Another day, another shocking development in the Wild Wild West that is the underground world of meme coins within the crypto space. This time, a gaggle of celebrities got caught up in a scam involving their public image, which was used to launch “celeb coins” via the pump.fun protocol.

At the center of the storm is Caitlyn Jenner, the former Olympic athlete and reality show personality. Over the weekend, Jenner’s social media accounts started to promote a new cryptocurrency token named “JENNER” that was issued on the Solana blockchain via pump.fun.

What initially seemed like a standard celebrity cash grab quickly devolved into chaos and confusion.

The JENNER Token is Legit – Here’s What Happened

According to reports, Jenner’s accounts shared posts about the JENNER token launch, including videos that appeared to show her personally endorsing the crypto project.

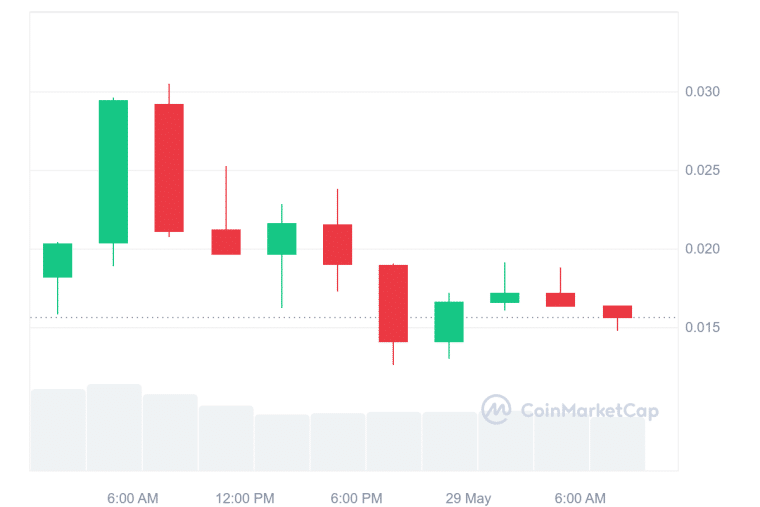

The price of the token experienced a sharp uptick right after it was minted, surging to over $100 million in trading volume within just a few hours and reaching a market cap of $20 million at some point before melting down. This is rather impressive for a token launched on pump.fun, a platform that allows users to launch tokens with essentially zero upfront liquidity.

However, red flags quickly emerged as individuals who typically monitor scams within the crypto space spotted that the same wallet address linked to JENNER had previously been used to promote a different token by an adult content creator who claimed that her account was hacked.

This triggered speculation that Jenner’s social media accounts may have been hacked and that the scheme could be part of an elaborate plan to rug-pull investors. But that wasn’t the end of the story.

The plot thickened at this point as Jenner’s manager Sophia Hutchins released a video statement, insisting that the JENNER token was legitimate and that the celebrity’s accounts had not been compromised.

“Her account has not been hacked,” Hutchins stated. “Yes, this is for real.”

Jenner Accuses Sahil Arora of Scamming Her and Her Team

Just when it seemed that the dust may have been cleared, Jenner dropped a bombshell accusation – she claims to have been scammed by a person named Sahil Arora, who allegedly performed a successful social engineering attack on her team to launch the JENNER project.

“F**K SAHIL! He scammed us! BIG TIME!”, Jenner raged on the social media platform X, formerly known as Twitter.

Although the details of the fiasco were not clear, it appears that Jenner and her team are still in control of the token. However, it may have happened that the proceeds from the initial coin offering (ICO) went to a wallet that was under Arora’s control, which would explain Jenner’s claims of being scammed.

Just watch what it hits today with what we have in store for you! https://t.co/s9L5MdUZjK

— Caitlyn Jenner (@Caitlyn_Jenner) May 29, 2024

Jenner is still promoting the token on her social media accounts. She also said that Sahil is no longer a part of the project and that she will keep investing and further advancing the vision of her meme coin.

“It’s Solana Summer! $Jenner isn’t going anywhere but up! Esp now that, that sob isn’t involved. I bet he won’t be launching many celebs coins again based on the conversations I’ve been having!”, she further posted on her X account.

Five Influencers May Have Fallen Victim of Arora’s Playbook Already

Digging deeper into the situation, a cryptocurrency enthusiast whose X handle is Roxo has voiced some explosive allegations that Arora masterminded multiple celebrity account compromises and token “rugs” or exit scams in recent days – with JENNER being just the tip of the iceberg.

