After some hiccups along the way, the popular Ethereum layer-2 protocol Blast is completing its widely awaited airdrop today in a major event that has been announced alongside the launch of a new governance body for the project called the Blast Foundation.

According to the details provided by the developing team, a total of 17 billion BLAST tokens will be distributed among early adopters, the community, and core contributors to the protocol at 10 a.m. ET as part of the first phase of the crypto airdrop.

Of that total, 50% will go to the project’s community. However, only 17% of the token’s total supply of 100 billion will be handed over during the airdrop’s “Phase 1” while the remaining 33% will be distributed based on future yet-to-be-determined dates.

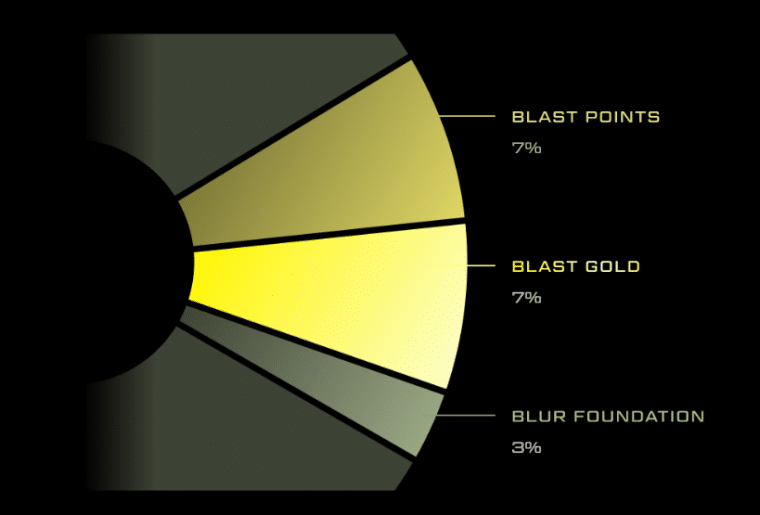

The distribution of the 17 billion tokens will be broken down as follows:

- 7% (7 billion tokens) will go to Blast Points holders.

- 7% (7 billion tokens) will be allocated to Blast Gold holders.

- 3% (3 billion tokens) will be handed over to the Blur Foundation.

More Details About the BLAST Airdrop

To be eligible for the airdrop, users must meet the following criteria:

- Blast Points Holders: Users who have held ETH, WETH, or USDB (Blast’s native stablecoin) on the Blast network since its mainnet launch in February have accumulated Blast Points. The more points a user has, the more tokens they will receive from the 7 billion pool of BLAST that will be allocated to this group.

- Blast Gold Holders: Over the past few months, Blast has selectively distributed Blast Gold to certain apps in its ecosystem. Users who have accumulated Blast Gold through these dApps are eligible to receive a share of the 7 billion BLAST tokens set aside for this category.

- Blur Foundation: The remaining 3 billion tokens will be received by the Blur Foundation to fund both retroactive and future airdrops.

The airdrop is scheduled to commence on June 26 at 10:00 AM ET (2:00 PM UTC). Eligible users will be able to claim their tokens at this time through the Blast platform.

The protocol’s website disclosed that there will be a vesting period for the BLAST tokens received as part of this airdrop.

“The top 0.1% users (~1000 wallets) will vest part of their airdrop linearly over 6 months. Vesting is subject to reaching a monthly Points threshold based on Phase 1 activity. Further details will be available on June 26,” the tokenomics section emphasizes.

Blast Foundation Launch Aims to Increase Decentralization

The launch of the Blast Foundation marks a step forward in the protocol’s goals to strengthen a decentralized governance structure. The move is designed to increase the community’s participation in the decisions that are relevant to the project’s future development.

The Blast Foundation unveiled today a document named the “Blast Vision”, which is a comprehensive roadmap that outlines the project’s ambitions and the steps it will take to achieve those goals in the long term.

Although the details of the governance structure have not been announced yet, it is expected that BLAST will embrace the usual procedures involving the issuance of proposals by core contributors that can be voted by the community based on their holdings.

