The US-based pure-play crypto exchange Voyager Digital issued a formal notice of default against Asian crypto hedge fund Three Arrows Capital (3AC) this morning as the firm failed to complete the payment of 15,250 BTC and $350 million worth of USDC tokens.

Shares of the trading platform are diving 17.6% so far today at 50 cents on the dollar while they accumulate a 96.1% loss since the year started as the crypto winter continues to send shockwaves across the entire industry.

In the press release published this morning, Voyager stated that its platform has managed to keep operating and fulfilling customer orders and withdrawals despite the impact of this default. As of June 24, the firm disclosed that it had reserves of $137 million in cash and crypto assets.

In addition, the company recently secured a line of credit of $200 million in cash and USDC and a total of 15,000 BTC tokens from Sam Bankman-Fried’s Alameda Research. A total of $75 million have already been used to fulfill customers’ requests as per Voyager. The management also clarified that the notice of default did not threaten this agreement with Alameda.

Your capital is at risk.

No Word from 3AC in Regards to These Proceedings

No official comments have been made by any of the founders of 3AC. The latest public communication known from Zhu Shu was a cryptic tweet in which the Singaporean investors stated that the firm was “in the process of communicating with relevant parties and fully committed to working this out”.

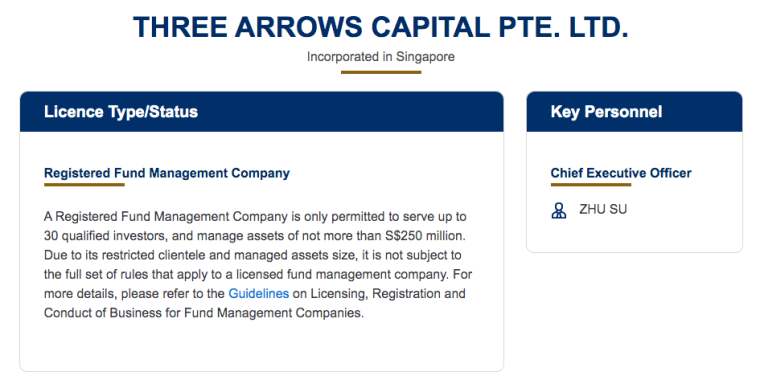

According to the Monetary Authority of Singapore, Three Arrows Capital PTE. LTD. is a registered fund management company allowed to serve up to 30 qualified investors and manage assets of no more than S$250 million.

This raises questions as to why Voyager decided to lend that much money to a company with such a small capital considering that the BTC loan alone was worth over $700 million at some point this year.

Other Firms Also Scramble to Survive as Crypto Winter Worsens

A wave of deals between crypto firms and financiers have been making the news lately as over-exposed cryptocurrency exchanges struggle to cope with customers’ en-masse withdrawals, defaults, and an overall decline in revenue and trading volumes.

In another interesting turn of events, reports have started to circulate about Goldman Sachs potentially raising around $2 billion to buy up the assets of the distressed crypto lender Celsius Network.

Celsius has reportedly been advised to file for bankruptcy to start its restructuring process. This would, however, raise several questions as to how customers’ assets will be treated as regulations regarding digital assets in bankruptcy proceedings of entities acting as custodians for a third party are either unclear or vary from one jurisdiction to the other.

Sources told The Block that Citigroup was appointed by Celsius as an advisor after the company temporarily paused all withdrawals, transfers, and swaps due to a liquidity crunch.

The bank could help the company in securing either some additional financing to honor customers’ requests and stay alive or it could assist the firm in filing for bankruptcy to begin the process of liquidating its assets.

According to the latest report from Celsius, the platform had over $11.8 billion in assets in custody for a total of 1.7 million users.

In a similar fashion, BlockFi, another large crypto exchange, recently secured a credit facility of $250 million from FTX to shore up its balance sheet at a point when customers’ withdrawals are skyrocketing.

Bankman-Fried’s firm has been one of the most active in helping crypto firms from going under as the risk of contagion across the entire ecosystem keeps building up and may accelerate if the price of digital assets continues to dive in the following months.

Other Related Articles:

- Best Crypto Savings Accounts 2022

- Best Crypto Wallet 2022

- Celsius Discusses Possible Bankruptcy Filing Amid Liquidity Issues

eToro - Top Crypto Platform

- Free Copy Trading of Professional Traders

- Free Demo Account, Crypto Wallet

- Open to US & Worldwide - Accepts Paypal

- Staking Rewards, Educational Courses