The Internal Revenue Service (IRS) recently changed its rules and procedures concerning how cryptocurrency-related taxes are reported. Among them, a new form has been drafted for taxpayers to file every year.

The tax collection agency aims to reduce tax evasion, improve compliance, and provide further clarity to investors in a rapidly evolving landscape. Here’s everything you need to know for tax season.

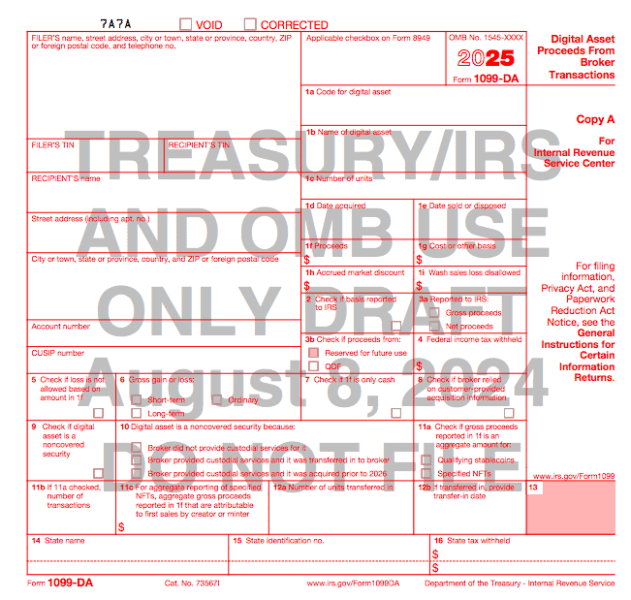

New Form 1099-DA: A Game-Changer for Crypto Reporting

The new form called Form 1099-DA – called the “Digital Asset Proceeds From Broker Transactions” – is becoming a crucial tool for brokers to adequately report certain digital asset sales and transactions starting in 2025.

These forms will be distributed to taxpayers in 2026 and will mark a significant change to how crypto transactions are reported to the agency.

One notable change introduced on 1099-DA forms involves the removal of a field that required investors to report their crypto wallet addresses. Industry professionals and crypto enthusiasts criticized this reporting requirement previously as it endangered the privacy of taxpayers.

Meanwhile, will no longer have to provide transaction IDs or the acquisition date of their digital assets.

IRS Addresses Concerns Raised by Industry Associations

With these changes, the IRS appears to be responding to concerns raised by the Chamber of Digital Commerce – an influential pro-crypto non-profit – in a three-page letter sent in June that expressed their views about the dangers of collecting sensitive data from investors like their wallet addresses.

“We recommend that the final Form 1099-DA request only that information necessary to facilitate reporting of digital asset transactions by taxpayers and that the other information be retained by the digital asset broker in the event it is needed in the examination context,” the letter read.

IRS Commissioner Danny Werfel emphasized the importance of the new form, stating: “This new form will provide more clarity for taxpayers and give them another tool to help them accurately report their digital assets transactions.”

He added: “We know third-party reporting greatly improves compliance with the nation’s tax law. This step will also help us make sure digital assets are not used to hide taxable income, including in high-income categories, while providing taxpayers who play by the rules more information to accurately report their income.”

Brokers will be the first in line to use this new form to report digital asset transactions during the 2025 calendar year. The year after, these new forms will be sent to taxpayers so they can start filing their taxes accordingly.

The agency has invited the public to make comments about the most recent 1099-DA draft in the next 30 days.

New Regulations for Custodial Brokers and NFTs

Aside from this new form released this month, the IRS also made changes in June to its rules concerning crypto custodians. From now on, both exchanges and payment processors must report their transactions to the tax collection agency.

The goal is to also avoid tax evasion by gathering all of the information associated with crypto transactions from the source. These rules apply specifically to platforms and entities that take possession of the digital assets – known as custodians.

Non-custodial brokers and decentralized institutions like DeFi protocols are exempt from these requirements. The IRS said a separate set of regulations and requirements will be drafted for this group shortly.

Starting in 2026, these platforms will be required to send these new reports to the IRS. According to estimates from the Congressional Budget Office, this could result in an additional $28 billion in tax earnings collected by the federal government.

Brokers will also be required to record the cost basis of every crypto transaction starting in 2026 to calculate the capital gains or losses resulting from each operation. Meanwhile, the year after, they will have to include cost basis information in their reports covering the 2026 fiscal year.

