Aided by two self-proclaimed “crypto punks” – Chase Herro and Zachary Folkman – Donald Trump has launched a new crypto venture called World Liberty Financial.

Just a week ago, he hosted a livestream with two characters relatively unknown in the crypto space and media outlets have already started to investigate their backgrounds and track record in the business field.

These two 39-year-old entrepreneurs have taken the lead in the project and are assisting Trump’s latest pivot to become a pro-crypto character and presidential candidate just three years after he referred to blockchain tech and digital assets as “a scam.”

Herro commonly refers to himself as a rags-to-riches kind of entrepreneur. He has been convicted of theft and possession of marijuana and spent a brief time in jail for his misdeeds. He admittedly fled California as a fugitive although his offenses were primarily misdemeanors.

However, when it comes to the financial aspect of his life, he has faced several challenges including car repossessions and tax liens. Despite these setbacks, he managed to make his first million after discovering and studying social media marketing.

Meanwhile, Folkman started his entrepreneurial journey with a business called Date Hotter Girls – a seminar where he taught other men how to approach and pick up girls at bars. “You’re going to be ripping their clothes off and throwing them up against the wall,” he claimed at one of his courses.

Like Herro, he experienced difficulties with his personal finances that included being sued by American Express for owing over $70,000 in unpaid credit card bills along with a large pending tax bill in the state of California.

Two Entrepreneurs with Little Track Record to Show are Leading WLF

Herro and Folkman have formed at least 17 companies according to an investigation by The New York Times published this week. They typically domicile these businesses in the US Virgin Islands and Puerto Rico and most of their ventures are associated with social media marketing and get-rich-quick hustles in the crypto and ecommerce spaces.

The Nexus Group, a social media advertising business, and Subify, a subscription-based platform for online creators, were some of their most prominent businesses. However, the two faced legal challenges and are currently inactive.

In their place of residence, the US Virgin Islands, they were hit with lawsuits from property owners who claimed that they were owed over $36,000 in unpaid rent and $75,000 in damages.

Moreover, they were involved in a defunct crypto project called Dough Finance that faced a massive hack in July 2023 that resulted in the loss of $2 million from its users. Herro was also a supporter of the demised crypto project Terra Labs, whose native crypto asset LUNA and UST stablecoin collapsed and produced billions in losses for investors.

Trump Could Be Using WLF to Help His Son Barron Pursuit His Crypto Ambitions

The connection between Trump and the Herro-Folkman was the result of an introduction by the real estate mogul Steve Witkoff, who is a close friend of the former president. Despite his limited crypto knowledge, he believed that the two entrepreneurs had something interesting to bring to the table.

World Liberty Financial is reportedly a decentralized finance (DeFi) project that will facilitate borrowing and lending for individuals outside of the United States and US-based accredited investors.

However, details about how the platform will work are scarce. Curiously, Donald Trump’s youngest son, 18-year-old Barron, has been described in the project’s bio as the “visionary” behind WLF. It’s difficult to tell if this is true as rich and successful parents often slap their kids’ names on their own projects to get them started young (like star rapper DJ Khaled naming his toddler son as an executive producer on his album). But we know for certain that Barron has been interested in crypto for at least a little while now.