Tokenomics and Long-Term Distribution Plan of BLAST

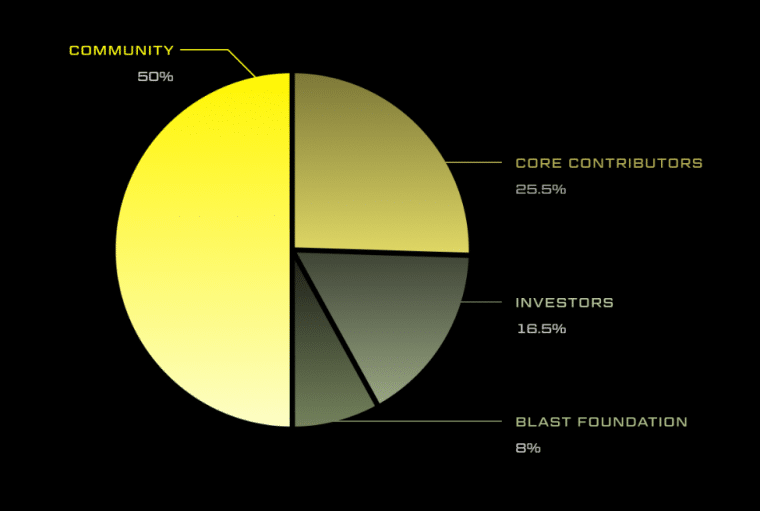

The total supply of BLAST tokens is set at 100 billion. These tokens will be allocated as follows:

- 50% for the community (including today’s and future airdrops).

- 5% for core contributors.

- 5% for investors.

- 8% for the Blast Foundation.

All Tokens allocated to core contributors, investors, and the Blast Foundation will be subject to a four-year vesting period. This extended vesting schedule is designed to align the long-term interests of these stakeholders with those of the protocol and to prevent sudden market disruptions from sizable offloads.

For the community allocation, the additional airdrops will be carried out in the next three years to gradually distribute the remaining 33% of tokens that have been set aside for this purpose.

Blast Secures Two Listings with Prominent Crypto Exchanges

Ahead of the airdrop, Blast has secured listings on prominent cryptocurrency exchanges, including Bitfinex and Bybit. These listings are set to go live on June 26, coinciding with the token distribution.

Blast secured initial listing on prominent crypto exchanges to provide liquidity to the BLAS token. For now, the token will be available to be traded on Bitfinex and Bybit. In both cases, the listings will go live today as well.

On Bitfinex, BLAST will be available for trading against US Dollars (BLAST/USD) and Tether tokens (BLAST/USDT).

Meanwhile, on Bybit, the exchange will support BLAST trading with deposits and withdrawals via the Blast Network.

Blast Attracts $2 Billion TVL and Rewards Developers to Grow its Ecosystem

Since the protocol was launched in November 2023, Blast has managed to attract a significant amount of capital from investors. According to data from L2Beat, the network currently boasts a Total Value Locked exceeding $2 billion. As a result, the project ranks fourth among Ethereum layer 2 solutions.

The launch of the Blast token and the creation of the Blast Foundation position the network as a major competitor in the layer 2 space. Just a few days ago, another important player in the L2 segment, zkSync, completed its widely awaited airdrop as well.

Through Blast Gold, the project is also aiming to incentivize its developer base. The significant allocation that they will receive aims to promote the creation of decentralized apps (dApps) powered by Blast and reward those who have already been using the network to build blockchain solutions.

The substantial allocation of tokens for community initiatives and the development of these decentralized apps suggests a strong focus from the development team on expanding the Blast ecosystem.

As an Ethereum Layer 2 solution, Blast’s future will be closely tied to its ability to provide scalability and efficiency improvements over the Ethereum mainnet. Ongoing upgrades to the protocol will be crucial to maintaining its competitive edge.

Finally, the performance of the BLAST token in the days and weeks following the airdrop will be closely watched by investors and analysts. Its price action and trading volume could provide insights into the market’s perception of Blast’s long-term potential.