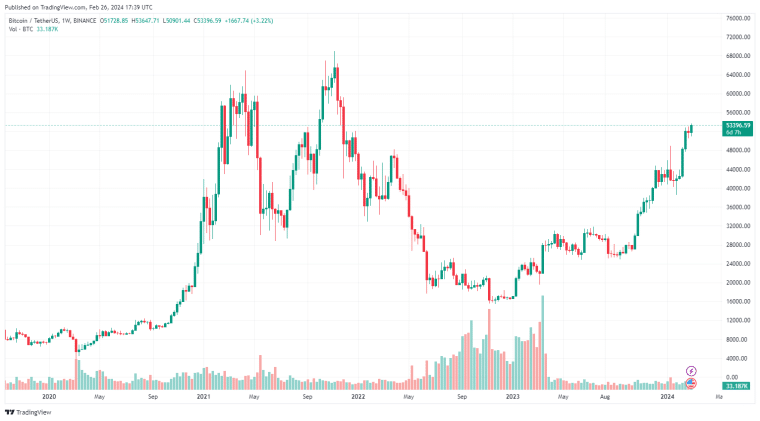

At the moment, bullish traders are quite pleased with Bitcoin crossing over $54,000 this afternoon. But leveraged Bitcoin traders (and other crypto traders) may be in for a rude awakening. A lesser-known metric is flashing a warning sign that could spell doom for them and the market overall.

The correlation between Bitcoin futures, options volatility, and the potential for a leverage flushout is raising eyebrows among market veterans and speculators alike.

Unpacking the BTC Indicator: A Prelude to Bitcoin Market Correction

The heart of the warning lies in the ratio that measures the annualized spread between prices for one-month futures and prices in spot markets against the expected volatility indicated by options. This sounds extremely complicated but it’s actually rather simple.

When this metric is high, it usually indicates that spot and leverage trades are not aligning with futures trades and anticipated volatility. For instance, spot Bitcoin prices are around $54,400 right now, while the latest one-month Bitcoin futures quote was just over $55k according to CME. Due to expected significant volatility (in either direction), these two prices are not in sync.

Warnings from the ratio, which has more than doubled to around 0.34 this year, is according to data tracked by crypto structuring and trading solutions firm STS Digital.

This significant uptick suggests an accumulation of speculative and disconnected leverage within the market, a condition that often precedes a dramatic pullback.

Jeff Anderson, a senior trader at STS Digital, shed light on this development which stems directly from Bitcoin’s recent gains.

“When the implied yield basis is large relative to the underlying volatility, it signifies outsized levels of leverage and speculation,” said Anderson.

“This speculative build-up, while indicative of heightened market activity, could pave the way for a leverage washout, where forced closures of leverage positions due to margin shortages may precipitate a sharp price decline.”

Some traders, like the popular influencer “Keyboard Monkey,” hope that the washout that this metric seems to predict already happened but no one knows for sure what is in store for the crypto community (as always).

What if those nukes today in alts/ crypto were the leverage washout in everything and now we can have fun again? Would be nice wouldn't it.

Don't want to overtrade now though and want to pick your spots and stay disciplined.

— Keyboard Monkey -KBM- (@KeyboardMonkey3) January 3, 2024

A Tightrope Walk: The Speculative BTC Bubble and Its Implications

Bitcoin’s price trajectory this year, with an impressive rally to nearly $54k, has been buoyed by the enthusiasm surrounding US-based spot exchange-traded funds (ETFs).

However, this uptrend is accompanied by a double-edged sword of speculative excess, highlighted by the slowed inflows last week, with 10 ETFs attracting a mere 500 BTC.

The market might be on the edge of a speculative bubble that, if it bursts, could result in big losses for those trapped in leverage. Even issues not linked to cryptocurrency could trigger a major correction. For instance, if the AI and tech bubble supported by the magnificent 7 (or now the magnificent 6 since Tesla isn’t doing well) stocks, particularly Nvidia.

The dynamic interplay between futures basis and options-induced volatility, as observed in the latter halves of 2023, resulted in enhanced daily price fluctuations, drawing attention to the precariousness of current market conditions.

The Waiting Game: Bitcoin’s Consolidation Phase

Amidst this backdrop of speculative fervor, Bitcoin has been navigating through a phase of consolidation. It finally broke up after prices oscillated between $50,500 and $53,500 for weeks.

This consolidation is more than a mere pause; it represents a build-up of market energy, potentially priming for a breakout that could manifest in large directional moves.

“BTC is currently in a negative gamma profile range, but spot prices seem to be stuck between the $50k-$52k range, we really need to see a move out of there for any momentum to come in,” emphasised Greg Magadini, head of derivatives at Amberdata.

This consolidation, coupled with the negative gamma situation where options market makers amplify the price trend, sets the stage for a volatile breakout.

The direction of this impending move remains to be seen, but the current market indicators suggest that traders should brace for significant volatility.

The Bottom Line: What Lies Ahead for Bitcoin Markets

A confluence of speculative leverage, market consolidation, and the looming potential for a leverage washout presents both challenges and opportunities for Bitcoin traders.

With the Bitcoin market at a critical juncture, and speculative leverage reaching levels that could precipitate a market correction, traders and investors alike are advised to tread carefully. Keeping a close eye on market indicators that hint at the future direction of Bitcoin’s price may certainly help but it’s important to do your own thorough research before making any trades or investment decisions.

As the narrative unfolds, the crypto community must prepare for the possibility of a leverage washout, a scenario that underscores the inherent risks and rewards of trading in the volatile world of cryptocurrency.