If you’re a German investor and want to get serious in the crypto market, you’ll need to make sure that you’re using the best crypto exchange in Germany.

We’ve carefully analysed the ins and outs of the top German exchanges to bring you clear, concise, and helpful recommendations. To ensure our reviews are as useful as possible, we’ve looked at a multitude of factors including fees, supported coins, regulations, and trading tools.

The Best Crypto Exchanges in Germany for 2025

So without further ado, let’s take a look at the best crypto exchanges in Germany.

- Crypto.com – Best Bitcoin Exchange in Germany for Staking

- Bitstamp – Longest-Running Crypto Exchange

- Coinbase – Beginner Crypto Exchange in Germany

- Binance – Global Crypto Exchange with Huge User Base

- Bitcoin.de – Best German-Based Exchange

- Pionex – Best Crypto Exchange for Automated Trading

- Coinsmart – Educational Crypto Exchange

The Top Bitcoin Exchanges in Germany Reviewed

In order to select the best crypto exchange in Germany, it’s important to consider what you need out of your broker. There are a ton of German Bitcoin exchanges so it can be difficult to select one that matches your needs.

So, to ensure our readers have access to the best Germany crypto exchanges we’ve carefully analysed some of the top crypto exchanges in Germany to bring you a comprehensive list of the least costly, most feature-rich platforms out there.

1. Crypto.com – Best Bitcoin Exchange in Germany for Staking

The Crypto.com mobile app is a great choice for beginners as it makes buying crypto incredibly intuitive. However, its ease of use isn’t all that Crypto.com has to offer, the platform’s main draw is its staking features.

When it comes to earning interest on your assets, Crypto.com is the best Bitcoin exchange in Germany. It offers up 14.5% returns on cryptos and 10% for stablecoins. If you actively trade, then the Crypto.com exchange has everything you need, a ton of order types, analytic tools, and heaps of assets make Crypto.com a great choice for technical traders.

If you’re looking for a German crypto exchange that does it all, Crypto.com is one of the best. It’s got everything you could possibly need in order to have a successful investing experience and with some of the lowest fees in the industry, it’s the perfect choice for anyone looking to save a little cash.

Pros Cons

| Number of Cryptos | 250+ |

| Trading Fee | Up to 0.4% |

| Debit/Credit Card Fee | 2.99% |

| Minimum Deposit | $1 |

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

2. Bitstamp – Longest-Running Crypto Exchange

Considering that it’s been operating for over 10 years, it’s no surprise that Bitstamp has its fair share of intriguing features. With some of the lowest trading fees on the market, Bitstamp can actually be cheaper to use than some larger competitors.

While the standard platform does leave a bit to be desired, the more advanced Tradeview platform (similar to the Crypto.com Exchange or Coinbase Pro) has everything you’d expect from one of the longest-standing exchanges. However, there is a blemish in BitStamp’s track record, it was hacked in 2015, resulting in almost 19,000 BTC being stolen.

Is Bitstamp the very best crypto exchange in Germany? Perhaps not but it is a solid option that comes with a ton of useful features. Ultimately, the best Bitcoin exchange in Germany is a matter of preference, but if you’re looking for a platform that’s already withstood the test of time, then you can’t go far wrong with Bitstamp.

Pros Cons

| Number of Cryptos | 73 |

| Trading Fee | 0.5% |

| Debit/Credit Card Fee | 5% |

| Minimum Deposit | $20 |

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

3. Coinbase – Beginner Crypto Exchange in Germany

Coinbase operates two different platforms, ‘Coinbase’ & ‘Coinbase Pro’. As the name suggests, the latter is aimed at those with previous investment experience as it’s more feature-rich than the regular Coinbase platform. Coinbase Pro also offers a more attractive fee structure, making it the more cost-effective choice.

Coinbase takes its security seriously. It holds around 98% of client assets in cold storage to ensure they’re not accessible even if an attacker was able to breach the Coinbase servers. On top of this, using the Coinbase DeFi wallet, you have full control over your keys just like you would when using a traditional decentralised wallet.

If you’re new to the crypto space and want an easy-to-use platform, Coinbase is certainly one of the best cryptocurrency exchanges. It’s regulated, available almost everywhere, and very customer-focused, making it a great choice for investors that need an extra hand getting started.

Pros Cons

| Fees | Coinbase | Coinbase Pro |

| Number of Cryptos | 150+ | 150+ |

| Trading Fee | 1.49% | 0.04% to 0.50% taker fee and a 0% to 0.50% maker free |

| Debit/Credit Card Fee | 3.99% | 0% |

| Minimum Deposit | $50 | $50 |

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

4. Binance – Global Crypto Exchange with Huge User Base

With more than 100 million clients worldwide, Binance is a titan of the industry and definitely pushes its weight around in order to outcompete other exchanges. The Binance ecosystem isn’t composed solely of an exchange but also an NFT marketplace and the decentralised Trust wallet. Because the exchange and NFT marketplace are both directly a part of the Binance ecosystem, users only need a single account to access both.