In addition, the IRS has introduced a specific reporting requirement for non-fungible tokens (NFTs). All annual NFT proceeds of $600 or more must now be reported, bringing this emerging asset class under closer scrutiny.

Taxpayers Should Find It Easier to Report their Crypto Taxes with the 1099-DA

🚨 An updated draft 1099-DA form just posted on the IRS website, which reflects the final broker regs issued in June. As a refresher, this is the form that “brokers” will start using in 2025 to report digital asset transactions to customers. https://t.co/NSSu8prl4X

Initial…

— Ji Kim (@_jikim) August 9, 2024

The new form and regulations are expected to provide greater clarity for taxpayers and improve compliance in the crypto space. Erin Fennimore, vice president of tax at TaxBit, commented: “These updates offer enterprises – specifically custodial exchanges – the guidance needed for proper compliance, further solidifying crypto’s position within the broader financial ecosystem.”

Individual investors should experience a simplified tax reporting process as a result of these new changes. Since Form 1099-DA eliminates the need to disclose sensitive information, they may also feel safer when filing their tax documents with the government.

That said, experts warn that the IRS is focusing too much on centralized exchanges and ignoring the huge transaction volumes processed daily by decentralized platforms in the DeFi space.

“The focus on centralized exchanges like Coinbase and Kraken certainly overlooks the burgeoning DeFi ecosystem, which, as we know, operates on fundamentally different principles. This could create an uneven playing field and stifle innovation in the crypto industry,” said Andrew Rossow, Chief Executive Officer at AR Media Consulting.

Rossow also highlighted that, even though wallet addresses and other sensitive information have been removed, these forms still increase the risk and potential damages to investors resulting from data breaches and identity theft if government systems are accessed by bad actors.

2024 Will be an Important Year for Crypto Taxation

Since these reporting requirements will be enforced starting in 2025, crypto investors may have limited time to prepare accordingly. Experts recommend taking proactive steps like reducing the number of crypto wallets owned to facilitate keeping track of the cost basis of different transactions.

“If you bought digital currency over several years across multiple wallets, you currently have ‘different basis lots,” commented Matt Metras from MDM Financial Services.

Andrew Gordon, tax attorney and president of Gordon Law Group, highlighted: “2024 is the most important tax year for crypto investors to be reporting.

Gordon emphasized that, while the new reporting rules won’t apply to the upcoming tax season, it’s crucial for investors to collect crypto data and properly report their activities, including the cost basis of their transactions, for 2024. This is because, starting in 2025, the IRS will have a “firehose of information” to verify if past reporting was accurate.

Industry Professionals Shared Positive Views About the New Rules

The crypto industry’s reaction to the new IRS rules has been mixed. While many appreciate the clarity provided by these updated forms and regulations, concerns still prevail about the impact on privacy and innovation.

Some industry experts see the new regulations as a positive step toward increasing mainstream adoption of cryptocurrencies. TaxBit’s Erin Fennimore stated: “With this new framework, we anticipate increased market adoption. These regulations address and clarify many critical areas while providing relief for the more complex areas that require additional time for Treasury and the industry to address properly.”

Meanwhile, Tony Tuths, a crypto tax practice leader and principal at Alternative Investments, noted the IRS’s decision to take more time to draft its DeFi regulations: “Interestingly, they decided to defer on DeFi by not immediately requiring full reporting.” This approach leaves questions about how transactions in the decentralized finance space will be treated in the future.

Also read: DNS Attack Hits 200+ DeFi Protocols – Here’s How to Keep Your Crypto Safe

As the crypto industry continues to evolve rapidly, it’s clear that regulatory frameworks will need to adapt to embrace the uniqueness of digital assets.

The IRS’s latest changes represent a significant step forward in embracing digital assets into the mainstream tax reporting system.

As cryptocurrencies operate on a global scale, questions persist about how these new US regulations will come into play and work alongside international tax laws and reporting requirements.

The potential for conflicting regulations across jurisdictions could create challenges for both investors and businesses with operations in multiple countries. Meanwhile, trading platforms and brokers will need to perform the required investments and changes to their backend to accommodate these new requirements as they will now be forced to collect sizable data sets from customers and report them back to the agency promptly.