The exact composition of reserves backing Tether (USDT), the largest stablecoin in the world, has been a mystery since its inception. USDT falsely claimed for years that it was backed 1 to 1 by cash USD until it was caught by the New York Attorney General Letitia James.

The Tether (USDT) Reserves Controversy

James said that “Tether’s claims that its virtual currency was fully backed by U.S. dollars at all times was a lie. [Tether and Bitfinex] obscured the true risk investors faced and were operated by unlicensed and unregulated individuals and entities dealing in the darkest corners of the financial system.”

She described the situation further saying that because Tether had little or no access to banking since mid-2017: “for periods of time held no reserves to back tethers in circulation at the rate of one dollar for every tether.”

The Attorney General levied a $41 million fine against Tether for the alleged misconduct in a settlement in February 2021. The agreement also required Tether to release a report detailing the current composition of its reserves every quarter.

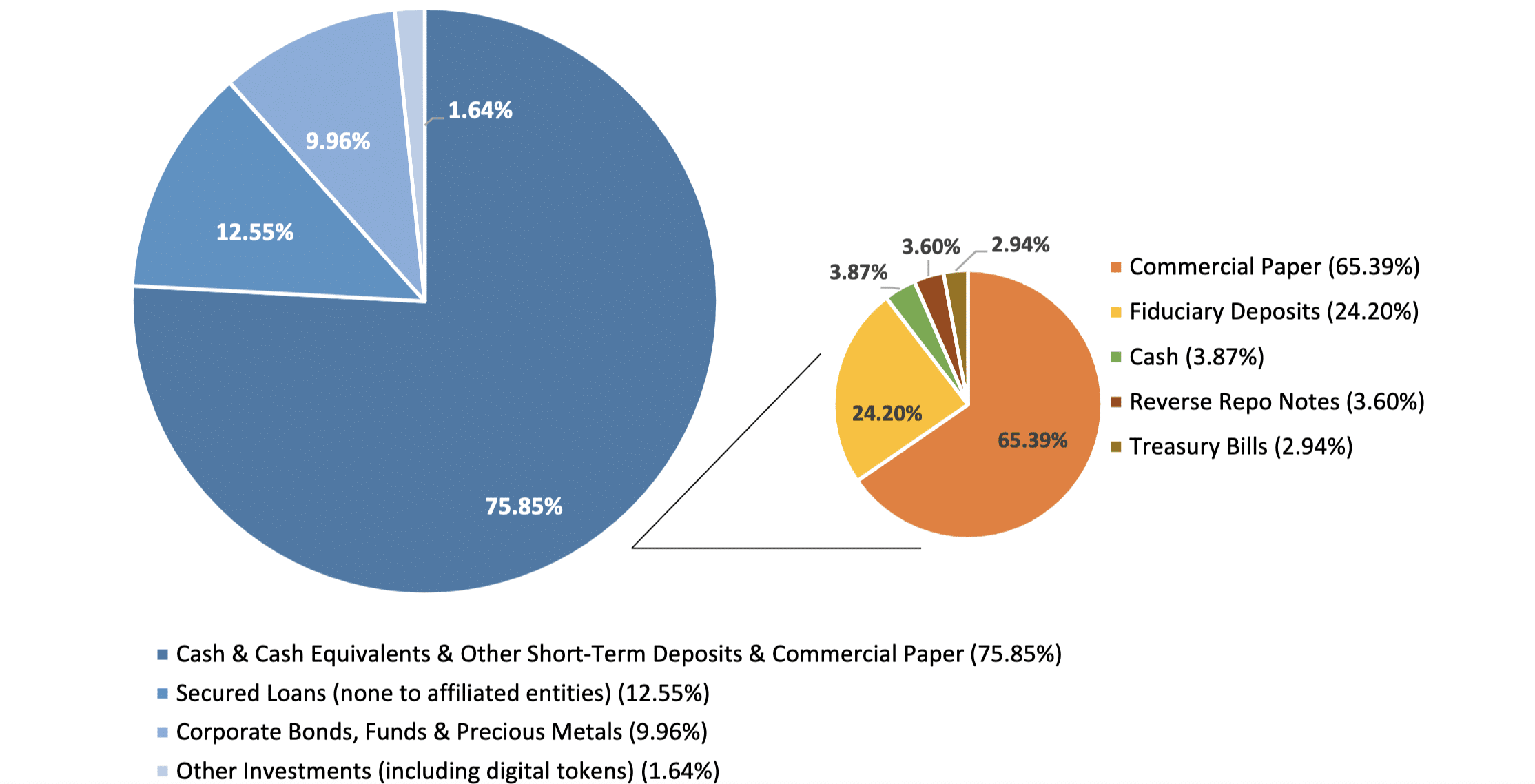

The reports have been an important, never-before-seen look into the shady stablecoin but they are still quite vague. They detail the types of assets held but give little more information.

Even without much specific information, experts immediately started worrying about how sound the reserves were when the first report was released. It showed that 49.59% (65.39% of 75.85%) of the reserves were held in commercial paper.

Commercial paper is a risky short-term, unsecured loan agreement issued by corporations, typically used for meeting short-term liabilities like inventory and payroll. It’s considered risky because it’s not backed by collateral, meaning if the issuer defaults, investors might lose their entire investment.

Commercial paper isn’t always tremendously risky when issued by entrenched, secure businesses. However, when the report was released, Tether didn’t reveal what companies issued the commercial paper making up nearly 50% of its reserves. For all the community knew, it could have been issued by risky crypto companies.

Now we don’t have to wonder.

Freedom of Information Act Request Reveals Tether (USDT) Backing