According to Roxo’s investigation, Arora is the common link between not just Jenner’s token but also other apparent scams targeting rappers like Rich The Kid and Soulja Boy as well as models Kazumi and Ivana Knöll. Each of these victims may have been rushed by Sahil to launch meme coins that were quickly dumped as part of an apparent “pump-and-dump” scheme.

“Sahil has now successfully ran 5 influencer rugs this week,” Roxo bluntly stated, attaching evidence including Telegram posts purportedly showing Arora boasting about his exploits.

if anyone wants the TLDR on the @Caitlyn_Jenner situation here it is

She was never hacked, Her team was socially engineered by a guy named Sahil.

He was the "middleman" and his role was to launch the token for Caitlyn as the team didn't know anything about crypto.

after… pic.twitter.com/yZloKHlon6

— Roxo (@CryptoRoxo) May 27, 2024

Rich The Kid spoke out in a video claiming that Sahil “pretty much made a pump and dump and dumped all the money into his account and blocked me.”

Despite Arora’s attempts to defend himself, his social media accounts have now been banned as scam allegations continue to pile up. In an interview with Decrypt, Arora called these unfounded accusations “dumb B.S.”

A Summary of What We Know Thus Far About JENNER

So what really happened? Was Jenner and her team, along with other celebrities, swept into the meme craze and victimized by a scammer? Or was she complicit?

Here’s what we know thus far:

- The JENNER token experienced a mind-blowing rise and fall in value following its heavily promoted launch (the pump phase).

- The wallet used to launch JENNER has been linked to other clearly compromised celebrity-endorsed cryptocurrency offerings.

- Multiple celebrities and influencers have fallen victim to nearly identical “rug-pulls” around the same time and involving the pump.fun platform.

- A person named Sahil Arora (potentially a pseudonym) has been identified as the mind behind these incidents or he has been at least involved to some extent with these projects.

- Significant amounts of money were rapidly made and lost by investors in these meme coins, with untold financial impacts on both them and the celebrities themselves.

- The JENNER token rose to $0.030 at some point yesterday but has shed most of those gains as it stands at $0.016 as of this morning.

- Caitlyn Jenner keeps promoting the JENNER token on her social media account and claims that Arora is no longer involved in the project.

Whatever transpired, the episode has probably burned a decent group of crypto investors while delivering another black eye to the industry in terms of credibility.

Meme coins survive and thrive on growing communities of supporters who push them forward on social media, messaging boards, public forums, and instant messaging apps like Telegram. Without them, they are just worthless pieces of basic code.

The latest controversy involving JENNER may have dealt a significant blow to Caitlyn’s ambitions to take advantage of the meme coin craze as the project’s credibility is now being questioned.

Legal Ramifications of Celebrity-Endorsed Scams

Beyond the monetary losses, the JENNER token incident and other related celebrity crypto scams could have massive legal implications.

The U.S. Securities and Exchange Commission (SEC) has already penalized numerous celebrities for illegally promoting cryptocurrencies without adequately disclosing the risks involved to their followers.

In 2018, Floyd Mayweather Jr. and DJ Khaled were forced to pay $300,000 and $150,000 penalties each respectively as well for their involvement in an initial coin offering (ICO) and for failing to disclose that they were paid by a company named Centra Tech Inc. for promoting these investments.

With this latest wave of celebrity-endorsed tokens plummeting in value shortly after being launched with their help, the SEC will likely examine potential breaches of existing security laws in the United States.

Did any of the celebrities financially benefit from artificially pumping these tokens? Were investors appropriately informed of the risks involved and potential conflicts of interest?

Also read: 8 Twitter Influencers Charged in $100 Million Criminal Pump-and-Dump Scheme

If the SEC proves that celebrities like Jenner actively orchestrated “pump-and-dump” schemes, they could face criminal fraud charges from regulators for market manipulation. In addition, and perhaps unknowingly, they could be on the hook for hefty civil penalties for enabling the scam.

The same goes for Arora, a person who has been accused repeatedly of promoting crypto scams involving celebrities. If he’s accused and found guilty of these allegations, he could also face fraud charges.

No matter how it all shakes out, the JENNER token fiasco will go down as an iconic example of why investing in random celebrity-endorsed cryptocurrencies can be detrimental to people’s finances.

Although a few lucky investors may have cashed in, the saga will likely leave a significant number of unfortunate souls who were financially affected holding worthless tokens.