Republican Senator Pat Toomey has challenged SEC chair Gary Gensler’s view that cryptocurrencies should be treated as a security and face greater regulation.

Earlier this week Gensler said that US Securities and Exchange Commission is working on developing a regulatory framework for crypto, believing it is vital for wider adoption of the asset class.

Regulation in the cryptocurrency industry has become one of the most important topics in the space, with clarity extremely important for market participants who want to feel comfortable that they are compliant – especially institutional investors who would seek to spend vast sums.

Without clarity it makes it difficult not only for the companies operating in a jurisdiction, but for regulators to know whether or not they ought to be enforcing particular strategies.

Unfortunately, the current state of regulation is such that the crypto industry not only lacks adequate regulatory clarity, but the regulators also lack the appropriate tools to reckon with this new asset class.

Senator Toomey (Pennsylvania) has spoken out about this phenomenon and explained many of the ways in which the current regulatory landscape is ill-equipped to deal with cryptocurrencies, which require regulators to take a different approach than they may have done before.

Cryptocurrencies need more ‘tailored regulation’

Whether or not something is likely to pass the Howey Test depends on a myriad of factors, but the way that the test currently operates almost certainly assigns the overwhelming majority of cryptocurrencies to the category of unregistered securities.

Many of the current laws that are applied to the definition of securities come from legislation that was passed a long time ago, and this presents a problem when it comes to using it to address the issues we face today.

Speaking on Bloomberg’s Odd Lots podcast, Senator Toomey said: “Much of our securities law is based on 1933 and 1934 legislation … court cases that followed that [were] often in the forties and fifties. Can you imagine being more far removed from crypto?”

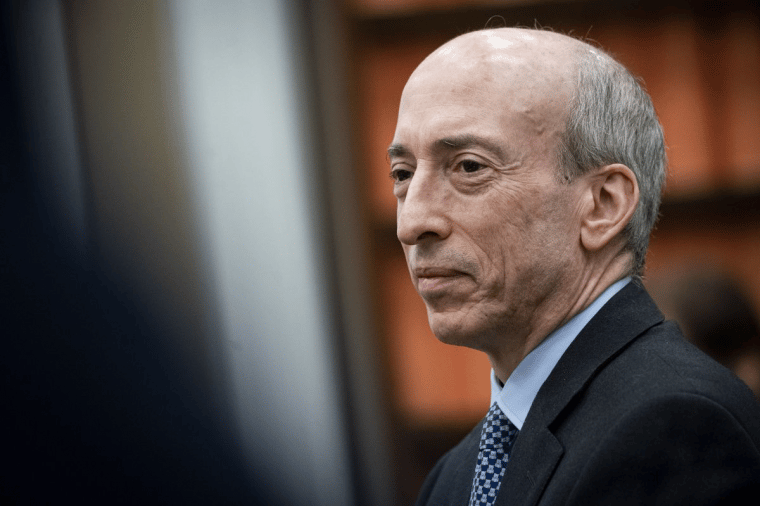

During a meeting of the Senate Banking Committee, where US Securities and Exchange Commission chair Gary Gensler (below) was present, Toomey pressed on in disagreement with Gensler’s recommendation that cryptos should face structure regulation:

“Crypto tokens have varying degrees of decentralization, they usually do not have a financial claim on the issuer, and typically can be settled in real time without intermediaries. These are very major and important differences from traditional securities and they merit a clearly stated and tailored regulatory framework.”

The fact that the securities laws haven’t been significantly changed since then presents an issue for cryptocurrencies, since there are many laws that quite clearly apply to securities that aren’t appropriate for cryptocurrencies.

There may be some cryptocurrencies that have many of the features of stocks and shares, such as governance tokens, but the current laws don’t make provisions for the nuances in each case.

Privacy is a human right

One of the main reasons that Senator Toomey declared that he is so supportive of cryptocurrencies, and the technology that underlies them, is because he believes that privacy is an important and fundamental human right.

It is for this reason that he believes the US, unlike countries such as China, should be extremely cautious of ever completely removing cash. Spending money without the prying eyes of government, especially when there is no evidence of any harm being caused, is not the way that a society should operate.

Cryptocurrencies are far more efficient

Another of the main reasons that Toomey is so confident in cryptocurrencies going forward is the fact that they remove middlemen. This is important not only because of the aforementioned concerns about privacy (when one uses a debit card, they inevitably share their personal information with other parties), but also because the current system is extremely expensive to use, especially when it comes to moving money overseas.

By removing intermediaries from transactions, people can have a high degree of confidence that their transactions will go through, and they won’t be paying extortionate fees to achieve this.

New innovation we don’t understand yet

There are a lot of risks to making knee-jerk reactions to particular new innovations, either by shutting them down or by endorsing them completely. For this reason, the SEC is understandably in a difficult position, and that shouldn’t come as a surprise.

However, the notion that the innovation is either wholly bad or wholly good is a misguided one, and the SEC must tread carefully if the US is to maintain a competitive advantage over other nations in the crypto space.

There is always new innovation happening in the space of cryptocurrencies. New consensus mechanisms, new forms of cryptography, DeFi, NFTs, oracles, DAOs, P2E gaming, etc. All of these have the potential to dramatically improve the way that we live our lives, and to do so on a foundation that is extremely solid.

It is extremely important that regulators, even when they are acting with the best of intentions, are extremely careful that they don’t stifle innovation or push positive innovation abroad.

Regulation by enforcement is a bad idea – there must be limits on the actions of regulators

One of the main problems with the way that the regulation on crypto is currently set up is that since the rules are so unclear, companies aren’t always aware whether or not what they are doing is legal or not.

This then results in companies receiving news from the SEC that they are to be facing a lawsuit for having acted in a way that they ought not to have done, despite no malintent. It is an extremely frustrating process for companies to have to deal with and makes the entire industry more inefficient, since more and more money must be spent on lawyers to remediate issues, rather than being used more proactively to enhance research and development to improve product offerings.

One example of this would have been last year, when Coinbase announced that they would be offering an interest rate on deposits made to the platform in USDC. This wasn’t thought to be a particularly controversial product offering, given that the yield was far lower than what many companies (such as Celsius, Nexo, and BlockFi) were offering.

Moreover, the CEO Brian Armstrong was very clear at the time that they had made their intentions clear to the SEC so that there would be no regulatory hurdles.

Without warning, the SEC announces that they would be suing Coinbase for their decision.

This is clearly not a good thing for the state of crypto, and it is something that Senator Toomey is keen to change. First and foremost, he believes that US regulators have a responsibility and a duty to be extremely clear over what the rules are for stablecoins, and what the reserve requirements ought to be.

Overall, it seems that Toomey’s main contention with the business of regulating the crypto industry is that it still has some way to go to reach maturity.

Regulation is important in the industry, since there are bad actors and there are times at which retail users are being exploited by companies like Celsius. Nevertheless, it is also important for regulators to understand what the rules are, so that they can be effectively and fairly enforced.

Tamadoge - The Play to Earn Dogecoin

- '10x - 50x Potential' - CNBC Report

- Deflationary, Low Supply - 2 Billion

- Listed on Bybit, OKX, Bitmart, LBank, MEXC, Uniswap

- Move to Earn, Metaverse Integration on Roadmap

- NFT Doge Pets - Potential for Mass Adoption