As June nears its end, summer has officially arrived.

That means crypto investors are asking, as they have been ever since Decentralized Finance (DeFi) burst into the crypto mainstream back in the summer of 2020, are we on the cusp of another “DeFi summer”?

DeFi is an alternative financial system that relies on blockchain technology, smart contracts, and decentralized applications (dApps) to provide financial services in an open and transparent manner and without the need to rely on trusted intermediaries.

The summer of 2020 saw an explosion of interest and investment in the nascent multi-chain DeFi ecosystem.

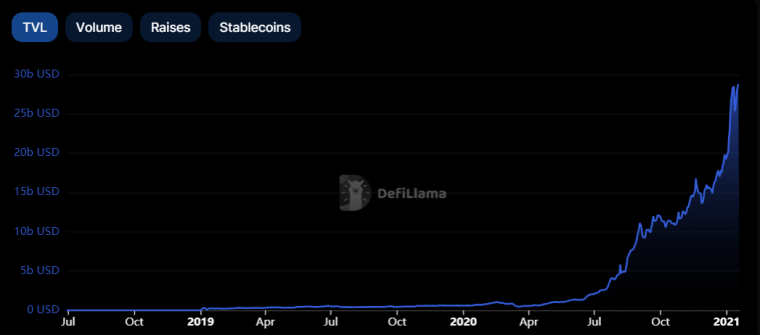

According to DeFi Llama, the trade value locked (TVL) across all major smart-contract-enabled blockchains rose 5x from around $2 billion to over $10 billion during summer 2020, before continuing to fly higher in 2021.

TVL refers to the dollar value of crypto locked in dApp smart contracts.

As summer 2023 gets underway, the broader DeFi ecosystem remains stuck in the doldrums.

TVL across major chains has remained stuck under $100 billion ever since last May’s spectacular collapse of the Ponzi-esque Terra blockchain’s DeFi ecosystem.

While major crypto industry failures such as the Terra collapse and FTX implosion last November are now long in the rear-view mirror, a return of the kind of optimism we saw towards DeFi in 2020 this summer seems unlikely.

Here are two key reasons why.

The SEC is on the Attack

One major uncertainty faced by the Decentralized Finance industry is the aggressive and litigious US Securities and Exchange Commission (SEC).

The SEC has been peppering the US crypto industry with lawsuits this year as it attempts to bring the industry into compliance.

So far, the focus has been on centralized crypto firms, with the most recent major lawsuits being unveiled against Binance and Coinbase.

But many expect DeFi to soon be in the firing line – though DeFi is borderless, protocols still offer services to the general public in the US, meaning they can find themselves in the SEC firing line.

The SEC has already named a number of top smart-contract-enabled blockchain-powering cryptocurrencies (like Polygon, Solana, BNB, Cosmos and Cardano) as securities.

The threat that these cryptocurrencies could face tougher US regulations has cast a shadow over their budding DeFi ecosystems.

While Ethereum, the dominant DeFi blockchain, has not yet been officially labeled as a security by the agency, the SEC Chairman Gary Gensler has in the past said he views it as a security.

Another attack vector for the SEC could also be to go over major USD stablecoins like USDT and USDC, which form the lifeblood of the DeFi ecosystem.

US regulatory uncertainty could act as a continued deterrent to crypto-interested investors, who may prefer US regulation-proof crypto investments like bitcoin, which the SEC has explicitly says it does not view as a security.

Yields in TradFi Are High and Rising

Unlike during the summer of 2020, the yields that investors can easily get by investing in traditional finance (TradFi) asset classes such as US government bonds are high in the summer of 2023, and may continue to rise.

In early 2020, central banks around the world cut interest rates aggressively to support the economy in wake of lockdowns as a result of the Covid-19 pandemic.

Government bond yields and deposit rates at banks collapsed.

Conversely, we arrive into the summer of 2023 after more than a year of aggressive interest rate hikes from the world’s major central banks like the Fed, BoE and ECB, all of whom have been trying to get a handle on rampant inflation.

Yields on government bonds and bank deposits are significantly higher than in 2020 and could yet go higher as central banks pledge further rate rises.

For example, if an investor is to buy US 2-year bonds and hold them to maturity right now, they will get a 4.7% annual return.

This time in 2020, the return on a 2-year yield held to maturity was under 0.2%.

One of the big driver of the 2020 DeFi summer was investors hunting for better yield opportunities.

Given attractive risk-free yields currently on offer in the TradFi market, the incentive to hunt for DeFi yields is much less.

Related Articles

- Decentralized Finance (DeFi) In A Nutshell

- What is DeFi Crypto? Beginners Guide for 2022

- 10 Best DeFi Wallets for June 2023

Wall Street Memes (WSM) - Newest Meme Coin

- Community of 1 Million Followers

- Experienced NFT Project Founders

- Listed On OKX

- Staking Rewards