Ethereum price upholds an optimistic outlook oblivious to the turbulence faced by the majority of crypto assets in the market. The largest smart contracts token, with $182 billion in market cap, is up 1.5% in 24 hours to exchange hands at $1,512 at the time of writing.

Experts believe Tuesday is an important day for the market due to the expected release of the United States Consumer Price Index (CPI). Many foresee a spike in volatility as market participants adjust their expectations based on real data.

Over the last seven days, Ethereum price lost 6.5% of its value after reaching a new 2023 high of around $1,712. On the downside, ETH price is holding above a crucial buyer congestion zone, as highlighted at $1,500 on the daily time frame chart.

Ethereum Price Gets Bullish Rating Following Zhejiang Testnet

Ethereum price appears poised to push for the resumption of the uptrend while holding firmly to support at $1,500. In particular, investors are banking on the upcoming Zhejiang Testnet to ignite another short-term rally in ETH.

The Ethereum core development team successfully simulated withdrawals of staked ETH on the Zhejiang Testnet. Investors are waiting with bated breath for the Shanghai upgrade, expected to debut before the end of March.

This software upgrade, will for the first time, enable the withdrawal of staked ETH in the Beacon Chain smart contract. According to Seeking Alpha, a crypto-based media platform, the successful rollout of test withdrawals on Zhejiang Testnet is a testament that the Ethereum Shanghai upgrade is around the corner.

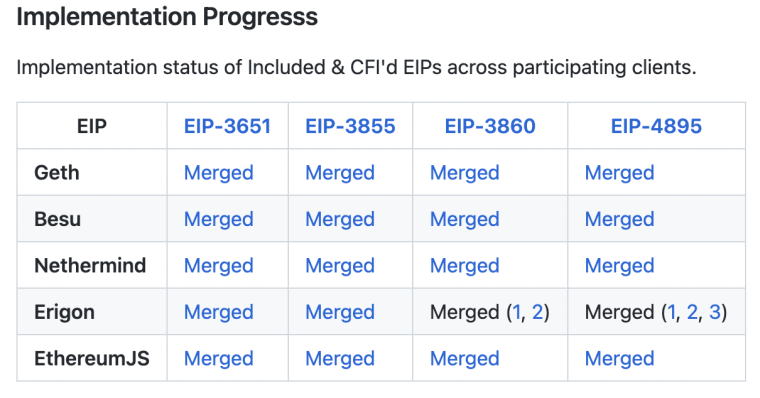

As highlighted on GitHub, all the key code changes needed for the Shanghai upgrade have now been merged into the network’s code base. In other words, developers are ready to launch the main upgrade, but first, a series of testing events must take place to ensure everything goes according to plan.

A testnet is a key component of any software development journey. It allows developers to test changes on the code in a controlled environment before these changes are taken to the actual software (blockchain). This helps to zero in on potential risks and mistakes that come with coding while balancing the need for stability.

Zhejiang Testnet was executed on February 7 but will not be the last one. There were no major issues reported during the staking withdrawals simulation. Two more testnets are expected before the main Shanghai upgrade.

Ethereum Price Technical Outlook After Zhejiang Testnet

Investors believe the Shanghai upgrade, which will see those who staked ETH in the Beacon Chain have access to their assets, will have a positive impact on Ethereum price. It is worth mentioning that while such expectations are in order, nothing is ever guaranteed in the crypto market.

Remember, Ethereum price dipped following the massive Merge upgrade last year that marked the transition from a proof-of-work (PoW) consensus algorithm to a proof-of-stake (PoS). However, liquidity-staking platforms like Rocket Pool and Lido DAO continue to perform exceptionally well in the weeks leading to the Shanghai upgrade.

It is believed investors may prefer to lock assets in liquid staking platforms as opposed to layer 1 blockchains like Ethereum. These protocols allow investors to access the liquidity of their assets even when staked in a smart contract, which can then be used to generate more income.

On the bright side, some argue more investors would confidently buy Ethereum to stake knowing that they can access the tokens following the Shanghai upgrade. With this scenario in mind, Ethereum price may trigger another upswing to $2,000 and possibly launch another leg toward $3,000.

From the daily chart, ETH holds above support at $1,500, strengthened by the 50-day Exponential Moving Average (EMA) (in red). However, with the 200-day EMA (in purple) at $1,527, it means Ethereum price is currently boxed between a rock and a hard place.

Despite the robust support at $1,500, a sell signal from the Moving Average Convergence Divergence (MACD) indicator adds credence to the pessimistic outlook. If bulls fail to close the day above the 200-day EMA, declines may stretch to $1,446, where the 100-day EMA (in blue) sits.

Traders looking for opportunities to short ETH must wait until the price breaks and holds below the 50-day EMA at $1,500, for a plausible profit booking at $1,446. Considering this is the last line of defense, Ethereum price may be forced to seek relief at $1,400. Bulls would collect more liquidity here to capitalize on the next upswing to $1,700 and $2,000, respectively.

On the upside, we cannot immediately rule out a conceivable chance of Ethereum price starting the uptrend immediately above the 200-day EMA (in purple). Such a move would quickly repair the deteriorating investor confidence, which would, in turn, propel Ethereum price to $ 1,700 and $2,000, respectively.

Ethereum Price Alternatives To Consider

Before buying Ethereum, investors may want to consider some of the best crypto presales in the market. A dedicated team of experts reviews the best altcoins to buy for 2023 every week to come up with a list of the best altcoins to buy as you build your crypto portfolio.

The web3 gaming sector has been catching momentum with new entrants like Meta Masters Guild (MMG) set to change the future of the space. Unlike existing play-to-earn ecosystems like The Sandbox, Axie Infinity, and Decentraland, MMG strives to remove all barriers to entry so that users can focus on playing the games they like.

Investors have over the last few weeks been scooping up MEMAG, the token powering the Meta Masters Guild ecosystem in a presale that has raised over $4.36 million, far ahead of the first exchange listing. Interested investors should act fast, considering this presale would be closing in less than 3 days.

Metropoly (METRO) is the second asset on the list and is seeking to revolutionize the real estate industry using key web3 solutions. The team is bringing up the first NFT marketplace, which will be the investment vehicle people will use to tap income-generating properties globally without having to rely on banks.

Ideally, this marketplace would be divided into smaller units, represented by NFTs. Therefore, owning an NFT on Metropoly would allow investors to receive passive income in form of monthly rental revenue. Follow the link provided below to explore and learn more about METRO.

Investors are not looking further than Fight Out for their fitness lifestyle goals. Fight Out is also committed to introducing the massive Web2 audience to move-to-earn (M2E) backed by user-friendly technologies. With digital avatars, users will seamlessly hop into Web3 and the metaverse.

The team is also building Fight Out as an M2E application, intending to gamify the fitness lifestyle. Users will receive rewards in REPs, an in-app currency, for completing workouts and challenges.

So far, the presale has raised $4.36 million but I should mention the price is increasing in 12-hour intervals ahead of the first CEX listing early next month.

Related Articles:

Fight Out - Next 100x Move to Earn Crypto

- Backed by LBank Labs, Transak

- Earn Rewards for Working Out

- Level Up and Compete in the Metaverse

- Presale Live Now - $4M+ Raised

- Real-World Community, Gym Chain