The crypto community is waiting with bated breath, hoping that the US Securities and Exchange Commission (SEC) decides to approve pending applications for spot Ethereum ETFs. Unfortunately, the SEC has recently delayed its decision on multiple applications for these ETFs.

Two major players, Grayscale Investments and BlackRock, are at the forefront, eagerly awaiting the SEC’s decision on their respective applications.

In this article, we break down the nuances of the situation, examining the SEC’s historical hesitance, application deadlines, and the broader implications for the entire cryptocurrency industry.

When Can We Expect a Decision on ETH ETFs?

Historically, the SEC has shown reluctance in approving spot crypto ETF products. This trend continued until the recent approval of 11 spot Bitcoin ETFs in January. It only approved spot Bitcoin ETFs after the courts forced it to make a decision by mid-January.

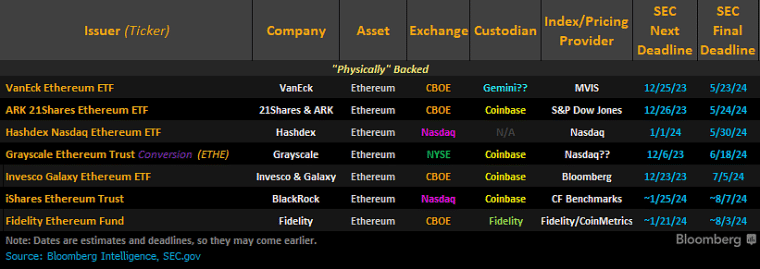

Most of the same institutions that were allowed to launch spot Bitcoin ETFs are also applying to open spot Ethereum ETFs. Despite the similarity between the 2 products, they will have to wait for the SEC to approve or deny their applications.

It’s technically possible that the SEC will approve all of them today, although that is quite unlikely as it has a few months before any of the applications reach their final deadlines. We do know that they must make their decision by the 5th of May, the first final deadline.

The SEC could still make its decision earlier, but judging by its extreme reluctance to make a decision on the Bitcoin ETFs, it seems likely that it will wait until the final hour.

Grayscale and BlackRock’s Ethereum ETF Proposals

Grayscale Investments, known for its Ethereum trust product (ETHE), seeks to transform it into an ETF, similarly, BlackRock has applied for an analogous ETF.

The SEC’s delay in these decisions reflects its continued cautious approach towards cryptocurrency ETFs, despite having recently approved spot Bitcoin ETFs.

Furthermore, the SEC’s request for public input on specific concerns, including Ethereum’s proof of stake consensus mechanism and susceptibility to fraud and manipulation, underscores the regulator’s meticulous evaluation process. However, critics of the SEC’s approach argue that it’s simply looking for excuses to deny the applications.

What Are the SEC’s Reservations About Spot Ethereum ETFs?

The SEC’s review process for Ethereum ETFs mirrors the path taken for Bitcoin ETFs. The regulator has raised queries about market manipulation, the correlation between spot and futures markets, and the size of the CME futures market for Ethereum.

These questions highlight the SEC’s reservations about spot Ethereum ETFs. They also signal key issues with further institutional acceptance of digital assets because many of these factors are present in nearly every other cryptocurrency.

Some analysts argue that the approval of spot Bitcoin ETFs will spark a wave of crypto products like other spot ETFs but even if Ethereum is approved, the buck may stop there. Bitcoin and Ethereum are by far the largest cryptocurrencies, making them more resistant to market manipulation than smaller assets.

However, this piece of the SEC’s argument doesn’t make a ton of sense, at least from the surface. There are plenty of stocks that are much smaller than Ethereum and other top cryptocurrencies that would be drastically easier to manipulate.

Despite the SEC’s hesitance, industry optimists predict spot Ethereum ETFs being approved as early as this summer.

This positive outlook is based on the SEC’s forthcoming decision, which could further clarify Ethereum’s status as a non-security. Such a clarification would pave the way for spot Ethereum ETFs, setting a new precedent for the crypto industry.

Binance’s Regulatory Challenges and Crypto’s Mainstream Future

The SEC’s ongoing trial involving Binance is another factor that the crypto community should be keeping a close eye on as it could provide clarity on Ethereum’s status under securities law.

This trial, particularly concerning the classification of certain coins and tokens as securities, could be a defining moment in the SEC’s approach towards Ethereum and digital assets as a whole.

Binance’s current regulatory challenges reflect a global trend of increasing scrutiny from regulators and banks alike.

This heightened attention towards crypto exchanges, primarily focused on risks like money laundering and the sale of unregistered securities, suggests a shift towards a more regulated and mainstream future for cryptocurrencies.

The outcome of Binance’s situation could significantly influence the landscape of crypto regulation and acceptance.

What’s Next?

The SEC is currently open to public comments regarding the pending Ethereum ETF applications, giving those in favor of these products a chance to be heard. The commission might not take any of these comments to heart but they couldn’t hurt.

Beyond that, there isn’t much that any of us can do while we await the monumental decision that is likely to change the trajectory of the cryptocurrency market forever. We will just have to sit and wait until May 5th and hope that the SEC makes the right decision.