Although Binance isn’t the most transparent when it comes to its security, it has committed a lot of resources to ensure clients are safe. All sensitive information is encrypted, the majority of client funds are held offline, and a risk management system monitors things like withdrawals and password resets in order to prevent customer accounts from getting compromised.

Without a doubt, Binance is one of the best Germany crypto exchanges. The exchange is phenomenal, it’s got tons of customizability and a low spread making it a great option for traders.

Pros Cons

| Number of Cryptos | 600+ |

| Trading Fee | 0.1% |

| Debit/Credit Card Fee | Depends on Payment Processor |

| Minimum Deposit | Variable based on deposit type |

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

5. Bitcoin.de – Best German-based Exchange

Bitcoin.de is a German Bitcoin exchange and allegedly the largest Bitcoin marketplace in Europe boasting more than 1 million customers. What differentiates Bitcoin.de from other exchanges is rather than buying from the exchange, you instead buy directly from a 3rd party seller, similar to Paxful.

There are plenty of advantages to using an exchange based in your home country, oftentimes deposits can be quicker and less costly. However, Bitcoin.de only supports deposits using wire transfer so you can expect to wait a day or two for your funds to be credited to your account.

Trading fees are limited to spreads, so while it’s definitely more difficult to know how much you’re paying in fees, it is also possible to get a better than usual deal.

Bitcoin.de isn’t the best Germany Bitcoin exchange on our list, however, it’s sure to be useful for German investors that aren’t a fan of traditional exchanges. While there’s no real-time trading, the peer-to-peer-esque system is sure to be of interest to believers of the decentralised crypto-ethos.

Pros Cons

| Number of Cryptos | 8 |

| Trading Fee | 0.5% + Variable Spread fee |

| Wire Transfer | 0% |

| Minimum Purchase | 0.001 BTC |

6. Pionex – Best Crypto Exchange for Automated Trading

The main feature that differentiates Pionex from other leading German Bitcoin exchanges is its focus on trading robots. The platform has 16 in-built trading robots that are completely free to use. It utilises the Binance liquidity engine so there’s more than enough liquidity in the order books.

Another positive for Pionex is its incredibly low fees. At just 0.05% for both maker and taker, Pioxex boasts some of the lowest fees on the market. However, as the in-built trading bots execute orders far more frequently than manual traders, there are more transactions for them to take a percentage of.

Although Pionex does support manual trading, the bots are where exchange really excels. Therefore, we can only recommend Pionex to users that are interested in trading bots as everyone else would be better served on a platform like Binance.

Pros Cons

| Number of Cryptos | 343+ |

| Trading Fee | 0.05% |

| Debit/Credit Card Fee | 3.50% – 4.5% |

| Minimum Deposit | $0 |

7. CoinSmart – Educational Crypto Exchange

CoinSmart’s main selling point is its educational platform, the GetSmart Hub. It comes equipped with heaps of information about cryptocurrency and investing in general. The content is a mixture of articles, news, and ‘how to’ guides, so there’s plenty of information to work through.

Outside of education, CoinSmart is a well-designed platform that has 16 tradable assets. It’s worth noting that there isn’t much in the way of technical indicators, so if that’s your preferred method of trading it’s advisable to use a different broker.

For beginners looking for an alternative to Coinbase, CoinSmart is an excellent choice. It makes trading a bit more engaging and easy to understand than most other brokers so it’s a great place to start your journey.

Pros Cons

| Number of Cryptos | 16 |

| Trading Fee | 0.2% |

| Debit/Credit Card Fee | Up to 6% |

| Minimum Deposit | $100 |

The Best Germany Crypto Exchanges Compared

We appreciate that it can be difficult to visualise how each platform compares to one another so we’ve included this easy-reference guide.

| Crypto Exchange | Number of Cryptos | Trading Fee | Debit/Credit Card Fee | Minimum Deposit |

| Crypto.com | 250+ | Up to 0.4% | 2.99% | $1 |

| Bitstamp | 73 | 0.5% | 5% | $20 |

| Coinbase | 150+ | 0.04% to 0.50% taker fee and a 0% to 0.50% maker free | 0% | $50 |

| Binance | 600+ | 0.1% | Depends on Payment Processor | Variable based on deposit type |

| Bitcoin.de | 8 | 0.5% + Variable Spread fee | 0% | $0 (0.001 BTC minimum purchase) |

| Pionex | 343+ | 0.05% | 3.50% – 4.5% | $0 |

| Coinsmart | 16 | 0.2% | Up to 6% | $100 |

How to Choose the Best Germany Cryptocurrency Exchange for You

When it comes to selecting the best crypto exchange in Germany, there’s a lot of factors to consider. To make this easier, we’ve included a few things to look out for when deciding which broker is right for you.

Regulation

Ensuring your platform of choice is regulated is crucial. A regulated platform has to answer to an authoritative body like the SEC, meaning they can get away with far less unscrupulous activities than unregulated exchanges. Some of the main authoritative bodies to look for are the SEC, the FCA, BaFin, and CySEC.

