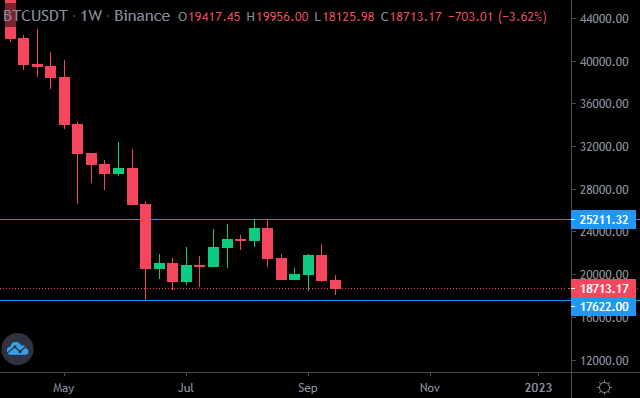

Bitcoin is in the red today, dropping to a new September low of $18,125 and selling off its early FOMC day rally. Is Bitcoin dead for now?

The crypto crash today was not as large as downward moves seen throughout this year – Bitcoin is down just 3.6% this week. However the post FOMC meeting BTC price action has been weak, and may see further continuation to the downside.

Is Crypto Dead For Now

The current sideways trading range Bitcoin has now been stuck in for three months may cap any upside in the remainder of 2022 and potentially into early 2023.

In our ‘how low will Bitcoin go‘ post we highlighted @SmartContracter’s Bitcoin price prediction – twelve months of sideways until late next year.

He posted that prior to FOMC and Bitcoin’s weakness today despite a 75 basis points rate hike – not the 100 bps which investors feared, and therefore good news – now makes his ‘max pain’ scenario more likely.

TraderXO also sees little significant upside in the near term for crypto prices – although is not shorting or overly bearish at the current price levels either.

Tell me why there is any significant upside from here on over the next several weeks?

— XO (@Trader_XO) September 15, 2022

In his technical analysis content TraderXO has made a similar Bitcoin price prediction of boring sideways trading to form an accumulation range.

Many other crypto analysts and traders predict Bitcoin will sweep the current 2022 lows at just over $17,500, but any buys below and around that area will be a smart investment in the long term.

Long Term Bitcoin Price Prediction

CryptoNews.com shared eight Bitcoin price predictions from Twitter traders on or around FOMC day.

The overall sentiment was short term bearish, but long term bullish on Bitcoin – with a long period of chop and an apparently dead crypto market to come.

Fed chair Jerome Powell repeatedly used the term ‘restrictive’ and cautioned that it will ‘take time’ for inflation to come down. Market analysts including a NatWest economist were quoted in CNBC as saying:

‘It’s really hawkish. He said the median rates are much higher than expected. Basically they’re saying it’s front loaded but they are staying restrictive all the way through 2025. It’s three years of tight policy.’

The explosive 2021 crypto bull run was marked by quantitative easing, Fed money printing and stimulus checks.

In contrast, 2022 – 2023 is shaping up to be marked by quantitative tightening and hawkish monetary policy. The next FOMC meeting is scheduled to take place November 1-2.

Related

Tamadoge - The Play to Earn Dogecoin

- '10x - 50x Potential' - CNBC Report

- Deflationary, Low Supply - 2 Billion

- Listed on Bybit, OKX, Bitmart, LBank, MEXC, Uniswap

- Move to Earn, Metaverse Integration on Roadmap

- NFT Doge Pets - Potential for Mass Adoption