ETH, the cryptocurrency that fuels the Ethereum network, slipped back into the mid-$1,200s on Thursday after a wide rally in risk assets on Wednesday. This rally was sparked by a more dovish-than-expected statement from US Federal Reserve Chairman Jerome Powell regarding future US interest rate hikes, which pushed ETH/USD above $1,300. The world’s second-largest cryptocurrency by market cap and the token for the leading smart-contract blockchain was last trading about 2.0% lower on the day, according to CoinMarketCap.

Profit-taking after the recent surge is being mentioned as a reason for the pullback. A decline in US stock prices due to disappointing US ISM manufacturing PMI data is also impacting the mood in the cryptocurrency market on Thursday. Other major cryptocurrencies, like bitcoin, are experiencing losses as well. However, ethereum is still up about 18% from the double bottom it hit last month below $1,100 and, according to CoinMarketCap, is up more than 6.0% over the past week. ETH gained upward momentum after surpassing its 21-Day Moving Average earlier this week, and price predictions remain positive.

Improving Macro Conditions To Support Ethereum?

US economic data on Thursday pointed to 1) price pressures easing faster than expected and 2) the US manufacturing sector weakening faster than expected. Other key parts of the US economy also look to be softening, with labor market data due tomorrow expected to indicate a slowdown in the pace of hiring. Economists are upping their bets for the US economy to enter a recession in 2023.

All of the above argues for a softer stance from the US Federal Reserve. That Fed Chair Powell indicated earlier this week that the bank will now be lifting interest rates at a slower pace is a first step in the softening of this stance. The Fed could soon be talking about a pause in rate hikes and then eventually some rate cuts.

As a result of the shift in economic data and the Fed’s tone in recent week, the US dollar has been getting hit, while US stocks and bonds have been rallying. This is generally a good macro backdrop for gains in crypto prices, but crypto investors have been side-tracked by the ongoing fallout of the abrupt collapse of Sam Bankman-Fried’s FTX business empire.

Despite its recent gains, Ethereum remains about 25% below its pre-FTX collapse highs. But should the current trend in traditional asset classes extend, crypto could well see an impressive recovery in the next few weeks or something of a “Santa rally”. Ethereum, as one of the dominant cryptocurrencies in the space, could be a key beneficiary.

Price Prediction – How High Can Ethereum Go?

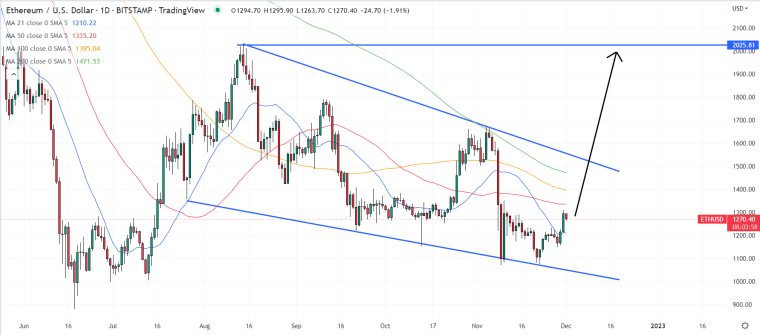

The next target being monitored by the ETH bulls is the 50-Day Moving Average (DMA) in the $1,330 area and, above that, a key balance area and the 100DMA in the $1,400 area. Beyond that, there is the 200DMA at $1,470 and then the upper bounds of a downward trend channel that has been capping ETH/USD price action going all the way back to August. If the cryptocurrency can overcome all of these hurdles, then it could threaten the peak pre-Ethereum “Merge” highs printed in August around $2,000.

If a dovish pivot from the US Federal Reserve to support a US economy in recession as inflation makes rapid progress back towards its target is really on the horizon for 2023, and traditional assets continue to act as such, then there is no reason why crypto prices, including that of ETH, can’t go substantially higher from here.

Related Articles

Binance CZ Says Crypto is Healthier Now – Is He Right And Should You Buy The Dip?

Bitcoin Price Prediction – Why BTC Could Pump Back to $20k Soon

IMPT - New Eco Friendly Crypto

- Carbon Offsetting Crypto & NFT Project

- Industry Partnerships, Public Team

- Listed on LBank, Uniswap

- Upcoming Listings - Bitmart Dec 28, Gate.io Jan 1st