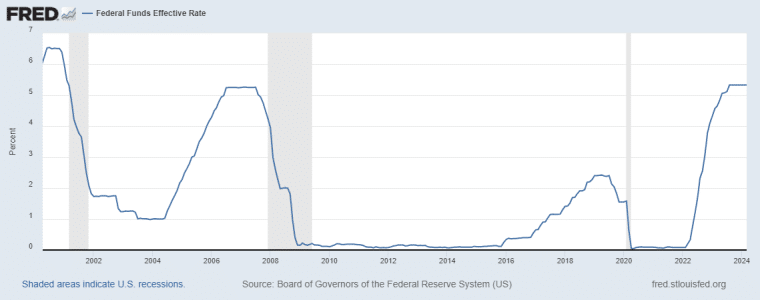

US Federal Reserve news remains a central topic in the market as the central bank’s interest rate decisions continue to send ripples across all asset classes, notably cryptocurrencies. This analysis delves into the intricate relationship between the Fed’s monetary policies and the volatile crypto market, offering insights into past Fed crypto trends, current scenarios, and future prospects.

The dance between Federal Reserve interest rate adjustments and cryptocurrency valuations is not new.

Historically, there’s a palpable tension: borrowing costs climb when the Fed hikes rates to curb inflation, making risk-laden assets like cryptocurrencies less attractive.

Conversely, rate cuts tend to breathe life into the crypto market and other high-risk assets as investors chase greater yields in riskier assets.

This is because low-risk assets like bonds and treasuries are much less attractive. It also helps that debt is much cheaper, allowing vastly greater leverage with minimal interest costs.

Higher-risk assets generally offer greater risk-adjusted returns in these times.

Rewinding to the not-so-distant past, we observed this dynamic in action during the 2018 rate hikes under Chair Janet Yellen. Bitcoin experienced a stark decline along with the stock market, showcasing the crypto market’s sensitivity to interest rate adjustments.

Fast forward to the 2021 bull run, ultra-low rates amidst the pandemic catalyzed a monumental bull run for Bitcoin and the rest of the crypto market, only to face a painful correction as the Fed signaled a hawkish pivot.

Key Highlights: Crypto Bull Market 2024

- Bitcoin Halving: The upcoming Bitcoin halving in April 2024 is widely expected to kickstart a new bull market, cutting Bitcoin’s block rewards in half and reducing the new supply entering circulation.

- Institutional Adoption: Increased institutional involvement, including ETFs, tokenization of real-world assets (RWA), and traditional financial institutions like Blackrock entering the crypto space, has bolstered investor confidence in long-term growth.

- Regulatory Clarity: Some regions, like the European Union with MiCA (Markets in Crypto-Assets), are offering clearer regulatory guidelines that are likely to attract more institutional and retail investors.

- Macro Factors: The potential for reduced interest rates or dovish Federal Reserve actions may spark increased liquidity in high-risk markets like crypto. Lower interest rates historically attract investors to riskier assets with higher returns, including cryptocurrencies.

- Technological Innovations: Layer 2 solutions (such as Ethereum’s scaling upgrades) and developments in blockchain interoperability are making the space more accessible and efficient, driving further adoption.

- Altcoin Boom: In addition to Bitcoin, analysts predict a rise in altcoins driven by advances in decentralized finance (DeFi), non-fungible tokens (NFTs), and Web3 technologies.

- Market Sentiment: Despite regulatory hurdles in key markets like the U.S., sentiment remains bullish, with many pointing to rising activity in decentralized applications (dApps) and strong on-chain data.

Latest Updates on the Crypto Run

The anticipation around Bitcoin’s 2024 halving has begun to fuel renewed interest in the crypto space, with multiple analysts forecasting a rally akin to past cycles. Institutional players like Blackrock and Fidelity continue to push for crypto ETFs, further legitimizing digital assets.

Additionally, recent economic data from the U.S. showing slower inflation rates has led to speculation that the Federal Reserve could ease monetary policies in late 2024, creating favorable conditions for a potential crypto bull run

Navigating Interest Rates Crypto Dynamic: Fed’s Current Stance and Crypto’s Response

As of now, the Federal Reserve maintains a cautious approach, holding interest rates steady to combat persistent inflation, which remains stubbornly above its 2% target, a sweet spot for the economy.

This decision reflects a strategic delay in anticipated rate cuts, signaling the Fed’s commitment to ensuring inflation is reined in before any monetary loosening occurs.

For the crypto market, this means navigating a landscape where traditional safe-haven assets become more appealing, potentially diverting investment away from riskier digital currencies.

The Fed’s resolve to keep rates elevated could dampen the speculative fervor that often drives crypto market rallies, ushering in a period of increased volatility and uncertainty.

Forecasting the Future: Implications of Prolonged Rate Hikes on Crypto

🌐Market update:

Overall, stocks have been down since the beginning of the week, as well as crypto. There are several relatively clear reasons for this:

◽️ Fed officials emphasized that they do not want to lower interest rates too soon, leading to a change in Fed Fund Futures,… pic.twitter.com/I6NLLyoDM9

— Jukov (@JukovCrypto) April 3, 2024

Looking ahead, the Fed’s future policy moves are a subject of intense speculation. Should the central bank postpone rate cuts further, the crypto market should brace for continued headwinds.

The prospect of enduring high rates would reinforce the appeal of traditional investments over cryptocurrencies, potentially leading to a reallocation of capital away from the digital asset space.

Conversely, any indication of forthcoming rate reductions amid Fed news could reignite enthusiasm in the crypto market, as investors might once again seek out the high-reward profile of digital currencies – especially against a background of a Bitcoin Halving event.

Yet, this optimism is tempered by the acknowledgment that premature rate cuts could reignite inflationary pressures, presenting a nuanced challenge for policymakers.

What to Watch Out For

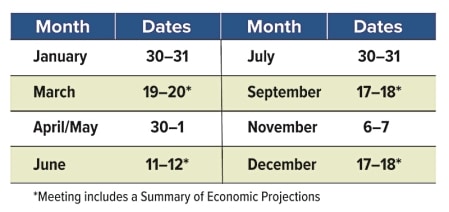

Naturally, if you’re concerned about the effects of Federal Reserve policy on the crypto market (as you probably should be if you own crypto), there are a few metrics and signals to watch out for. First of all, make sure to pay attention to each and every Fed meeting.

They occur each month on a predetermined date with the next set for April 30th to May 1st. You can check out the schedule for the rest of 2024 below.

Inflation statistics are the next most important signal to follow here.

The Fed has been quite clear that they are targeting stable 2% inflation so they likely won’t cut rates until that figure is reached and sustained for some period of time. If inflation continues to stubbornly hover above 2% for months, the Fed will likely continue to push rate cuts. The US Bureau of Labor Statistics releases inflation statistics (specifically consumer price index or CPI) monthly at regular intervals.

The next announcement is planned for April 10th and you can check the rest of the schedule below.

Keep An Eye On Fed Crypto Dynamic

As the Federal Reserve navigates the delicate balance between curbing inflation and fostering economic growth, the crypto market remains a keen observer, sensitive to the slightest shifts in monetary policy.

Investors and enthusiasts alike are advised to stay informed, adopting a vigilant stance as they traverse a financial landscape where traditional and digital asset classes are increasingly intertwined, influenced by the overarching strategies of the world’s most powerful central bank.