Tether (USDT) has had a multitude of scandals over the past few years, making some experts warn of a potential depegging, but almost no one suggests shorting it for a few reasons.

On the surface, USDT may seem like a great asset to short. Its price will likely never rise much above $1, reducing the potential losses of a short position, and a depeg could be quite profitable.

Notably, with the United States Securities and Exchange Commission (SEC) not leaving any stone unturned in its quest to prevent another FTX-like saga, USDT could be walking on eggshells.

There are glaring signs of regulatory pressure and other market forces, including concerns about the stablecoin’s reserves exerting significant pressure on Tether’s health.

What Are Stablecoins?

Stablecoins are a type of cryptocurrency that aim to keep their value stable by pegging it to another asset, such as a fiat currency or a commodity.

Unlike Bitcoin and other volatile cryptocurrencies, stablecoins are designed to be used as a medium of exchange without the risk of losing purchasing power.

However, not all stablecoins are created equal, and some have been accused of lacking transparency and adequate backing.

USDT is the most prominent stablecoin in the world. It claims to be backed one-to-one by U.S. dollars held in reserve. Tether is widely used by crypto traders and investors who want to move in and out of the crypto market quickly and cheaply.

However, Tether has also faced scrutiny from regulators and critics who doubt its claims of full backing and compliance.

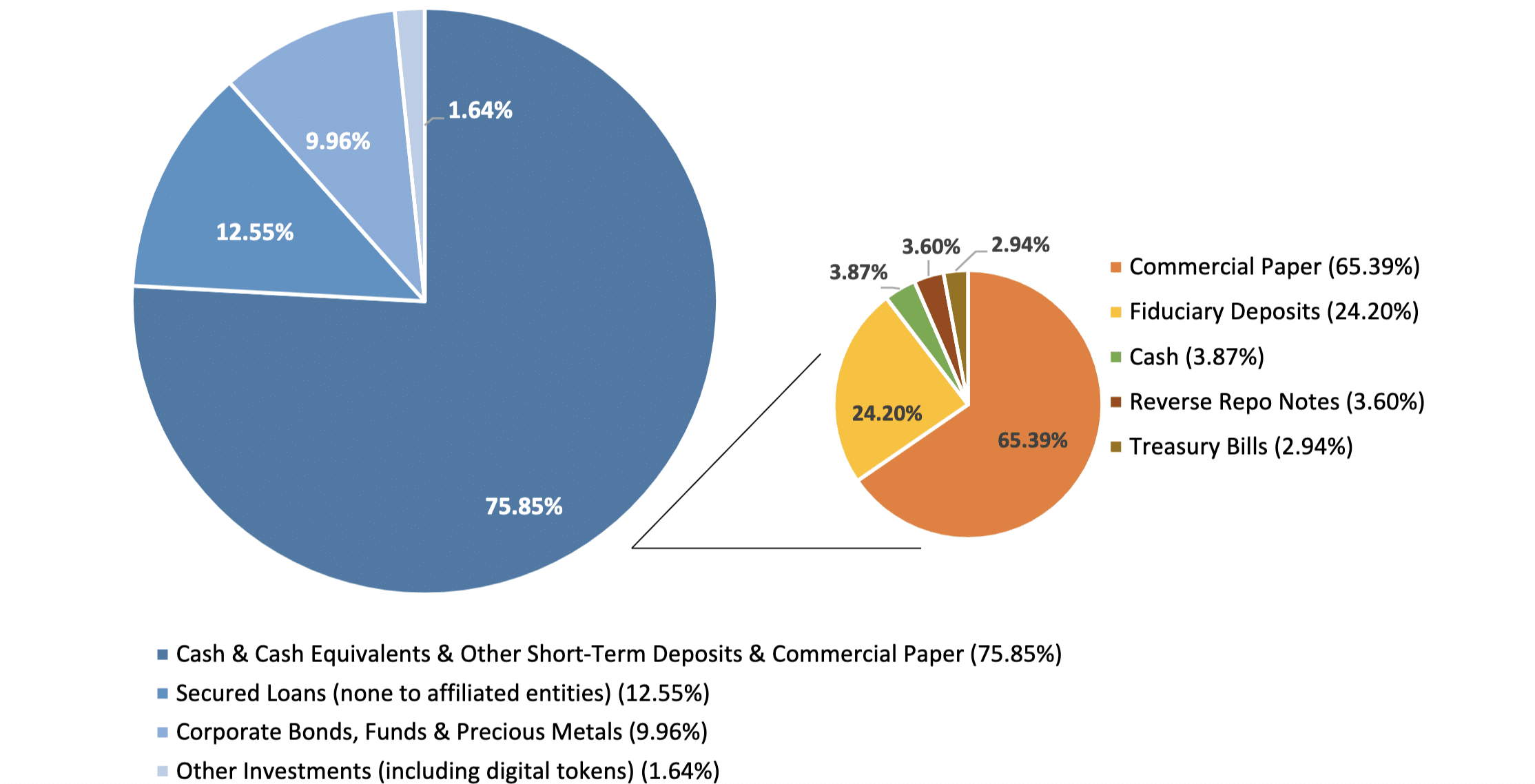

Tether says it maintains a sum of commercial paper, fiduciary deposits, cash, reserve repo notes, and treasury bills in reserves that are equal in USD value to the number of USDT in circulation, Investopedia reports.

