The recent choice by the United States Securities and Exchange Commission (SEC) to greenlight the first spot exchange-traded fund (ETF) for Ether (ETH), the main crypto asset of the Ethereum blockchain, was seen as a key moment for the industry. Ethereum’s price surged following rumors that the SEC was shifting its stance, but it has since dropped sharply along with the broader crypto market.

The decision sparked a whirlwind of speculation among crypto enthusiasts regarding the future trajectory that the price of the digital asset could take. Onlookers argue that billions of dollars from mainstream investors could be poured into these vehicles – similar to what happened to Bitcoin (BTC) right after its spot ETF was approved as well.

However, and despite this seemingly obvious correlation, some analysts think that the market price was already reflecting the impact of the approval, meaning that ETH could now experience a ‘sell the news’ moment now that the SEC has given its nod to the vehicle.

It’s Been a Month Since the SEC Approved the First Eight Spot Ethereum ETFs

On May 23, the SEC approved eight Ethereum ETF applications at once, paving the way for these products to be listed in multiple exchanges in the United States like the Nasdaq, CBOE, and New York Stock Exchange (NYSE).

The move represented a significant leap forward for the agency in acknowledging the desire of mainstream investors to incorporate cryptocurrencies into their investment portfolios without resorting to pure-play centralized crypto exchanges. The decision was preceded by the approval of a Bitcoin spot ETF in the first few days of the year.

Regarding the approval, the SEC’s Chairman Gary Gensler stated: “After careful review, the Commission finds that the Proposals are consistent with the Exchange Act and rules and regulations thereunder applicable to a national securities exchange.”

The approved applications came from several prominent asset managers, many of whom were also approved to launch a spot Bitcoin ETF previously. This group includes industry giants like Fidelity, BlackRock, Bitwise, and Grayscale, as well as Franklin Templeton, VanEck, Ark, and Invesco Galaxy.

Initial Market Reactions – Was a Spot ETF Approval Already Priced in?

Shortly after the SEC’s announcement, there were some interesting developments in the marketplace, including the following:

Investments products from around the globe that provided investors with access to Ether (ETH) saw a total of $69 million in capital inflows the week after the announcement. This is the largest weekly outpouring that these vehicles have experienced since March the phenomenon was attributed to the SEC’s landmark decision.

Moreover, crypto exchanges saw significant ETH outflows of approximately $3 billion – around 797,000 ETH – between May 23 and June 2. Analysts attribute the move to investors’ growing preference to store their digital assets safely in cold wallets. In addition, these transactions are typically viewed as bullish as these coins become relatively illiquid and immediately reduce the available supply within exchanges, which usually results in a price hike.

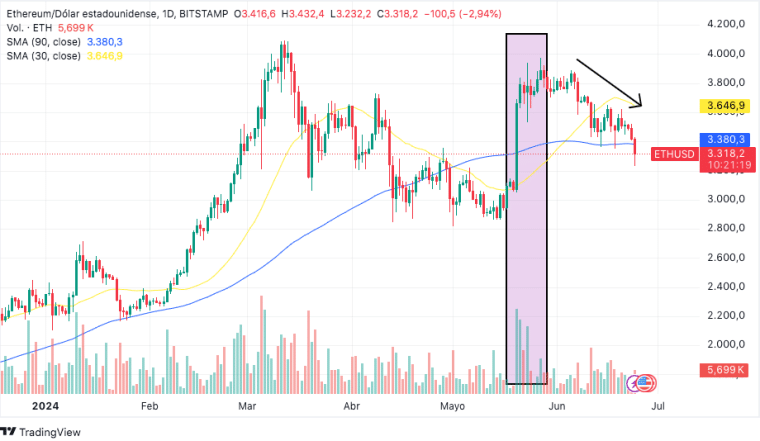

Finally, contrary to the prevalent expectation, Ether’s price did not manage to deliver a sustained positive performance after the news. While ETH initially rose by more than 30% to reach nearly $4,000 from May 19 to 27, it subsequently retreated to the $3,500 level. This lack of persistent price momentum reflects the notion that much of the approval news may have already been priced in by the market.

Analyst Predictions: A Mixed Bag of Bullish and Bearish Takes

As the crypto community looks ahead to what the actual impact of these new trading vehicles could be, analysts are already weighing on the matter and sharing their “two cents”.

I was quite adamant that the Bitcoin ETF approval was not a sell the news event and would quickly bring us to new highs off real net inflows

While we may see interest prior to the launch, I am not as sure the same plays out for the Ethereum ETF

— Andrew Kang (@Rewkang) June 14, 2024

Andrew Kang, founder and partner at the crypto-focused venture capital firm Mechanism Capital, shared a bearish prediction for ETH recently. In a June 23 post on X (formerly Twitter), Kang predicted that Ether could fall to as low as $2,400 after the launch of these spot Ether ETFs. This would result in a 30% drop from its current price.

