Crypto businesses have been on the receiving end with regulatory bodies in the United States increasing oversight of the industry.

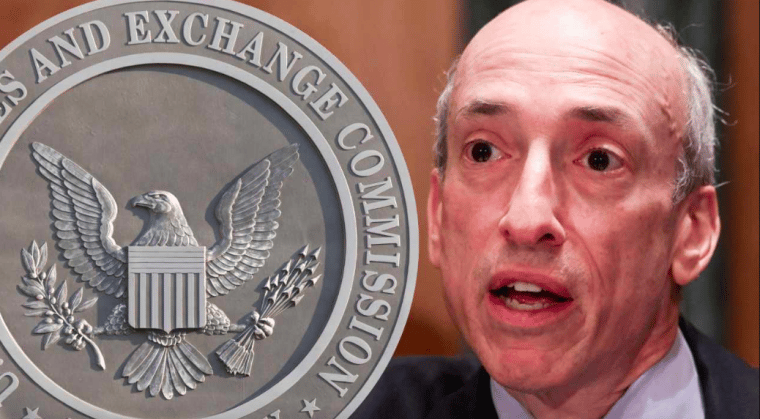

Gary Gensler, the Chair of the Securities and Exchange Commission (SEC), went guns blazing on stakeholders in the crypto market for their stubbornness in complying with existing regulatory guidelines.

Gensler argued that there is no love lost if crypto companies decide to leave the US in favor of other jurisdictions – according to Wall Street’s highest-ranking cop, the stakes remain high when it comes to protecting investors.

Therefore, crypto businesses are requested to prioritize the disclosure of information to relevant regulatory bodies if they plan to raise money from the public and that’s the “basic bargain in finance.”

During an interview at the agency’s headquarters in Washington on Tuesday, Gensler said:

“We lose more if investors get harmed here. It’s a basic bargain in finance: If you want to raise money from the public, disclose certain facts and figures.”

The SEC has since the implosion of Sam Bankman-Fried’s FTX exchange vowed to weed out uncompliant crypto entities to ensure such a ‘luxury rug pull’ does not happen again.

Bankman-Fried is currently behind bars in the US after his extradition from the Bahamas late last year.

The former boss of the fallen crypto exchange is facing several charges including conspiring to commit money laundering, wire fraud, unlawful political donations, and civil charges among others.

Gensler and the SEC Not Ready To Budge In The Fight To Control Crypto Industry

The SEC chair steadied his tough stance against crypto firms not meeting set regulations weeks after going after Kraken exchange for not registering its staking-as-a-service program.

Other firms at loggerheads with the SEC include Genesis Global Capital and Gemini Trust for apparently offering unregistered products to the public.

Regulatory bodies in the US have maintained the narrative that crypto is not special or very different from other sectors of the economy and should comply with existing securities laws.

Gensler’s stance is tough despite some big crypto firms threatening to move their operations overseas.

5/ Regulation by enforcement doesn’t work. It encourages companies to operate offshore, which is what happened with FTX.

— Brian Armstrong (@brian_armstrong) February 8, 2023

Coinbase CEO Brian Armstrong recently accused the SEC amid rumors of a potential ban on crypto staking – such a move, according to Armstrong, would stifle innovation in the US despite the country lagging compared to regions like Europe and Asia.

“We’re hearing rumors that the SEC would like to get rid of crypto staking in the U.S. for retail customers. I hope that’s not the case as I believe it would be a terrible path for the U.S. if that was allowed to happen,” the Coinbase CEO tweeted on February 9.

Armstrong argued that the SEC needs to consider working together with stakeholders in the crypto industry “to publish clear rules… and come up with sensible solutions that protect consumers while preserving innovation and national security interests in the US.”

Gensler disregarded concerns from crypto leaders about the worrying state of the regulatory landscape in the US – their fears have also been echoed by crypto-friendly faces in Congress.

Some House Republicans have expressed concerns about how Gensler is ramping up oversight of the industry and appear ready to put his actions under a microscope.

Crypto progressive lawmakers like Sen. Elizabeth Warren are also pressuring the SEC to maintain a strict approach to crypto as well.

Is The SEC Making Progress?

Unfortunately, Gensler said crypto firms are still adamant about complying despite the agency launching a series of litigation and crackdowns.

Nevertheless, he maintained that “the path to compliance is clear” although some companies have continued to operate disregarding the law.

“The path to compliance is clear. It’s [that] the firms, in some regard, have generally been operating outside of those parameters,” Gensler said.

Leading crypto companies like Coinbase and Ripple continue to lobby for a new regulatory framework – one that would allow a cohesive relationship with US agencies.

However, Gensler is of the view that crypto does not need new rules.

The SEC chair believes the so progress seen in Europe with the Markets in Crypto Assets law, or MiCA cannot be used as a benchmark.

“Do you know that MiCA doesn’t even cover Bitcoin?” Gensler said casting doubts on European law’s effectiveness.

Gensler said in the interview that the SEC often consults internationally but primarily focuses “on how to best help the American public.”

In the meantime, US lawmakers are engaged in a debate on how best to regulate crypto businesses like exchanges and brokerage firms.

On the other hand, crypto lobbyists term the push by Gensler to use 90-year-old securities laws to regulate a relatively young industry as ridiculous and the fastest way to stifle financial regulation.

“The much more transformative technology right now of our times is predictive data analytics and everything underlying artificial intelligence,” Gesler said at the end of the interview.

Gensler appears to be digressing his agency’s efforts on new rules in areas of artificial intelligence and predictive data analytics.

He said during the interview that he is looking forward to collaborating with lawmakers on how best to regulate these emerging tools likely to be sued by financial data aggregators and brokerages.

Related News

- Shiba Inu Price Could Be About to Rocket After Whale Makes $1.5m Move – Time to Buy?

- Alameda is Suing Grayscale and DCG, Demands Redemptions and Lower Fees for Trusts

What's the Best Crypto to Buy Now?

- B2C Listed the Top Rated Cryptocurrencies for 2023

- Get Early Access to Presales & Private Sales

- KYC Verified & Audited, Public Teams

- Most Voted for Tokens on CoinSniper

- Upcoming Listings on Exchanges, NFT Drops