In a historic and unprecedented outcome, nearly all creditors of the failed cryptocurrency exchange FTX will recover 100% of the funds they had on the platform before its shocking collapse in November 2022. But there’s a huge catch. Victims who were holding cryptocurrencies on the platform will not be paid back in crypto. They will be paid in USD based on the value of the coins around the time of the collapse, which is much less than they are worth today.

The appointed administrators of FTX during the bankruptcy proceeding revealed a plan to raise between $14.5 and $16.3 billion from selling various assets owned by the failed crypto exchange. These figures exceed the $11.2 billion worth of claims that they have received from FTX´s customers.

To fairly distribute the surplus, each creditor will receive interest payments at a rate of around 9% per year according to court filings.

The lucrative recovery plan, laid out in filings to the US Bankruptcy Court in Delaware, is considered an exceptional result in bankruptcy law. Companies that go through Chapter 11 proceedings rarely return all of the money they owe to creditors, let alone offer any interest payment on their claim.

FTX’s ability to fully reimburse its customers stands as a rare outcome that contrasts the results of cases involving high-profile bankruptcies like Enron, Lehman Brothers, and countless other corporations whose creditors recovered just pennies on the dollar.

John Ray III, the veteran restructuring officer brought in to clean up FTX’s mess, called the expected 100% repayment plus interest a pleasing outcome given the exchange’s complete failure just 17 months ago.

“We are pleased to be in a position to propose a Chapter 11 plan that contemplates the return of 100% of bankruptcy claim amounts plus interest for non-governmental creditors,”, said the seasoned bankruptcy lawyer in a prepared statement.

Under his leadership, FTX’s bankruptcy team has monetized a large number of assets to accumulate the funds needed to settle the historic payout.

Where Did the Money Come from?

Most of the funds recovered by Ray’s team came primarily from investments held by the Alameda Research hedge fund and FTX Ventures as well as some litigation claims.

Meanwhile, a major windfall came from selling FTX’s stake in the red-hot artificial intelligence company Anthropic – the developers of the popular AI model Claude – that was worth over $880 million. FTX also held a significant portfolio of crypto assets like Bitcoin (BTC) and Solana (SOL) that appreciated substantially in value as the market rebounded over the past year.

The bankruptcy estate was further upended after lawyers managed to recover $2.6 billion in cash reserves and liquidated 38 properties in the Bahamas that were previously owned by FTX and its executives.

“John Ray has sold everything that wasn’t nailed down to the floor,” commented Louis d’Origny, the founder of a fund that bought FTX creditor claims. D’Origny expects to book a $25 million profit once his firm receives the payout.

Meanwhile, Thomas Braziel, a broker who also bought millions in claims from the largest hedge funds that had money in the exchange, praised Ray’s work by saying: “John and the team absolutely crushed it.”

Group of Claim Holders Complain that Assets Were Sold at Heavily Discounted Prices

While the repayment is undoubtedly a massive win for former FTX users who feared that their money was gone forever, the biggest beneficiaries are distressed debt traders who scooped up bankruptcy claims at bargain prices.

Hedge funds like Attestor, Baupost, and Farallon managed to buy a combined total of nearly $1.4 billion in claims last year for just cents on the dollar. With Ray’s plan to pay full value plus interest, these risk-takers could see their investments pay off quite a handsome reward.

However, not every creditor is celebrating the deal. Some investors like Arush Sehgal, who had $4 million trapped on FTX, argue that the repayment plan severely undervalues their holdings by pegging claims to depressed crypto prices from November 2022 rather than using current market rates.

“The damage done to the estate assets by John Ray has now exceeded Bankman-Fried’s original crime,” Sehgal claimed, referring to the fraudulent actions of FTX’s founder.

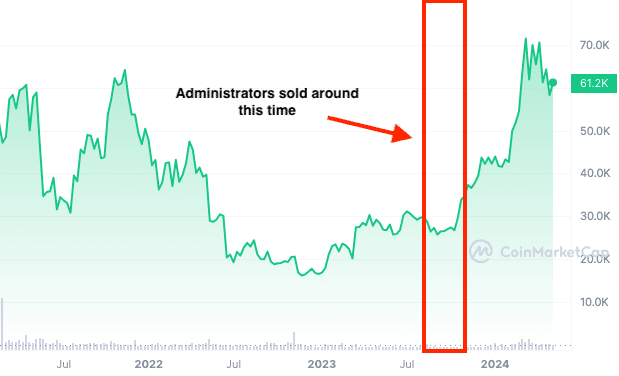

Creditors are also angered that FTX sold off billions worth of its Solana holdings last year at a price of around $64 per token – less than half Solana’s current market value of over $140.

