This Macro Update Triggered The Latest Crypto Pull-Back

Most major cryptocurrency prices have pulled lower in the last 24 hours. Bitcoin was last down around 1.4% over that time period, as per CoinMarketCap, with BTC/USD changing hands in the $17,000 area. Ether, meanwhile, was last down about 2.4% over the same time period and trading in the $1,260 area, while the likes of BNB, Ripple, Dogecoin, Cardano and Polygon were all also last down between 2-5%.

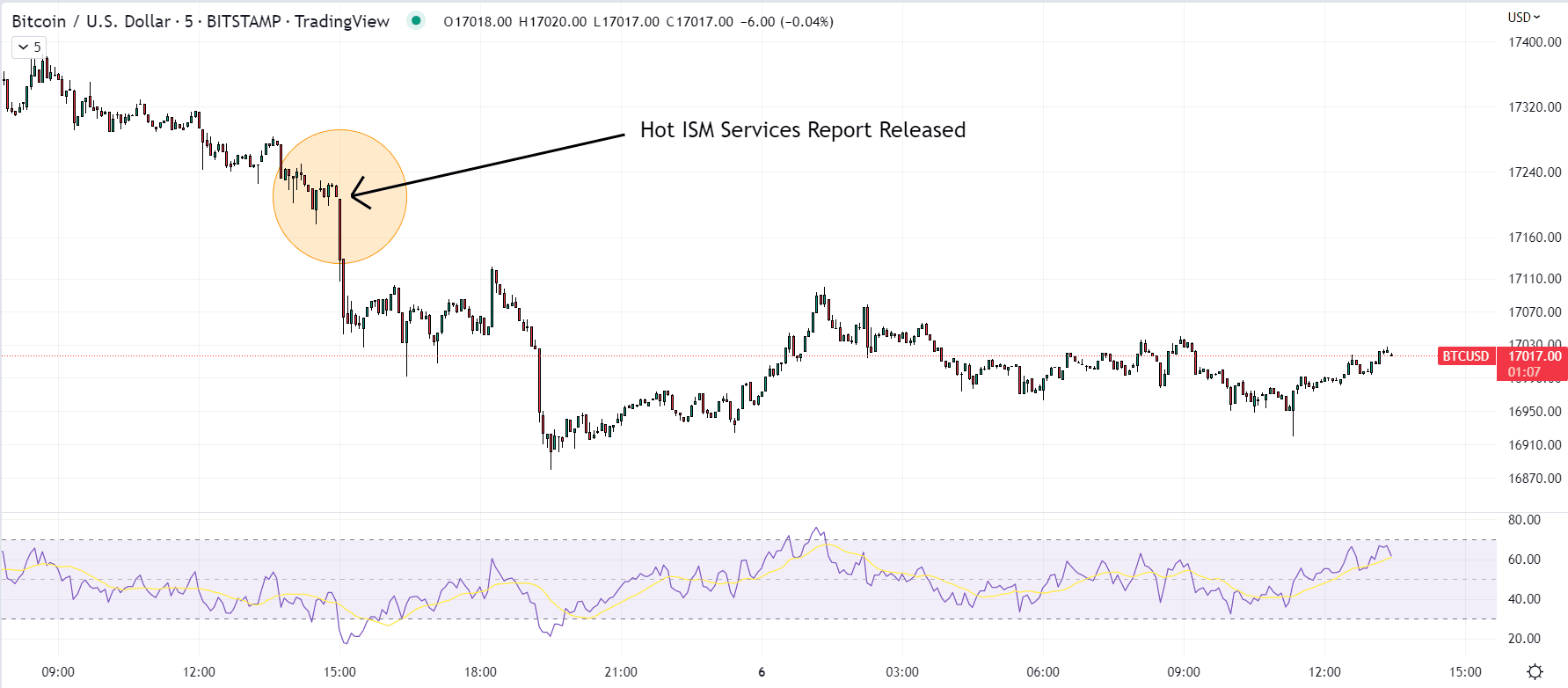

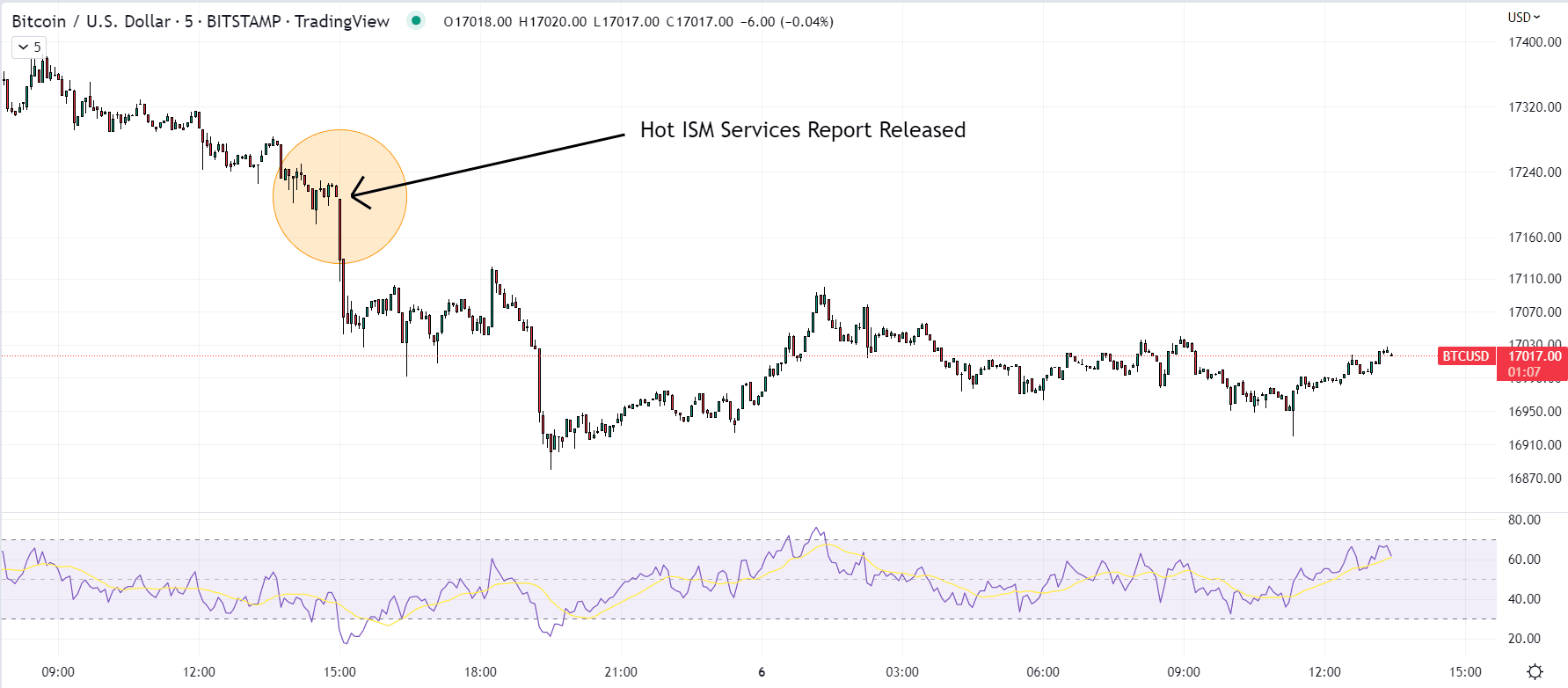

The latest pullback, which has seen most major cryptocurrencies drop back modestly from multi-week highs, was catalyzed by macro events. US ISM Services PMI data for November was released on Monday and came in significantly stronger than expected. Combined with last Friday’s solid jobs report, also for November, traders have become more fearful that the US economy won’t slow sufficiently for US inflation to come back to the US Federal Reserve’s 2.0% target, meaning the central bank might have to put its foot on the breaks even harder with more rate hikes next year.

That resulted in the US dollar rallying, US yields jumping, US stock indices declining and cryptocurrency prices also falling back. While cryptocurrency prices have stabilized on Tuesday, they still remain a fair whack lower versus Monday’s pre-data levels. Bitcoin, for example, had reached as high as the $17,400s prior to the data on Monday, and is now more than 2.0% lower versus these pre-data highs.

But The Crypto Pullback Might Be Temporary

Just as macro forces dragged crypto lower on Monday, they could lift cryptocurrency prices later this week. There isn’t much by way of important US economic data until Friday, so over the next few days, price action across asset classes, including crypto, could remain fairly quiet. But things could get lively on Friday.

US Producer Price Inflation (PPI) data for November is scheduled for release, as well as the preliminary version of December’s University of Michigan (UoM) Consumer Sentiment survey. The YoY rate of PPI is seen plummeting for 7.2%, which would be its lowest since mid-2021. The MoM gain in PPI is seen coming in at a moderate 0.2% for a third successive month – 0.2% MoM readings are consistent with inflation at very slightly above the Fed’s 2.0% target.

