The trading volume of Tether’s USDT stablecoin is tumbling while its market capitalization grows faster than ever. According to CoinGecko data, USDT daily trading volume plummeted below $10 billion for the first time in over 4 years.

Technical crypto traders and on-chain analysts have long known Tether for its remarkable growth. It’s so remarkable that some experts think it’s suspicious. There are periods where USDT’s market capitalization rises by absurd amounts, often sandwiched between periods of relative stagnation.

One of these unbelievable growth spurts took place in March of this year. Tether’s market cap rose by an absurd $7 Billion (over 10%) in less than 2 weeks while Bitcoin and Ethereum rallied after the Silicon Valley Bank collapse.

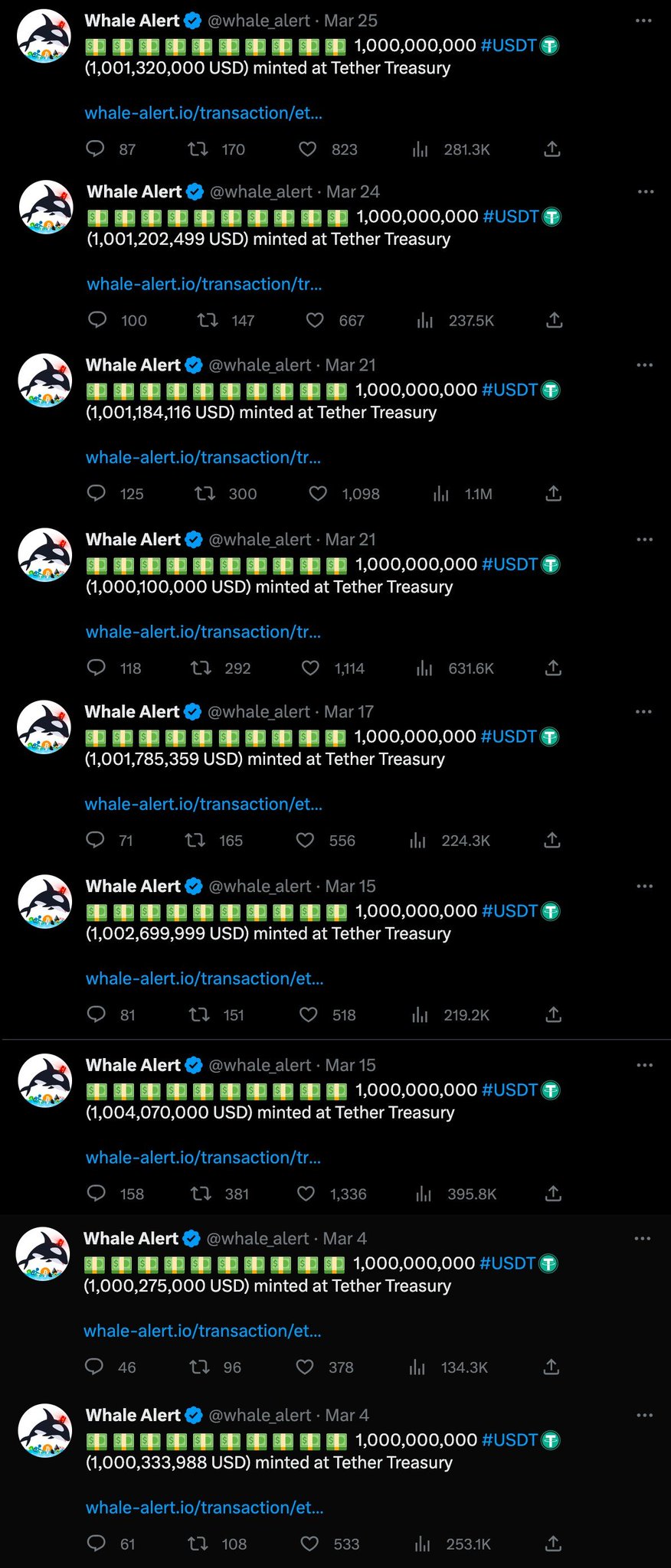

Tether is known for its lack of transparency but the open nature of the blockchain means that anyone can see when they mint tokens. If you are active on crypto Twitter, you have no doubt seen the many updates from news and update accounts like Whale Alert reporting on Tether minting ridiculous amounts of USDT.

The stretch of incredible growth this March was captured by Whale Alert transaction by transaction.

