The bitcoin bull market is alive and well.

Bitcoin has rebounded more than 20% back to the north of the $30,000 in the last two week, bolstered by optimism that the first US spot bitcoin exchange-traded funds (ETFs) might be near, with huge financial institutions BlackRock and now Fidelity having thrown their hats into the ring with applications.

The rebound from earlier monthly lows to the south of $25,000 confirmed that the 2023 uptrend remains strongly intact, with bulls now targeting a move higher to near-term price targets in the mid and upper $30,000s next.

But signals regarding the strength of the bitcoin bull market don’t just come from the cryptocurrency’s impressive price action.

On-chain metrics are also sending strong bullish signals.

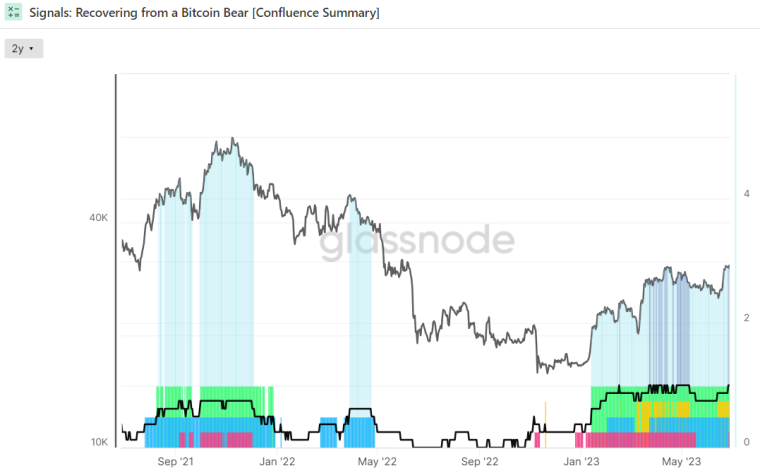

Take on-chain analytics firm Glassnode’s widely followed “Recovering from a Bitcoin Bear” dashboard of eight on-chain and technical indicators.

All eight indicators are currently sending a signal of market strength, which, according to Glassnode, implies a strong probability “that Bitcoin is experiencing a period of relative market strength”.

Suite of On-chain Indicators Hints at Bull Market

Glassnode’s “Recovering from a Bitcoin Bear” dashboard tracks eight indicators to ascertain whether Bitcoin is trading above key pricing models, whether or not network utilization momentum is increasing, whether market profitability is returning and whether the balance of USD-denominated Bitcoin wealth favors the long-term HODLers.

When all eight are flashing green, this has historically been a strong bullish sign for the Bitcoin market.

At the moment, all eight indicators are flashing green.

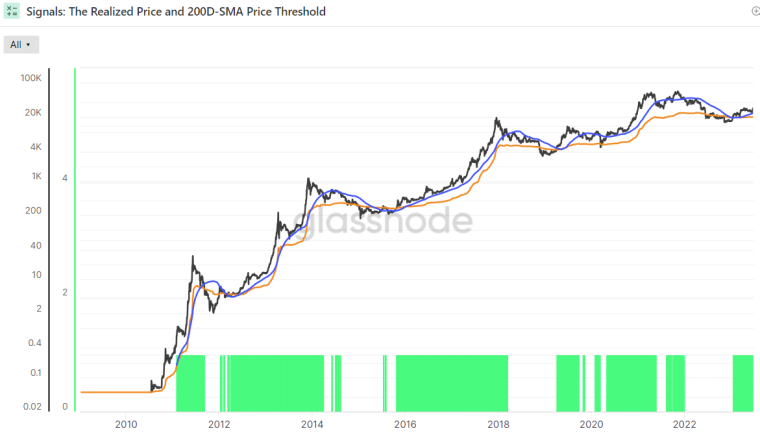

Bitcoin is trading comfortably above its 200DMA and Realized Price, the first two.

A break above these key levels is viewed by many as an indicator that near-term price momentum is shifting in a positive direction.

