With more people than ever holding cryptocurrency, ‘crypto cards’ have become increasingly popular. These cards work much like regular credit and debit cards, except they allow you to spend your cryptocurrency holdings easily – with no need to convert into FIAT currency before doing so.

With that in mind, this guide will discuss the best crypto credit cards in detail, reviewing the top providers on the market and showing you how to get started using a highly-rated crypto card today – all from the comfort of your own home.

Best Crypto Credit Cards List

Below are five of the best crypto credit cards available on the market right now. We’ll review each of these cards individually in the following section, discussing their fees, rewards, and availability.

- Crypto.com – Excellent Crypto Card Offering Up To 8% Cashback

- BlockFi – Best Crypto Card for Restriction-Free Cashback

- Nexo – Great Mastercard Crypto Card with Apple Pay Support

- Celsius – Upcoming Crypto Card with Zero Fees

- Gemini – Premium Crypto Credit Card with Instant Reward Payout

Best Crypto Cards Reviewed

If you regularly invest in Bitcoin (or any other cryptos), having a dedicated crypto Visa card can significantly streamline your purchasing activities. Since these cards link directly to your crypto balance, there’s no need for lengthy conversion processes – which often results in cost savings in the long term. Alternatively, you might also want to find the best crypto banks that offer high interest rates on crypto staking.

With that in mind, let’s dive in and review the best crypto cards that were highlighted in the previous section, ensuring you’ve got a clear understanding of your options.

1. Crypto.com – Best Crypto Card with up to 8% Cashback

The card has no annual fees and allows top-ups via FIAT currency or crypto. There are five Crypto.com card tiers, each offering a specific cashback amount. The highest tier, Obsidian, provides an impressive 8% cashback on eligible transactions. However, this tier is only accessible by Crypto.com users that stake £300,000 ($391,530) worth of CRO – Crypto.com’s native token.

The only tier that doesn’t require any CRO staking is the Midnight Blue tier, which offers 1% cashback on eligible purchases. Cashback distributions are paid in CRO and are instantly deposited into your crypto wallet on the Crypto.com app. In terms of payments, our research for this Crypto.com card review found that you can use the card worldwide, with competitive exchange rates offered.

Each Crypto.com card tier comes with a specific fee-free withdrawal amount per month, starting at £180 ($234) for the Midnight Blue tier. Users are also offered a minimum of £1,800 ($2,349) of free currency exchange transactions per month, with anything above this costing 0.5%. Finally, higher tiers also provide exclusive benefits, such as airport lounge access, priority customer service, and merchandise welcome packs. Crypto.com is also considered one of the best crypto staking platforms that beginner investors can access in 2022.

| Provider | Supported Coins | Fees | Rewards | Availability |

| Crypto.com | 90 | No monthly fees | Up to 8% cashback | Anywhere that Visa cards are accepted |

Cryptoassets are a highly volatile unregulated investment product.

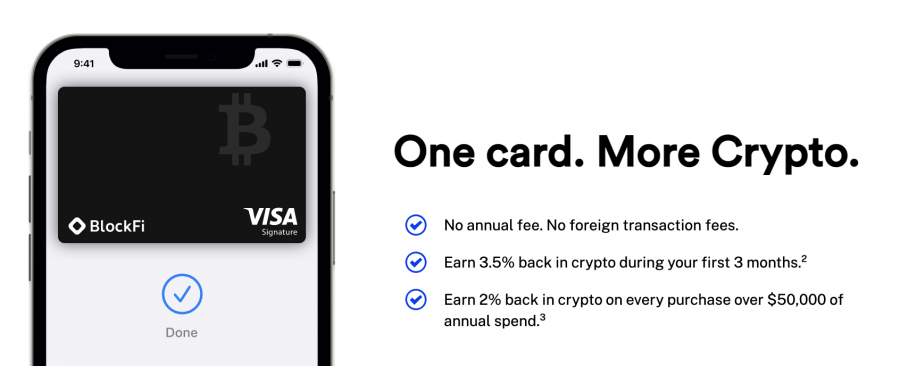

2. BlockFi – Best Crypto Card for Restriction-Free Cashback

Although users can earn a minimum of 1.5% on all purchases, denominated in BTC, BlockFi also runs an introductory offer where new users can receive an impressive 3.5% on eligible purchases – capped at $100 worth BTC. Users can also refer a friend and earn $30 worth of BTC if they use the BlockFi crypto card. Notably, users who spend over $50,000 annually on the BlockFi card will receive 2% cashback on all purchases, rather than the standard 1.5%. As such, Blockfi has also become popular as one of the best crypto interest accounts.

Although BlockFi does require ‘good’ credit to utilize their card, the pre-approval process will not affect your credit score. There are also no monthly spending limits once the card is obtained, and BlockFi even provides 0.25% reimbursements on all eligible crypto trades made using the card. Overall, due to these factors, BlockFi’s Visa card is undoubtedly one of the best crypto credit cards available in the market right now.

| Provider | Supported Coins | Fees | Rewards | Availability |

| BlockFi | 8 | No monthly fees | 3.5% cashback for the first 90 days of use; 1.5% cashback after this point | Anywhere that Visa cards are accepted |

Cryptoassets are a highly volatile unregulated investment product.