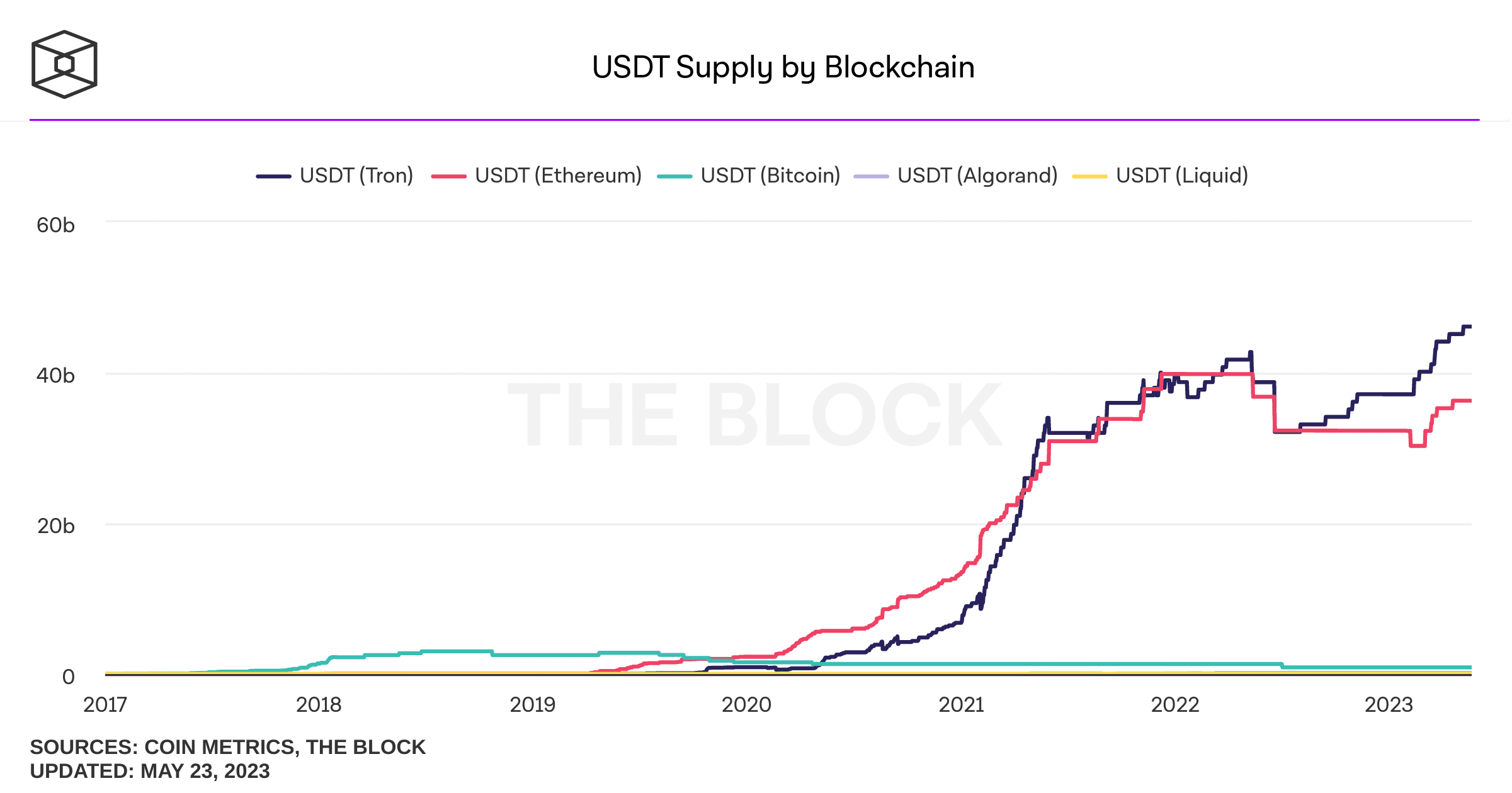

One potential explanation for the rising market capitalization of USDT is that the largest exchanges and market makers are minting tons of new USDT and moving it to the Tron network. Tron is a layer 1 blockchain that offers much faster and cheaper transactions than Ethereum.

Despite Tron’s relatively dismal size of its user base, it has over 40 billion USDT on it, more than Ethereum.

Another potential reason for the growth is mistrust in banks. The fact that USDT’s market cap soared faster than ever in the 2 weeks following the collapse of SVB doesn’t seem like a coincidence. Perhaps investors are simply moving their cash from banks to stablecoins like USDT but don’t want to invest in volatile cryptos like Bitcoin or Ethereum.

A third potential cause of the growth is fraud. Tether has long been criticized for its severe lack of transparency in its reserves and was even caught (allegedly) lying to the community about its reserves for years.

The Commodity Futures Trading Commission (CFTC) fined Tether and an affiliated company Bitfinex $42 million for allegedly lying about its backing.

It claimed for years on its website that “Every tether is always backed 1-to-1, by traditional currency held in our reserves.” It was revealed by subsequent investigations by the New York Attorney General and the CFTC that this was patently false.

Tether’s executives have (allegedly) lied about other important matters as well, including denying that the 2 companies were controlled by the same people. The Paradise Papers leak of 2017 revealed that this was not true.

These are only a few of the sketchy scandals that surround Tether, yet the stablecoin grows in market capitalization almost every single day.

Related Articles:

10+ Best Altcoins to Invest in 2023 – Which New Altcoins to Buy?

How Can We Maximize the Effects of Climate Activism? This Web3 Project Has the Answer

Wall Street Memes (WSM) - Newest Meme Coin

- Community of 1 Million Followers

- Experienced NFT Project Founders

- Listed On OKX

- Staking Rewards