PPI data, if it comes in as expected or surprises to the downside, thus holds the possibility of further strengthening the idea that US inflation is swiftly returning to the Fed’s 2.0% target. It can thus ease fears about how aggressive the Fed will need to get in order to dampen inflation, which could come as a boost to stocks and crypto.

Meanwhile, traders will be closely scrutinizing the UoM’s latest Consumer Sentiment survey. In particular, they will be monitoring the inflation expectations aspect of the survey, as this is something that the Fed has in the past said it pays close attention to. 1-year inflation expectations have stabilized near 5.0% in recent months. Any downside surprise could ease fears about sticky inflation and could also come as a boost to sentiment in crypto markets.

Incoming Santa Rally?

Another factor to note is the seasonality of cryptocurrency markets (and the stock market). Both historically tend to strengthen into the end of the year. This is often referred to as a “Santa Rally”. In the past nine years, bitcoin’s mean MoM return in December has been a gain of 5.7%. The largest loss was a 34.81% drop in 2013 while the largest gain was a 46.92% gain in 2020.

Meanwhile, Ether’s mean monthly gain in December over the last 6 years, has been 11.3%, with the biggest gain a 70.54% rise in 2017 and the biggest loss a 20.61% decline in 2021. While seasonality alone won’t be enough to spark a broad cryptocurrency rally, it could accelerate things if macro forces and other trends can lift prices in the coming weeks.

Related Articles

- Altcoin Prices Erase Gains as US Dollar Rallies on This Key Macro Development

- Bitcoin Price Prediction – Why BTC Could Pump Back to $20k Soon

IMPT - New Eco Friendly Crypto

- Carbon Offsetting Crypto & NFT Project

- Industry Partnerships, Public Team

- Listed on LBank, Uniswap

- Upcoming Listings - Bitmart Dec 28, Gate.io Jan 1st