As Bitcoin (BTC) maintains its composure above the $29,000 mark, the market is keeping a watchful eye on the U.S. Personal Consumption Expenditures (PCE) Index data and the Federal Reserve’s interest rate decision.

PCE Data Fails to Deliver Market Shock

The U.S. PCE Index data, which measures changes in consumer spending, was anticipated to be a significant macro event with the potential to impact financial markets.

However, the data release did not deliver any major surprises, as the numbers broadly aligned with market expectations.

US PCE numbers for March '23

Headline: +4.2% versus +4.1% Exp. (prev. +5.0%)

Core: +4.6 versus +4.6% exp. (prev. +4.6%)

gud

— tedtalksmacro (@tedtalksmacro) April 28, 2023

headline falling sharply… core sticky.

Overall nothing to shock the market, which is 'gud'

— tedtalksmacro (@tedtalksmacro) April 28, 2023

Financial commentator Tedtalksmacro noted that the PCE data showed no significant deviation from the trend, adding that there was “Overall nothing to shock the market.”

As a result, U.S. equities showed little movement at the market opening, and Bitcoin’s price remained relatively stable around the $29,000 level.

Bids stacking on the binance #Bitcoin spot market, around 29k. pic.twitter.com/jOHJheL2uv

— tedtalksmacro (@tedtalksmacro) April 28, 2023

Binance’s order book data indicated modest bid liquidity moving toward the spot price, suggesting a potential compression of volatility.

Focus Shifts to Federal Reserve’s Interest Rate Decision

With the PCE data release behind them, market participants are now shifting their attention to the upcoming Federal Reserve interest rate decision.

According to CME Group’s FedWatch Tool, there’s an 86% probability of a 0.25% rate hike at the time of writing.

Bitcoin Price Outlook: A New Uptrend on the Horizon?

Amid the macroeconomic developments, traders are assessing the longer-term trend for Bitcoin’s price.

Popular trader and analyst Rekt Capital took a broader perspective, suggesting that historical bullish trends could signal the end of last year’s bearish trend for Bitcoin.

#BTC has already broken its Downtrend

Now it's all about continuing the new Uptrend

Whether a retest is needed or not is the question

But history suggests the mid-term to long-term outlook looks bullish$BTC #Crypto #Bitcoin pic.twitter.com/OhFan73uwW

— Rekt Capital (@rektcapital) April 27, 2023

“Bitcoin has already broken its Downtrend. Now it’s all about continuing the new Uptrend. Whether a retest is needed or not is the question,” he tweeted. “But history suggests the mid-term to long-term outlook looks bullish.”

As the market awaits the Federal Reserve’s interest rate decision, Bitcoin’s price stability at around $29,000, along with a YTD increase of 75%, serves as a reminder of the cryptocurrency’s resilience in the face of macroeconomic uncertainties.

Amid this financial climate, three altcoins—FLOW, DLANCE, and ARB—have emerged as potential trailblazers, each with the capacity to yield significant returns in 2023.

FLOW’s Unique Architecture

Dapper Labs’ brainchild, Flow, is a blockchain protocol that has captured the attention of crypto market observers with its unique architecture that offers a number of benefits.

Designed to power a new generation of games, apps, and digital assets, Flow boasts a multi-role architecture that enables scalability without the need for sharding.

The protocol’s user-friendly programming language, Cadence, and ACID transactions further enhance the user experience.

Flow’s ecosystem is enriched by strategic partnerships, and its native cryptocurrency, FLOW, is poised for growth.

FLOW’s Path to New Heights

Despite facing bearish trends, FLOW’s outlook remains optimistic.

The protocol’s innovative architecture and strong partnerships position it as a formidable player in the blockchain arena.

Currently, FLOW is trading at $0.90, with the Fib 0.236 level at $0.829 serving as its immediate support.

The cryptocurrency is encountering significant resistance at the $1 psychological level, which coincides with the Fib 0.5 level.

Although FLOW is down from its year-to-date (YTD) high of $1.446, it still boasts a positive YTD gain of 37%.

Experts predict that FLOW’s price could reach up to $2 in 2023, signaling a significant potential recovery from its current price.

DeeLance: Pioneering the Future of Freelancing with Web3

DeeLance is leading the charge in the emerging freelance industry of the future, spearheading a shift that empowers both freelancers and employers.

Hello DeeLancers!

Ready to take your #Metaverse experience to the next level?

Unlock Metaverse VIP access to premium virtual land, office space, & brand awareness advertising opportunities with $DLANCE tokens.

Join the #Presale now!⤵️https://t.co/XHnTqVzeWf#Crypto pic.twitter.com/PNNUwyF4Ak

— DeeLance (@deelance_com) April 26, 2023

By harnessing the power of Web3 technology, DeeLance is creating a dynamic and forward-thinking freelance marketplace that transcends traditional freelancing business boundaries.

The project’s utility token, $DLANCE, has garnered significant interest from investors, as evidenced by the successful presale that raised over $509,000.

This strong start underscores the confidence that the market has in DeeLance’s potential to reshape the freelance industry.

DeeLance’s commitment to transparency, security, and efficiency, combined with its innovative integration of NFTs and the metaverse, sets it apart as a trailblazer in the freelance space.

As the platform continues to develop and refine its offerings, it is poised to become a standout player in the cryptocurrency market in 2023.

