The safest and most simple way to buy and sell digital assets online in the Czech Republic is via a reputable exchange.

Choosing the right crypto exchange can be time-consuming, considering that investors need to explore factors surrounding fees, safety, payments, supported coins, and more.

With this in mind, today we review the best crypto exchanges in the Czech Republic for 2025.

The Best Crypto Exchanges in the Czech Republic for 2025

Below is a quick-view list of the top crypto exchanges in the Czech Republic for 2025:

- Crypto.com – Secure Crypto Exchange With Savings Accounts

- Bitstamp – Established Crypto Exchange With High Security

- Coinbase – Top Crypto Exchange in the Czech Republic for Beginners

- Binance – Popular Crypto Exchange for Low-Cost Trading

- Bitpanda – Crypto Trading Platform With Multiple Markets and Rewards

- Paxful – Leading P2P Bitcoin Marketplace in the Czech Republic

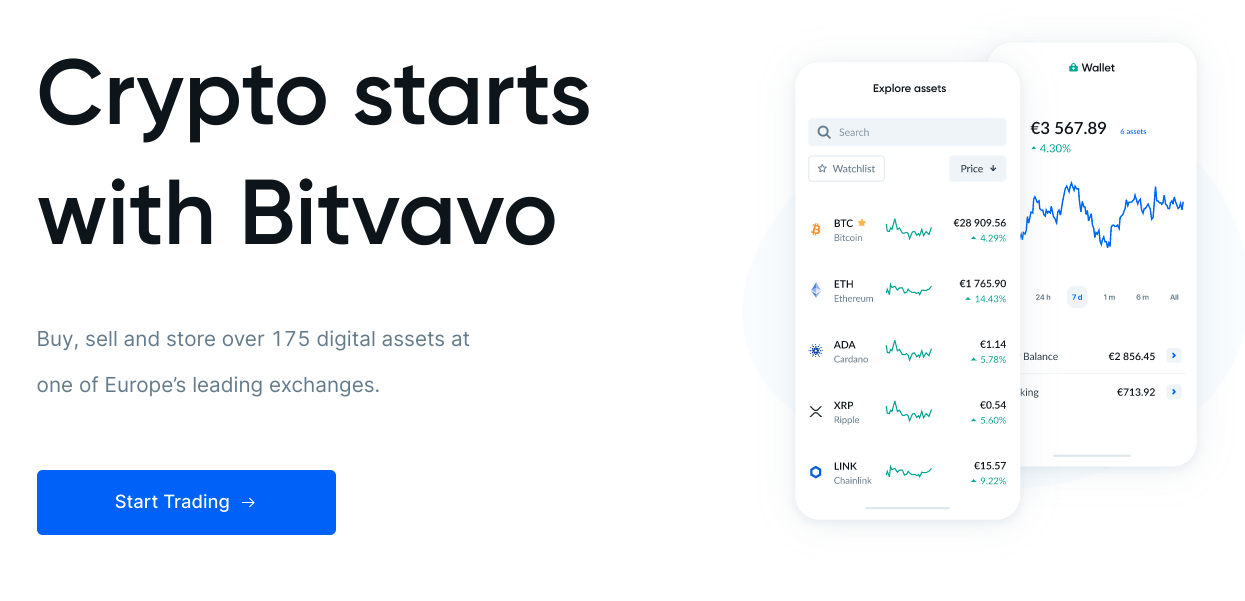

- Bitvavo – Buy Bitcoin and Over 175 Digital Assets With €5 or More

We offer a full review of each crypto exchange listed above in the following sections.

The Top Bitcoin Exchanges in Czech Republic Reviewed

A professional service and secure trading environment should be offered as standard at crypto exchanges in the Czech Republic. It’s also wise to pick an exchange with a skill-appropriate interface.

Some Czech traders might require a beginner-friendly platform with passive investing tools. Others might be looking for sophisticated technical indicators and charting features.

As such, the below reviews should help clear the mist on the most suitable platform. We talk about everything from tools and features to fees, available assets, and supported deposit types.

