The cryptocurrency market continues to surprise everyone with its persistent recovery in 2023. Following the messy implosion of Sam Bankman-Fried’s FTX exchange in November, the future of the market looked bleak, with experts predicting crypto prices would sweep the floor possibly until the end of the year.

The cryptocurrency market continues to surprise everyone with its persistent recovery in 2023. Following the messy implosion of Sam Bankman-Fried’s FTX exchange in November, the future of the market looked bleak, with experts predicting crypto prices would sweep the floor possibly until the end of the year.

Nevertheless, investors have had reasons to smile, with Bitcoin leading the recovery phase to trade highs at $23,282. The total market cap has for the first time since early November spiked above the $1 trillion mark and stretched as far as $1.05 trillion. More than $62 billion worth of crypto assets have been traded in the last $24 hours.

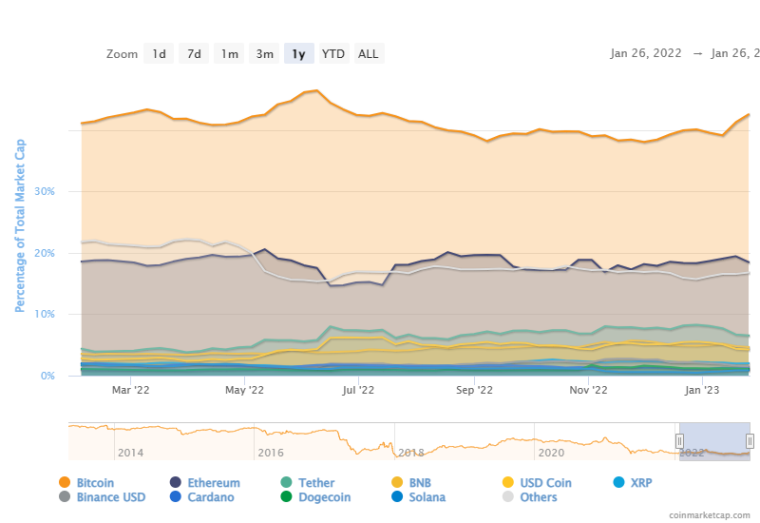

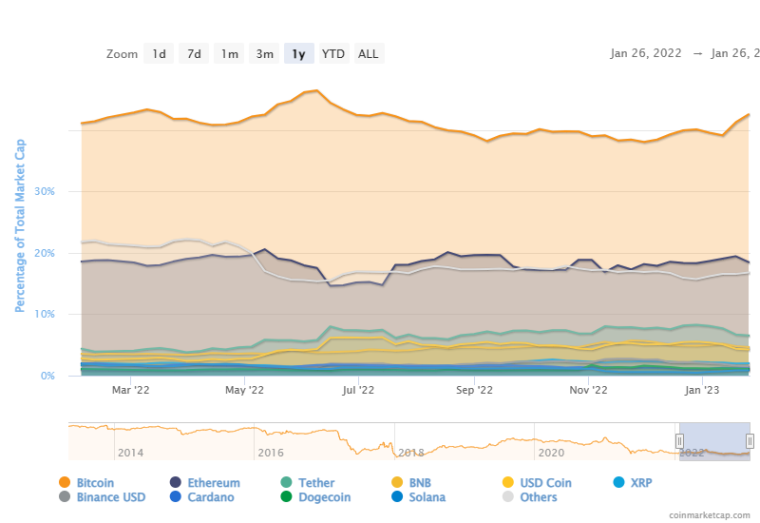

Bitcoin still holds the lion’s share of the market at 42.6%, followed by Ethereum at 18.50% and Tether (USDT) comes in third position at 6.53%. Altcoins have been performing exceptionally well over the last three weeks, their dominance appears to be dropping in comparison to that of Bitcoin.

What’s Behind the $97 billion Crypto Prices Rally

The crypto market cap is a whopping $97 billion since January first, bolstered by selected altcoins that have been soaring nonstop for slightly over three weeks. Investors have welcomed the bullish move with open arms following a turbulent 2022 marred with scandals and numerous bankruptcy filings by crypto giants like BlockFi, Three Arrows Capital, FTX, Alameda Research, and Celsius Network among others.

Signs of Easing Inflation in The US Triggers Crypto Prices Pump

The United States Federal Reserve has since December recorded a notable slump in inflation levels for the first time in a year – a situation likely to see the regulator lift the feet off the interest rates hike pedal.

