Troubled cryptocurrency exchange FTX used its native token, FTT, to fund an $84 million purchase of the majority stake in the Blockfolio trading company. FTX closed a deal to acquire the majority stake in the trading company in 2020.

FTX used FTT tokens to acquire a majority stake in Blockfolio

A report published by Bloomberg on Thursday noted that 94% of the amount used to acquire the trading platform was paid in FTT. Through this deal, FTX acquired a 52% stake in Blockfolio, according to the financial documents seen by Bloomberg.

Blockfolio is a trading platform that was created in 2014. The trading platform emerged as one of the largest players in the sector, with around six million customers in the coming years. The company partnered with the FTX exchange seeking to create a unique trading experience for its users.

The FTT token played a role in the collapse of FTX. A CoinDesk report in early November showed that Alameda Research’s balance sheet was loaded with FTT tokens. This put the crypto hedge fund at significant risk and highlighted the tight connection between FTX and Alameda.

The token also came to the limelight after the Binance exchange announced that it would sell its entire FTT holdings because of some revelations that had come to light. The announcement triggered a notable plunge in the price of FTT.

SEC classifies FTT as a security

The FTT token lost nearly all its value following the FTX bankruptcy case. The token is also at the center of the investigations conducted by the US Securities and Exchange Commission (SEC) into the FTX fallout.

According to the SEC, FTT was an “illiquid crypto asset security that was issued by FTX and provided to Alameda at no cost.” The regulatory body has also said that the bankrupt FTX exchange generated profits from the sale of the asset, which was directed towards boosting the company’s development, marketing the brand, and supporting business operations.

The agency also maintained that FTX lured customers by promising them that FTT was an investment that had massive potential. It also referenced the FTX whitepaper, saying that some of the features of the exchange gave it an advantage over the other competing platforms.

The Chair of the SEC, Gary Gensler, has previously said that the majority of cryptocurrencies in the market were securities. Gensler opines that only Bitcoin met the threshold of being classified as a commodity. The SEC is currently entangled in a legal battle with Ripple over the status of the XRP token. The lawsuit’s outcome could determine how the SEC will classify cryptocurrencies.

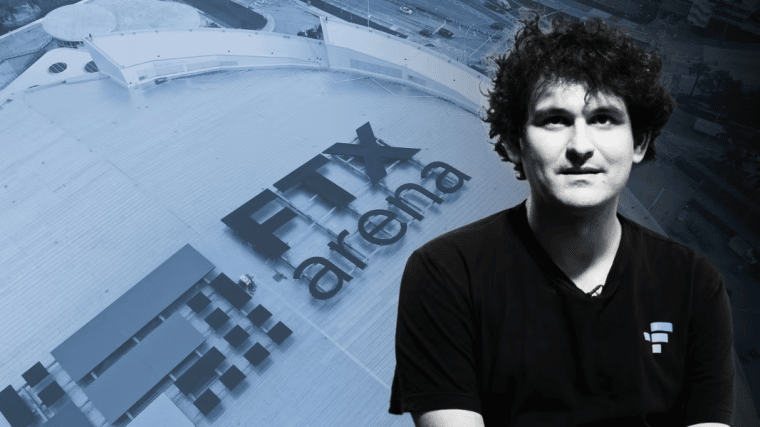

The SEC, alongside the Commodity Futures Trading Commission (CFTC), filed charges against the FTX founder, Sam Bankman-Fried. After being extradited from the Bahamas to the US earlier this week, Bankman-Fried has been released on a $250 million bail.

Related

- Where to Buy FTX Token (FTT) – Beginner’s Guide

- Avoid Next FTX By Using This Pro Traders Platform And Get 10x Gains Too

Wall Street Memes (WSM) - Newest Meme Coin

- Community of 1 Million Followers

- Experienced NFT Project Founders

- Listed On OKX

- Staking Rewards