1. Crypto.com – Secure Crypto Exchange With Savings Accounts

There are more than 250 digital assets to trade at Crypto.com. However, there are only 40+ tokens available at the time of writing for Crypto Earn. Nonetheless, there is a calculator on the platform which enables traders to estimate their interest rewards.

Rewards are determined by the cryptocurrencies held and the length of the term, whether it’s 3 months, 1 month, or flexible. Another way to earn on Crypto.com is by using the soft staking feature. Here, traders can earn just by holding CRO. Users who stake the platform’s native cryptocurrency for 180 days or longer can receive a higher APR.

This differs from standard staking as traders need to hold a minimum of 10,000 CRO tokens for six months or more on the platform. CRO is Crypto.com’s native token. By holding CRO and using the digital currency to pay fees, traders can also receive a rebate of the percentage of what they were charged.

The minimum deposit amount is $20, which is around 470 Kč. There is a fee of 2.99% charged on deposits made via credit/debit cards. Furthermore, a fee of up to 0.40% is payable on all buy and sell orders. Finally, traders can select CZK as the payment currency from within the Crypto.com app when making a fiat deposit.

| Number of cryptocurrencies | 250+ |

| Debit card fee | 2.99% |

| Fee to trade crypto | Up to 0.40% |

| Minimum deposit | $20 |

Pros

- Over 250 cryptocurrencies to choose from

- Low commission and trading fees

- Staking and interest-earning options on cryptocurrencies

- NFT marketplace and crypto Visa card

Cons

- Need CRO to access additional benefits

Cryptoassets are a highly volatile unregulated investment product.

2. Bitstamp – Crypto Exchange With High Security

Bitstamp has been operational since 2011 and keeps the vast majority of crypto assets in cold storage. Whitelisting and transaction confirmations are also in place and the platform encrypts all personal data. This platform also protects assets with BitGo insurance.

Furthermore, like many of the best cryptocurrency exchanges on this list, Bitstamp allows people to earn from staking. On this platform, there are only two options in this regard. They are Algorand and Ethereum. Although, the Bitstamp platform states it will add more to this list later. There are over 155 markets at Bitstamp and the trading fee costs up to 0.50%.

The Bitstamp platform will suit advanced Czech investors, and perhaps intermediate traders. This is because the interface is highly intuitive and there is a section dedicated to pro investors. This includes industry-leading API connectivity to ensure a stable and fast crypto trading platform, as well as various advanced tools for analysis.

Bitstamp clients can also download a free mobile app. This allows traders from the Czech Republic to deposit and withdraw funds, check charts, manage orders and send and receive cryptocurrencies on the go. The minimum order size at Bitstamp is $10.

Accepted payment types include credit/debit cards and bank transfers. Although this is one of the best Czech Republic crypto exchanges for security, it’s worth noting people wishing to make a deposit using Visa or MasterCard may prefer another platform. This is because Bitstamp charges 5% on each debit/credit card deposit, plus there may be additional fees from the provider.

| Number of cryptocurrencies | 155+ markets |

| Debit card fee | 5% |

| Fee to trade Bitcoin | Up to 0.50% |

| Minimum deposit | Depends on payment method |

Pros

- Trading fee of up to 0.50%

- Advanced trading platform

Cons

- High fee to buy crypto with a debit/credit card

Cryptoassets are a highly volatile unregulated investment product.

3. Coinbase – Top Crypto Exchange in the Czech Republic for Beginners

Coinbase is one of the biggest crypto exchanges globally and its platform is super easy to use. This makes it a great place to start for newbie traders in the Czech Republic. There are over 170 cryptocurrencies listed at Coinbase, so diversification isn’t a problem.

It should, however, be noted that this platform isn’t the cheapest in this list of the best Czech Republic crypto exchanges. Traders will be charged a standard commission of 1.49% on each buy and sell order. An advantage of this platform is that Coinbase supports fractional investing. The minimum trade size is 2.00 Kč when buying and selling crypto assets at Coinbase.