While we still don’t know the exact composition of the USDT reserves right now, a Freedom of Information Act (FOIA) request by CoinDesk revealed the sources of commercial paper that Tether held in 2021. After a 2-year-long legal battle, Tether eventually capitulated and didn’t appeal the document release under FOIA.

Only two years of legal battle, and we finally know what @Tether_to had in its vaults to back $USDT…

And yes, part of the reserves were commercial papers by Chinese banks, as many had suspected for a while. @nikhileshde doing the work we exist for.https://t.co/Fm0w6lHIOs— Anna Baydakova (@baidakova) June 16, 2023

While much of the commercial paper came from top financial institutions in the west and the Middle East including Qatar National Bank QPSC, Barclays Bank PLC, Deutsche Bank AG, Emirates NBD Bank PJSC and Natwest Group PLC, a large portion came from Chinese banks and institutions.

Surprisingly or not, many of these banks are either completely state-owned or at least state-controlled, despite the government’s anti-cryptocurrency policies.

These Chinese banks all issued commercial paper to Tether: The Agricultural Bank of China Ltd, Bank of China Hong Kong, Bank of Communications Co Ltd, Industrial and Commercial Bank of China, China Merchants Bank, China Construction Bank, China Everbright Bank Co.

You can find the full list of Tether’s commercial paper issuers in 2021 here.

The documents obtained by the FOIA request say that Tether had about $35.5 billion worth of commercial paper from these institutions on March 31, 2021. Tether also claimed that it had another $5.1 billion in its reserves, detailed under “USDT Lending.” Together, this lines up relatively closely with the total outstanding USDT at the time: 40.8 billion.

The revelation that most of Tether’s commercial paper came from top, relatively stable banks and institutions is positive (though the connections to the Chinese government banks are intriguing). The company has long since pivoted away from commercial paper and now holds most of its reserves in US Treasury Bills and Reverse Repurchase Agreements but now also invests in some risky assets like Bitcoin in small amounts.

Related Articles:

Wall Street Memes (WSM) - Newest Meme Coin

- Community of 1 Million Followers

- Experienced NFT Project Founders

- Listed On OKX

- Staking Rewards