The bitcoin price has dropped by over 70% since its all-time high in November last year, keeping crypto prices bearish. The token’s current price is modest but stable. For the past seven days, the most traded cryptocurrency has remained stable around the $19,000 mark. As of Tuesday’s Asain session, it was almost at that level, but that’s par for the course these days.

Over the past month, the price of Bitcoin has risen and fallen above and below the $19,000 mark, having difficulty maintaining a price above $20,000 for more than a few hours at a time. Due to negative economic headwinds, the price remains low. At the same time, the US stock markets are showing a sign of recovery.

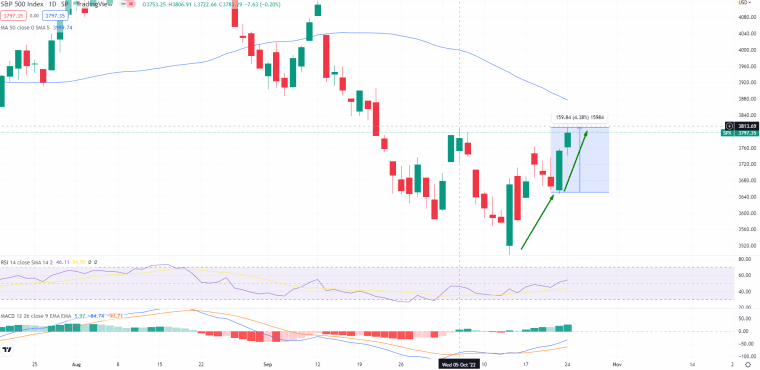

S&P500 Uptrend – Source: Tradingview

A day before, the market opened higher ahead of the release of earnings reports from the S&P 500 companies. Both the Dow and the S&P 500 reached their highest closing levels in almost a month. Options traders, however, appear to be betting that this week’s reports would increase volatility. UK bonds rose in value elsewhere when Boris Johnson conceded the prime ministerial race to his challenger, Rishi Sunak.

Up to 3870-3900, then last nuke to 3180-3250 which should be the local bottom for some months. pic.twitter.com/4wXZHIyraR

— il Capo Of Crypto (@CryptoCapo_) October 17, 2022

Despite an uptrend in the US stock market, Bitcoin has not shown any upward movement and appears to be pending. Given the positive correlation between US stocks and Bitcoin, the BTC/USD is expected to rise, if not now, then in the near future.

Crypto Prices and Stocks: The Correlation Has Leveled Off

Crypto prices, especially, Bitcoin, have followed stock markets for the better part of this year. But since the Federal Reserve tightened monetary conditions to curb inflation, the value of risky assets has declined. During the last week, cryptocurrency data provider Kaiko released a study showing that Bitcoin’s 20-day realized volatility, a measure of the daily variations in price, has dropped below the level of the Nasdaq and the S&P 500 for the first time in two years.

In our latest Data Debrief, we explore:

– #BTC volatility matching Nasdaq

– All-time low metaverse trade volumes

– Coinbase regaining dominant BTC-USD market shareGive it a read https://t.co/9uiU7uHT89

— Kaiko (@KaikoData) October 17, 2022

Bitcoin’s volatility is lower than the Nasdaq’s for the first time since October 2020. More importantly, the link between bitcoin and stock prices hit a record low. There has been a recent weakening in the correlation, leading some experts in digital assets to speculate that cryptocurrencies may be decoupling from stocks. Additionally, decoupling explains why Bitcoin didn’t follow the stock market’s upward trend last week.

For now, Bitcoin’s correlation with stocks is stabilizing, which could fuel an uptrend in BTC if the stock market keeps going up. It’s possible that crypto prices could go up again if there is a strong positive correlation between Bitcoin and stock markets.

Crypto Prices May Recover as Fed’s Pivot Remain Dovish

During its November meeting, the Federal Reserve will likely discuss whether or not to reveal plans to approve a lesser-than-expected rate hike in December, and if so, how to make that announcement. There will be a further increase of 75 basis points in interest rates.

CEO and founder of Reventure Consulting Nick Timiraos wrote an essay for The Wall Street Journal on October 21. Timiraos, the reporter the Federal Reserve goes to when it needs to get a message across, is known on Wall Street as the Fed Whisperer. His most recent piece of writing asserts that following the Fed’s meeting on November 2, interest rates would be raised by 0.75 percentage points.

"I think the time is now to start talking about stepping down. The time is now to start planning for stepping down," said San Francisco Fed President Mary Daly during a talk at the University of California, Berkeley on Friday. https://t.co/vPMSXDAKN8

— Nick Timiraos (@NickTimiraos) October 22, 2022

Timiraos claims that the Fed is split down the middle, with some members showing extreme concern about further rate hikes to curb inflation. Some policymakers are calling for a pause in rate hikes during the first quarter of the following year to assess the impact of their policies and prevent an unexpectedly sharp economic downturn. The Federal Reserve saw this year’s high inflation as a temporary tendency throughout most of 2021 and the first few months of this year, but it has begun making up for lost time since March.

The article’s positive effect on the markets is evidenced by Bitcoin’s rebound, which causes the safe-haven US dollar to give up some of its intraday gains.

Bitcoin Price & Tokenomics

The current Bitcoin price is $19,342, and the 24-hour trading volume is $27 billion. CoinMarketCap now ranks first, with a live market cap of $371 billion. It has a total quantity of 21,000,000 BTC coins and a circulating supply of 19,188,712 BTC coins.

Bitcoin Price Chart – Source: Tradingview

Technically, Bitcoin is gaining immediate support near the $19,200 level, with the possibility of moving up to the $19,650 resistance level. Further up, Bitcoin’s immediate resistance remains at $19,900. On the downside, Bitcoin may find immediate support near $19,200, with $18,925 and $18,660 acting as major resistance levels below this.

Related news:

- Best Crypto Winter Tokens – Top Coins to Invest in

- Stocks Fail to Recover Losses as Federal Reserve Raises Interest Rates

- Best Beginner Crypto to Invest in 2022

Dash 2 Trade - New Gate.io Listing

- Also Listed on Bitmart, Changelly, LBank, Uniswap

- Collaborative Trading Platform Token

- Featured in Bitcoinist, Cointelegraph

- Solid Proof Audited, CoinSniper KYC Verified

- Trading Community of 70,000+ Members