The platform accepts deposits made via credit/debit card. Any traders wanting to fund their accounts with this method will be charged a fee of 3.99%. SEPA is also accepted as a deposit method, with no fees. In this case, residents of the Czech Republic need to specify CZK in the currency section of the form, instead of euros.

A minimum deposit of $50 is recommended by Coinbase. All accounts need to have 2FA installed for safety. Not only that, but there are additional security features such as a crypto address book, the Coinbase Vault, and support for hardware keys to further protect traders’ assets.

Pros

- One of the best Czech Republic crypto exchanges for beginners

- Good selection of supported coins

- High security

Cons

- High fees for trading cryptocurrencies

- 3.99% charged on debit/credit card payments

Cryptoassets are a highly volatile unregulated investment product.

4. Binance – Low Commission Crypto Exchange for Trading

There is also a vast and diverse selection of digital assets to trade at Binance. The platform lists over 600 cryptocurrencies. Additionally, Czech traders can access Binance’s NFT trading platform. The NFT marketplace enables people to buy one-of-a-kind digital collections and also mystery boxes to use on top-tier gaming projects.

When it’s time to make a deposit, traders can choose between a credit or debit card. Note that ‘Instant Buy’ credit/debit card deposits are charged at 1.8% per transaction. Crypto deposits are fee-free. Moreover, the Binance platform offers traders ample opportunity to carry out analysis, with its many trading tools.

Binance supports full TradingView integration, which allows technical indicators and customizable charting tools to be easily linked to the platform. Furthermore, traders can increase their income by staking. Put simply, this allows traders to earn rewards in the form of crypto. People can also opt to buy and sell crypto assets via Binance’s P2P platform.

This entails buying directly from a fellow trader by filtering down the results and choosing the most appropriate listing. In this instance, the accepted payment method will depend on the seller in question. It’s also worth noting that at the time of writing, only six digital currencies are available to buy and sell on Binance P2P Czech.

| Number of cryptocurrencies | 600+ |

| Debit card fee | 1.8% |

| Fee to trade crypto | Up to 0.10% |

| Minimum deposit | Depends on payment type |

Pros

- Over 600 cryptocurrencies supported

- Low commission and trading fees

- Yield farming and staking supported

Cons

- PayPal not supported

Cryptoassets are a highly volatile unregulated investment product.

5. Bitpanda – Crypto Trading Platform With Multiple Markets and Rewards

Traders can claim over 15% in extra BEST tokens per year and the more people buy and hold, the higher the reward. BEST rewards vary depending on the volume of the trader. For instance, anyone holding 10 BEST tokens who make one trade per week can claim 0.10% back on a weekly basis. The BEST VIP level also dictates staking rewards, which go up to 12.5%.

Moreover, traders holding 1,000 BEST tokens can get 5% in additional staking rewards. Those holding 5,000 BEST can claim 7.5% more staking rewards. In terms of its exchange, there are almost 100 cryptocurrencies listed at Bitpanda. This guide found that Czech traders can build a portfolio of crypto assets steadily via the Bitpanda savings account.

This entails choosing the desired frequency, from daily, weekly or monthly, and then deciding how much to allocate. Following this, Bitpanda will automatically place buy orders on your behalf. Deposit methods include credit/debit cards, bank transfers, and more.

Do note that at this time deposits can only be made in a handful of currencies. As such, traders may need to first convert CZK to USD or EUR. The minimum deposit is $25 (around 587 Kč).

| Number of cryptocurrencies | 96 |

| Debit card fee | Not stated |

| Fee to trade crypto | Up to 1.49% |

| Minimum deposit | $25 |

Pros

- Up to 12.5% staking rewards with BEST VIP

- Bitcoin savings plan available

- Other assets are also available to trade

Cons

- Some payment methods attract extra charges

- Fees higher than other platforms

6. Paxful – Leading P2P Bitcoin Marketplace in the Czech Republic

Paxful is a P2P marketplace whereby Czech traders can buy and sell Bitcoin, Tether, and Ethereum. The platform states that there are more than 300 ways to pay for crypto assets.

