Robinhood, the US-based trading platform that popularized the zero-commission trading model, is doubling down in its efforts to provide its services to international customers who wish to enter the crypto markets with its latest acquisition of Bitstamp for $200 million.

Johann Kerbrat, General Manager of Robinhood Crypto justified the move and deemed this a “major step in growing our crypto business”. The company founded by Vlad Tenev and Baiju Bhatt entered the crypto space in 2018 and brought with it its flagship zero-commission trading offering to the space.

We’re accelerating Robinhood Crypto’s worldwide expansion. Robinhood has officially entered into an agreement to acquire @Bitstamp, a global cryptocurrency exchange with customers across the EU, UK, US and Asia.

More details: https://t.co/wk3x02z0rU pic.twitter.com/aadKzhCxlx

— Robinhood (@RobinhoodApp) June 6, 2024

Now, more than six years later, they are looking to expand their global presence to countries in Europe and Asia through this strategic acquisition. Bitstamp was founded in 2011 and it has 50 active licenses to operate in key markets including the United Kingdom, the European Union, and multiple countries in the Asian continent.

Robinhood Will Tap the Institutional Market with Bitstamp Acquisition

By completing this purchase, Robinhood would instantly have access to these regions to offer crypto trading services. They will probably leverage their expertise and add new products and features that have proven to be successful in the markets they currently serve.

Another major benefit of the acquisition is that it will grant Robinhood the ability to serve institutional investors who wish to get exposure to the crypto market. The demand for these products from this particular segment has been growing as more regulatory clarity has been brought.

“The Bitstamp team has established one of the strongest reputations across retail and institutional crypto investors. Through this strategic combination, we are better positioned to expand our footprint outside of the U.S. and welcome institutional customers to Robinhood,” Kerbrat commented in a press release.

One major event was the recent approval of a spot Bitcoin exchange-traded fund (ETF) – a landmark moment for the space that resulted in billions of dollars being poured into the digital asset.

Bitstamp Is known by its institutional clients for reliably executing transactions, providing access to deep order books, and a top-notch API that they can integrate with their internal trading systems. In addition, Bitstamp offers access to lending, staking, and straightforward trading of over 85 digital assets that will strengthen Robinhood’s portfolio of available trading products.

“Bringing Bitstamp’s platform and expertise into Robinhood’s ecosystem will give users an enhanced trading experience with a continuing commitment to compliance, security, and customer-centricity,” commented JB Graftieaux, Chief Executive Officer of Bitstamp.

Analysts Weigh in: A Positive Move for Robinhood

Most analysts are categorizing the move as positive as it positions the company to compete with more well-established pure-play crypto exchanges like Coinbase and Kraken, whose portfolio of trading products are much more extensive than Robinhood’s.

In a research report, Bernstein analysts Gautam Chhugani and Mahika Sapra noted that the deal positions the company much better against competitors and allows Robinhood to improve its bottom line on crypto trades by increasing its scale and trading volumes.

“With a full exchange, HOOD gets access to global liquidity, and thus can offer the liquidity to its own broker platform, potentially improving its economics,” the two analysts wrote on Thursday.

Meanwhile, JMP Securities believes that the acquisition will “drive opportunities to broaden Robinhood’s participation in the evolving crypto value chain” as they will now own an exchange. They could also participate actively in other types of operations in the crypto space including asset tokenization and initial coin offerings (ICO).

Stock Reaction and Performance Following the News

Following the announcement of the Bitstamp acquisition, Robinhood’s stock (HOOD) rose by 6.5% during Thursday’s trading session to $22.97 per share – the highest level the stock has reached since December 2021. The positive reaction of the market reflects investors’ confidence in Robinhood’s crypto strategy and the potential synergies that the transaction creates.

In 2024 alone, the stock accumulates gains of 77.3% along with a 12-month return of 143.2% as a positive economic outlook and hints that the Federal Reserve will be easing its policy have helped equities recover some of the territory they lost the years between 2021 and 2022.

In addition, the firm reported some positive results from its crypto business, which generated $43 million out of the $200 million that the firm brought in revenues during the last quarter of its 2023 fiscal year.

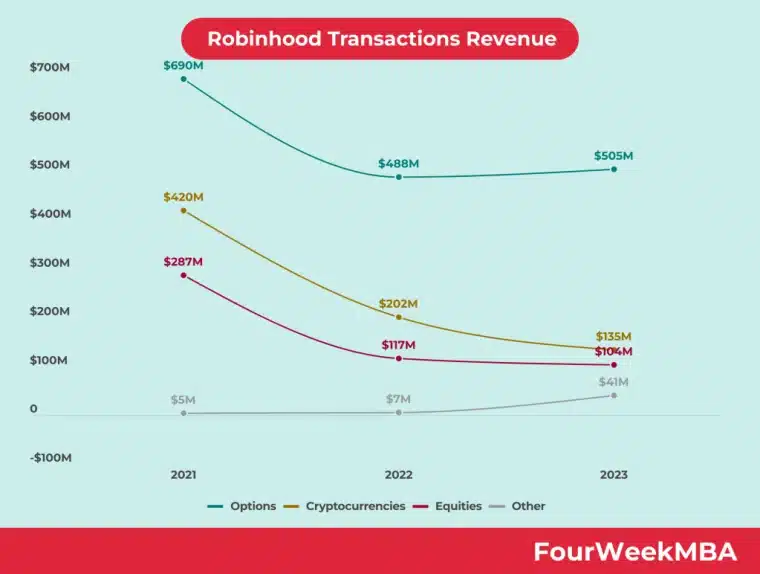

Meanwhile, by the end of 2023, crypto revenues accounted for 17% of the company’s total $785 million annual transaction-based revenue.

Regulators Could Move to Block the Acquisition

Although the Bitstamp acquisition is a positive move by Robinhood in the eyes of analysts, regulators may not share that same opinion.

On 4 May, it was reported by Reuters that the United States Securities and Exchange Commission (SEC) was gearing up to take legal action against the company for allegedly offering unregistered securities through its crypto trading services.

Robinhood maintains that the crypto assets offered through its platform are not securities. This could set the stage for a legal battle that could result in legal costs and a delay in any crypto-related corporate action.

Last year, the firm opted to remove Solana (SOL), Cardano, and Polygon from its portfolio of available assets.

“We firmly believe that the assets listed on our platform are not securities and we look forward to engaging with the SEC to make clear just how weak any case against Robinhood Crypto would be,” commented Dan Gallagher, the firm’s Chief Legal Officer.

Robinhood and Bitstamp said that they are committed to maintaining transparency throughout the acquisition process to ensure a smooth transition for customers.

As the crypto industry continues to evolve and gain further traction among mainstream retail and institutional investors, Robinhood’s acquisition of Bitstamp clearly seeks to position the company as a formidable player in the space.

Bitstamp’s global reach, institutional expertise, and diverse product offerings are quite appealing to Robinhood and their match seems perfect as long as regulators give the deal the green light.