The US Securities and Exchange Commission (SEC) has filed charges against NovaTech Ltd., its founders, and several promoters for allegedly orchestrating a massive $650 million fraud scheme.

The company was founded in 2019 by Cynthia and Eddy Petion who used multi-level marketing (MLM) tactics to attract investors by promising weekly returns ranging between 2% and 3%. They claimed in their marketing materials that they never experienced a trading loss and reportedly operated in the crypto and forex markets.

However, the SEC alleges that the reality was far different from these bold promises. The regulatory body stated that NovaTech reserved only a small fraction of investor funds for actual trading while the bulk of the money was being used to make payments to existing investors and commissions for promoters – a classic trait of a traditional Ponzi scheme.

NovaTech Targeted Haitians Primarily

The SEC’s charges paint a picture of a massive fraud operation that targeted over 200,000 investors worldwide, many of them from the Haitian-American community. The scheme allegedly raised more than $650 million over a four-year period from June 2019 to May 2023, when the company ultimately collapsed.

Eric Werner, director of the SEC’s Fort Worth regional office, emphasized the scale of the alleged fraud, stating: “NovaTech and the Petions caused untold losses to tens of thousands of victims around the world.”

“As we allege, MLM schemes of this size require promoters to fuel them, and today’s action demonstrates that we will hold accountable not just the principal architects of these massive schemes, but also promoters who spread their fraud by unlawfully soliciting victims.”

One of the most troubling aspects of the NovaTech case is the practice of targeting specific affinity groups – prominently focusing on Haitian-American churchgoers. The SEC’s complaint describes how the company and its promoters used WhatsApp groups and promotional events with religious themes to appeal to these communities.

Also read: Popular Online Pastor Caught in Massive Crypto Scam, Says God Told Him to Do It (Literally)

Cynthia Petion, one of the founders, reportedly referred to herself as the “Reverend CEO” in promotional materials and claimed that God had sent her a “vision” of starting the company while she was brushing her teeth. This approach of using religious and cultural affiliations to gain trust is a common tactic in affinity fraud cases.

The Collapse of NovaTech

The SEC alleges that the scheme began to unravel in October 2022 when investors started experiencing significant delays when they attempted to withdraw their funds. By May 2023, the Petions had shut down NovaTech and taken down its website, leaving those who had invested money with them completely unable to access their funds.

Interestingly, NovaTech claimed that the funds were stolen in a cyberattack that took place in May 2023 and reassured customers that the company was working to recover the assets. However, the SEC’s charges suggest that this was merely a cover for the collapsing Ponzi scheme.

In addition to NovaTech and its founders, the SEC has also named several promoters as defendants in its securities anti-fraud suit. These include Martin Zizi, Dapilinu Dunbar, James Corbett, Corrie Sampson, John Garofano, and Marsha Hadley.

Also read: FBI Busts Las Vegas Scammer Idin Dalpour Who Stole $43M from Investors Through Ponzi Scheme

The SEC alleges that these promoters played a crucial role in fueling the scheme by recruiting investors and downplaying the red flags that customers identified when they were presented with NovaTech’s offering.

The agency is seeking permanent injunctive relief, disgorgement of ill-gotten gains, and civil penalties against all defendants. One promoter, Martin Zizi, has already agreed to a partial settlement, consenting to a $100,000 civil penalty and agreeing to be permanently enjoined from future securities violations although he abstained from admitting or denying the charges.

The SEC Keeps Applying “One-Size-Fits-All” Approach to Regulate Crypto Activities

The NovaTech case is just the latest in a series of enforcement actions by the SEC against companies accused of crypto fraud. It highlights the regulatory body’s commitment to protecting investors from the scams that keep popping up in the rapidly evolving and often opaque world of digital assets.

Seth Goertz, partner at law firm Dorsey & Whitney and former assistant US attorney with the Department of Justice, told TechCrunch: “Overall, this, sadly, appears to be a textbook affinity group Ponzi scheme. The size and scale of the scheme is noteworthy, though, and you always wonder whether it would have been possible if it was tied to traditional fiat currency, rather than cryptocurrency, which remains ethereal enough that fraudsters can more easily promise grand returns.”

The NovaTech case brings into sharp focus the ongoing debate about the need for clearer regulations for the cryptocurrency industry. While the SEC’s actions aim to deter fraud and protect investors, many in the industry argue that the current regulatory environment is overly punitive and unclear. As a result, regulators could be stifling innovation and growth in their attempt to safeguard the public.

More Than 100 Crypto Fraud Cases Have Been Filed by the SEC in the Past 10 Years

Will Hughes from Consensys highlighted this tension in his reaction to the SEC’s charges against NovaTech: “Yes sure the NY AG already sued Novatech founders and, if the allegations are to be believed, the DOJ should probably charge them, but this is the type of case no one can credibly complain about the SEC bringing.”

He added: “Important question: How many of these cases aren’t being pursued because companies that would be happy to register if there was a coherent, workable regime are now being investigated and sued because SEC leadership wants to operate as a merits based regulator?”

This comment encapsulates the frustration felt by professionals within the sector who argue that clearer regulations could actually help legitimate businesses that would like to serve customers appropriately while it would also make it harder for fraudulent schemes to proliferate.

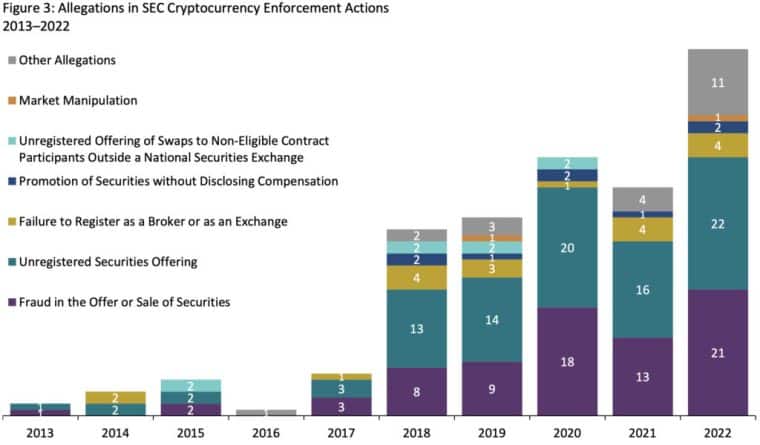

The SEC’s actions against NovaTech are part of a broader crackdown on legally dubious crypto ventures. In a recent statement, Gurbir Grewal, director of the SEC’s division of enforcement, revealed that the agency has taken over 100 crypto-related actions over the past decade.

Notable recent actions from the SEC against crypto companies include:

- A recently resolved lawsuit against Ripple for allegedly raising more than $1.3 billion through an unregistered security offering of XRP tokens. The proceeding ended with a $125 million fine imposed on the company.

- Charges against BitClout founder Nader Al-Naji for fraud, alleging that proceeds from the startup’s crypto activities paid for the entrepreneur’s LA mansion and gifts.

- Reports of the SEC sending letters to venture capitalists over their involvement with decentralized crypto exchange operator Uniswap Labs.

These actions demonstrate the SEC’s relentless pursuit to bring down fraudulent schemes in the crypto sector and its determination to apply existing securities laws to this new asset class.

However, its detractors emphasize that digital assets cannot be treated as regular securities as their unique characteristics demand a specific legal framework to avoid applying “one-size-fits-all” approaches.

As the crypto industry continues to evolve and mature, cases like NovaTech continue to highlight the urgent need for clearer regulations that can protect investors while allowing legitimate businesses to thrive. The challenge for regulators lies in finding the right balance between deterring fraud and fostering innovation in this rapidly changing sector.