The P2P marketplace allows traders located in the Czech Republic to find local sellers from which to buy the aforementioned digital assets. The payment type supported depends on the seller in question. Nonetheless, options include payment methods such as PayPal, gift cards, credit/debit cards, MoneyGram, Western Union, and more.

The minimum deposit required will also depend on the seller chosen but starts from $10. The charge to buy cryptocurrencies is zero at Paxful, however, the selling fee is 1%. That said, this depends on the payment type, as gift cards can attract a fee of 5%.

The platform has a simple system whereby traders can filter down the offers they see by location, the accepted payment type, and more.

When it’s time to cash out the crypto investment, traders just need to create an offer to sell their tokens. This entails picking a payment method the buyer can use, stating the asset being sold, and then customizing the listing.

Pros

- Accepts PayPal

- Offers benefits and rewards to crypto traders

- P2P platform that supports over 300 payment methods

Cons

- No debit card deposits

- No phone support

Cryptoassets are a highly volatile unregulated investment product.

7. Bitvavo – Buy Over 175 Digital Assets With $5 or More

This is because Bitvavo supports fractional crypto trading. Depending on the volume of cryptocurrencies being traded, the platform charges up to 0.25% to buy and sell. Like many platforms, Bitvavo offers staking rewards to traders.

This can be anywhere between 0.50% and 7.5%. Moreover, the platform offers both on-chain and off-chain staking. Off-chain allows investors to earn a passive income on idle crypto tokens held on the platform.

On-chain staking enables Czech traders to take part in transaction validation, which is comparable to mining and takes place on a proof-of-stake blockchain. Staking rewards are available on almost 20 digital assets at the time of writing.

Deposit methods include SEPA and Sofort. The latter is quick but can attract a fee of up to 2.25%. SEPA is free but can take 1-2 business days to clear in the Bitvavo trading account. This platform does not stipulate a minimum deposit.

Pros

- 175+ digital assets supported

- The platform offers on-chain and off-chain staking rewards

- Small investments from $5 supported

Cons

- Credit card deposits are not supported

[/su_list]

The Best Czech Republic Crypto Exchanges Compared

Below is a comparison of the best crypto exchanges in the Czech Republic to help clear the mist on the most compatible with each trader’s goals.

Crypto exchange

Number of cryptos

Debit card fee

Fee for trading crypto

Min deposit

Accepted payment methods

Crypto.com

250+

2.99%

Up to 0.40%

$20

Credit/debit cards, SEPA

Bitstamp

155+

5%

Up to 0.50%

Depends on payment type

Credit/debit cards, bank transfers

Coinbase

170+

3.99%

1.49%

$50 is recommended

Debit/credit cards, bank wire, Paypal

Binance

600+

1.80%

Up to 0.10%

Depends on Payment type

Credit/debit card, SEPA, Advcash

Bitpanda

96

Not stated

1.49%

$25

Cryptocurrencies, bank transfer

Paxful

3

Not stated

No buy fee, sell fee is 1%. Some gift cards attract a fee of 5%

$10 but depends on seller

Depends on seller. Includes PayPal, gift cards, credit/debit card, Moneygram, Western Union and more

Bitvavo

175+

N/A

Maker/Taker up to 0.25%

Not stated

SEPA, Sofort

How to Choose the Best Netherlands Cryptocurrency Exchange for You

Below is a simple guide on how to choose the best bitcoin exchange in the Czech Republic.

This covers everything from potential charges traders might have to pay to tools and features, regulation, promotions, and more.

Regulation

Regulated crypto exchanges and brokers must comply with a wide range of rules and maintain strict standards. At the time of writing, there isn’t an official regulator of this kind in the Czech Republic.

That said, as we touch on later, exchanges must register with Czech authorities and follow AML laws.

- However, if a platform complies with the rules of at least one reputable body, this should provide people with a better trading experience.

- The best crypto exchanges in the Czech Republic hold a license from the likes of CySEC, the FCA, the SEC, or ASIC.

Tradable Cryptos

Some investors may only have eyes for one cryptocurrency.