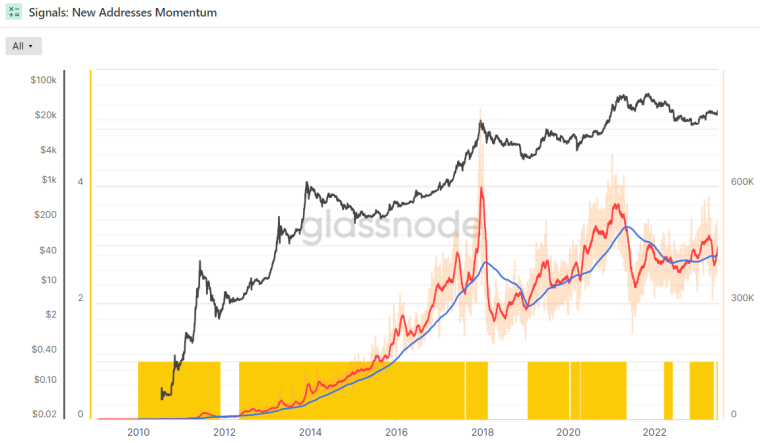

The 30-Day SMA of new Bitcoin address creation moved above its 365-Day SMA a few months ago, a sign that the rate at which new Bitcoin wallets are being created is accelerating. This has historically occurred at the start of bull markets.

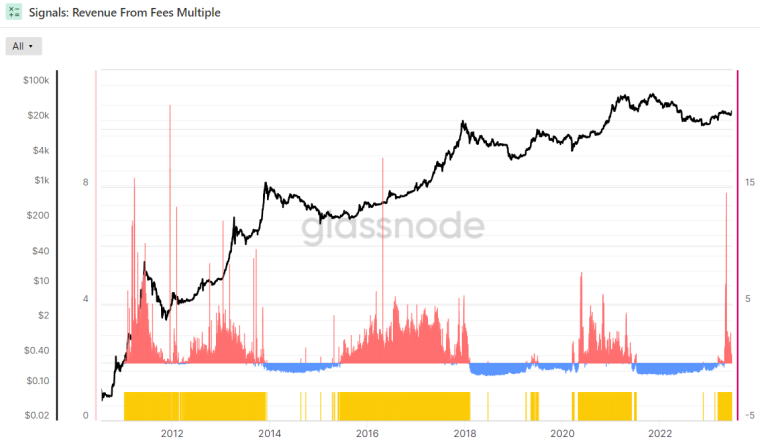

Meanwhile, Revenue From Fees Multiple turned positive a few weeks ago.

The Z-score is the number of standard deviations above or below the mean of a data sample.

In this instance, Glassnode’s Z-score is the number of standard deviations above or below the mean Bitcoin Fee Revenue of the last 2-years.

This means the third and fourth indicators relating to whether network utilization is trending positively once again are also sending a bullish signal.

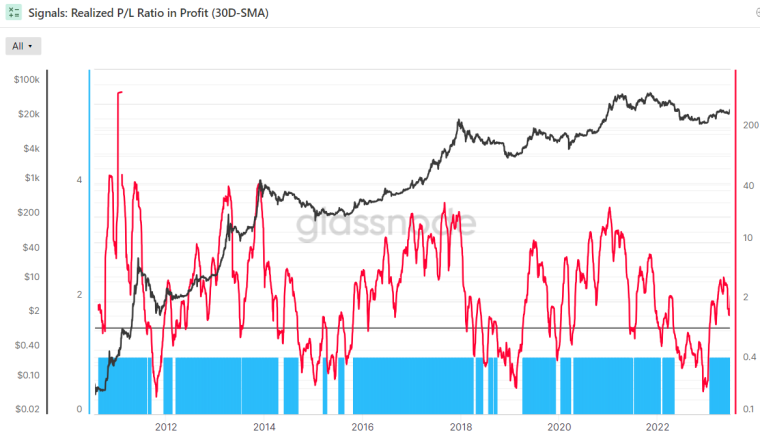

Moving on to the fifth and sixth indicators relating to market profitability, the 30-Day Simple Moving Average (SMA) of the Bitcoin Realized Profit-Loss Ratio (RPLR) indicator above one.

That means that the Bitcoin market is realizing a greater proportion of profits (denominated in USD) than losses.