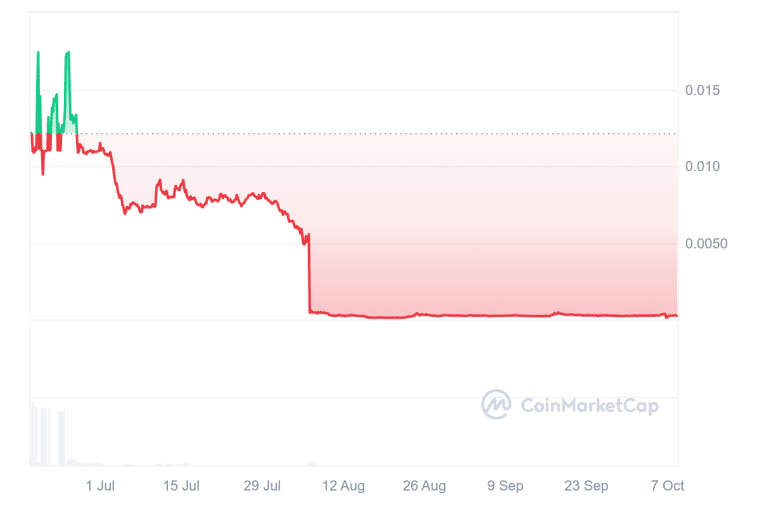

Barron has been tied, although not officially, with a collapsed meme coin named TrumpCoin (DJT) that was promoted a few months ago as the official cryptocurrency of Donald Trump. The value of the DJT token declined by over 90% just days before Barron’s older brothers – Donald Jr. and Eric – started to tease WLF.

The timing is quite curious and some speculate that launching WLF is a move aimed at protecting Barron from getting involved in shady crypto projects that could get him into legal trouble and could taint the reputation of his father (if that ship hasn’t already sailed).

If this theory is correct, Herro and Folkman would be assisting Barron in realizing his “vision” for the project by taking care of the technical side of the business.

Detractors of WLF and its value proposition include John Reed Stark, a former senior official of the US Securities and Exchange Commission (SEC) who deemed it a “bunch of nonsense, and a terrible opportunity for investors.”

The truth is that WLF brings nothing new to the DeFi space apart from the endorsement of high-profile political figures and the billions of dollars that the Trump organization has at its disposal (though they may not spend much on the project).

Borrowing and lending platforms already exist in this space – many of which are already successful and trusted by the crypto community. Moreover, Trump, his sons, Herro, Folkman, Witkoff, and Barron have zero experience with crypto projects.

Although Trump could use his popularity to lure users to give WLF a try, the success of the platform will primarily depend on how user-friendly it is. Moreover, the project is only available to accredited investors in the US, which dramatically narrows down the audience that it can serve to individuals with high incomes or a net worth exceeding $1 million.

Trump’s Involvement with Business Projects Raises Ethical Questions

Trump’s involvement in World Liberty Financial raises serious questions about potential conflicts of interest. If he is elected president, Trump would be in a position to influence regulations that could determine the success or failure of his crypto venture.

This situation is part of a broader pattern of Trump mixing his personal finances with his political ambitions, as seen with his social media platform Truth Social and various branded products tied to his campaign themes. Even worse, his campaign has spent more than $28 million on businesses that Trump himself owns like his resorts and even a business that he set up to operate his own jet, which he pays out of the campaign’s coffers. In effect, Trump is dumping tens of millions of dollars in campaign cash into his own pockets. He doesn’t even really seem to need to hide any of these sketchy operations, likely because he understands that campaign finance law in the US is little more than a joke.

The timing of World Liberty Financial, just weeks before the election, appears to be an attempt to appeal to cryptocurrency enthusiasts, who tend to be young individuals (who often don’t vote in large numbers). Trump has made other moves to court this demographic including the use of Bitcoin (BTC) to pay for hamburgers and Diet Cokes during a campaign stop in Greenwich Village.

The project also marks a significant shift in Trump’s views about the crypto space. His evolution from crypto skeptic to advocate raises questions about the sincerity of his position and the potential influence of his business interests on his policy decisions.

WLF Caters to a Small Audience of Wealthy Individuals in The US

Trump has shielded World Liberty Financial from being scrutinized any further by allowing only accredited investors to access the platform in the US These individuals are typically considered financially savvy and well aware of the risks of exposing their money to these kinds of ventures.

However, it is unclear why he is taking such a risky step that could end up hurting his image in the public’s eye with so little to gain in a heavily competed space where he (and his partners) have little to no experience at all.

Herro and Folkman’s backgrounds, marked by legal troubles, unpaid debts, and questionable business practices also cast doubt on the venture’s credibility and potential success.

As the 2024 election approaches, Trump’s business interests and political ambitions will likely be a talking point for Democrats who could exploit this intersection to portray Trump as a candidate with questionable ethics.