Bitcoin bull signals abound when one looks at Bitcoin over longer-term time frames rather than shorter-term. Bitcoin was not created with the ultimate goal of enriching traders; the store of value component that Bitcoin offers to holders means that it is better suited to long-term investing and savings rather than short-term speculation.

Bitcoin Bull Plan B touts his S2F Model

Plan B’s stock to flow model shows the relationship between the stock to flow of Bitcoin and the price.

Currently, just like the Rainbow Model for charting Bitcoin’s future price on a logarithmic scale, the model shows Bitcoin to be in a very attractive price territory, with signs that the price could has a lot of potential room to grow as it becomes scarcer.

With Bitcoin’s current emission rate, it is about as inflationary as gold, with a stock to flow of about 50 (meaning that the existing stockpile is about 50x the new inflow, and the inflation rate at about 2%).

After the next halving, Bitcoin’s inflation rate will be cut in half, meaning that its stock to flow will rise 100 and the inflation rate fall to 1%.

This puts Bitcoin on a par with real estate, which also is able to maintain its value because the inflation rate of real estate is so low: the supply is existing houses is far larger than the supply of new houses that are built each year.

This represents a monumental shift for asset allocators, as Bitcoin continues on its journey to become the scarcest asset on the planet.

Despite not being entirely accurate in all of his predictions in the last bull market, Plan B has maintained that he still holds a high degree of confidence in his models and based on his models is currently making further investments into Bitcoin.

My first bitcoin investment was in 2015 at ~$400 (yellow circle). Most people said bitcoin was dead.

My 2nd investment was in 2018 at ~$4000 when I published the S2F model. Most people said bitcoin was dead.

My 3rd investment is now at ~$20,000. Most people say bitcoin is dead. pic.twitter.com/oUWppoJgxo

— PlanB (@100trillionUSD) October 2, 2022

Bitcoin bull market may resume in 2024

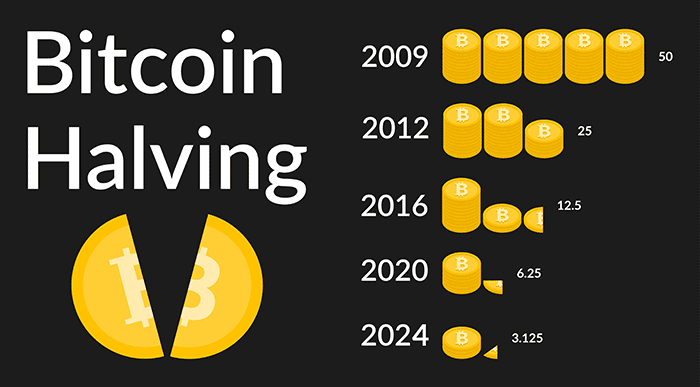

Bitcoin cycles typically operate in four year cycles around the Bitcoin halving.

Every four years, thanks to the halving, the Bitcoin block reward is cut in half. At Bitcoin’s current rate of emission, there are 6.25 Bitcoin rewarded to miners per block.

After the next halving, the Bitcoin rewards per block to miners will fall to 3.125, as the inflation rate.

The next Bitcoin halving is in 2024, and traditionally bull markets have gone into full swing a few months after the halving starts.

If this time is the same, then one could reasonably expect a Bitcoin bull market to resume in 2024.

However, it is worth noting that all previous Bitcoin bull markets occurred within a larger macroeconomic context that was bullish: since 2008, the SPY and the FTSE have risen significantly. Now, the situation is not so certain: countries around the world are now in a recession and forced to reckon with devaluing fiat currencies and weakening stock markets.

Trading as a “risk on” asset with a relatively high degree of correlation to the stock market, this could prove problematic for assets like Bitcoin.

Investors may look to Bitcoin as an inflation hedge

People around the world are currently suffering from the devaluation of currencies thanks to the profligate spending on central banks around the world combined with supply chains disruptions and a declining economy.

Over the past year currencies have collapsed against the dollar:

CAD -8%, CNY -9%, AUD -11%, ZAR -17%, KRW -18%, EUR -18%, PLN -21%, GBP -22%, JPY -23%, TRY -52%

Over the past four years the dollar has collapsed -67% against #bitcoin.

— Michael Saylor⚡️ (@saylor) September 26, 2022

Since fiat currencies aren’t scarce compared with an asset that has a fixed supply, and since Bitcoin has plenty of room to grow and become more adopted, the history of money shows us that Bitcoin will appreciate in value and importance over the coming years.

Macroeconomic investor Dan Tubb has spoken about the phenomenon of the importance of liquidity flows rather than market fundamentals in such an entropic political environment and a society that is so indebted.

Speaking on a recent Monero podcast, he voiced his belief that politicians and central banks have three options:

- They can raise interest rates to extremely high levels and keep them there for a decade.

- They can default on their debt.

- They can inflate the currency.

He believes that the first option is not politically viable as it could cause a sharp return to the late 1970s, except that the high rates of leverage and debt in the system would mean that the situation could be far worse.

Principally, he doesn’t believe that an electorate would ever vote for a politician or political party that wanted to adopt a strategy of impoverishing a society for over a decade in order to be fiscally responsible. He adds that it may have been possible to have gone a different path during the 1989 recession, but that past that point it has become increasingly difficult as the “can is kicked down the road”, and that after 2008 it would be nigh on impossible.

He ascertains the second option to also be unlikely given that in a debt-based system, foreign debt reserves are extremely important and act as the foundation for fiat currency itself.

To completely default on one’s debt would be a catastrophe for a government which, completely bankrupt, would mean that society would likely fall into decline and disorder very quickly.

The third option, and the one that he believes is most likely to win support in elections, is to inflate the currency away.

He stresses that this isn’t such a good option, but that it is the most likely to come to pass, regardless of the ways in which inequality would be exacerbated.

In such an environment, as with the coronavirus period, “risk on” assets would trade very well, since currencies are being devalued so quickly.

Compared to buying the S&P 500, Bitcoin is viewed by many as a “risk on” asset, and its scarcity should mean that it ought to perform extremely well in such times.

Tamadoge - The Play to Earn Dogecoin

- '10x - 50x Potential' - CNBC Report

- Deflationary, Low Supply - 2 Billion

- Listed on Bybit, OKX, Bitmart, LBank, MEXC, Uniswap

- Move to Earn, Metaverse Integration on Roadmap

- NFT Doge Pets - Potential for Mass Adoption