According to Glassnode, “this generally signifies that sellers with unrealized losses have been exhausted, and a healthier inflow of demand exists to absorb profit taking”.

Hence, this indicator continues to send a bullish signal.

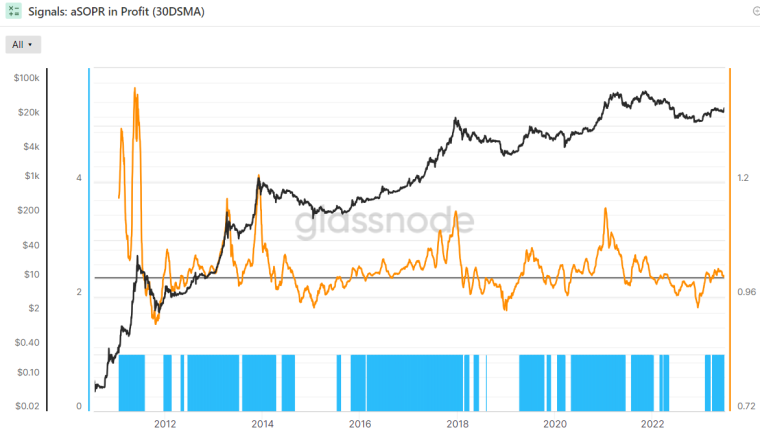

Meanwhile, the 30-day SMA of Bitcoin’s Adjusted Spent Output Profit Ration (aSOPR) indicator, an indicator that reflects the degree of realized profit and loss for all coins moved on-chain is also above one.

That essentially means that, on average over the past 30 days, the market is well in profit.

Looking back over the last eight years of Bitcoin history, the aSOPR rising above 1 after a prolonged spell below it has been a fantastic buy signal.

Finally, there are the final two indicators that relate to whether the balance of USD wealth had sufficiently swung back in favor of the HODLers to signal weak-hand seller exhaustion.

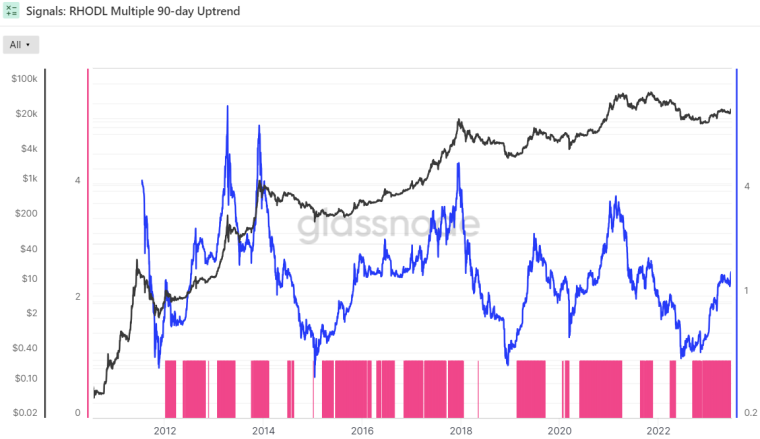

The Bitcoin Realized HODL Multiple has been in an uptrend over the last 90 days, a bullish sign according to Glassnode.

The crypto analytics firm states that “when the RHODL Multiple transitions into an uptrend over a 90-day window, it indicates that USD-denominated wealth is starting to shift back towards new demand inflows”.

It “indicates profits are being taken, the market is capable of absorbing them… (and) that longer-term holders are starting to spend coins” Glassnode states.