Kang cited two reasons to justify his bearish prediction. First, Ether (ETH) is way less attractive to institutional investors than BTC, which means that they have fewer incentives to convert their spot holdings to ETFs.

Moreover, he argued that the network’s cash flows have not been impressive either in the past few days, possibly referring to the capital inflows that these vehicles have experienced since they hit the trading desks.

“How much upside would an ETH ETF Provide? I would argue not much. After the ETF launch my expectation is $2,400 to $3,000,” he shared with his followers.

Kang estimates that spot Ether ETFs could attract only about 15% of the inflows that spot Bitcoin ETFs have seen. Based on his calculations, this could translate to around $840 million in “true” inflows over the first six months.

“I believe that the expectations of crypto natives are overinflated and disconnected from the true preferences of tradfi allocators,” he stressed.

On the other end of the spectrum, some analysts and firms maintain a bullish outlook for Ether’s price following these ETF approvals.

Patrick Scott, an industry analyst known as Dynamo DeFi, told Cointelegraph Magazine that he “expects a similar directional movement” to how the spot Bitcoin ETFs have performed lately, although he doesn’t anticipate that Ether’s price will double.

Moreover, the asset management firm VanEck, one of the companies that had its application approved for both spot ETFs, is sharing an ever more optimistic outlook, projecting that spot Ether ETFs could help drive Ether to $22,000 by 2030.

This long-term forecast is based on VanEck’s prediction that Ethereum could generate around $66 billion in free cash flows by that time.

However, Kang counters that Ethereum’s capacity to produce free cash flows is not enough to sustain its current valuation.

“At $1.5B 30d annualized revenue, a 300x PS ratio, negative earnings/PE ratio after inflation, how will analysts justify this price to their daddy’s family office or their macro fund boss?” he concluded.

Which Factors Will Influence ETH’s Future Price?

Several variables will be crucial to shaping how Ether (ETH) will perform in the following weeks, months, and even years.

Here’s a summary of the most relevant ones that analysts and crypto research firms have emphasized in their latest reports:

New Gateway for Investors

The approval of a spot Ether ETF represents a landmark moment for the smart contracts network as its native asset is now more easily accessible than ever to a broader group of investors.

This increased accessibility could result in a significant spike in capital inflows that will go to the Ethereum ecosystem, particularly from institutional investors who may prefer to invest in regulated products rather than pouring billions of dollars into loosely regulated crypto exchanges.

Supply Volumes

The SEC did not approve that asset managers offered staked ETH. What this means is that all the ETH bought by these investment funds will remain liquid and available to be sold as needed.

Staking a crypto asset reduces its available supply, which tends to raise its price. Hence, if billions of dollars are poured into spot ETH ETFs, the available supply will likely remain high as these funds will not be able to stake them.

Capital Inflows

How much money will investors pour into Ethereum spot ETFs? That’s the question that everyone in the Ethereum community is pondering. It will no doubt be a significant factor that will influence the performance of the digital asset in the near future. Although analysts agree that these inflows will not reach the levels seen by spot Bitcoin ETFs, most estimates suggest that they could be at least 20% to 30% of what BTC-backed vehicles have seen thus far.

This would result in approximately $3 to $4 billion being poured into the market. Considering that around 25% of ETH’s supply is staked, this would mean that investors will be chasing around 2% of its non-staked market cap at least. Is this enough to sustain a short-term rally?

However, estimates from JMP analysts highlighted that inflows to Bitcoin spot ETFs could surge to over $200 billion in the next 10 years. This would mean a significant outpouring of over $60 billion at least going to Ether (ETH) if those predictions turn out to be true.

Broader Implications for the Crypto Market

The approval of a spot Ethereum ETF has been opening up the debate regarding how the SEC may now view the application of investment products backed by other altcoins like Solana (SOL) or BNB (BNB), both of which boast high market capitalizations exceeding $50 billion.

Also read: Which Crypto Will Get a Spot ETF Next? Experts Weigh In

This latest decision is surely bringing investors’ hopes up to a future where many digital assets can be accessed by mainstream retail and institutional investors through regulated products like ETFs.

There are no hints that the agency has received such applications or that they will be opened to consideration. However, what seems to be true is that regulators are leaning toward embracing digital assets more than they were 10 years ago as investors’ interest in these financial instruments has grown exponentially in the past decade as well.

Although most experts agree that the impact of a spot ETF approval will not immediately translate into huge gains for ETH, they all view the decision as a positive catalyst for the performance of the digital asset in the next five to ten years.