Despite the crypto markets correcting in 2022, institutions like Goldman Sachs are bullish on decentralized finance. How to invest in DeFi?

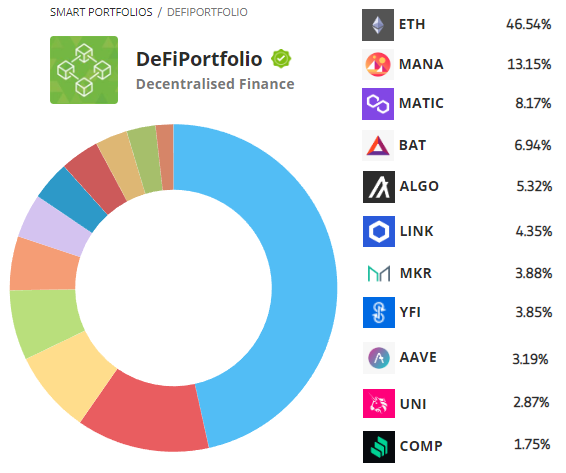

One way is on FCA regulated stocks and crypto platform eToro.com where you can invest in DeFi yourself or use their own ‘Smart Portfolio’ built around DeFi crypto projects and DeFi stocks.

That’s known as their ‘DeFi Portfolio’ and they also have a general crypto portfolio and a metaverse portfolio. You can also copy trade an individual pro traders who has a positive return on investment (ROI) in the last 12 months and knows how to invest in DeFi tokens early.

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

Why Invest in DeFi

The total DeFi market capitalization retraced approximately 66% from its all time high of $200 billion set in November 2021, to a low of $50 billion in 2022 – a retest of the same 2021 lows – where it found support and at the time of writing, has bounced 15%.

Partly that was due to issues unrelated to decentralized finance as a concept such as the traditional markets (TradFi) selling off – the SPX crashed under 4,000. Bitcoin, not considered a DeFi coin, also dropped below $28,000.

One specific DeFi project, Terra (LUNA) also crashed 99% in a black swan event. That issue facing Terraform Labs and its CEO Do Kwon was not indicative of other DeFi crypto’s potential. S

Some DeFi coins such as Maker actually pumped up to 35% to the upside on the same day as the LUNA crash as investors moved into other DeFi projects with a similar DeFi use case and utility.

In their DeFi report Goldman Sachs have a long-term outlook into the future – the DeFi ecosystem is still relatively new and has increased over 25x since its valuation of under $2 billion early in 2020.

How to Invest in DeFi Crypto

Opening an account on eToro is free, beginner friendly and the minimum deposit is $10 in the US and UK, and slightly more worldwide.

Currently their DeFi portfolio is focused on DeFi crypto projects although that may also be partially weighted more towards DeFi stocks in the future.

It includes DeFi coins we’ve reviewed on this site such as Algorand (ticker symbol ALGO), Chainlink (LINK), Maker (MKR), Basic Attention Token (BAT), Uniswap (UNI), Compound (COMP) and others.

A large percentage is held in Ethereum (ETH) for stability – most DeFi projects run on on the ‘Layer 1’ Ethereum blockchain. It’s also the second largest crypto by marketcap and has held its value well despite the 2022 crypto market correction.

We also wrote a guide on how to buy DeFi Coin (DEFC) an undervalued DeFi token that recently showed bullish price action in Q2 2022.

That’s listed on Pancakeswap where low market cap DeFi coins are often listed before they are available on larger crypto exchanges like Binance, Coinbase or eToro. Using a decentralized exchange (DEX) like Pancakeswap is a way to invest in DeFi tokens early.

DeFi News

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.