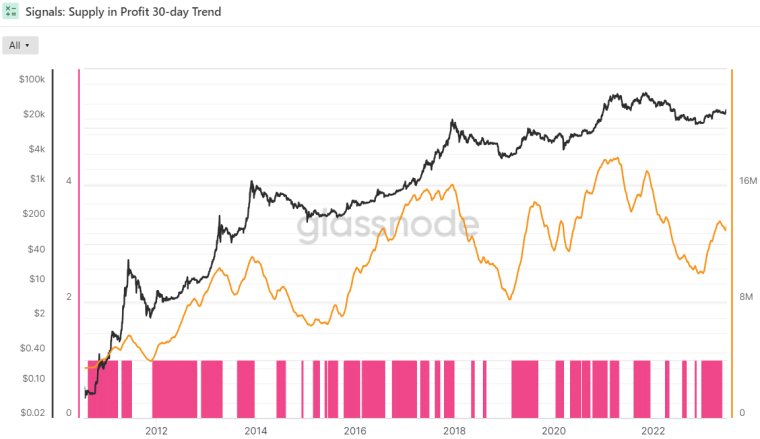

Glassnode’s final indicator in its Recovering from a Bitcoin Bear dashboard is whether or not the 90-day Exponential Moving Average (EMA) of Bitcoin Supply in Profit has been in an uptrend over the last 30 days or not.

Supply in Profit is the number of Bitcoins that last moved when USD-denominated prices were lower than they are right now, implying they were bought for a lower price and the wallet is holding onto a paper profit.

This indicator is also flashing green.

How High Can Bitcoin (BTC) Go?

Analysis of Bitcoin’s longer-term market cycle, which tends to last about four years, suggests Bitcoin could be in the year stages of a potentially three-year-long bull market.

In the past three market cycles, each Bitcoin bear market has lasted for around one year, while each bull market has lasted around three years.

If Bitcoin’s November 2021 (around the time of the record highs) to November 2022 (around the time of the 2022 lows) bear market has concluded, we might now be about six months into a new roughly three-year-long bull market.

The Bitcoin Stock-to-Flow (S2F) model lends itself to the idea that a new bull run is coming in the lead-up to and aftermath of next year’s Bitcoin halving event.

According to the Bitcoin Stock-to-Flow pricing model, the Bitcoin market cycle is roughly four years, which shows an estimated price level based on the number of BTC available in the market relative to the amount being mined each year.

Bitcoin’s fair price right now is around $55K and could rise above $500K in the next post-halving market cycle – that’s around 18.5x gains from current levels.

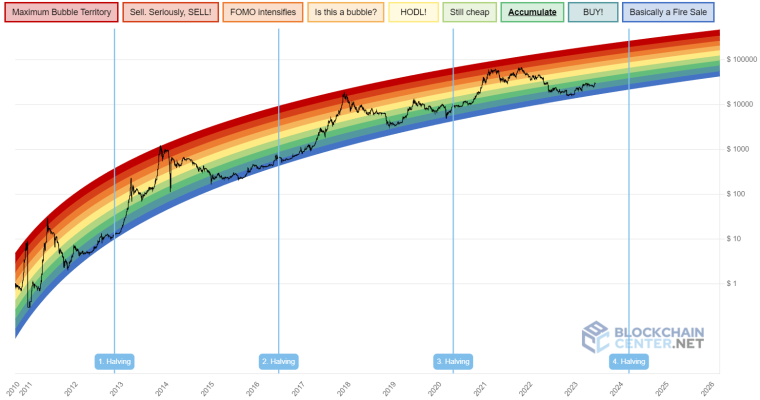

Finally, Blockchaincenter.net’s popular Bitcoin Rainbow Chart shows that, at current levels, Bitcoin is in the “BUY!” zone, having recently recovered from the “Basically a Fire Sale” zone in late 2022.

In other words, the model suggests that Bitcoin is gradually recovering from being highly oversold.

During its last bull run, Bitcoin was able to reach the “Sell. Seriously, SELL!” zone.

If it can repeat this feat in the next post-halving market cycle within one to one and a half years after the next halving, the model suggests a possible Bitcoin price in the $200-$300K region. That’s around 8-13x gains from current levels.

Related Articles

- Bitcoin (BTC) Price Prediction 2023 – 2040

- Bitcoin Closes in on Strong Monthly Gain – Could Things Get Even Better for the BTC Price in July?

- Bitcoin Price Prediction: Institutional Interest Started the Rally But Retail Traders Will Drive the Real Bull Market

Wall Street Memes (WSM) - Newest Meme Coin

- Community of 1 Million Followers

- Experienced NFT Project Founders

- Listed On OKX

- Staking Rewards