Tradable Cryptos

If you plan on diversifying your portfolio or trading a variety of assets, it’s important to look at the range of cryptos offered by a platform before registering. Although you only technically need the asset you want to buy, it’s always nice to have options.

Sign Up Offers

In order to draw in new users, lots of exchanges and brokers have rather lucrative sign-up offers. For the most part, they’ll be something akin to a tiny bit of free crypto but some offers can certainly be worthwhile.

Fees

Fees are the bane of any investor’s existence. Some platforms charge egregious fees so you should always double-check deposit/withdrawal and trading fees before registering with a broker.

Tools & Features

Every exchange has its own special features, Binance & Coinbase have NFT marketplaces, and Pionex has trading robots. It’s worth checking what an exchange offers because there will always be something that piques your interest.

Payment Methods

Having a few different payment options might not seem like a big deal but it’s so much more convenient than getting stuck with one. It’s worth double-checking to make sure your platform of choice offers wire/bank deposits as they tend to incur the least fees.

Customer Service

At the core of any business is customer service. You should watch out for exchanges that don’t offer 24/7 live chat or offer no easy way to contact customer service.

How to Use a German Crypto Exchange

We understand that getting used to a new platform can be time-consuming. So to help our readers get started on the right foot, we’ve included this comprehensive guide covering how to use the best Germany crypto exchange

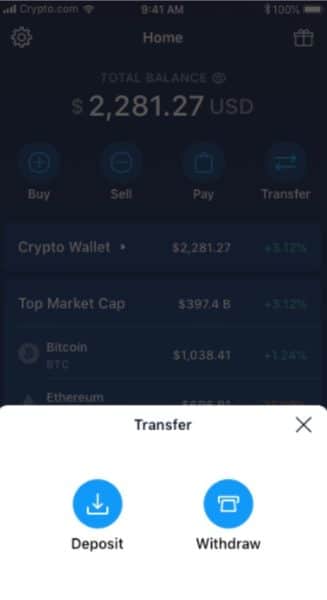

Step 1: Download the Crypto.com App

Before you can buy any Crypto, you’ll first need to register for an account with Crypto.com. Visit the site and download the Crypto.com mobile app.

Step 2: Create an Account

Create an account by using your email address and then verify it after you receive a Crypto.com email.

Step 3: Deposit Funds

Select the dashboard and find “Deposit” under the “Transfer” tab. Choose your currency and the amount.

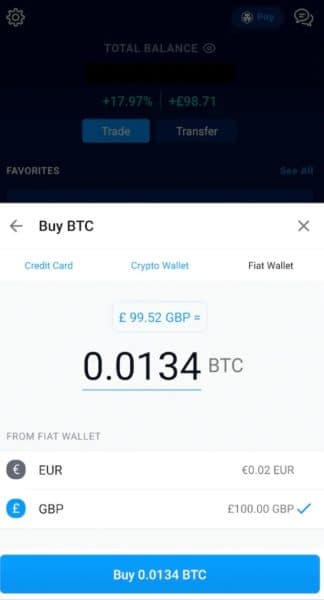

Step 4: Buy Crypto

Search for the cryptocurrency you want in the search tab. Select the coin you want to buy and select the “Buy” option. Enter the number of coins you wish to buy.

Are Crypto Exchanges Legal in Germany?

While crypto is legal in Germany, the finer points of the law can be difficult to understand. Thankfully, German crypto regulations are fairly concise so once you understand a few key points, you’ll be ready to invest!

Germany considers crypto-assets as a type of ‘financial service’. However, it’s important to understand that Germany does not consider Bitcoin legal tender. All German citizens and entities are able to purchase/sell/hold crypto-assets as long as they are purchased through a BaFin-licensed (Germany’s regulatory body for crypto) exchange, broker, or Bitcoin ATM.

Exchanges that hold your crypto are considered custodians. Therefore, if an exchange offers a custodial wallet it has to be BaFin-licensed, otherwise, it’ll be in breach of the German Banking Act (Kreditwesengesetz – KWG), which could lead to issues when trying to deposit/withdraw further down the line.

In order to fulfil anti-money laundering (AML) and combatting the financing of terrorism (CFT) obligations, Germany requires all brokers/exchanges to follow enhanced due diligence (EDD) and know your customer (KYC) policies.

Crypto Tax in Germany

Compared to countries like the United Kingdom, Germany’s crypto tax laws are quite tame. For short-term capital gains, your tax rate will be the same as your income tax, up to 45% in addition to the 5.5% solidarity tax. However, if you hold your crypto-assets for over one year, you’re not subject to any tax on your gains.

Conclusion

If you’re new to crypto or simply not up to date with the latest developments, it can be extremely difficult to find the best Germany crypto exchanges. There are a ton of options out there, so you should always consider your personal investment goals before committing to a broker.

However, we’ve analysed the fees, features, and security of countless crypto exchanges with Crypto.com coming out on top across every metric. Therefore, if you’re still unsure which platform is right for you, Crypto.com is always a solid bet.

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.