Bitcoin continues to be the undisputed king of the crypto realm and a reference of the state and future of the market. Naturally, everyone is wondering whether now is the best time to start selling their Bitcoin. Luckily, tons of experts are weighing in to help people make more informed decisions.

Analysts closely watch both on-chain and off-chain trends to identify interesting insights that could provide hints about where the market is going next. The latest drop the digital asset has experienced is causing concern among investors that a pronounced sell-off could be right around the corner.

So, is it a good time to sell BTC? A bunch of top analysts have expressed their views about what the future might hold for BTC. None of these opinions should be considered recommendations to buy or sell the asset but they can be used to enrich investors’ own assessments. It’s always smart to talk to a financial advisor before making these kinds of decisions too.

Short-Term Outlook: Enduring the Recent Spike in Market Volatility

Three perspectives could be considered when analyzing what BTC could do next. The first of those is the short term, which is mostly influenced by capital inflows to exchange-traded funds (ETFs), investors’ appetite for risk, liquidity, fear and greed, relevant market events, and other similar metrics.

Here’s an overview of the short-term indicators that analysts are considering to draft their BTC predictions for the next few weeks.

The Mt. Gox Factor: Overblown Fears or Legitimate Concern?

The distribution of the BTC coins owned by Mt. Gox’s creditors is one of the most pressing matters at the time for market analysts as a total of 140,000 coins will be progressively returned by July 2024, leading to fears that this could trigger a sell-off.

Alex Thorn, head of research at Galaxy, offered an interesting perspective on this particular event. “We think fewer coins will be distributed than people think and that it will cause less bitcoin sell pressure than market expects,” Thorn commented. He bases this assessment on several factors:

- Only about 95,000 coins are likely to be distributed in the initial “early” payout.

- Approximately 65,000 coins will go to individual creditors, many of whom may be long-term Bitcoin believers who could be reluctant to sell considering that they first bought the asset decades ago when its popularity was limited to a small circle of tech-savvy individuals.

- Certain tax considerations may deter these investors from selling their assets immediately as the astronomical increase in the price of BTC will result in huge capital gains taxes on their holdings.

Although the market initially reacted negatively to the Mt. Gox news, Thorn’s analysis suggests that the impact may be less severe than feared.

Long Squeeze in Play According to Willy Woo

Willy Woo, a renowned Bitcoin analyst, attributes the recent price drop to a “cascading long squeeze” in the futures market.

I don't usually do short time frame price action as it's the domain of gamblers. But worth a break down of what's happening given the fear in the market…

We've been flushing out the leverage, 62.5k was the target to get most of it.

Until… https://t.co/ughwSKGYoo

— Willy Woo (@woonomic) June 24, 2024

He refers to a situation where deep-pocketed participants short-sell a significant amount of BTC to cause a drop in the price that should be exacerbated by triggering the stop-loss orders of investors who are holding optimistic long positions on BTC.

He claims that most of the leveraged long positions had a cost basis of around $62,500, meaning that a 5% below those levels could trigger a major sell-off if the stop price of these positions is hit.

Woo also highlights the role of post-halving miner capitulation, noting that “miners are on a Bitcoin selling spree to pay for hardware upgrades due to the old hardware no longer being profitable. The weakest miners closing shop and being liquidated.”

While Woo sees potential for a short-term reversal, he cautions that “BTC is not out of the woods” and emphasizes that investors should monitor if this excess leverage was wiped out of the system by the latest drop in the price of the asset.

Medium-Term Catalysts: Political and Economic Factors

As for the following months, according to analysts, these are some of the catalysts to consider that could have an impact on the price and performance of BTC.

The US Election and Regulatory Landscape

The upcoming presidential election in the United States is considered an important driver for the price of BTC by crypto analyst Rekt Fencer, who claims that the way digital assets are treated and how politicians embrace them or block their advancement is becoming a focal point.

The Republican candidate and former US President, Donald Trump, has made it clear that he is in favor of the crypto market. If he wins, that could result in another wave of interest and demand heading to BTC and altcoins as he could push for additional regulatory clarity and the elimination of roadblocks that are currently preventing the industry from expanding its reach. However, the SEC under the Biden administration has already shifted to be more pro-crypto (or at least less anti-crypto) recently anyway, so this may not be as big of a deal as it may seem.

Federal Reserve Policy and Global Liquidity

Several analysts point to the Federal Reserve’s monetary policy as a crucial factor in Bitcoin’s medium-term outlook. Rekt Fencer notes that the Federal Reserve’s total assets chart is bottoming out, suggesting potential future liquidity injections that could benefit crypto markets.

Fencer is also among the analysts who constantly point to the Federal Reserve’s decisions concerning monetary policy and their impact on the mid-term outlook for Bitcoin. He notes that the central bank’s total assets are bottoming, which could suggest that there could be future liquidity injections that will support higher prices for all assets in the financial system, including BTC.