However, Tether has not provided a full audit of its reserves and has only disclosed a breakdown of its assets in May 2021, after years of legal battles with the New York Attorney General.

“Tether’s claims that its virtual currency was fully backed by U.S. dollars at all times was a lie.” Letitia James, the New York Attorney General, refuted the claims. “[Tether and Bitfinex] obscured the true risk investors faced and were operated by unlicensed and unregulated individuals and entities dealing in the darkest corners of the financial system.”

According to the disclosure, only 2.9% of Tether’s reserves were in cash, while 49.6% were in commercial paper, a type of short-term debt.

Tether denied these allegations and said it follows strict due diligence processes and diversification strategies for its reserves. It also said it is working with regulators and auditors to increase its transparency and accountability.

As Business2Community reported on the matter, the quality and liquidity of Tether’s commercial paper holdings have been questioned by some analysts, who wonder how Tether can access such a large amount of this market without revealing its identity or credit rating.

Some also suspect that Tether may be buying commercial paper from crypto companies that are unable to access traditional financing, creating a circular risk in the crypto ecosystem.

In a more detailed explanation, James stated that owing to Tether’s little to no access to banking facilities since the middle of 2017, there were instances when the company lacked the necessary reserves to uphold the one-to-one dollar backing for circulating tethers.

The Attorney General’s office imposed a hefty penalty of $41 million on Tether in a February 2021 settlement in response to this purported transgression.

In addition to the fine, the settlement necessitated that Tether discloses the make-up of its reserve assets quarterly.

Interest In Shorting USDT On The Rise

Concerns about Tether’s reserves should be taken seriously by all investors. If the stablecoin assets on hand fall short of the circulating supply, currently slightly over $83 billion, it will imply that some investors may be unable to redeem their tokens in case of a surge in withdrawal requests.

As the market downturn carries on, more and more USDT holders have been considering taking short positions, aiming to capitalize on the possibility of the token losing its dollar peg. These investor concerns were exacerbated by another depegging incident last week that saw Tether drop to $0.0996.

According to CoinDesk, on June 20, the Compound decentralized lending platform recorded a dramatic increase in the borrowing interest rate for Tether, peaking at 7.7%, following several weeks in the 4% to 4.4% range. This sharp uptick signals an elevated borrowing demand.

Curve’s Pool, on the other hand, experienced a significant surge in Tether borrowing interest, driven predominantly by a single address that is said to have exchanged the borrowed Tether for USDC, the runner-up in the stablecoin market capitalization ranking.

This move exerted a subtle but notable effect on Tether’s peg within the Curve market and on a broader scale.

Furthermore, recent weeks have seen an upswing in borrowing and lending activities on the Aave V2 platform, reaching heights unseen since April, as per Parsec data.

Why Shorting Tether May Be A Bad Idea

Unlike TerraUSD (UST), which lost its algorithmic peg in 2022, sending the entire crypto market into a tailspin, Tether is a beast in its own measure. The process involved in shorting Tether could expose investors to certain risks, including technical and financial perils.

Estimating the extent of short interest is particularly challenging given the extensive incorporation of USDT into the cryptocurrency ecosystem and its prevalent use in cryptocurrency trading pairs.

An escalating annual percentage yield (APY) burden on Tether borrowers might be indicative of various contributing elements. This includes an increase in open interest for short positions or heightened demand for leveraged long positions in alternative assets, like Bitcoin.

“A lot of the firms that want to short Tether are not [crypto] natives; they’re traditional finance,” Austin Campbell, a stablecoin expert and founder of Zero Knowledge Consulting, told CoinDesk. “They wind up going through broker-dealers, and it’s more expensive.”

However, Campbell reckons that the “easiest way to short tether is to do it on-chain – borrow tether, then sell it. As explained, investors would borrow USDT on a DeFi platform like Compound and then use the funds to buy another stablecoin to sidestep the pressure from the price.

Buying crypto through brokers significantly increases the amount spent on the underlying asset – due to the borrowing interest rate. Investors will have to incur this cost until the short becomes profitable. In practice, this eats into the potential profits, especially if the stablecoin takes time to depeg.

The situation is further complicated by dismal profits, considering Tether is unlikely to depeg by a substantial margin.

“Even if you short tether, it’s not going to zero, so what’s your risk reward?” asks Campbell. “If you want to make eight cents [on the dollar], is that worth it?”

Related Articles

- Top 10 Crypto Tips to Boost Returns in 2023

- AI Adoption Still Has A Long Way to Go in Crypto Trading – Here’s How to Get Ahead With the Best AI Trading Tools

- Claim Your $L Meme Coin Airdrop Before it Skyrockets 7,500% Again – Elon Musk Tweets at New Cryptocurrency $WSM

AiDoge (AI) - Meme Generation Platform

- Create & Share AI-Generated Memes

- Newest Meme Coin in the AI Crypto Sector

- Listed on MEXC, Uniswap

- Token-Based Credit System

- Stake $AI Tokens to Earn Daily Rewards