Ethereum, which many Layer-2 DeFi coins run on is currently +6% in the green over the past 24 hours, leading Bitcoin which is +5%. Bitcoin wicked back above $40,000 and Ethereum almost to $3,000, recovering most of their losses over the previous week.

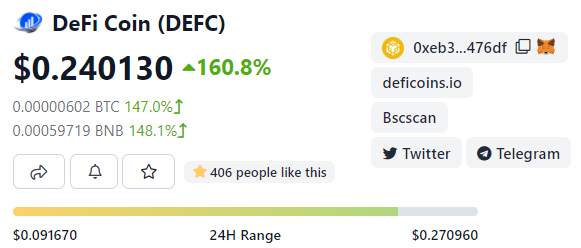

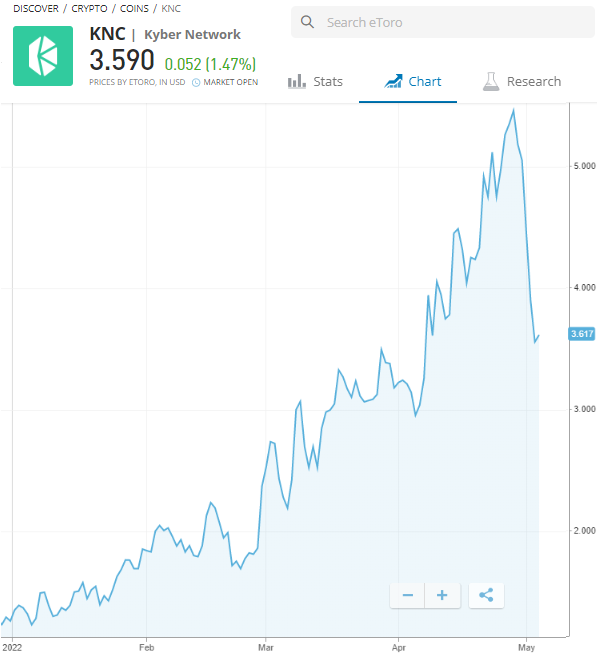

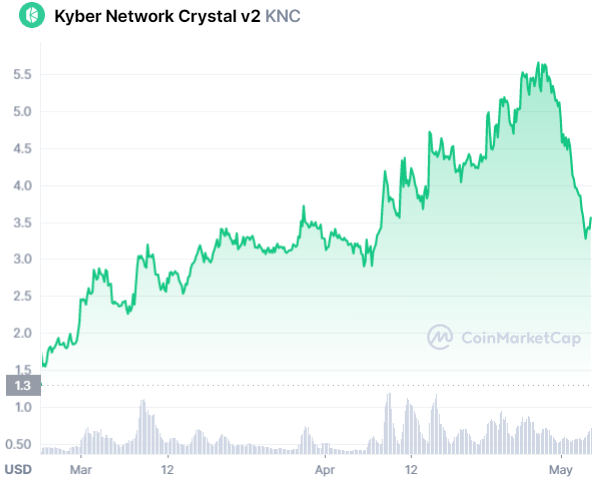

Some low cap decentralized finance (DeFi) projects have also been outperforming the blue chip cryptos – Kyber Network Crystal (KNC) rose 490% YTD, and DeFi coin (DEFC) spiked 160% in the past day.

FOMC Meeting

The Wednesday FOMC meeting concluded March 5th with the crypto markets pumping as Jerome Powell announced the Federal Reserve would hike interest rates by 50 basis points.

After the last FOMC meeting, when interest rates were raised by 25 basis points, the markets also rallied, in reaction to the Fed taking a strong stance on combating inflation. Some traders called this week’s FOMC a ‘sell the rumour, buy the news’ event where fears of a recession were already ‘priced in’ and the markets rallying to the upside was more likely.

Next Big DeFi Coin in 2022

With Ethereum leading Bitcoin and the ETH/BTC trading pair in a bullish uptrend, a potential ‘altcoin season’ could result, particularly for DeFi tokens.

1. DeFi Coin (DEFC)

DeFi Coin (DEFC) exploded on Wednesday, almost a 300% intraday move from the daily low to high, before stabilising at around $0.24.

DeFi Coin’s previous all time high on Bitmart exchange where it is listed was $4 hit in July 2021. In total it retraced 98.75% to $0.05, back to its presale price before bouncing.

Rather than the FOMC meeting, the main reason for DeFi Coin gaining in value was the completion of key parts of its roadmap, its DeFi Swap exchange v3 and farming pool.

The DeFi Swap decentralized exchange (DEX) is a competitor to DEXes like Uniswap, Sushiswap and Pancakeswap.

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

2. Kyber Network (KNC)

Kyber Network Crystal has a similar use case to DeFi Coin related to liquidity pools and decentralized crypto swaps, connecting traders without the need of a centralized entity.

KNC showed DeFi coins can have a bull run despite macroeconomic conditions and the rest of the crypto markets being bearish – from a January 2022 low of $1.18 it pumped to $5.77, a 490% move.

KNC has now retraced some of that move and like DEFC could be a good ‘buy the dip’ opportunity. Today it is trading at around $3.6 on crypto platforms such as eToro, Binance, Coinbase and Crypto.com.

Showing its use case and utility since its launch in 2017, Kyber Network Crystal is listed at most crypto exchanges. It demonstrates the potential return on investment (ROI) DeFi coin could achieve if listed on more online exchanges.

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

3. Ethereum (ETH)

Holding some of your portfolio in Ethereum is a way to invest with low risk and diversify rather than being over-invested in one or two cheap cryptos with a low market cap.

CEO of Bitmex exchange Arthur Hayes who writes crypto price predictions on his widely followed Medium blog, predicts $ETH will explode to hit $10,000 by the end of 2022 or early in 2023.

The next Bitcoin halving is also scheduled for mid 2024 and the previous halving event led to the impulse move from a $10k Bitcoin to the $69k ATH.

eToro also offers a ‘DeFi Portfolio’ users can copytrade. Currently its weighting is 40% Ethereum, alongside ten other cryptos each making up 5-6%, including Aave, Maker, Compound, Chainlink, Yearn Finance, Polygon and others.

Some of those we reviewed on our best DeFi coins guide, as well as Kyber Network Crystal.

Read More:

- Best Crypto To Buy Now

- Best Crypto Presales to Invest in 2024 – Compare Pre-ICO Projects

- New Cryptocurrency to Invest in 2024 – Compare New Crypto to Buy

- Best DeFi Coins to Buy in 2024

- Best Crypto Faucets

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.