As we look to the future, DeeLance’s vision of a decentralized and empowered freelance community is coming to fruition.

The project’s dedication to transitioning from traditional freelancing platforms to the adoption of Web3 technology underscores its potential to disrupt the freelancing industry.

The ARB Price Ascends: Arbitrum’s Layer-2 Solution

Arbitrum, developed by Offchain Labs, is a layer-2 scaling solution for Ethereum’s decentralized apps (dApps). Utilizing Rollup and AnyTrust protocols, Arbitrum enhances the capacity and user-friendliness of the Ethereum network.

The release of Arbitrum One and Arbitrum Nova empowers developers to create dApps that benefit from Arbitrum’s scaling advantages.

The ARB Price Prediction and Technical Analysis: A Rising Star in Layer-2 Solutions

The protocol’s ability to execute over 200 million transactions and its high number of daily active addresses have contributed to the ARB price’s upward trajectory.

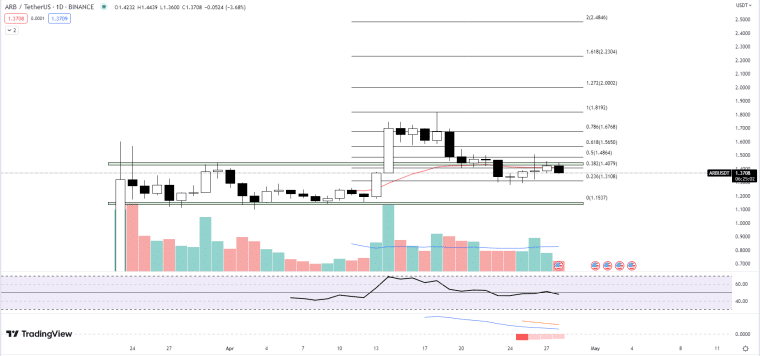

After reaching a high of $1.82 on April 18, the ARB price has been on a downward trajectory, however.

The cryptocurrency is currently facing resistance from the horizontal area of $1.4236 to $1.4462, which has proven to be a formidable barrier for the bulls.

As of writing, the ARB price is trading at $1.3705, representing a loss of 3.68% so far today.

Traders should keep a close eye on this resistance zone, as a successful break above it could signal a potential bullish reversal.

ARB Price and the 20 EMA: A Crucial Level to Watch

The 20-day EMA is a widely used technical indicator that helps traders identify short-term trends. Currently, the 20 EMA for ARB is at $1.4057, which is slightly above the current ARB price.

This suggests that ARB is trading below its short-term average, indicating bearish momentum. If the ARB price can reclaim the 20 EMA and hold above it, it may provide a bullish signal for traders.

ARB Price and the RSI: Neutral Territory

The RSI is a momentum oscillator that measures the speed and change of price movements. The current RSI value for ARB is 48.04, down from yesterday’s 51.21.

An RSI value below 30 is considered oversold, while a value above 70 is considered overbought. With an RSI value close to 50, ARB is currently in neutral territory.

Traders are advised to monitor the RSI for any significant shifts that could indicate a change in momentum.

ARB Price and the MACD: Awaiting a Bullish Crossover

The MACD is a trend-following momentum indicator that shows the relationship between two moving averages of a coin’s price.

The MACD Indicator histogram for ARB is currently at -0.0366, up slightly from yesterday’s -0.0383.

While the histogram remains in negative territory, indicating bearish momentum, the slight increase suggests that selling pressure may be easing.

Traders should watch for a bullish crossover, where the MACD line crosses above the signal line, as this could signal a potential bullish reversal.

ARB Price and Volume: A Decrease in Trading Activity

Volume is a key indicator of market interest and liquidity. The current volume for ARB is 79.77 million, significantly lower than the previous day’s volume of 143.216 million and below the volume moving average of 195.63 million.

The decrease in volume suggests a lack of strong buying interest, which may contribute to the difficulty ARB is facing in breaking through the immediate resistance level.

ARB Price Support and Resistance: Key Levels to Monitor

In terms of support and resistance, the immediate resistance for ARB lies in the horizontal area of $1.4236 to $1.4462, which coincides with the Fib 0.382 level at $1.4079.

On the downside, the immediate potential support is the Fib 0.236 level at $0.13108. A break below this support level could signal further bearish momentum.

ARB Price Outlook: Potential Targets for 2023

Despite the downturn, a favorable shift in market sentiment could easily reverse the current trend and send prices above their current levels.

Utilizing the Fibonacci extension levels, Fib 1.272 at $2, Fib 0.618 at $2.23, and Fib 2 at $2.48 are the potential targets for ARB in 2023.

Analysts are optimistic about ARB’s potential to reach new heights in 2023 and traders should keep these levels in mind.

A Promising Outlook for 2023

As we venture into the second quarter of 2023, the crypto market’s ability to adapt and thrive amid macroeconomic uncertainties is a testament to its unpredictable nature. As Bitcoin holds steady and projects like FLOW, DeeLance, and Arbitrum continue to innovate, investors should stay vigilant and be ready to capitalize on new opportunities.

Related:

Wall Street Memes (WSM) - Newest Meme Coin

- Community of 1 Million Followers

- Experienced NFT Project Founders

- Listed On OKX

- Staking Rewards