The Bitcoin network’s fourth-ever “halving” event was completed on Friday, slashing rewards for miners by 50% in a widely-awaited technical occurrence that highlights the digital asset’s unique monetary policy during a period of high inflation worldwide.

While past halvings have ignited rallies in the price of BTC, this cycle may play out differently as institutional investors are starting to embrace the cryptocurrency through newly approved financial products like Bitcoin ETFs.

Key Takeaways: Bitcoin’s 4th Halving

- Reward Reduction: Bitcoin’s latest halving event cut mining rewards from 6.25 BTC to 3.125 BTC per block, marking another milestone in its deflationary monetary policy.

- Historical Impact: Previous halvings triggered massive price increases in the months following the event, but analysts predict this cycle may differ.

- Institutional Adoption: The rise of Bitcoin ETFs and institutional involvement may reduce the volatility previously seen after halving events.

- Miner Impact: With halved rewards, miners face immediate revenue reductions, which may drive consolidation in the sector.

- Latest Updates: While many expected significant price moves, Bitcoin’s price remained relatively stable following the halving. Experts suggest that institutional adoption may have tempered some volatility, but the market is closely watching for any delayed price effects .

What Is the Bitcoin Halving?

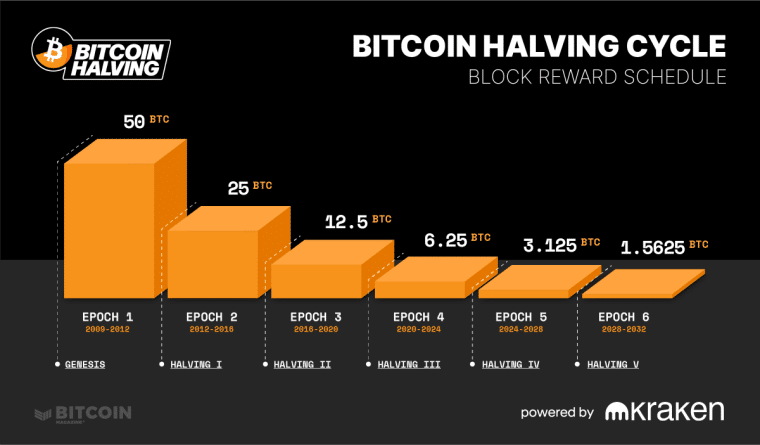

Occurring roughly every four years, the “halving” is a hard-coded adjustment that cuts in half the number of new bitcoins issued as rewards to miners for validating transactions within the Bitcoin blockchain.

This reduction in supply happens systematically, with the latest halving dropping Bitcoin’s issuance rate from 6.25 BTC to 3.125 BTC per block. As per the latest estimates, a new BTC block is minted every 10 minutes or so.

The halving took place at block 840,000 on Friday at around 8:09 pm EST. ViaBTC was the mining pool that completed this block, earning over 40 BTC worth $2.6 million in block rewards and fees – far higher than recent blocks due to users paying premium fees to get into the halving block.

“[The halving is] the backbone of [Bitcoin’s] transparent, predictable monetary policy and makes Bitcoin a provably scarce asset,” said Gabe Parker, an analyst at Galaxy Digital, in regard to the event.

Only around 19.6 million Bitcoin (BTC) out of a maximum supply of 21 million have been mined to date and miners’ rewards will continue to shrink in future halvings until the final Bitcoin block is minted. According to estimates, this could occur in the year 2140. This programmed reduction in supply aims to make BTC more scarce and valuable over time, assuming that demand remains steady or even increases.

The Price Impact of the Halving Remains a Question Mark in This Economic Cycle

Bitcoin has historically followed a basic cyclic trend for over a decade now where it sees unbelievable bull runs soon after the halving, followed by lengthy corrections.

Following the three previous halvings in 2012, 2016, and 2020, Bitcoin prices have shown an upward trend as the digital asset tends to gain momentum in the following years as the rate at which its supply grows slows down.

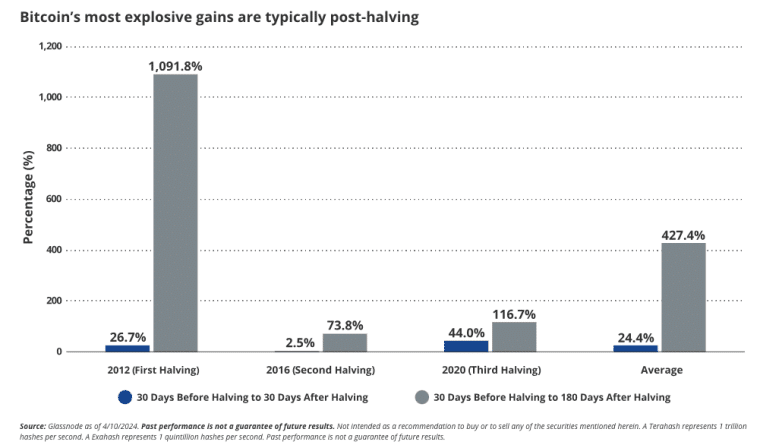

A recent study published by VanEck’s Head of Digital Assets Research, Matthew Sigel, showed that the most explosive gains that BTC has experienced post-halving have occurred in the 30 to 180 days after the technical event is completed.

