On March 12, Ethereum, the blockchain network behind the world’s second-largest cryptocurrency, completed its highly anticipated Shanghai update.

This major transition, following “The Merge” in September of last year, decisively severed Ethereum’s connection to the energy-hungry crypto-mining process.

The move has not only propelled Ethereum price predictions upward but also sparked intense debate over the environmental footprint of Bitcoin.

Can Ethereum’s Transition Inspire Change in the Crypto World?

With the Shanghai update, Ethereum switched from the proof-of-work (PoW) mining system to a proof-of-stake (PoS) system, significantly reducing energy consumption.

According to a report by the University of Cambridge, the energy consumption of the Bitcoin network in 2022 was estimated to be around 107 terawatt-hours.

However, it was found that only a small portion, roughly one-quarter of the total energy consumed, was generated from renewable sources.

Meanwhile, it is said that Ethereum’s PoS transition slashed energy consumption by at least 99.84%, according to Alex de Vries, a data scientist at De Nederlandsche Bank.

Ethereum Price Soars on Green Credentials

The shift to PoS has not only bolstered Ethereum price predictions but also showcased the potential for large-scale blockchains to become more environmentally friendly.

This development has intensified the debate around Bitcoin’s energy consumption, with some arguing that its reliance on PoW mining is unsustainable.

Ethereum’s transition could inspire other cryptocurrencies to follow suit, potentially drawing more attention from institutions and making the blockchain more usable for industry and commerce.

The Great Crypto Debate

The divide between those who view cryptocurrencies as a sustainable solution and those who see them as an environmental burden is deep and ideological.

As Ethereum proves that large-scale blockchains can adopt PoS, discussions around Bitcoin’s environmental impact are becoming more polarized.

De Vries suggests that Bitcoin could technically move to PoS, but the challenge lies in overcoming social and ideological barriers.

Ethereum Price Prediction and Technical Analysis

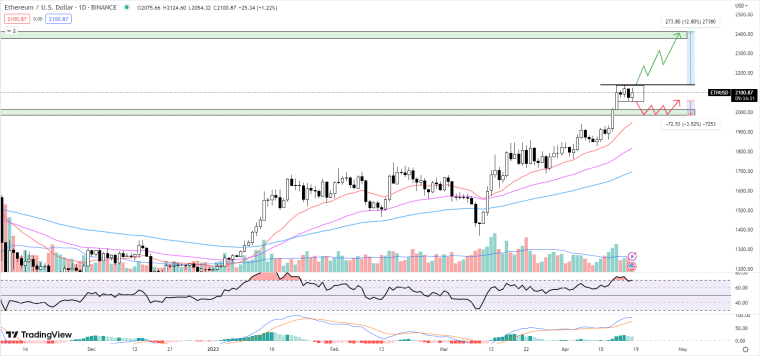

Ethereum has recently exhibited an impressive breakout from the critical $2,000 psychological level on April 13, reaching its year-to-date high of $2,138.

Since then, it has been trading within a range, with a low of $2,050.

Examining the Exponential Moving Averages and What They Tell About Ethereum Price

The 20-day exponential moving average (EMA) is currently at $1,947, while the 50-day EMA stands at $1,816, and the 100-day EMA is $1,696.

These values indicate a bullish trend in Ethereum, with the price consistently trading above these averages.

RSI and Macd Indicators Are Suggesting Short-Term Bearishness for Ethereum Price

The Relative Strength Index (RSI) is currently at 69.85, approaching overbought territory. This suggests that the market could experience a brief pullback before continuing its upward trajectory.

The Moving Average Convergence Divergence (MACD) indicator’s previous day histogram is at 18.81, and the current day histogram stands at 16.57.

This decrease in the histogram might signal a short-term weakening of bullish momentum.

Volume Analysis

The current trading volume is 48.519k, lower than the previous day’s volume of 77.434k and below the volume moving average of 76.495k. This reduced volume may indicate a potential consolidation before the next move.

Ethereum Price Movements and Key Levels

Ethereum’s previous price close was $2,075, with a previous day price movement of -2.11%. The current price is $2,100, representing a 1.22% increase so far today.

The immediate resistance level for Ethereum is $2,150. If the price surpasses this level, the next significant resistance stands at $2,400, representing a potential 12% move to the upside.

On the other hand, the potential support level is at $2,050, with a possibility to retest at $1,990, indicating a 3.50% move to the downside.

Based on the technical analysis, traders may consider a short-term strategy that involves closely monitoring the $2,150 resistance level.

If Ethereum can break above this level, it could signal an opportunity to enter long positions with a target of $2,400.

Conversely, if the price retraces to the $2,050 support level or even $1,990, traders might consider taking short positions, anticipating a temporary pullback before the resumption of the bullish trend.

Keep a close eye on the RSI and MACD indicators, as they may provide further insights into the market’s short-term direction.

Ethereum Price Hinges on a Greener Future

The success of Ethereum’s transition to PoS has the potential to make or break the future of cryptocurrencies in terms of both price and sustainability.