Moreover, he highlights that countries like Canada and Switzerland have already opted to cut interest rates and this could be a hint that the US could be ready to undertake similar actions. An expansionary policy would also push the value of BTC higher, as has happened in the past.

Stablecoin Market Cap and Altcoin Dynamics

Finally, Ki Young Ju, the head of CryptoQuant, talks about the importance of the stablecoin market as a factor that influences the overall liquidity in the crypto space. In this regard, he cites that the market cap of these tokens is near all-time highs, which indicates elevated levels of buy-side liquidity.

Young says that interest in altcoins is growing and this could lead to a shift in the demand for BTC only as investors look for other projects offering more promising near-term returns at a point when the digital asset is already sitting at all-time highs.

Long-Term Projections: Bullish Sentiment Prevails

Finally, a small group of analysts have ventured to make bold statements about where BTC could be headed in the next few years based on macro variables that they believe could result in higher prices in most cases.

The $100,000 Milestone and Beyond

Despite the current spike in BTC’s short-term volatility, most analysts maintain bullish long-term projections for the digital asset. Some estimates suggest that BTC could reach $100,582 by the end of 2024 while more optimistic predictions see it expanding beyond $150,000 within the same timeframe.

Generational Wealth Transfer as a Game-Changer

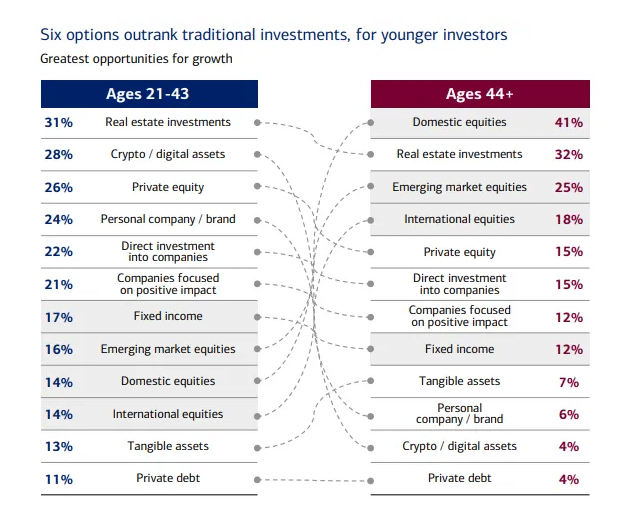

Noelle Acheson, former head of market insights for Genesis Global Trading, presents a compelling long-term bull case based on the anticipated transfer of wealth from baby boomers to younger generations. Acheson estimates that up to $20 trillion could flow into the crypto market over the next decade as a result of this wealth transfer.

“If the inheriting class follows the pattern suggested by the survey, 24% of the wealth transfer (28% of the younger group favour crypto over stocks and bonds, minus 4% from the older group) could flow into the crypto market,” she noted in the latest edition of his newsletter “Crypto is Macro Now”.

In her analysis, Acheson suggests that Bitcoin and Ethereum could receive approximately $10 trillion of these inflows. Under this scenario, she projects potential price targets of $600,000 for Bitcoin and $32,000 for Ethereum.

Institutional Embrace of BTC and ETH Spot ETFs Further Support a Bullish Long-Term Outlook

The approval of spot exchange-traded funds (ETFs) for both Bitcoin and Ethereum is also an important catalyst that analysts are considering to chart the long-term trajectory of these digital assets as it could result in billions of dollars being poured into the ecosystem within the next three to five years.

ETFs are accessible to institutional investors who have deep pockets that can move the needle quite high if their interest in these assets, accompanied by the ease of access provided by these vehicles, keeps growing.

Navigating Uncertainty with Informed Perspectives

Analysts’ opinions about financial assets can help investors in making more informed decisions about their investment decisions, but you should always do your own thorough research. Although it is nearly impossible to time the market, it is often a good idea to try to get a good sense of where things stand to enter or exit positions at the most seemingly advantageous moments.

Right now, BTC is standing close to its all-time high. Will it go higher? Analysts agree that it almost certainly will in the long term (though it’s possible that they’re wrong). However, if you are an investor who is looking to make a quick buck by buying and selling BTC in the span of a few weeks, it is way more difficult to tell if this is a good time to buy or not as plenty of factors could result in a sell-off or push the asset to new highs.

Investors and traders should consider a wide range of factors when assessing Bitcoin’s future prospects, including:

- Technical market dynamics and leverage levels.

- Macroeconomic conditions and central bank policies.

- Regulatory developments and political landscape.

- Long-term adoption trends and significant changes in investors’ preferences.

- Technological advancements in the blockchain space.

As with any investment, it’s crucial to conduct thorough research, diversify appropriately, and only invest amounts that one can afford to lose. The crypto market’s inherent volatility demands a balanced approach that considers both the potential for significant gains and the risk of substantial losses.