For example, in 2020, the author notes that the price moved from $6,852, where it was 30 days before the halving, to $14,849 per coin exactly 180 days after the event – a 116.71% gain in just half a year.

However, this cycle’s trajectory may differ as Bitcoin’s price surged to new all-time highs of over $70,000 this year ahead of the halving for the first time. The rally was fueled primarily by rising institutional adoption catalyzed by the launch of spot Bitcoin ETFs in the US. Investors likely looked at Bitcoin’s regular, repeating pattern and decided to invest before the quadrennial bull run.

“With major institutional players now capable of taking exposure through these vehicles, Bitcoin’s response to the upcoming halving may not necessarily mirror its performance in prior cycles”, analysts from Coinbase wrote last month. “Stable demand for the products could lead to less volatility.”

Meanwhile, JPMorgan analysts expect some downside for Bitcoin post-halving as the event is likely “priced in” already, while Deutsche Bank’s team said that it “does not expect prices to increase significantly.”

Moreover, it is worth noting that the global economic landscape was entirely different back in 2020 as top central banks across the world adopted highly accommodative monetary policies to contain the impact of COVID-19 in their respective economies.

“For me, the main difference relative to the most recent halving, the one we had in 2020, is the macro environment.”, Dessislava Aubert from the crypto analytics firm Kaiko told the crypto-focused magazine Decrypt.

The Inflation Hedge Narrative

Despite the possibility of a muted price reaction in the coming months, the halving still provides a powerful symbolic backdrop against the rampant inflation seen across the globe.

“At a time when people are looking at their conventional currencies – inflation, interest rates and the economic environment – they see this alternative form of currency, Bitcoin”, said Thomas Perfumo, head of strategy at crypto exchange Kraken.

He emphasized the symbolism behind Bitcoin’s robust and immutable deflationary structure, which contrasts the rather volatile policies adopted by central banks to react to changes in the economic landscape.

With central banks printing trillions to stimulate economies, the contrast of Bitcoin’s provable scarcity through its hard-coded issuance rate highlights one of the key value propositions touted by crypto advocates.

Meanwhile, Benchmark analyst Mark Palmer believes that the advent of spot ETFs could magnify the impact of this latest supply shock on Bitcoin’s price over the next year.

The Impact on Miners Will Be Almost Immediate

While prices may take time to reflect the halving, the revenue hit to miners who secure the Bitcoin network will be immediate and severe.

Miners who validate transactions by contributing significant computing power are rewarded with newly issued BTC tokens. With that reward pool now cut in half from 6.25 BTC to 3.125 BTC worth around $200,000 as of Friday, miners face a production cost increase that will challenge their profit margins.

Publicly traded miners like Marathon Digital, Riot Blockchain, and others will feel the squeeze unless BTC’s price can rally to offset the drop in mining rewards. Some degree of consolidation in the sector is expected as less efficient miners are forced out.

“Miners with access to inexpensive, reliable power sources are well positioned to navigate the post-halving market dynamics”, said Matthew Galinko, an analyst at Maxim. “Some miners, many that are not public, could exit the market with a combination of poor access to power, efficient machines, and capital.”

The hash rate, which measures the total computing power contributed to mining Bitcoin, could initially drop before recovering in the months after as has happened in past halvings. Meanwhile, more prepared miners may be able to stomach the transition.

“While the prospect of revenues halving overnight every four years is unparalleled in other sectors, the predictable nature of these events allows for strategic preparation,” said Charles Chong, director of strategy at crypto mining firm Foundry. “Overall, the halving necessitates a refinement in operations, which could be construed as bullish in the long term by fostering a more resilient and efficient mining landscape.”

Rising Importance of Transaction Fees

With block rewards now slashed, miners may increasingly rely on transaction fees paid by Bitcoin users to supplement revenues.

This could drive up fees during periods of high network activity.

However, recent developments like Ordinals, which permit the storage of data like digital artworks on satoshis or slivers of bitcoin, have already led to higher fees being paid to miners. Moreover, layer-2 networks like the Lightning Network that batch transactions off-chain before settling on the main Bitcoin blockchain in larger bundles could also boost aggregate fees.

Finally, for HODLers and the crypto faithful, the symbolism may be as powerful as the quantitative supply shock itself.