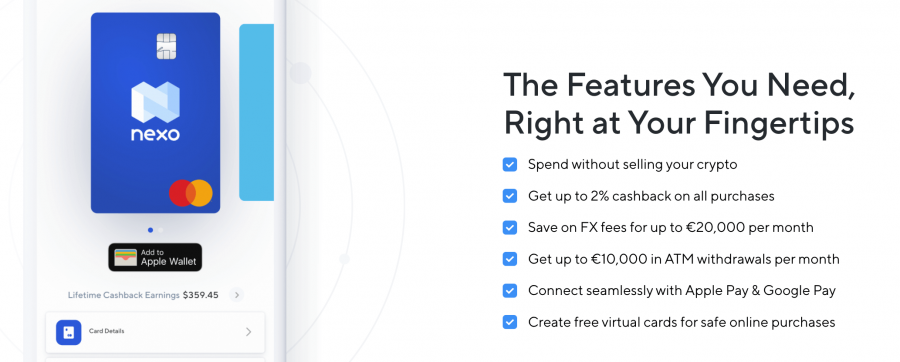

3. Nexo – Great Mastercard Crypto Card with Apple Pay Support

Another great feature of the Nexo Card is that it can connect with Google Pay and Apple Pay, meaning contactless payments are accepted. Nexo also allows users to create ‘virtual cards’ with unique credentials, making online transactions much safer. Furthermore, if you wish to make withdrawals, Nexo enables users to withdraw up to €10,000 ($10,958) from ATMs per month.

When you make payments with the Nexo card, the purchase is made in the local currency. This means that you save on FX fees, up to a total of €20,000 ($21,917) per month. Finally, aside from the crypto card, Nexo also offers one of the best crypto interest accounts, offering a remarkable 17% APR on eligible coins.

| Provider | Supported Coins | Fees | Rewards | Availability |

| Nexo | 32+ | No monthly fees | Up to 2% cashback on all transactions | Anywhere that Mastercard cards are accepted |

Cryptoassets are a highly volatile unregulated investment product.

4. Celsius – Upcoming Crypto Card with Zero Fees

In terms of the Celsius card itself, this looks set to be the best crypto credit card for users interested in high rewards with zero monthly fees. The card will offer weekly rewards on your crypto holdings, although the specific percentages are unclear. Since the card is designated as a credit card rather than a debit card, Celsius will allow users to repay the balance using FIAT, stablecoins, or rewards.

The Celsius website provides the option to join the waiting list for this crypto card, which will enable priority updates and entry for exclusive surprises. Finally, as one of the best crypto loan sites, Celsius offers crypto-backed loans from as little as 1% APR.

| Provider | Supported Coins | Fees | Rewards | Availability |

| Celsius | 50+ | No monthly fees | Not announced yet (waiting list) | Not announced yet (waiting list) |

5. Gemini – Premium Crypto Credit Card with Instant Reward Payout

This card promises to offer crypto rewards on every purchase, with up to 3% cashback offered on eligible transactions. Users can decide whether they’d like rewards to be paid in BTC, ETH, or a selection of 50+ cryptos. In terms of costs, the Gemini Credit Card will charge no annual fees, no FX fees, and no exchange fees.

Interestingly, Gemini pledges to offer instant rewards, removing the need to wait until the end of the month for reward amounts to be distributed. The card itself is aesthetically pleasing, with users able to choose between a black, silver, or rose gold colour scheme. Finally, since the Gemini Credit Card will leverage the scale of the Mastercard network, users will be able to make transactions pretty much anywhere in the world.

| Provider | Supported Coins | Fees | Rewards | Availability |

| Gemini | 50+ | No monthly fees | Up to 3% cashback on transactions | Anywhere that Mastercard cards are accepted |

Best Crypto Credit Cards Comparison

As you’ll now be aware, many of the best crypto exchanges offer crypto cards that provide direct access to your trading balance. To help streamline the process of choosing between them, the table below presents the supported coins, fees, rewards, and availability of each crypto card mentioned in the previous section – allowing for easy comparison between the providers.

| Provider | Supported Coins | Fees | Rewards | Availability |

| Crypto.com | 90 | No monthly fees | Up to 8% cashback | Anywhere that Visa cards are accepted |

| BlockFi | 8 | No monthly fees | 3.5% cashback for the first 90 days of use; 1.5% cashback after this point | Anywhere that Visa cards are accepted |

| Nexo | 32+ | No monthly fees | Up to 2% cashback on all transactions | Anywhere that Mastercard cards are accepted |

| Celsius | 50+ | No monthly fees | Not announced yet (waiting list) | Not announced yet (waiting list) |

| Gemini | 50+ | No monthly fees | Up to 3% cashback on transactions | Anywhere that Mastercard cards are accepted |

How do Crypto Cards Work?

