investors can legally trade cryptos.

Crypto Tax in Greece

The Greek government has made provisions for cryptocurrency taxes. Traders are taxed at 15% on capital gains arising from cryptocurrency transactions. However, the crypto gains tax applies only if the profits enter the banking system. So the gains have to be realized in Euros and stored in a bank account to qualify for taxation.

Conclusion

Our review analyzed the best Greek crypto exchanges, and we compared their offerings in a table. We looked at each exchange’s security, fees, regulations and features. To make investing simpler, we also provided key aspects investors must analyze before they buy Bitcoin on a platform.