With Ethereum price predictions soaring and its green credentials becoming increasingly attractive to investors, the pressure is mounting for other cryptocurrencies to address their environmental impact.

The ongoing debate surrounding the sustainability of cryptocurrencies, particularly Bitcoin, will undoubtedly shape the future of the industry as it continues to evolve.

The Rise of Green Crypto: ecoterra’s Impact on the Recycling Industry

As Ethereum’s green transition gains momentum, investors are increasingly drawn to its potential for sustainability and positive price performance of green cryptos.

This has placed pressure on other cryptocurrencies to also prioritize eco-friendliness.

Enter ecoterra, a cutting-edge green crypto that is bringing new tools to the fight against climate change by promoting recycling and environmental sustainability.

The project has already raised an impressive $1.6 million during its presale, with $225,000 collected in just the last 24 hours.

So, what exactly sets ecoterra apart in the green crypto space?

ecoterra’s primary focus is addressing environmental degradation and climate change through recycling.

By devising a comprehensive incentive plan, the green crypto project aims to promote recycling among both consumers and businesses.

Climate change causes major ecosystem disruptions, species extinction and food insecurity for communities worldwide

By promoting recycling and offsetting CO2 emissions, we are working towards a better future ♻️

Join our #Presale now ⬇️https://t.co/1fYkPOsPYG pic.twitter.com/7QAUeK1h3V

— ecoterra (@ecoterraio) April 18, 2023

Central to their strategy are token rewards and ecology actions, which together form the foundation of ecoterra’s approach.

The ecoterra recycle2earn app serves as the platform where users can earn money by recycling, access recycled materials and carbon offset marketplaces, and track their sustainable actions.

ecoterra’s Partnerships and Expanding Database

One of ecoterra’s strengths is its ability to forge partnerships that bolster its recycling mission.

A notable example is its partnership with the supermarket chain Delhaize, which operates in Europe, North America, and Asia.

Delhaize stores feature reverse vending machines (RVMs), which are integral to ecoterra’s recycling system.

RVMs accept recyclable materials and issue rewards in the form of ecoterra tokens.

Additionally, ecoterra is integrating products from popular brands such as Vittel, San Pellegrino, Heineken, Pepsi, Fanta, Peroni, Evian, and Dr. Pepper into its database of scannable recyclable materials.

The next step for the green crypto project is to secure partnerships with the parent companies of these brands.

The Green Crypto Wave: Riding the Tide of ESG Interest

ecoterra’s green crypto model has garnered significant interest from investors, particularly from environmentally conscious countries like Germany.

Early investors in ecoterra could potentially reap substantial returns on investment due to the growing popularity of sustainable crypto projects with real-world use cases.

Together, we can make a difference!

Join our #Presale and support a better, greener future⬇️https://t.co/1fYkPOsPYG#Blockchain #EcoCrypto #ReFi pic.twitter.com/A0Hlo8M3nX

— ecoterra (@ecoterraio) April 15, 2023

Analysts predict that green crypto projects like ecoterra will gain traction in the market, as investors increasingly assign value to environmentally friendly and impactful initiatives.

ecoterra aims to empower companies to take a leading role in the fight against climate change. By connecting with ecoterra, companies can offer customers recycling rewards and earn rewards for their ecological efforts.

This approach effectively combats greenwashing, a practice where companies deceive consumers into thinking they are more eco-friendly than they are in reality.

Blockchain-based networks like ecoterra provide transparency and accountability, making it difficult for companies to hide their ecological footprint.

This feature makes ecoterra’s green crypto system highly appealing to businesses seeking genuine sustainability solutions.

ecoterra goes beyond incentivizing recycling; it also encourages individuals and companies to spend tokens on impactful ecological actions, such as beach cleanups or tree planting. These actions contribute to each user’s impact profile, which can be tracked on the platform.

ecoterra also incorporates non-fungible tokens (NFTs) to represent users’ ecological actions, effectively commodifying these efforts and making them exchangeable.

Powering Up the Green Crypto Economy

Another compelling aspect of ecoterra’s green crypto strategy is the integration of renewable energy generation.

Households and companies that produce renewable electricity can create an ecoterra token income stream, further emphasizing the project’s commitment to incentivizing sustainability.

By combining recycling, renewable energy, and environmental actions, ecoterra has developed a comprehensive and engaging solution to address global ecological challenges.

As the presale for ecoterra tokens advances, FOMO around the green crypto project continues to grow.

With a unique approach to incentivizing recycling, forging strategic partnerships, and incorporating renewable energy, ecoterra has positioned itself as a serious contender in the green crypto market.

Investors and environmentally conscious individuals alike should keep a close eye on the development of this green crypto project, as it could potentially make a significant difference in our collective fight against climate change.

Related:

Wall Street Memes (WSM) - Newest Meme Coin

- Community of 1 Million Followers

- Experienced NFT Project Founders

- Listed On OKX

- Staking Rewards