So, how do these crypto cards work? Essentially, crypto cards function in precisely the same way that regular credit or debit cards operate. Users of crypto cards will usually receive a physical card (either Visa or Mastercard), complete with a card number, expiry date, and CVV/CVC number. This ensures that the card can be used online, physically using a card machine, or contactless.

However, unlike regular bank cards, these crypto cards are backed using the cryptocurrency held in the account that you have with the card provider.

Notably, the merchant does not receive payment in crypto. Instead, when you make a purchase using your crypto card, the necessary funds are automatically converted into FIAT currency in real-time by the card provider. Therefore, the merchant receives payment in their desired currency, whilst you can still use crypto to fund the purchase. Ultimately, this presents a ‘win-win’ scenario for all involved.

Alongside significantly streamlining the purchasing process, crypto cards also come with various additional benefits. Most cards will offer cashback on crypto purchases to entice people to use them, with cashback rates often being higher than traditional bank cards. Many providers also provide fee-free ATM withdrawals up to a certain threshold or reductions in FX fees.

Crypto Debit Cards vs Crypto Credit Cards

When researching the best crypto cards, you’ll likely notice that certain providers use the term ‘credit card’ whilst others opt for ‘debit card’. Although this can seem confusing, these terms can usually be used interchangeably. This is because crypto cards that offer credit facilities are not yet offered on the market.

Therefore, all of the crypto cards mentioned on our list will technically be termed debit cards, as they are backed by your account balance. Essentially this means that you cannot spend more than you have available and cannot borrow extra funds from the provider in the form of credit.

Benefits of Crypto Credit Cards

As you will likely be aware by now, crypto credit cards offer a variety of practical benefits for cardholders. Detailed below are three of the main advantages to consider:

Lucrative Rewards

Many of the crypto cards noted within this guide will offer impressive rewards to cardholders in the form of cashback. Cashback within the context of crypto cards will be paid in crypto – with the specific crypto either being the provider’s native token or a widely-used coin such as BTC. The best crypto credit card for cashback rewards is likely the one offered by Crypto.com, which provides up to 8% cashback on the highest tier.

Make Payments Using Crypto

As expected, the main benefit of crypto cards is the ability to spend your crypto holdings easily and instantly. If you made a successful crypto trade and wished to use the proceeds without a crypto card, then you’d have to convert the crypto into FIAT and send the funds back to your bank account – which can be a lengthy process. However, crypto cards are designed to streamline the process, allowing users to spend the crypto they have in their balance as if it was FIAT, whilst leveraging the power of the Visa or Mastercard network.

Can Be Used Abroad

Finally, most crypto cards can be used abroad with competitive exchange rates. This is great for people that travel frequently, as it offers an ‘all-in-one’ spending solution. Furthermore, certain crypto card providers will even waiver foreign exchange fees up to a certain threshold, offering an attractive alternative to using a traditional bank card.

How to Choose the Right Crypto Credit Card for You

Although the list presented earlier has provided an overview of the best crypto cards, it may still be challenging to decide between them. Ultimately, this decision will be based on your unique circumstances and needs, so it’s vital to conduct all of the necessary research.

To help with the decision-making process, here are five of the main factors to bear in mind when choosing a crypto credit card:

Fees

Fees are obviously something to consider, as there’s no point opting for a crypto card if it’s going to cost you an excessive amount each month. Luckily, most crypto cards are reasonably priced and may even be cheaper to use than some traditional debit cards.

The most common fees to be aware of are monthly/annual account fees and ATM withdrawal fees. For example, the Crypto.com credit card fee is non-existent for withdrawals up to £180 ($234) per month on the Midnight Blue tier. The provider also offers a minimum of £1,800 ($2,349) worth of free currency exchange transactions per month.

Rewards

Much like many crypto staking platforms, crypto credit cards often come accompanied by rewards in the form of crypto. Many of the cards presented on our list offer cashback, although most tend to have eligibility criteria attached.

Supported Cryptos

The best crypto credit cards offer support for a selection of cryptocurrencies, rather than just one or two. The card is an excellent example of this, as it allows users to use over 50 different cryptos to facilitate payments.

Eligibility Criteria

Due to the nature of these crypto cards, some providers will have eligibility criteria that would-be users must meet. A few providers will require users to have good credit scores before being able to use the card, whilst others may require a certain amount of their native token staked.

Usability

Finally, the card’s usability is a crucial factor to consider, as this will ensure you can use the card in the same manner as a traditional debit card. Fortunately, all of the cards presented in this guide utilize the Visa or Mastercard network, meaning they are accepted by merchants worldwide. Interestingly, since the funds are automatically exchanged into FIAT before payment, the merchant won’t know that you are using a crypto-backed debit card.

Those interested in the cryptos behind powering payment networks might also be interested in our article on Swipe (SPX).

Best Crypto Credit Card – Conclusion

To summarize, this guide has presented everything you need to know about the best crypto debit cards, covering the top providers and the benefits of using these cards. With crypto adoption increasing every month, crypto cards are likely to become more prevalent as we move forward – meaning now could be the ideal time to get involved.

If you are looking to set up a crypto credit card today, we’d recommend using the one offered by Crypto.com.