According to Bloomberg, “economists project a 5% annual increase in the personal consumption expenditures price index due Friday, and a 4.4% rise in the core metric, which excludes food and energy.”

Meanwhile, the latest CPI figures – released on January 12 were positive to a great extent, falling from 7.1% in November to 6.5% in December. In December alone, CPI data reduced by 0.1%, igniting optimism among investors.

Although there was an increase, it is the smallest since the figures in late 2021. Estimates for monthly changes indicate that the rate of change is not as great as it was in the previous year.

With that in mind, market watchers are looking forward to the Federal Reserve reducing the pace of interest rate hikes. Such a positive indicator from the regulator would encourage investors to return to high-risk assets like cryptos. The spike in Bitcoin price to $23,282 can be attributed to this positive sentiment traversing the market.

FTX Lawyers Find $5 Billion To Pay Customers

The collapse of FTX has been a thorn in the lives of many crypto enthusiasts. However, there could be light at the end of the tunnel after the FTX Group Lawyers said they had more than $5 billion in liquid assets that can be used to repay the firm’s creditors and customers.

Similarly, the lawyers have discovered vast amounts of illiquid assets that cannot be liquidated at the moment, lest they greatly impact the market. The same advisors have been spending time sorting through confusing financial records, trying to figure out how funds were spent and stored at the fallen crypto giant.

According to an article that appeared on Forbes last week, 9 million customer accounts were discovered to have had an association with FTX. It was good news for FTX customers and the crypto space in general because many believed the assets were unrecoverable.

The Crypto Job Market Is Improving

The disastrous 2022 saw many people lose their livelihoods as crypto businesses resolved to reduce workforces or were forced out of business entirely. However, 2023 comes with good news from Binance, the largest crypto exchange, as it plans to increase its workforce by 15-30% in preparation for the next bull market for crypto prices.

Bitcoin Price Update – Is The Bottom In?

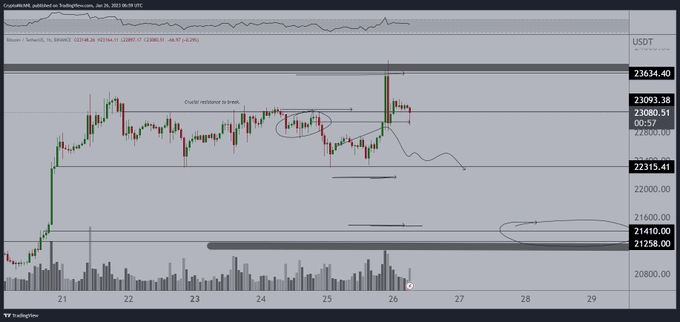

Experts believe that Bitcoin price may have bottomed at $18,000 but was forced down the rabbit hole to $15,500 due to the impact of FTX’s collapse. According to Michaël van de Poppe, a renowned analyst, and trader, BTC price needs to break resistance at $23,600 to carry on with the uptrend to $30,000. However, we are likely to see a rejection to sun $22,900. If this happens, investors should start acclimatizing to lower prices.

The analyst mentions one dependency, the United States GDP, which could push Bitcoin significantly higher or lead to more losses.

In another tweet, Michaël van de Poppe reckoned that “in a few years from now we’ll be laughing at the current valuations.” Poppe followed this projection with another forecast that could see Bitcoin price reach “$200k or more” with Ethereum adoption expanding astronomically.

While Bitcoin price’s bullish outlook sets the momentum for the rest of the market, some altcoins like Ethereum, Solana, Aptos, Optimism, Near Protocol, and Lido DAO are leading the recovery. Aptos and Optimism are among the first tokens to rally to new all-time highs, rewarding patient investors.

Meanwhile, insight from Crypto Quant, one of the leading on-chain analytics platforms, points toward a possible retracement in crypto prices. The Bitcoin supply in loss has recently hit a new low in nine months amid signs of a possible trend reversal.

Should You Buy Bitcoin Now?

Bitcoin price recovery reached highs above $23,000, but many analysts feel it is yet to confirm an uptrend. Therefore, investors buying Bitcoin may pique interest in some of our carefully selected internal projects. Some of them are in their presale stages and are selling out fast.

Related Articles:

Fight Out - Next 100x Move to Earn Crypto

- Backed by LBank Labs, Transak

- Earn Rewards for Working Out

- Level Up and Compete in the Metaverse

- Presale Live Now - $4M+ Raised

- Real-World Community, Gym Chain