However, as diversification is likely to appeal to most crypto traders at some point, it’s better to ensure there are multiple markets listed.

For instance, Paxful is one of the best Czech Republic crypto exchanges for people who want to buy and sell on a P2P platform.

However, the downside is that there are only three digital tokens available to buy or sell. In stark contrast, at Crypto.com there are over 250 digital assets.

Sign-up Offers

Some of the best crypto exchanges in the Czech Republic offer traders rewards just for signing up, recommending someone else, or holding tokens.

- Crypto.com also runs promotions on a regular basis New clients who sign up using a referral link can earn a reward for themselves and the person who recommends them

- At the time of writing, this is to the value of up to $50 in CRO tokens

All offers are subject to change. As such, this is something to check prior to signing up.

Fees

Something that all the best crypto exchanges in the Czech Republic have in common is that they all charge fees.

As the platform is providing a service, this is to be expected. However, we found there to be a huge disparity between what traders need to pay.

Crypto.com is the overall best Bitcoin exchange in the Czech Republic for multiple reasons. As you can see, the platform’s low and transparent fees are more competitive than most.

Tools & Features

Most Czech Bitcoin exchanges will have tools and features available. For example, this could be as basic as customizable price charts or be a full suite of sophisticated technical indicators and order types.

Traders need to consider which tools might be most compatible with their objectives when researching the best Czech crypto exchange for 2025.

As we touched on in our earlier review, thanks to the platform’s trading tools, Crypto.com is one of the best crypto exchanges to shorten the learning curve.

Customer Service

Good customer service is a lifeline to traders in their hour of need. As such, it makes sense to check how the team is contactable and also what the operating hours are.

Cryptocurrencies trade on a 24/7 basis, so it is better if the Czech crypto exchange offers round-the-clock customer support.

Are Crypto Exchanges Legal in the Czech Republic?

Cryptocurrency exchanges are legal in the Czech Republic, and ‘soft regulation’ is in place in the country.

- Prior to 2017, cryptocurrencies were not subject to national legislation and were not governed by EU laws

- The Czech government amended its legislation in 2017, imposing requirements on cryptocurrency exchanges, banks, and other financial service providers

- Customers were required to complete the KYC process from that point forward

- The Czech Republic was one of the first EU nations to adopt a so-called ‘soft regulation’ of virtual currencies and their legal status

- Moreover, in 2018, the Czech Republic established the Czech Alliance/Blockchain Connect

- This is a specialist blockchain alliance whose overarching goal is to develop and apply technology in the nation

All exchanges in the country are required to follow AML laws and provide evidence of compliance. Platforms must register with the Trade Licensing Authority for a trading license.

Crypto Tax in the Czech Republic

All cryptocurrencies are categorized in the same way by the Czech government.

This implies that all cryptocurrencies are lumped together regardless of the purpose or use of each project, whether it be speculative, trading, or mining.

Tax is payable on cryptocurrencies in the Czech Republic, as explained below:

- The taxpayer must submit a personal income tax return if they receive money from the selling of cryptocurrency

- It is important to note that this refers to revenues, not profits, so even if the taxpayer has incurred a loss, filing the tax return may still be required

- The personal income tax rate is 15%, which is applied to any crypto-generated earnings

- However, a tax rate of 23% will be applied if the total income (including income from work and business operations) exceeds the statutory threshold

- At the time of writing, the statutory threshold is 1,867,728 Kč for 2022

As you may have noticed in our reviews of the best crypto exchanges in the Czech Republic, Crypto.com offers a free tax calculator. This should make things easier for traders who are liable for tax on their crypto investments.

Conclusion

This guide has reviewed the best crypto exchanges in the Czech Republic.

Platforms worth considering should have an uncomplicated fee structure. Not to mention an easy-to-navigate trading site, lots of assets, and preferably some useful tools and features.

To offer a quick recap, Crypto.com is the overall best Czech crypto exchange. Traders pay a small fee when depositing, buying, and selling crypto assets. The platform is regulated and is easy to use, even for a novice.

Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.