As the bitcoin (BTC) price continues to swing within the $26,000-$28,000 range that has been in play now since early May, various market-based measures of expectations for future price volatility continue to plummet.

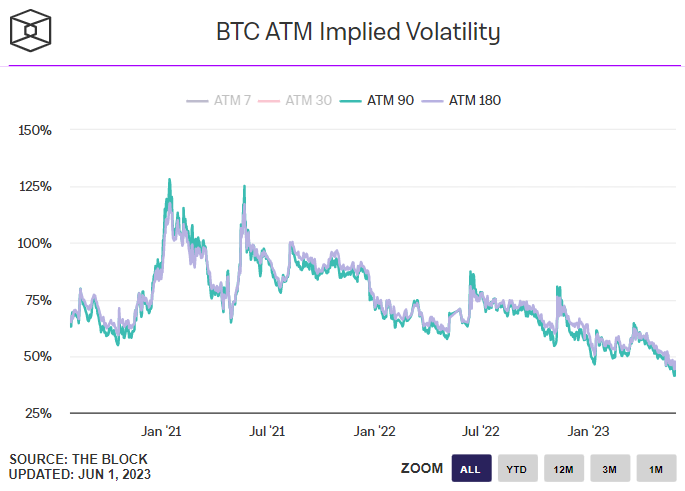

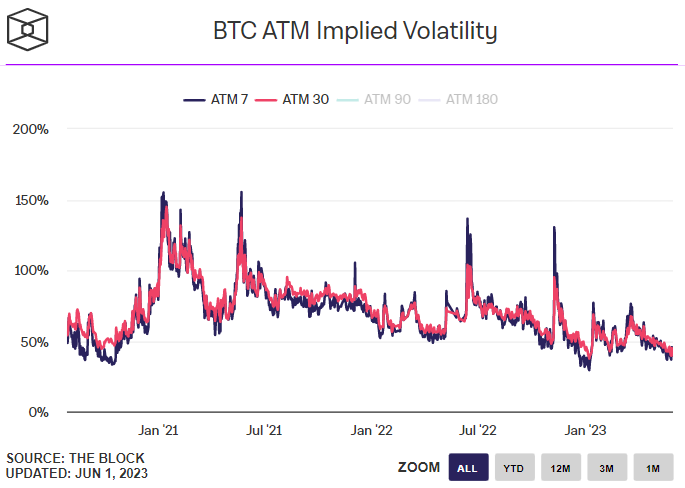

Bitcoin’s 7 and 30-day Implied Volatility according to At-The-Money (ATM) options markets fell to just under 40% on Tuesday, close to multi-month lows.

Meanwhile, Bitcoin’s 90 and 180-day ATM Implied Volatility were close to the record lows printed last week in the respective 41.3% and 44.3% areas.

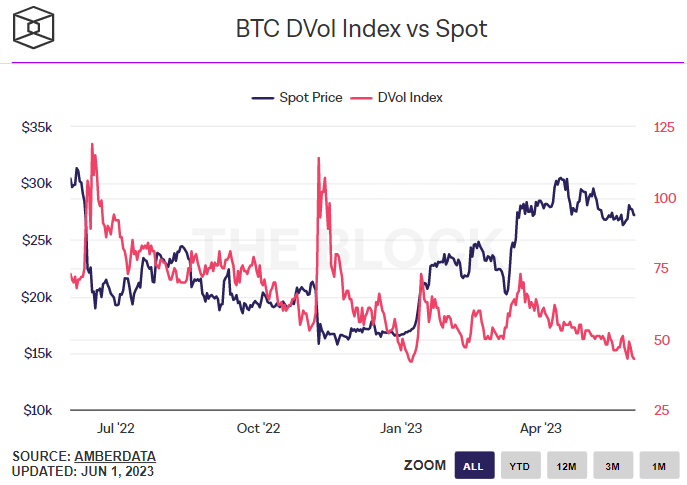

Separately, dominant crypto derivatives exchange Derebit’s index of Bitcoin volatility expectations DVOL was around its lowest levels on record at 43.

The steep drop in volatility expectations comes as the Bitcoin market begins June with a whimper after posting its worst monthly performance in six in May.

Prices were last in the $26,800s, almost bang on the 100-day Moving Average and slightly below the 21DMA.

Technicians largely remain bearish in light of bitcoin’s recent rejection of its 50DMA and a downtrend from the yearly highs in the low-$28,000s.

Many think a retest of recent sub-$26,000 lows is likely, and that bitcoin may be in the process of forming a descending triangle structure, a break to the downside of which could trigger a test of, or even break below key long-term support in the low-$25,000s.

But Any Upcoming Bearish Moves May Be Small Compared to 2022

But subdued volatility expectations suggest that, whatever move is coming, investors don’t think it will be a particularly big one.

Indeed, despite the slow, continuous pullback from year-to-date highs hit around a month and a half ago in the $31,000s, most agree that bitcoin remains in the early stages of a new bull market.

The Fed’s tightening cycle seems to be done (for now), and in the coming years, interest rates are likely to drop as inflation returns to the Fed’s 2.0% target. This suggests that the overall economic situation should improve, while the wider adoption of crypto is expected to keep moving forward.

Many long-term bitcoin bulls would probably love another chance to get to buy bitcoin at $25,000, at $24,000 if it falls back to test the 2023 uptrend, or at $23,000 if it falls all the way back to the 200DMA.

That means any bitcoin downside in the near future ought to be limited in comparison to the swift sell-offs of 2022, when inflation was raging and the Fed racing to catch up with aggressive interest hikes.

Related Articles

- How to Buy Bitcoin in 2023 – Safely & With Low Fees

- Bitcoin Price Prediction: Liquidity Shock Poses Major Threat to Short Term Prices

- Here’s One of the Fastest Ways to Get All the Knowledge You Need to Succeed in Crypto Trading

Wall Street Memes (WSM) - Newest Meme Coin

- Community of 1 Million Followers

- Experienced NFT Project Founders

- Listed On OKX

- Staking Rewards