Ethereum as an Inflation Hedge

Many assets that performed well in previous years are underperforming this year due to levels of inflation that haven’t been seen in years. The average global inflation has soared to 10.2%, the first double-digit increase since statistics began.

To put things into perspective: Average #inflation in the world has jumped to 10.2%, the first double-digit increase since statistics began. pic.twitter.com/hGBTeBPeXt

— Holger Zschaepitz (@Schuldensuehner) October 14, 2022

When inflation is high, people try to buy limited-supply items such as commodities and real estate. Furthermore, there is a limited supply of cryptocurrencies, and many supporters tout their benefits as a hedge against inflation.

Considering its relatively low inflation rate and significant market capitalization, Bitcoin is a prudent investment to use as an inflation hedge.

Ethereum, on the other hand, is intended to be deflationary. The network continues to generate new Ether tokens. It does, however, regularly burn or destroy them in order to reduce the total supply. The coin must become scarce over time and serve as a hedge against inflation.

Ethereum Became Deflationary

The Ethereum network was successfully converted from a proof-of-work network to a proof-of-stake network almost a month ago. The Ethereum merge has significantly reduced the energy required to create new currencies, as well as the distribution of ETH. Furthermore, for the first time since the network merger, Ethereum is deflationary.

The dynamic of burn and issuance, combined with the network’s staking system, makes a price squeeze much more appealing. If the network had not merged to proof-of-stake, it would have issued more than 344k ETH in the previous month, according to Ultrasound money’s PoW simulation. If there is network demand for the asset since the merge, it means there will be a significant shortage of ETH supply.

Ethereum is not deflationary on its own. The merge issuance modification with EIP-1559, on the other hand, theoretically makes ETH deflationary. Since a significant portion of the ETH supply has been staked to validate and receive incentives, liquidity has been declining. However, Ethereum will continue to be deflationary as long as issuance lags behind to burn.

Ethereum Starts Shanghai Upgrade on Testnet

Following last month’s successfully implemented merge event, Ethereum’s core developers are now beginning to focus on the network’s next, widely awaited update, code-named Shanghai.

On Friday, the Ethereum Foundation announced the launch of a pre-Shanghai testnet it is calling “Shandong.”

We are happy to announce the launch of an early Pre-Shanghai testnet we are calling "Shandong". https://t.co/1HpFTPUMOU

This is an experimental testnet run in cooperation with EF DevOps which activates a set of selected Shanghai-considered EIPs for early client testing.

— EF JavaScript Team (@EFJavaScript) October 14, 2022

This testnet will serve as a proving ground for numerous Ethereum Improvement Proposals (EIPs), which Ethereum’s core developers will build, tweak, and eventually whittle down to the select number of updates that will be included in Shanghai when it eventually goes live.

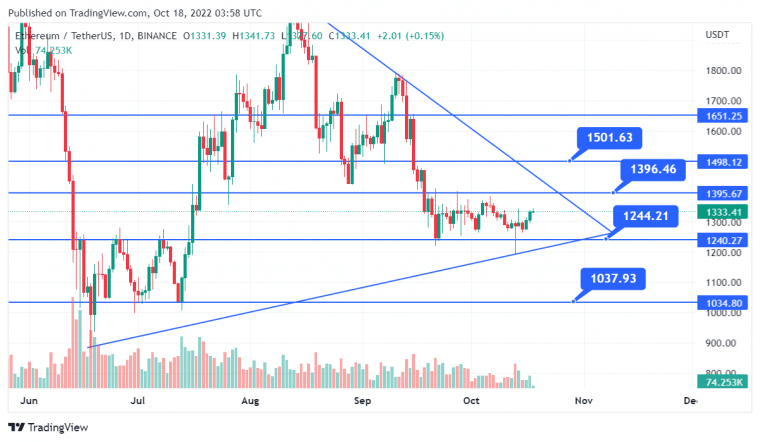

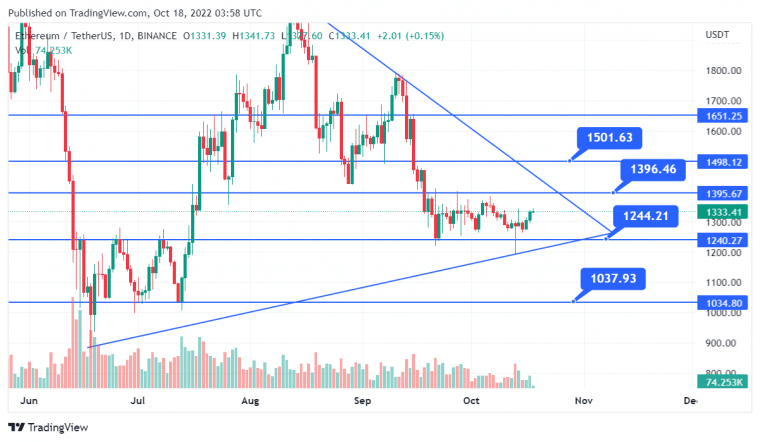

Ethereum Price Prediction

Ethereum Price Chart – Source: Tradingview

On the technical front, Ethereum’s immediate support is at $1,244 and it is moving north toward the next resistance area of $1,396. A bullish break of $1,396 could expose the ETH -price to $1,446 or $1,501. While the support remains at $1,285 or $1,244.

Related news:

- Here’s Why Crypto Prices Might Be Getting Ready to Explode If This Happens

- 10 Best Altcoins to Invest in 2022

- Ethereum Price Prediction for 2022 & 2025

- Best Crypto To Buy Now

- Best Long Term Crypto Investments

Tamadoge - The Play to Earn Dogecoin

- '10x - 50x Potential' - CNBC Report

- Deflationary, Low Supply - 2 Billion

- Listed on Bybit, OKX, Bitmart, LBank, MEXC, Uniswap

- Move to Earn, Metaverse Integration on Roadmap

- NFT Doge Pets - Potential for Mass Adoption