Also read: FTX’s Amended Reorganization Plan Could Cost Creditors Millions

Some see those sales as detrimental to their claims and believe that lawyers are selling a lie by stating that they are being paid in full while they are actually experiencing significant losses due to administrators’ decision to sell these assets at deeply discounted prices.

Moreover, a coalition of over 1,600 creditors plans to vote against Ray’s repayment proposal in June because they believe that it shields FTX’s legal advisors from liability for their potential roles in the collapse.

“There are a million ways that creditors can get screwed over. The plan administrator can go back on the promises in the plan,” warned Sehgal, who previously sat on FTX’s creditor committee before it was disbanded.

“It’s an insult to creditors,” Sehgal highlighted, referring to John Ray’s proposed distribution.

Despite the criticism, experts in bankruptcy law have commented that John Ray III and his team followed a well-known procedure called dollarization that seeks to make claims homogeneous by assigning them a dollar value rather than treating them as individual cases with a specific list of assets. It is extremely unfortunate that the FTX collapse itself helped crash crypto markets, making the coins worth much less than they would otherwise when they were sold to refund creditors.

Estimates claim that investors may be losing around a third of the value that their holdings would have if these digital assets had not have been sold by bankruptcy administrators, depending on the assets they lost.

Further Details about the Repayment Plan

Under the terms of the proposed repayment plan, creditors who are owed $50,000 or less – around 98% of FTX’s customer base – will recover approximately 118% of their claim to account for the time value of their trapped funds.

The remaining creditors will receive a full 100% repayment of their claim, plus supplemental payments calculated at a 9% annual interest rate for amounts exceeding $50,000.

Also read: Founder of Binance Changpeng Zhao Sentenced to 4 Months in Prison – Which Crypto CEOs Could Be Next?

FTX said that the precise timeline for distributing funds remains uncertain but customers can likely expect repayments within 60 days after the court approves the final plan, which could take place during a scheduled hearing set for June 25, 2024.

The proposal allows the IRS and other US government agencies to recoup $200 million upfront while deferring their larger claims until after customer repayments are completed.

While FTX’s estate has secured enough assets to fully compensate creditors, the payout amounts are based on the US dollar value of customers’ accounts who had crypto holdings with the exchange when it filed for bankruptcy in November 2022. This prevents them from benefitting from the rally that the crypto market has experienced over the past 18 months, which has seen assets like Bitcoin (BTC) gain more than 200%.

For example, if a customer held 1 Bitcoin worth $16,000 on FTX in November 2022, they would receive a repayment of around $16,000 plus interest and not the current market value of BTC, which exceeds $60,000. So in real economic terms, most creditors are still losing a lot of money even with a full repayment.

“I’ve been trying to impress on fellow creditors that simply agreeing to this plan in no way guarantees a wholesome end to the whole sordid bankruptcy affair,” commented Pat Rabbitte, an FTX creditor who has been actively recruiting fellow claimants to cast a vote against John Ray’s proposal.

Despite his efforts, Rabbitte believes that people who signed up to vote against the proposal could ultimately agree with the plan due to “creditor fatigue”.

A Rare “Happy” Ending to the Crypto King’s Former Empire

Victims will be unhappy that they missed out on the crypto bull run so far but they can be grateful that they at least got the dollar value of their accounts at the time of the collapse. Many bankruptcies like this end with a majority of creditors going unreimbursed. FTX’s ability to refund all of its customers remains a historic accomplishment that will surely become a case study for bankruptcy law.

FTX’s downfall was one of the most sensational corporate implosions in recent history. It involved revelations of misused customer funds, criminal misconduct by the leadership team, and overall mismanagement of a multi-billion-dollar crypto empire.

The exchange’s 30-year-old founder Sam Bankman-Fried, who went from being hailed as the “Crypto King” to an incarcerated felon in a matter of months, is currently serving a 25-year prison sentence for defrauding investors and customers.

While Bankman-Fried originally claimed that FTX’s customers would all be made whole, the reality turned out to be far bleaker as the exchange collapsed into bankruptcy with an $8 billion deficit on its books.

Ray’s repayment plan marks an exceptional turn of events in one of the most complex bankruptcy cases in history. It offers a rare case study of how to recover maximum value for creditors, despite leaving some investors still dissatisfied with the outcome.